Income Tax Return For Unemployed India Offline Utilities for filing ITR 1 2 4 and 6 for AY 2024 25 are live now 3 ITR 1 ITR 2 and ITR 4 for AY 2024 25 are enabled for filing in Online mode at e filing portal 4 Eligible

Who is required to file nil income tax return If your gross total income in FY 2022 23 AY 2022 23 is less than the basic exemption limit then it is not mandatory for 1 ITR 2 Applicable for Non Resident Individual This return is applicable for Individual whether Resident or Non Resident and Hindu Undivided Family HUF Not having

Income Tax Return For Unemployed India

Income Tax Return For Unemployed India

https://carajput.com/art_imgs/frequently-asked-question-on-income-tax-return.jpg

Unemployment In India Mises India

https://i0.wp.com/misesindia.in/wp-content/uploads/2019/02/21e56-s.jpg?fit=760%2C474&ssl=1

India s Unemployment Rate Highest Since 2016 Report YouTube

https://i.ytimg.com/vi/oLY0klCNz-Y/maxresdefault.jpg

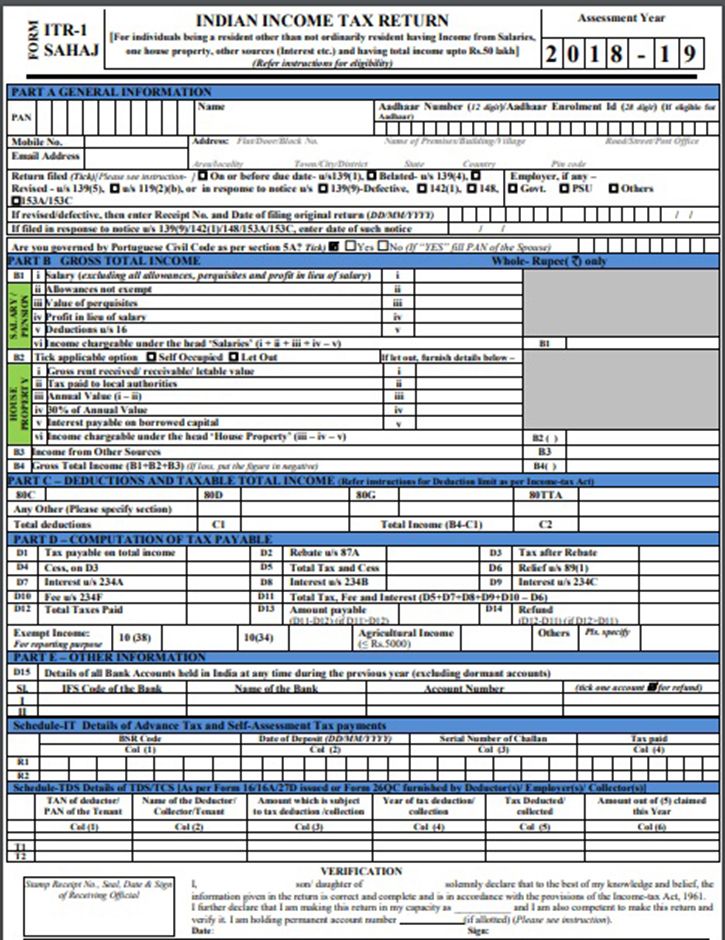

The process of filing taxes and the documents required vary depending on the income earned and the source of income like business profit investment profit In general any individual or entity whose total income during the financial year exceeds the basic exemption limit which varies depending on age and income category must file

