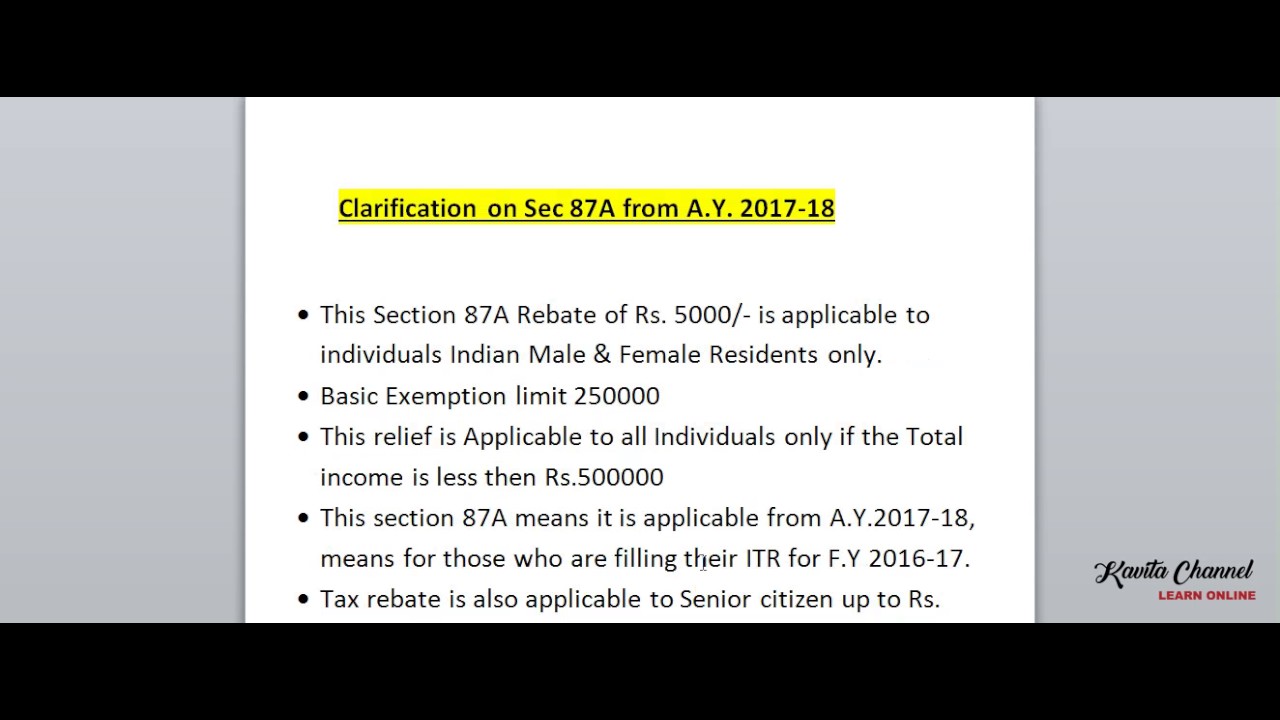

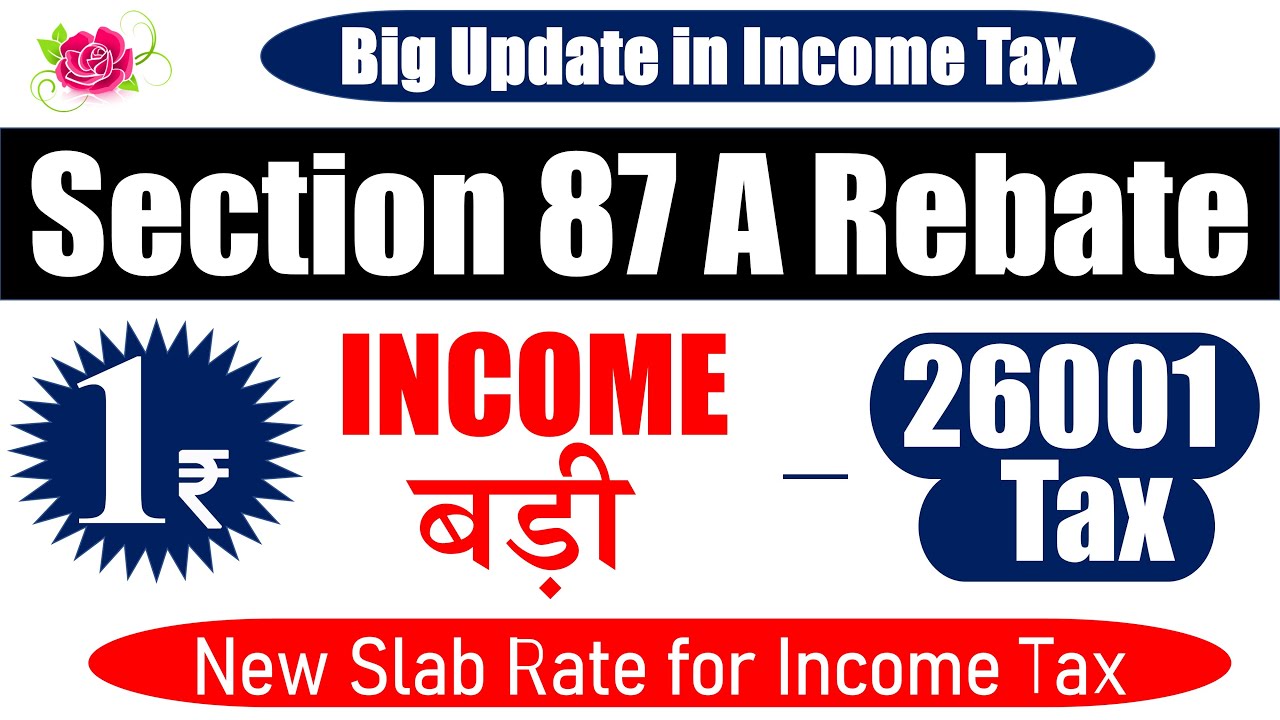

Income Tax Rebate Under Section 87a Web 3 f 233 vr 2023 nbsp 0183 32 To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual

