Recovery Rebate Credit Line Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

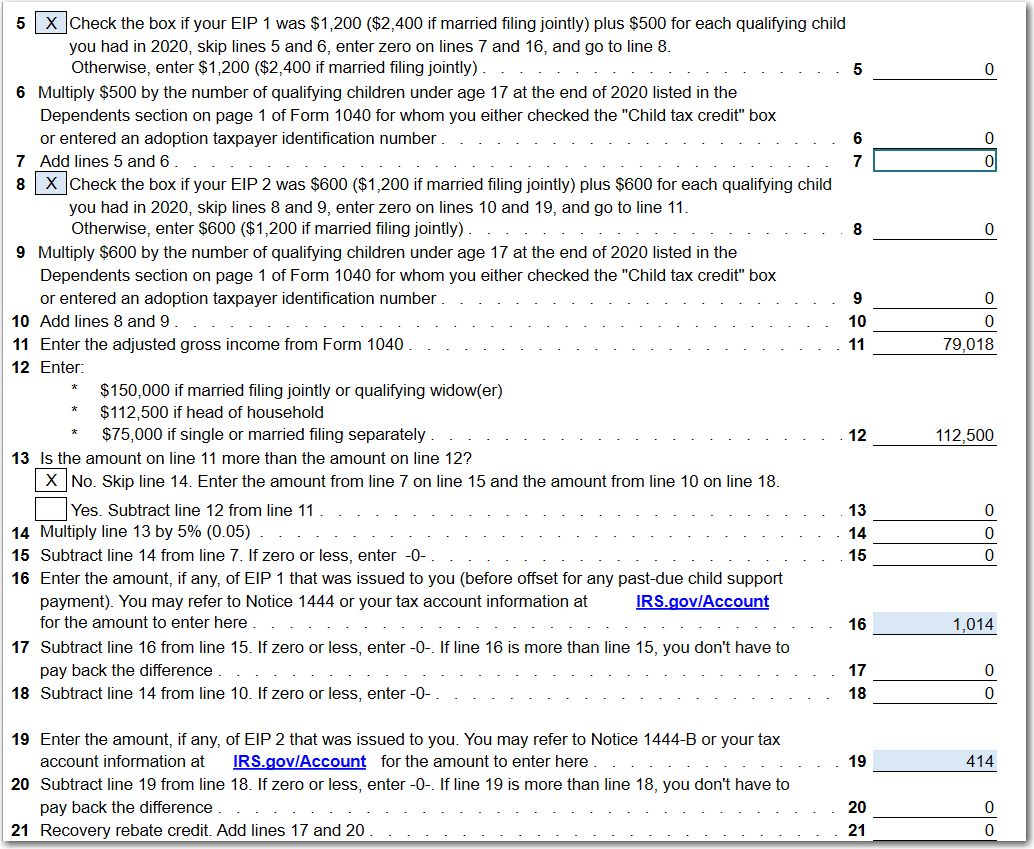

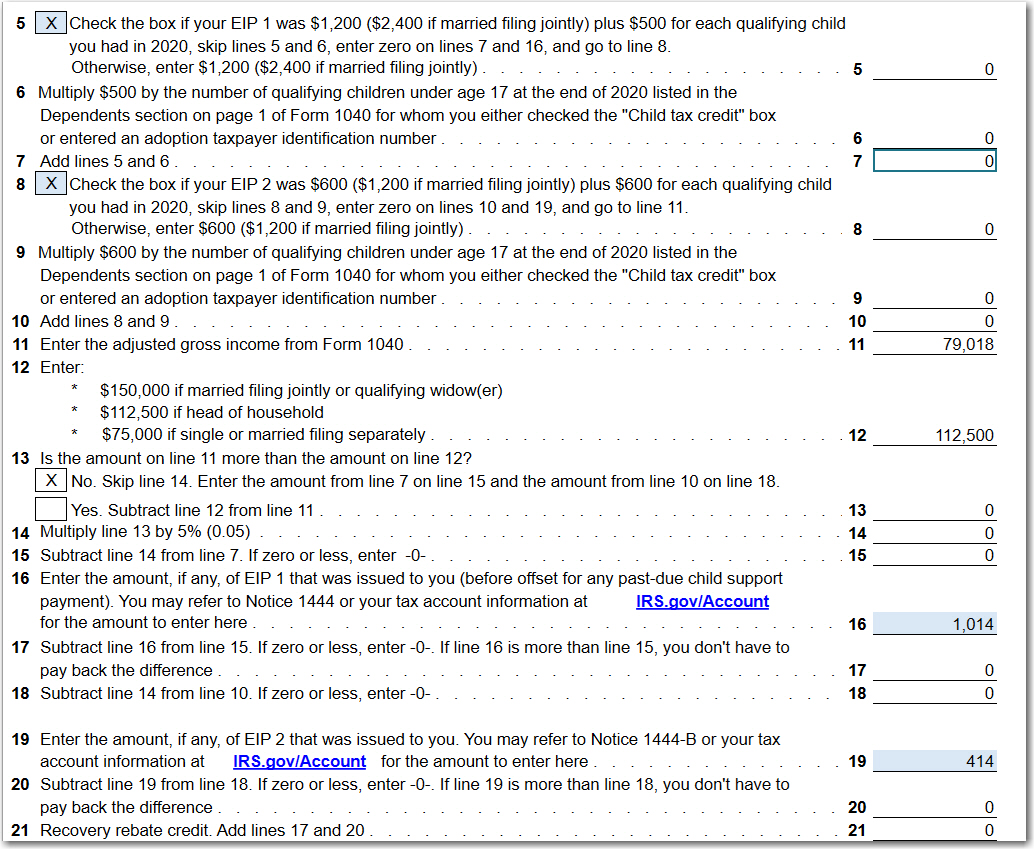

Web 10 d 233 c 2021 nbsp 0183 32 A10 The only way to get a Recovery Rebate Credit is to file a 2020 tax return even if you are otherwise not required to file a tax return The Recovery Rebate Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Recovery Rebate Credit Line

Recovery Rebate Credit Line

https://www.atxcommunity.com/uploads/monthly_2021_02/2077495236_Line30JF.jpg.5cf61402ed45b71039c02279dc1b0758.jpg

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information Web 17 ao 251 t 2022 nbsp 0183 32 Both Form 1040 and Form 1040 SR included a line specifically for the Recovery Rebate Credit If you received a Recovery Rebate Credit it would have either increased the amount of your tax

Web 8 mars 2022 nbsp 0183 32 What Is the Recovery Rebate Credit Economic Impact Payments also known as stimulus payments were a series of three tax credits sent to most Americans Web 10 d 233 c 2021 nbsp 0183 32 If you entered an amount on line 30 of your 2020 tax return but made a mistake in calculating the amount the IRS will calculate the correct amount of the

Download Recovery Rebate Credit Line

More picture related to Recovery Rebate Credit Line

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840 Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Web Recovery Rebate Credit Worksheet Explained As the IRS indicated they are reconciling refunds with stimulus payments and the Recovery Rebate Credit claimed on your Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

https://www.consumerismcommentary.com/wp-content/uploads/2009/01/recovery-rebate-credit-1040.jpg

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-b...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-d...

Web 10 d 233 c 2021 nbsp 0183 32 A10 The only way to get a Recovery Rebate Credit is to file a 2020 tax return even if you are otherwise not required to file a tax return The Recovery Rebate

Recovery Rebate Credit Worksheet Explained Support

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Recovery Credit Printable Rebate Form

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

10 Recovery Rebate Credit Worksheet

10 Recovery Rebate Credit Worksheet

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

Recovery Rebate Credit Worksheet Explained Support

How To Fill Out The Recovery Rebate Credit Line 30 Form 1040 Otosection

Recovery Rebate Credit Line - Web 27 avr 2023 nbsp 0183 32 The first full stimulus payment was 1 200 for single individuals 2 400 for married couples and 500 per qualified dependent The second full stimulus payment