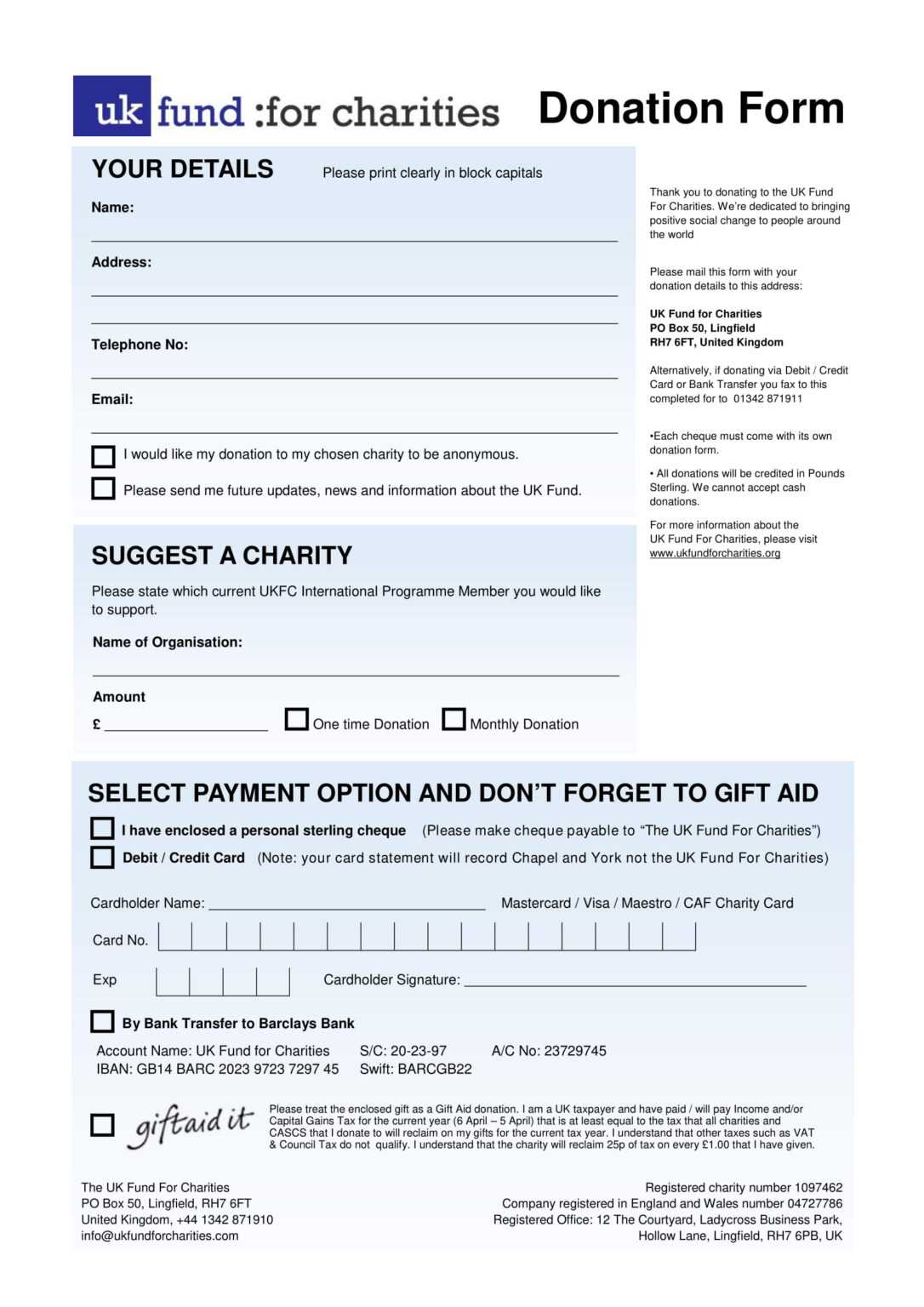

Income Tax Relief For Charitable Donations If you pay UK tax and donate to charity Gift Aid means the charity gets more And if you re a higher or additional rate taxpayer you can claim extra tax relief on the donation This

