Income Tax Rebate Under Section 80ggc Web 17 juil 2019 nbsp 0183 32 Section 80GGC specifies the deduction under the Income Tax Act that is allowed from the total gross income of specified assessees for contributions to a political

Web 30 sept 2019 nbsp 0183 32 Amount of deduction available under section 80GGC The whole of the amount of contribution donation is available as a deduction under section 80GGC In Web 30 d 233 c 2022 nbsp 0183 32 Section 80GGC under the Income Tax Act 1961 provides tax deduction benefits on donations made by any individual to political parties subject to certain

Income Tax Rebate Under Section 80ggc

Income Tax Rebate Under Section 80ggc

http://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0001-724x1024.jpg

![]()

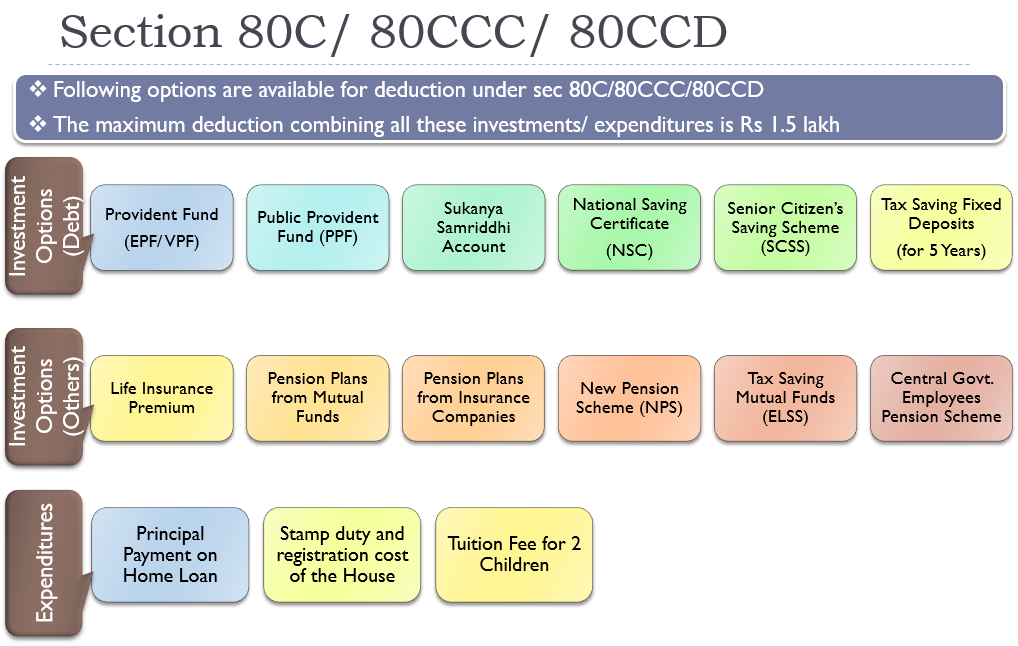

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web An individual taxpayer can claim tax deduction under Section 80GGC Deduction under 80GGC is available to every Individual HUF Firm AOP and BOI A local authority cannot claim tax deduction under this Web 28 sept 2022 nbsp 0183 32 Updated on 10 Nov 2022 What is Section 80GGC Section 80GGC provides for a tax deduction on any sum contributed in the previous year by any

Web How much tax rebate is allowed under Section 80GGC of Income Tax Act Full tax rebates are allowed in most cases but in certain cases the tax rebate stays between Web 26 avr 2023 nbsp 0183 32 HOME INCOME TAX 80C 80 DEDUCTIONS DEDUCTIONS UNDER SECTION 80GGB Deductions under Section 80GGB Updated on Dec 12th 2022

