Income Tax Rebate U S 10 13a Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is a component of an employee s salary that may be subject to partial or full tax deductions

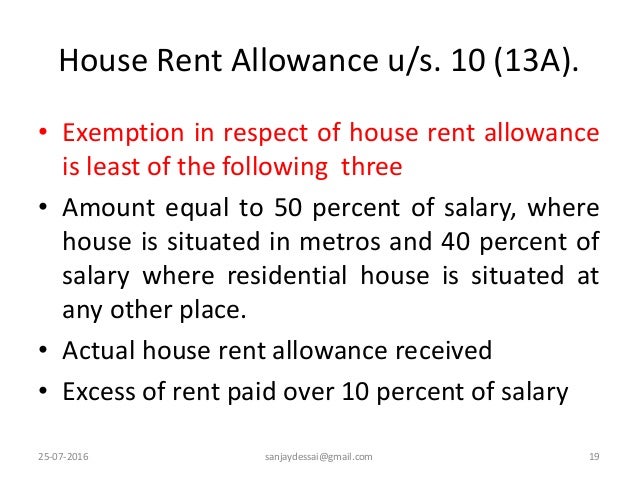

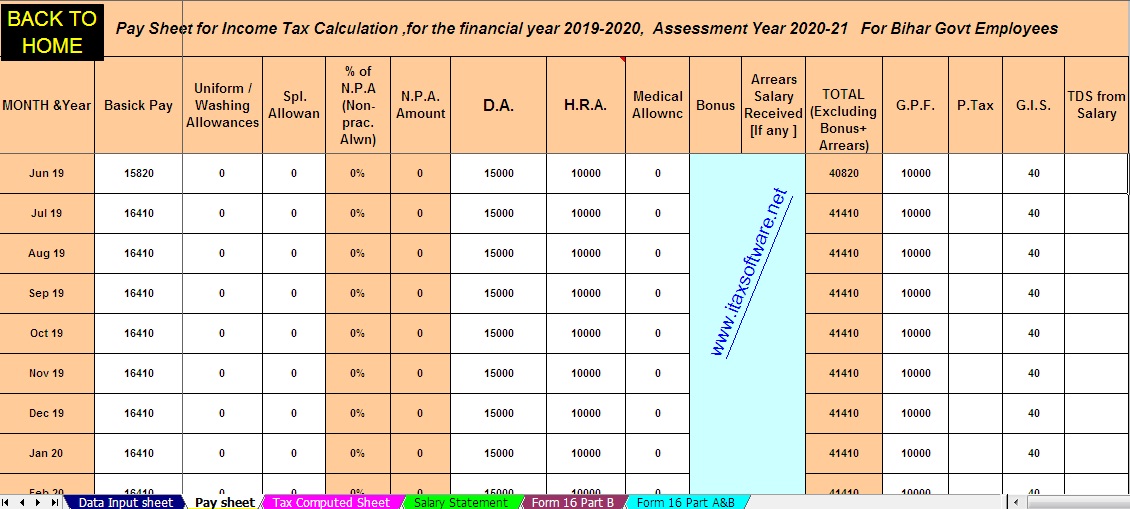

Web 9 f 233 vr 2023 nbsp 0183 32 Actual House Rent Allowance INR 1 75 000 Actual Rent Paid 10 of Basic Salary INR 1 30 000 1 80 000 10 5 00 000 40 of the Basic Salary INR Web 10 janv 2023 nbsp 0183 32 Section 10 13A of the Income Tax Act covers House Rent Allowance HRA The part of your salary that you receive for covering house rent and

Income Tax Rebate U S 10 13a

Income Tax Rebate U S 10 13a

https://financialcontrol.in/wp-content/uploads/2018/08/sec-1013A.jpg

Income Exempt Under Section 10 For Assessment Year 2016 17

https://image.slidesharecdn.com/incomeexemptundersection10forassessmentyear2016-17-160725155452/95/income-exempt-under-section-10-for-assessment-year-2016-17-19-638.jpg?cb=1469462193

Specific Conditions For Salary Individuals To Claim HRA U S 10 13A

https://blog.saginfotech.com/wp-content/uploads/2023/02/specific-conditions-for-claiming-hra-u-s-10-13a.jpg

Web 22 sept 2022 nbsp 0183 32 House rent allowance is eligible for HRA deduction under Section 10 13A of the Income Tax Act if an individual meets the following criteria The person claiming Web Standard Deduction of Rs 50 000 Entertainment Allowance Deduction in respect of this is available to a government employee to the extent of Rs 5 000 or 20 of his salary or