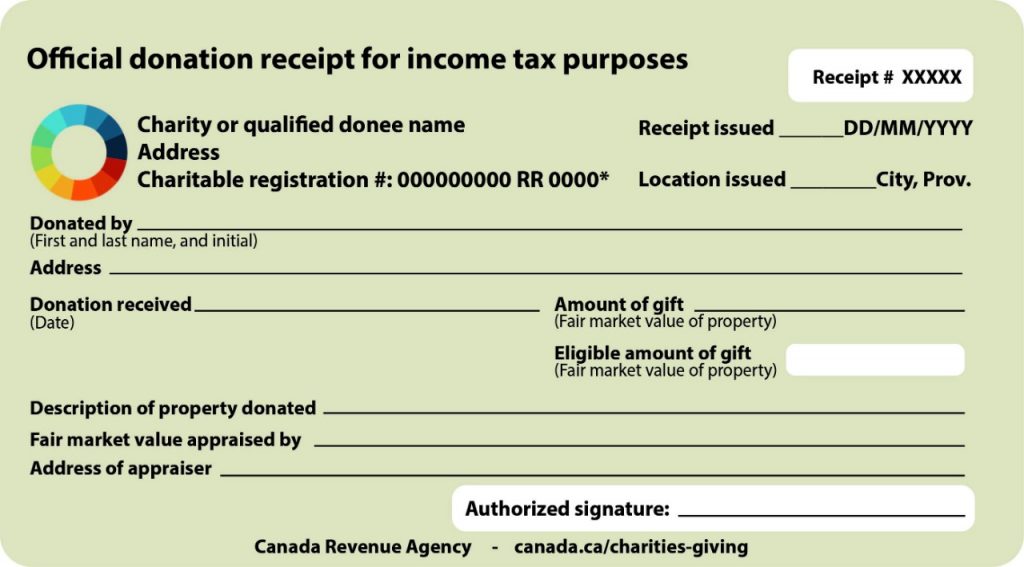

The following donations to approved bodies qualify for tax relief a minimum donation of 250 a maximum donation of 1 000 000 in any one year Relief will be restricted A number of tax incentives for giving to charity are made available to incentivise taxpayers to donate Gift Aid being the most commonly used income tax relief This article

Income Tax Relief For Charitable Donations

Income Tax Relief For Charitable Donations

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

How To Ensure You Get Tax Relief On Charitable Donations

https://www.accountwise.co.uk/wp-content/uploads/2019/06/donations-1041971_1920-1080x675.jpg

Noncash Charitable Contributions Fair Market Value Guide 2019

https://www.accountingservicesofhhi.com/images/Streamlabs-charity-fundraising-donation.jpg

Charitable donations or contributions are potentially a tax saving opportunity Not only does the charity benefit but taxpayers enjoy tax savings by deducting part or all of their Tax reliefs for charities As a charity you do not pay tax on most of your income and gains if you use it for charitable purposes this is known as charitable expenditure This includes tax

The tax relief you get depends on the rate of tax you pay To donate 1 you pay 80p if you re a basic rate taxpayer 60p if you re a higher rate taxpayer 55p if you re an additional rate Unless you are donating to charity through a workplace scheme you can claim your tax relief by filling out a self assessment tax return where you can declare your charitable income and

Download Income Tax Relief For Charitable Donations

More picture related to Income Tax Relief For Charitable Donations

Expert Answers Is Combination Of Dividend And Charitable Donation A

https://www.companybug.com/wp-content/uploads/2019/02/balloons-charity-colorful-1409716.jpg