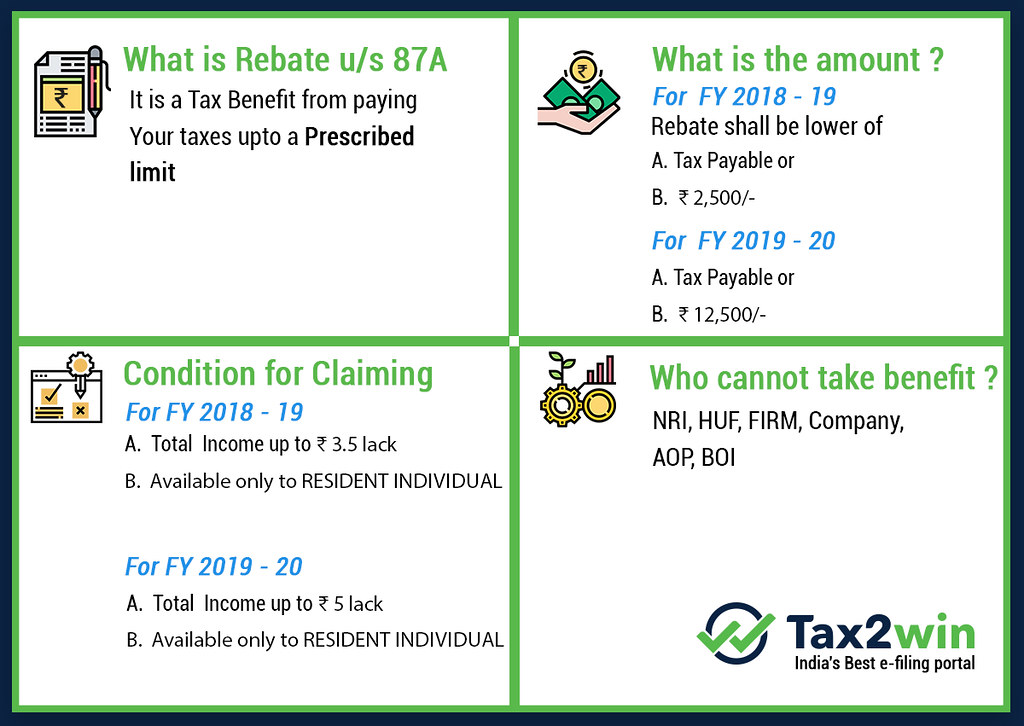

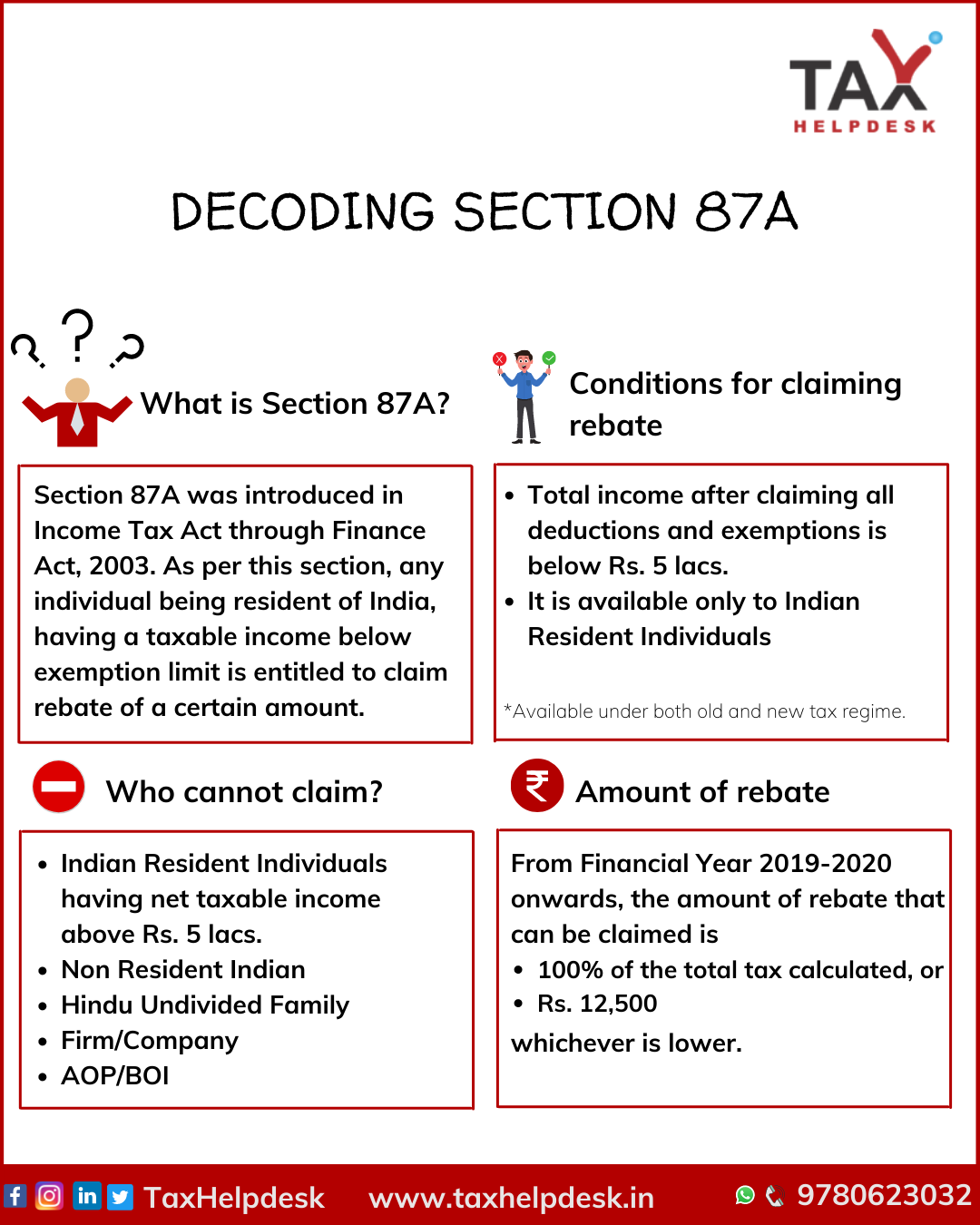

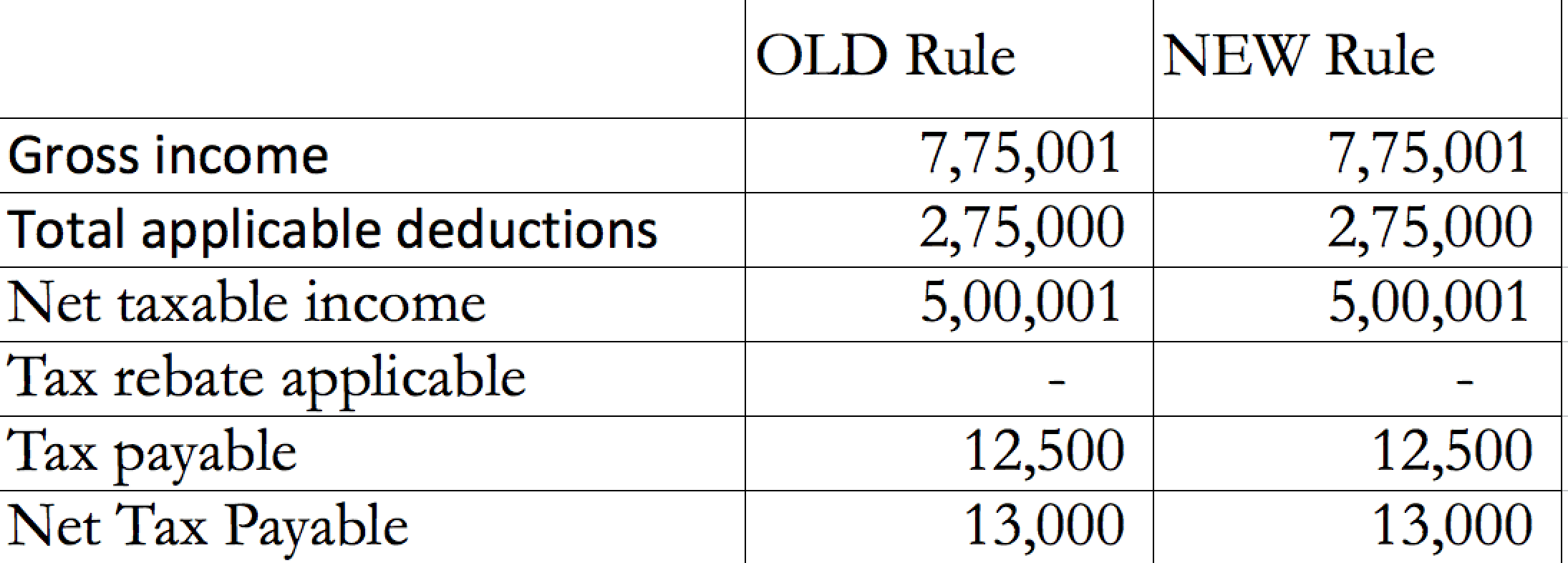

Web 14 sept 2019 nbsp 0183 32 Section 87A rebate can be claimed against tax liabilities on Income which is calculated as taxable as per the slab rate Long term capital gains under Section 112 Web 26 avr 2022 nbsp 0183 32 Taxpayers can reduce their tax liability through the rebate under Section 87A of the Income Tax Act Individuals can claim the rebate if the total income after

Income Tax Rebate Under Section 87a

Income Tax Rebate Under Section 87a

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Section 87A Tax Rebate FY 2019 20 Tax Wealth Tax Tax Deductions

https://i.pinimg.com/736x/b5/1d/a1/b51da136da3645c53e1d0b5dea60983c.jpg

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

Web 2 f 233 vr 2023 nbsp 0183 32 Rebate under section 87A of Income Tax Act helps taxpayers to reduce their tax liability Resident individuals having a net taxable income less than or equal to INR Web Income Tax Applicable Rebate under Section 87A Total Tax Payable Rs 3 lakhs Rs 2 500 Rs 2 500 Nil Rs 3 1 lakhs Rs 3 000 Rs 2 500 Rs 500 Rs 3 2 lakhs Rs