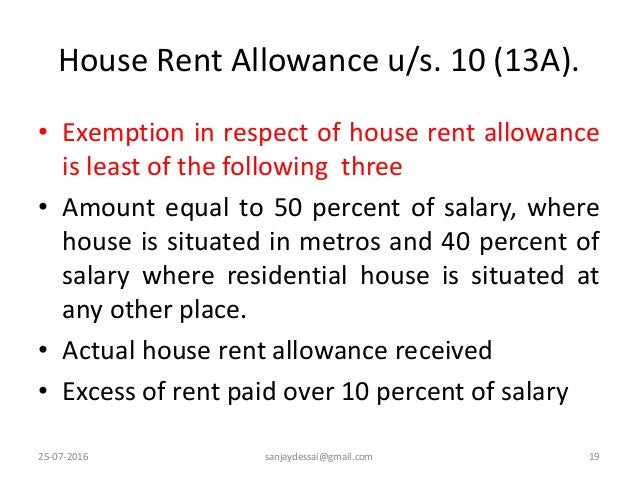

Web HRA Exemption Calculation u s 10 13A The minimum of the following three amounts calculated would be exempted Actual HRA received from the employer Actual rent paid Web HRA received is exempt u s 10 13A to the extent of the minimum of the following 3 amounts Actual House Rent allowance received by the employee in respect of the relevant period Excess of Rent paid for the

Download Income Tax Rebate U S 10 13a

More picture related to Income Tax Rebate U S 10 13a

Understanding Section 10 13A Of The Income Tax Act

https://margcompusoft.com/m/wp-content/uploads/2023/03/3-32-1024x576.jpg

House Rent Allowance Section 10 13A Income Tax Act YouTube

https://i.ytimg.com/vi/44JAiSKr9D4/maxresdefault.jpg

How HRA Tax Exemption Is Calculated U s 10 13A Calculation Guide

https://financialcontrol.in/wp-content/uploads/2018/08/HRA-House-Rent-Allowance-us-10-13A-exemption.png

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web 10 mars 2019 nbsp 0183 32 It is the allowance paid by the employer to the employee against travel with your family or alone LTA is 100 Tax exempted u s 10 5 and restricted only to the travel cost incurred by the employee The

Web 28 juin 2018 nbsp 0183 32 The exemption on HRA is covered under Section 10 13A of the Income Tax Act and Rule 2A of the Income Tax Rules It is to be noted that the entire HRA is not Web Regulated by the provisions of Section 10 13A of the IT Act the house rent allowance serves to be quite beneficial to salaried employees in India As per law only salaried

Income Tax Rebate U S 87A For The FY 2020 21 AY 2021 22 FY 2019

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/income-tax-rebate-u-s-87a-for-the-fy-2020-21-ay-2021-22-fy-2019.jpg?fit=1280%2C720&ssl=1

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-AEpesV1mLQE/XSdGDhx6cdI/AAAAAAAAJ9M/J_VXZxmpahESkmu6aBQnpetirOLVX0a7gCLcBGAs/s1600/Picture%2B2%2Bof%2BBihar%2BAll%2Bin%2BOne%2B19-20.jpg

https://cleartax.in/s/hra-house-rent-allowance

Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is a component of an employee s salary that may be subject to partial or full tax deductions

https://learn.quicko.com/house-rent-allowance-hra

Web 9 f 233 vr 2023 nbsp 0183 32 Actual House Rent Allowance INR 1 75 000 Actual Rent Paid 10 of Basic Salary INR 1 30 000 1 80 000 10 5 00 000 40 of the Basic Salary INR

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Income Tax Rebate U S 87A For The FY 2020 21 AY 2021 22 FY 2019

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Income Tax Rebate U s 87A For The Financial Year 2023 24

.jpg)

87A Rebate Rebate U s 87A How To Get Income

.jpg)

87A Rebate Rebate U s 87A How To Get Income

Income Tax Rebate Under Section 87A PulseHRM

Step By Step Guide To Claim Income Tax Rebate U s 87A Cashing Information

Exemptions Under Section 10 Of The Income Tax Act Enterslice

Income Tax Rebate U S 10 13a - Web 1 d 233 c 2021 nbsp 0183 32 Both self employed and salaried individuals are eligible to claim deductions for house rent that is paid under several sections like Section 80GG and 10 13A of the