Tips On Tax Deductions For Donations

https://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

How To Get Tax Relief For Charitable Donations

https://www.thetaxdefenders.com/wp-content/uploads/2020/10/495983408.jpg

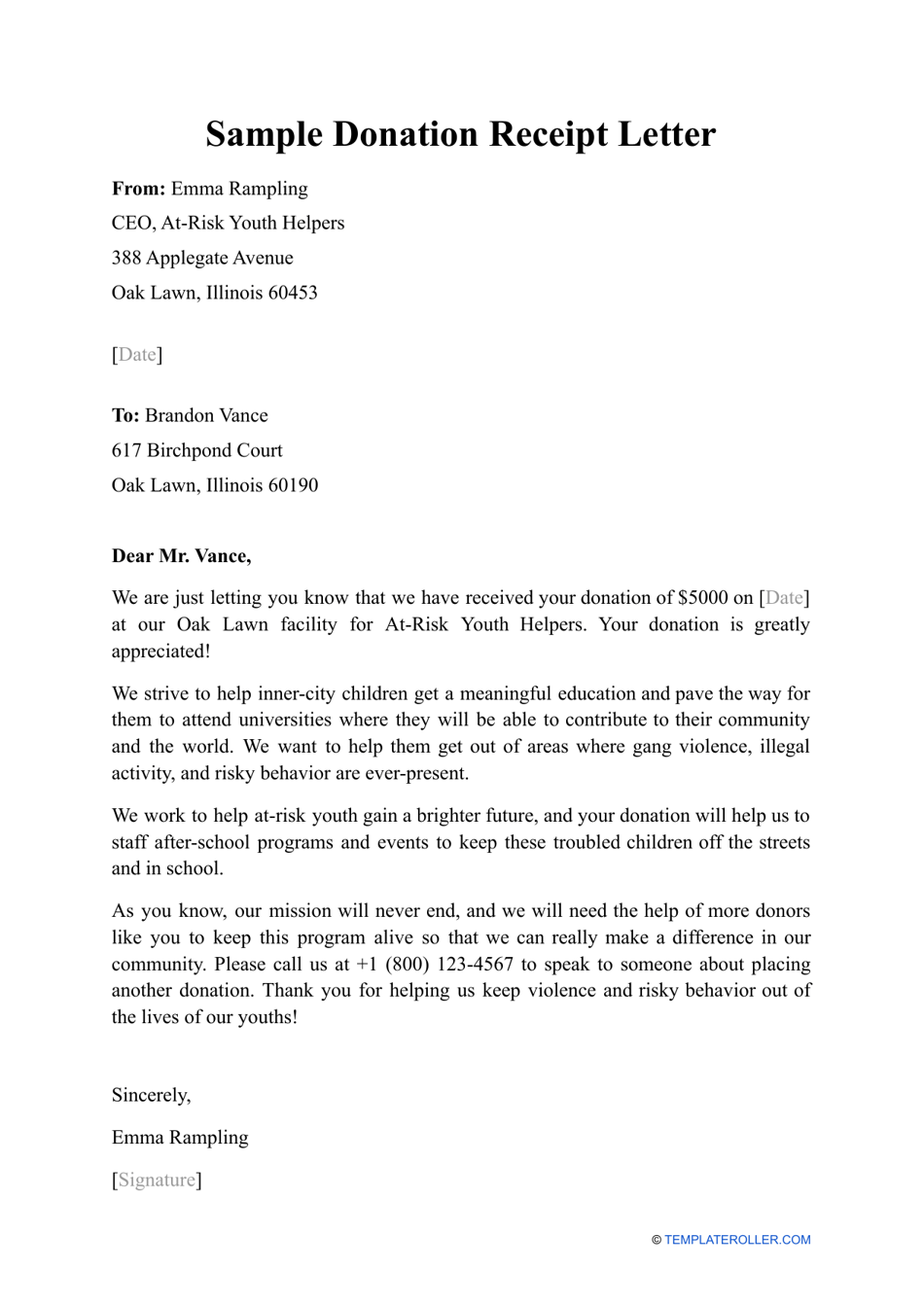

Charitable contributions are generally tax deductible though there can be limitations and exceptions Eligible itemized charitable donations made in cash for instance With payroll giving donations are taken from gross pay before income tax is deducted The charities you care about get a regular income and it costs you less The result is that all the

Donating to charity can help reduce your taxable income Here are some tips for how you can maximize tax deductible donations Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your

How To Get Tax Relief For Charitable Donations

https://www.thetaxdefenders.com/wp-content/uploads/2020/10/Tax-Relief-for-Charitable-Donations.jpg

Income Tax Relief Income Tax Relief Charitable Donations

http://cdn.equitablegrowth.org/wp-content/uploads/2017/03/06142708/Fig3.png

https://www.moneysavingexpert.com/family/gift-aid

If you pay UK tax and donate to charity Gift Aid means the charity gets more And if you re a higher or additional rate taxpayer you can claim extra tax relief on the donation This

https://www.revenue.ie/en/personal-tax-credits...