Web 6 f 233 vr 2023 nbsp 0183 32 The income tax rebate will be up to Rs 12 500 on the total tax liability before adding the health and education cess of 4 New Tax Regime With effect from the FY 2023 24 a taxpayer can claim a tax Web Tax Rebate Under Section 87A Claim Income Tax Rebate for FY 21 22 AY 22 23 What is Insurance What is Superannuation View All FAQs Section 80CCC Section 80DDB

Download Income Tax Rebate Under Section 87a

More picture related to Income Tax Rebate Under Section 87a

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Web 3 f 233 vr 2023 nbsp 0183 32 A rebate of Rs 12 500 is available u s 87A for those under the OLD tax regime for individuals whose taxable income is Rs 5 lakh or less in a year Therefore the Section 87A Tax rebate is available under Web 21 ao 251 t 2023 nbsp 0183 32 Follow these steps to claim a rebate under Section 87A of the Income Tax Act Add your income from all the sources to calculate your total gross income for the

Web 25 janv 2022 nbsp 0183 32 Rebate Under Section 87A for AY 2021 22 FY 2020 21 Taxpayers with income up to Rs 5 lakh can claim a tax rebate of up to Rs 12 500 for AY 2021 22 or as Web 6 f 233 vr 2023 nbsp 0183 32 If your net taxable income does not exceed Rs 5 lakh you are eligible for the tax rebate under Section 87A This tax rebate will be automatically taken into account

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 Section 87A rebate can be claimed against tax liabilities on Income which is calculated as taxable as per the slab rate Long term capital gains under Section 112

Income Tax Rebate Under Section 87A

Rebate Of Income Tax Under Section 87A YouTube

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate Under Section 87A

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

Income Tax Rebate U s 87A For The Financial Year 2022 23

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Income Tax Rebate Under Section 87a - Web 6 f 233 vr 2023 nbsp 0183 32 The income tax rebate will be up to Rs 12 500 on the total tax liability before adding the health and education cess of 4 New Tax Regime With effect from the FY 2023 24 a taxpayer can claim a tax