Income Tax Rebate Under Section 80ddb Web 20 avr 2017 nbsp 0183 32 Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number

Web 7 janv 2022 nbsp 0183 32 Section 80DDB of the Income Tax Act 1961 is one such provision that enables taxpayers to claim tax deductions for the expenses of specified ailments Let us Web 6 juil 2023 nbsp 0183 32 The nature of diseases and ailments that are included for deduction under Section 80DDB is mentioned in Rule 11DD of Income Tax and the same are as follows Neurological Diseases as identified by

Income Tax Rebate Under Section 80ddb

![]()

Income Tax Rebate Under Section 80ddb

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_597,h_652/https://www.paisabazaar.com/wp-content/uploads/2017/06/Section-80DDB-Form-Format.png

![]()

Income Tax Deduction For Medical Treatment IndiaFilings

https://cdn.shortpixel.ai/client/q_glossy,ret_img,w_985/https://www.indiafilings.com/learn/wp-content/uploads/2017/10/Diseases-Eligible-for-Deduction-under-Section-80DDB.png

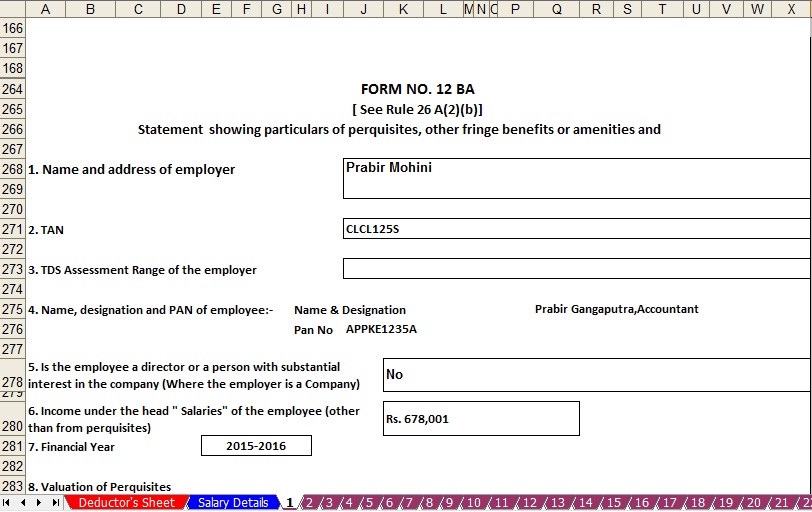

How To Claim IT Deduction Under Section 80DDB Which Is Now Becomes Easy

http://3.bp.blogspot.com/-U86ck01YIWA/Vmmg-OHP_3I/AAAAAAAAAs0/lWJ85UTccq0/s1600/12BA.jpg

Web Section 80DDB under the ITA puts forth certain provisions which permit eligible taxpayers to claim specific benefits and help them to save on taxes annually What is Section Web 26 sept 2022 nbsp 0183 32 Section 80DDB of the Income Tax Act of 1961 allows tax deductions to taxpayers on the treatment of certain specified diseases According to Section 80DDB

Web 18 juin 2023 nbsp 0183 32 Simply upload the payment receipt of your ACKO Health Insurance policy while filing income tax returns under Section 80DDB You can claim up to Rs 1 lakh under this section Eligibility for Section Web Deductions Under Section 80DDB of Income Tax Act Below mentioned is the list of deductions and their limitations under Section 80DDB of the Income Tax Act A