The following donations to approved bodies qualify for tax relief a minimum donation of 250 a maximum donation of 1 000 000 in any one year Relief will be restricted

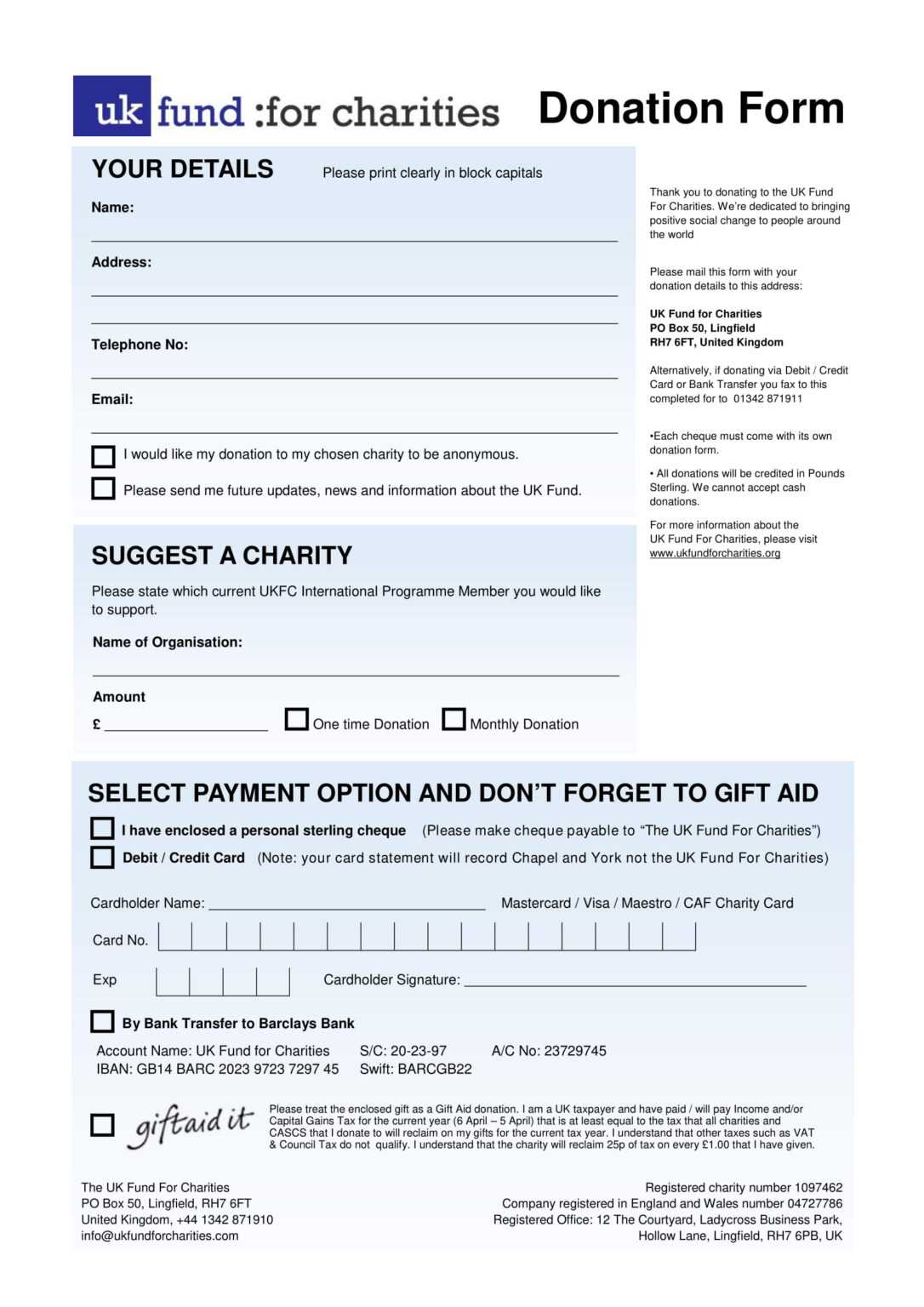

Apply For Tax Relief Using Charitable Donations

How To Get Tax Relief For Charitable Donations