Download Income Tax Rebate Under Section 80ggc

More picture related to Income Tax Rebate Under Section 80ggc

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

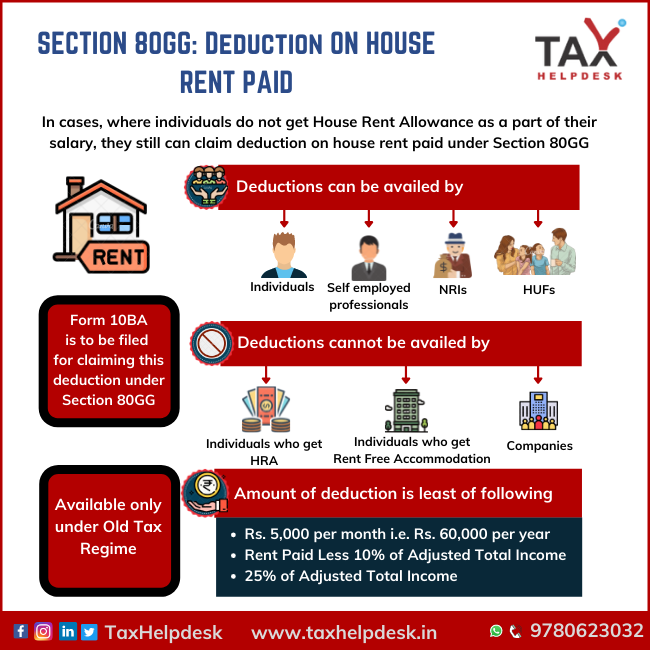

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2019/07/Section-80GG-1.png?fit=1047%2C604&ssl=1

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

https://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0002-1085x1536.jpg

Web 30 janv 2020 nbsp 0183 32 Section 80GGB and 80GGC of the Income tax Act 1961 1 mainly deals with donations and contributions made by an individual taxpayer and Indian Companies towards political parties The cashless Web 11 sept 2023 nbsp 0183 32 Under Section 80GGS of Income Tax Act 1961 any contribution to the electoral trust or political party by any individual in the previous year can be claimed for

Web The full amount or 100 of the contribution made by an individual taxpayer to a registered political party or electoral trust can be claimed as a tax deduction under Section 80GGC Web 30 janv 2023 nbsp 0183 32 As mentioned above Section 80GGC allows an individual taxpayer to claim a 100 tax deduction on the amount he she contributes or donates to any political party

Budget 2014 Impact On Money Taxes And Savings

http://i1.wp.com/apnaplan.com/wp-content/uploads/2014/07/Investments-to-Save-Tax-under-Section-80C.png?fit=757%2C475

Income Tax For Under Construction House The Property Files

https://blog.tax2win.in/wp-content/uploads/2019/03/80C-Deduction-in-respect-of-LIP-PF-PPF-NSC-etc-1024x819.jpg

https://tax2win.in/guide/section-80ggc

Web 17 juil 2019 nbsp 0183 32 Section 80GGC specifies the deduction under the Income Tax Act that is allowed from the total gross income of specified assessees for contributions to a political

https://taxguru.in/income-tax/deduction-section-80ggc.html

Web 30 sept 2019 nbsp 0183 32 Amount of deduction available under section 80GGC The whole of the amount of contribution donation is available as a deduction under section 80GGC In

All You Need To Know About Section 80C

Budget 2014 Impact On Money Taxes And Savings

Deduction Under Section 80C Its Allied Sections

11 Section 80GGC SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

A Quick Look At Deductions Under Section 80C To Section 80U

Section 80GGC Of Income Tax Act Eligibility Types Deductions How

Section 80GGC Of Income Tax Act Eligibility Types Deductions How

How To Claim Health Insurance Under Section 80D From 2018 19

How Can Section 80G 80GG Help You Avail Tax Benefits

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Income Tax Rebate Under Section 80ggc - Web 28 sept 2022 nbsp 0183 32 Updated on 10 Nov 2022 What is Section 80GGC Section 80GGC provides for a tax deduction on any sum contributed in the previous year by any