Income Tax Return For Retired Person In India Yes pensioners can file their income tax returns online through the Income Tax Department s e filing portal or other authorized e filing websites

Pensioners can claim a Rs 50 000 deduction on pension income In case of senior citizens no tax is if income is up to Rs 5 00 000 under old tax regime and under new tax regime limit is up to Rs 7 00 000 and rebate can be claim up to Rs 25 000 File Income Tax Return for Pensioners Learn more about ITR filing process for Pensioners Which ITR form to use ITR for Retired Government Employees What are the Taxation Rules Payment TDS and other details

Income Tax Return For Retired Person In India

Income Tax Return For Retired Person In India

https://www.cnet.com/a/img/resize/a1acdd1390bbf55f36127cf4b8e02fbf0d4e9688/hub/2022/11/04/d982df6b-0a22-48d7-8605-209d98b44883/gettyimages-1348247162.jpg?auto=webp&fit=crop&height=675&width=1200

Photo Gallery Free EFiling Income Tax Return Online For FY 2021 22

https://czytax.in/wp-content/uploads/2023/01/preview.jpg

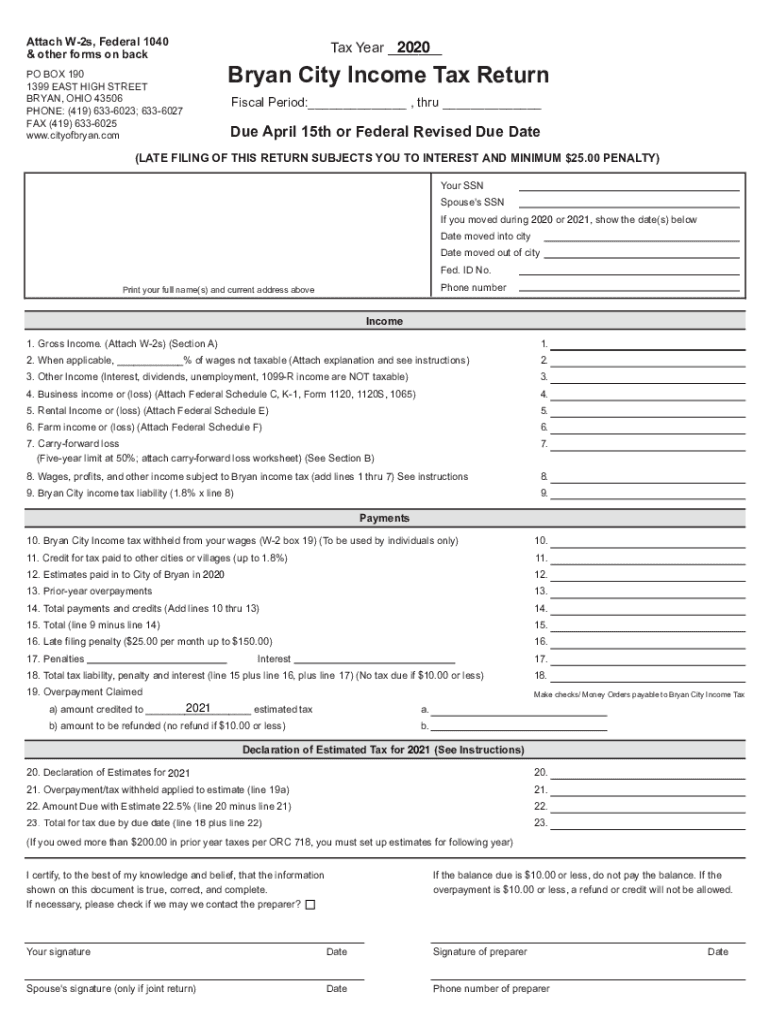

2018 Income Tax Return Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/609/975/609975446/large.png

Individuals must report their retirement benefits as part of their total income when filing their Income Tax Return ITR and pay tax accordingly For example Under the Payment of Finance Act 2021 inserted a new section 194P which provided conditions for exempting senior citizens from filing income tax returns aged 75 years and above New Section 194P will become applicable from 1st April 2021

ITR 1 Sahaj This straightforward form is suitable for senior citizens whose income includes salary pension interest from savings accounts fixed deposits and rental income from a single E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025

Download Income Tax Return For Retired Person In India

More picture related to Income Tax Return For Retired Person In India

Income Tax Return ITR Filing For FY 2022 23 Important Tips Form 16

https://static.toiimg.com/thumb/msid-100690943,width-1070,height-580,imgsize-23082,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

Business Person Income Tax Return Master Course Syed Tech

https://syedtech.net/wp-content/uploads/2023/09/Business-Income-Tax-Return-Master-Course.jpg

Due Date Extended For Filing Income Tax Return AY 2021 22 Income Tax

https://i.pinimg.com/originals/d5/f8/99/d5f899339ddc63ef394cd0c00c055375.jpg

If you receive retirement benefits in the form of a pension the amount received will be taxable and must be included in your income tax return ITR Just like other incomes accrued in India Learn how to file Income Tax Returns ITR as a pensioner in 2024 This step by step guide covers document requirements form selection e filing registration and maximising tax savings

Learn how to file Income Tax Return ITR for pensioners Get step by step instructions tips and important information for a hassle free filing process Calculate your SIP Return Yes senior citizens have to file income tax returns mandatorily However senior citizens over 75 years of age whose income consists of only pension and interest income from the same bank are exempted from filing income tax return provided he submits a declaration under Form 12BB

i s 31122022 (2).png)

Alliance Tax Experts How To File GSTR 1

https://www.alltaxfin.com/blog_admin/assets/images/blog/blogpo_122533Last Date to file belated or revised income tax return for a.y 2022-23 (f.y. 2021-22) i s 31122022 (2).png

Income Tax TDS Deducted But ITR Not Filed Here s What Professionals

https://cdn.zeebiz.com/sites/default/files/2017/07/19/21907-tax3-pixabay.png

https://cleartax.in/s/how-to-file-itr-for-pensioners

Yes pensioners can file their income tax returns online through the Income Tax Department s e filing portal or other authorized e filing websites

https://www.caclubindia.com/guide/pension

Pensioners can claim a Rs 50 000 deduction on pension income In case of senior citizens no tax is if income is up to Rs 5 00 000 under old tax regime and under new tax regime limit is up to Rs 7 00 000 and rebate can be claim up to Rs 25 000

How To File FBR Income Tax Return For Salaried Person Online In

i s 31122022 (2).png)

Alliance Tax Experts How To File GSTR 1

Top Five Reminders When Filing Income Tax Returns In 2022 Accounting

QUESTION OF THE DAY 1 What Is The Income Tax Return Last Date And

File Income Tax Return For A Y 2024 25 Due Date 31st July

File Income Tax Return For A Y 2024 25 Due Date 31st July

ITR Filing Income Tax Deadline Penalties And Loss Of Benefits After

The Latest Updates In Income Tax Filing What You Need To Know

Income Tax India On Twitter Dear Taxpayers Do Remember To File Your

Income Tax Return For Retired Person In India - Individuals must report their retirement benefits as part of their total income when filing their Income Tax Return ITR and pay tax accordingly For example Under the Payment of