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

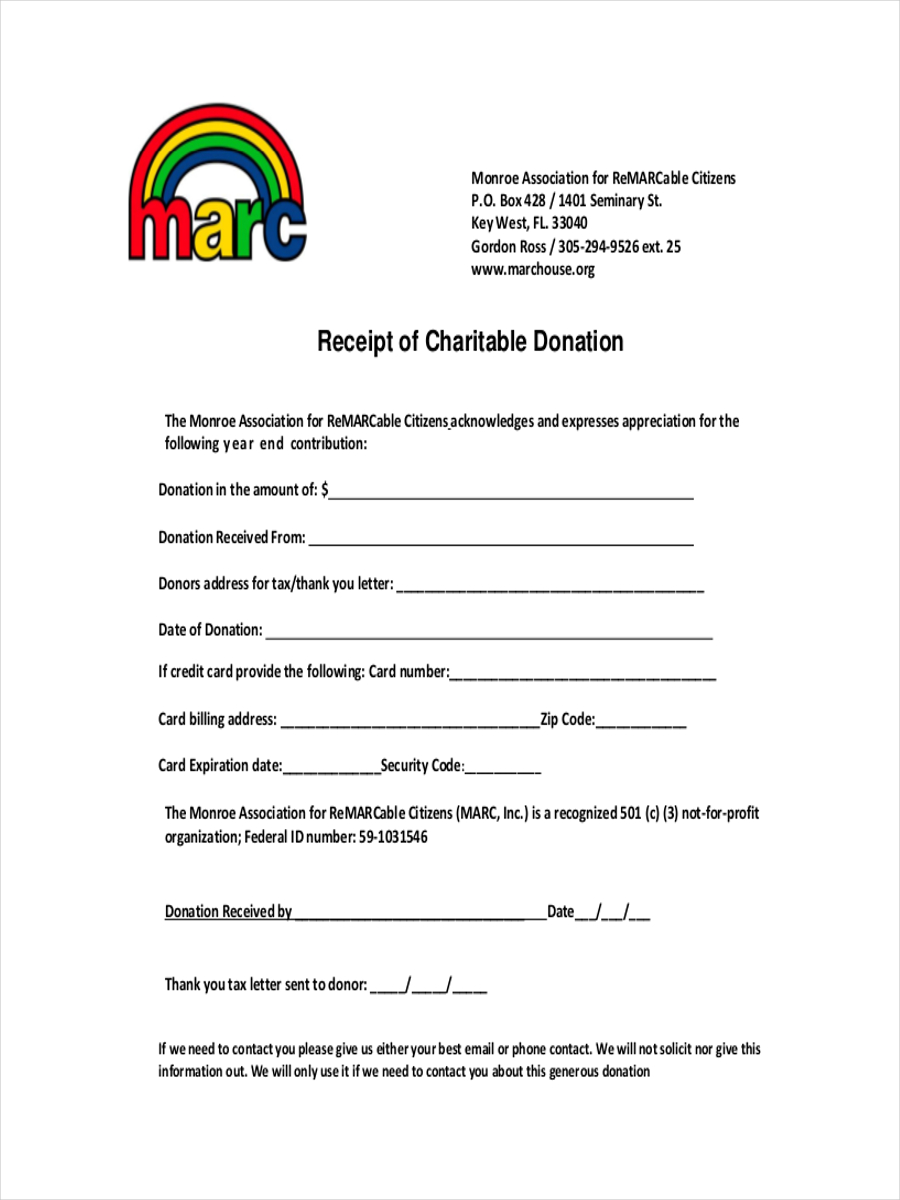

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

Sample Acknowledgement Receipt For Donation

Charity Donation Card Template

Charity Donation Card Template

Gift Receipt Template

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