Download Income Tax Rebate Under Section 80ddb

More picture related to Income Tax Rebate Under Section 80ddb

PDF Section 80DDB Deduction Certificate Form PDF Download In English

https://instapdf.in/wp-content/uploads/pdf-thumbnails/small/10i-pdf-270.jpg

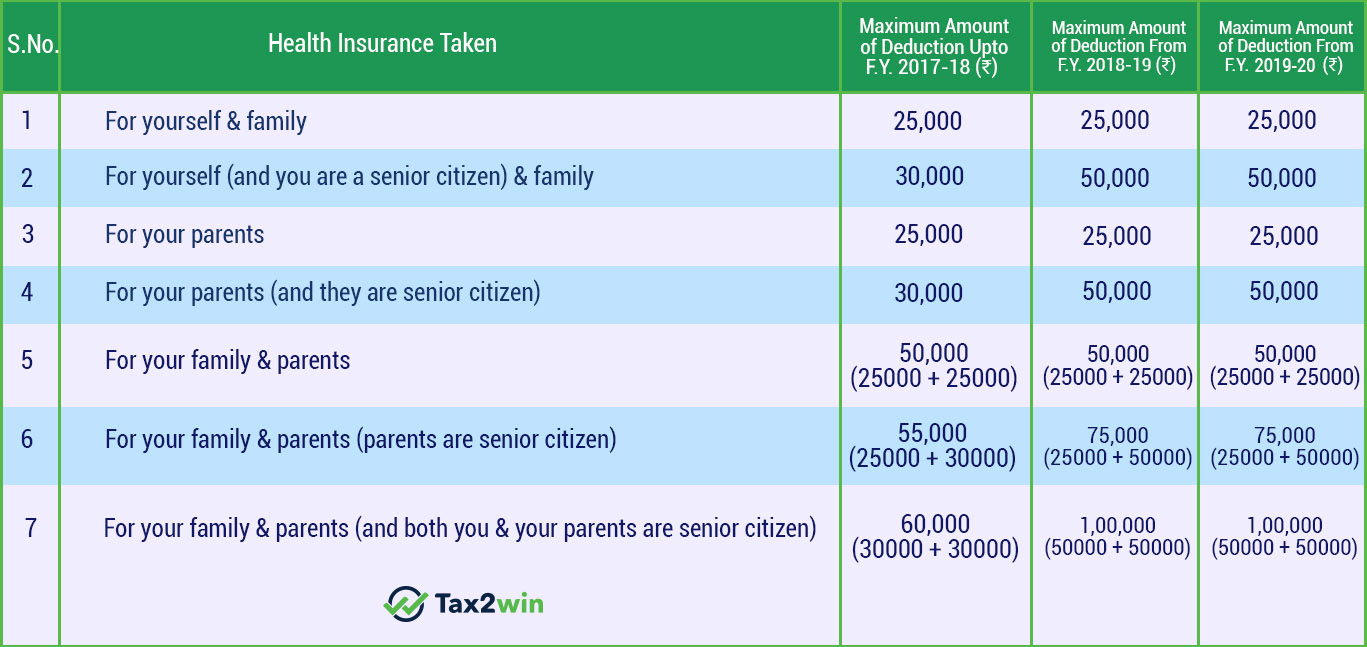

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

Web 18 nov 2021 nbsp 0183 32 Section 80DDB of the Income Tax Act 1961 has gained its popularity in recent years You can claim a tax deduction against the expenses made for the medical Web Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for

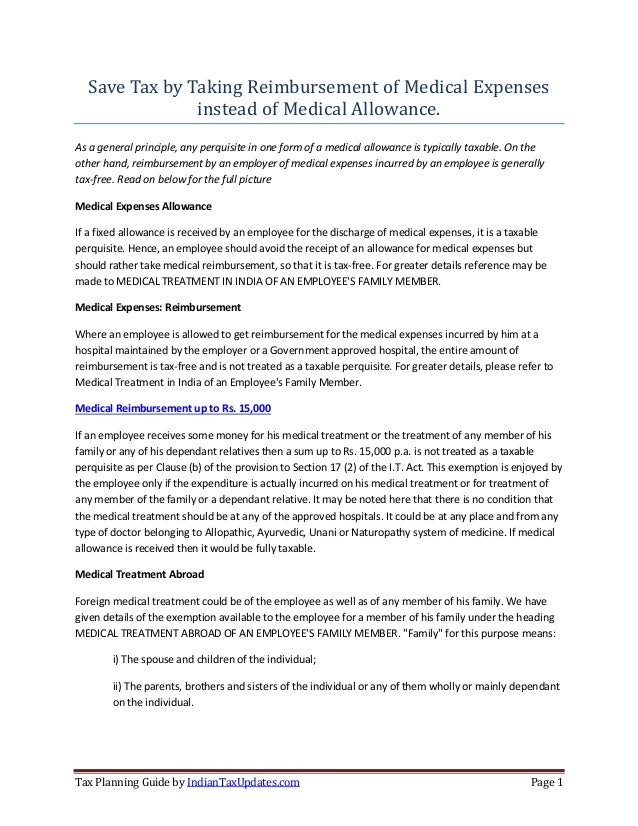

Web 15 mars 2019 nbsp 0183 32 Medical expenditures for certain specified diseases provide tax benefits under the Income tax Act Section 80D 80DD and 80DDB and 80U of the act provide tax benefits Here are rules you must know to Web 29 juin 2018 nbsp 0183 32 Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80DDB-Deductions-1024x762.jpg

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up-1024x866.jpg

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Web 20 avr 2017 nbsp 0183 32 Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number

https://navi.com/blog/everything-about-section-80ddb

Web 7 janv 2022 nbsp 0183 32 Section 80DDB of the Income Tax Act 1961 is one such provision that enables taxpayers to claim tax deductions for the expenses of specified ailments Let us

Section 80D Income Tax Deduction For Medical Insurance Preventive

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

PDF Income Tax Section 80 DDB Form PDF Download InstaPDF

What Are Sections 80DD 80DDB And 80U All About Rupiko

46 INFO HOW TO GET 80DDB CERTIFICATE WITH VIDEO TUTORIAL Certificate

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deduction From Gross Total Income Section 80C To 80U Graphical Table

DEDUCTION UNDER SECTION 80C TO 80U PDF

80C 80U

Income Tax Deduction Section 80DDB YouTube

Income Tax Rebate Under Section 80ddb - Web 18 juin 2023 nbsp 0183 32 Simply upload the payment receipt of your ACKO Health Insurance policy while filing income tax returns under Section 80DDB You can claim up to Rs 1 lakh under this section Eligibility for Section