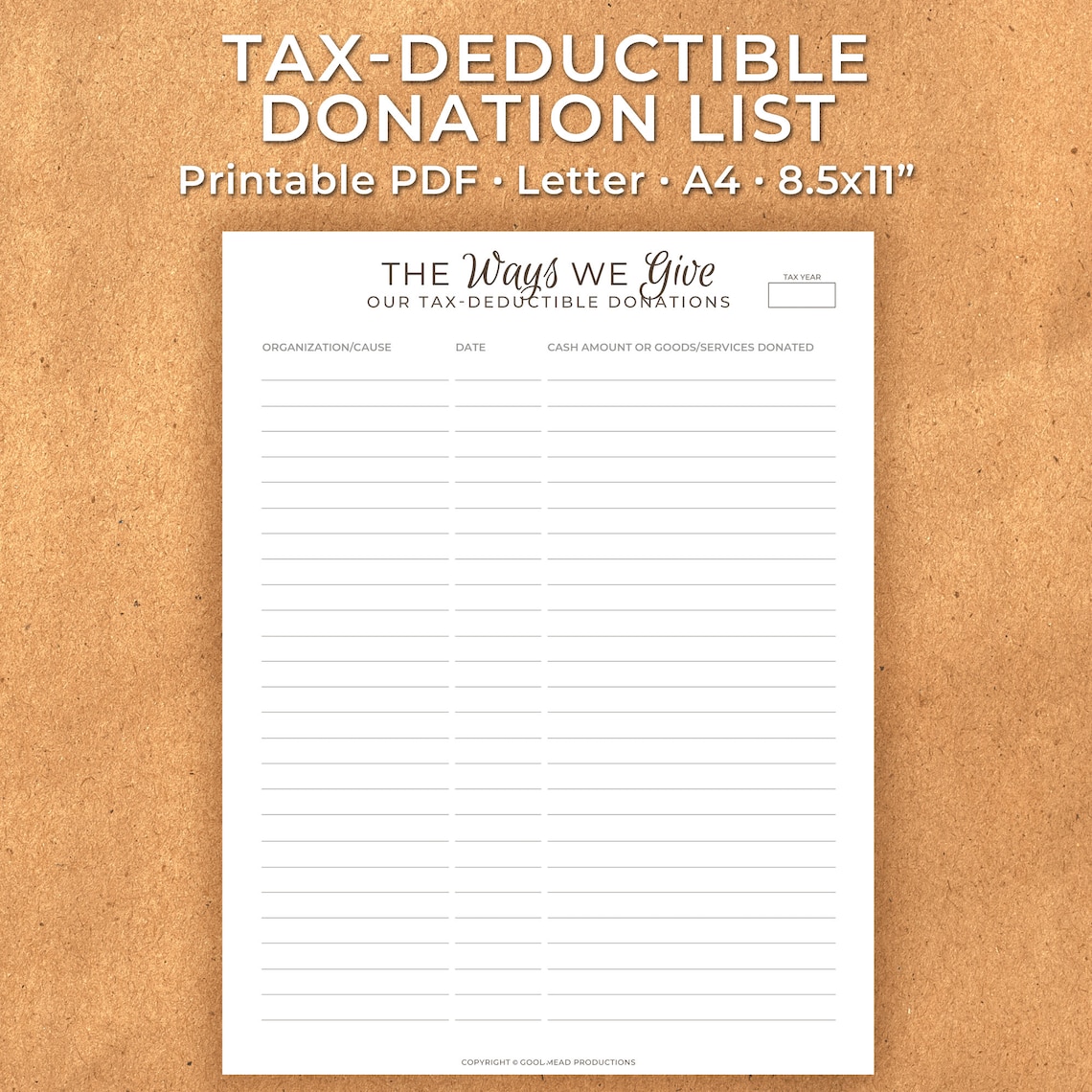

Donation List For Taxes Charitable Donations Tracker Tax Deductions Tax

Income Tax Relief For Charitable Donations - Tax reliefs for charities As a charity you do not pay tax on most of your income and gains if you use it for charitable purposes this is known as charitable expenditure This includes tax