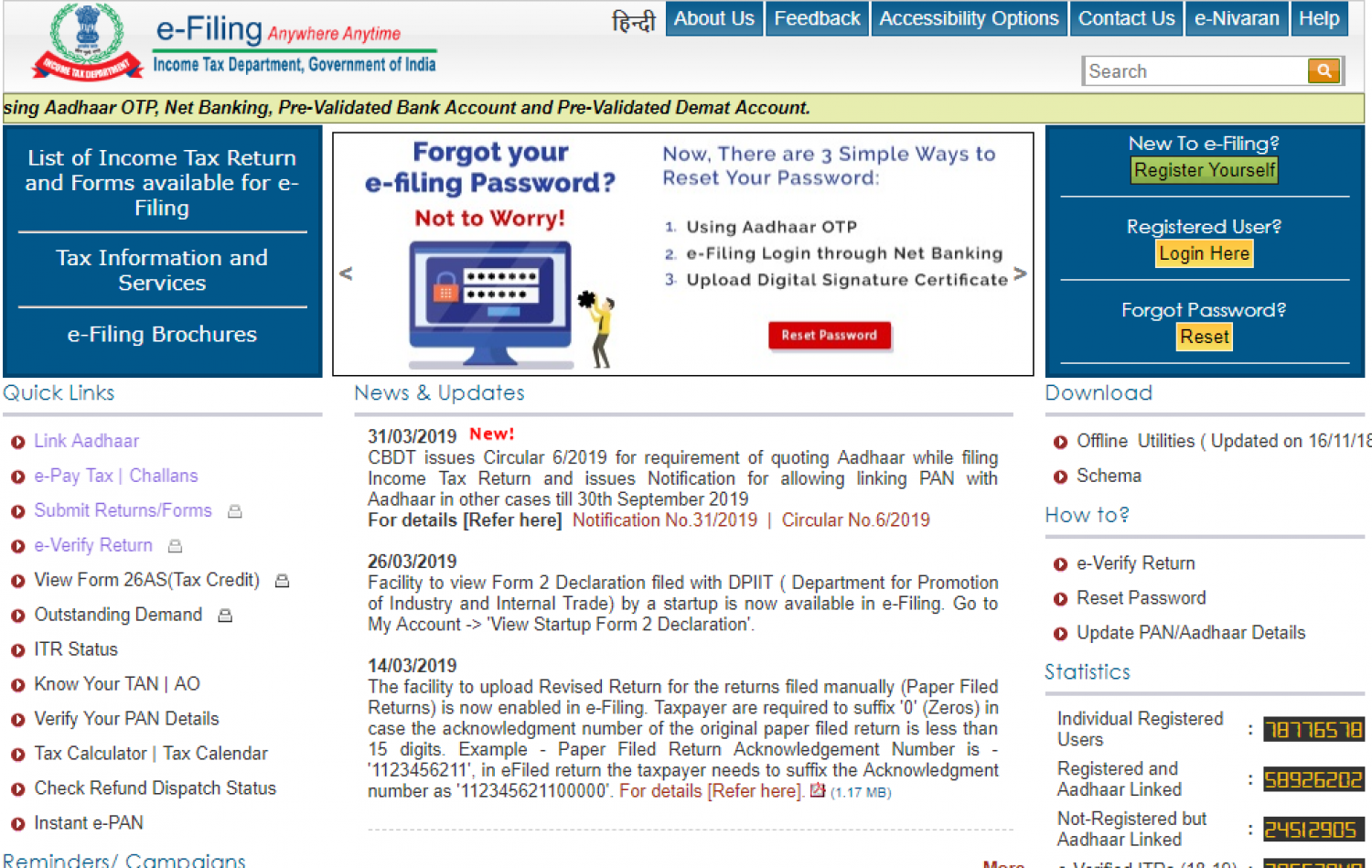

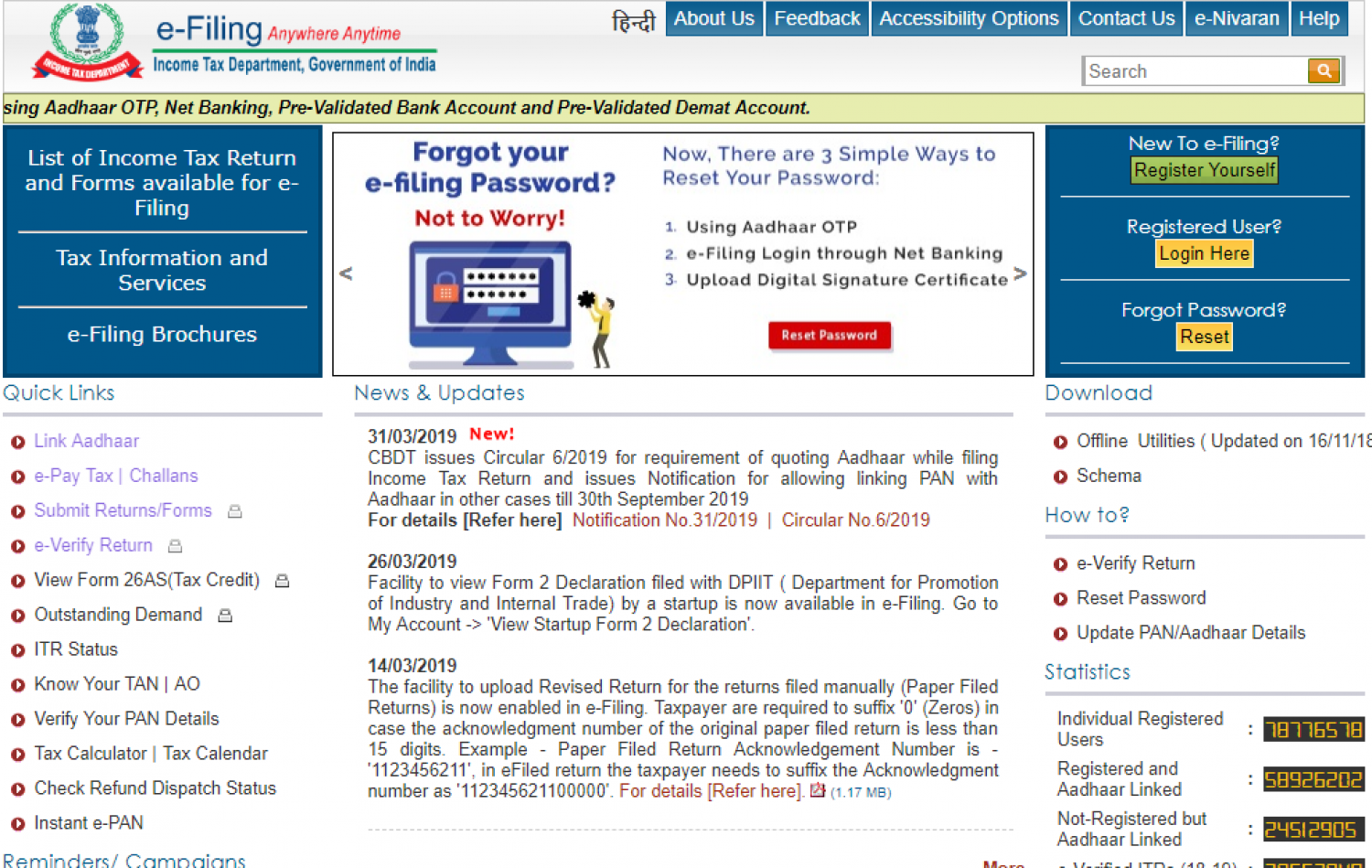

E Filing Home Page Income Tax Department Government of India loading Updated on Mar 12th 2024 11 min read Switch Language An Income Tax Return ITR is a form that enables a taxpayer to declare his income expenses tax deductions investments taxes etc The

Download Income Tax Return For Unemployed India

More picture related to Income Tax Return For Unemployed India

Unemployment India A Country Of Unemployed YouTube

https://i.ytimg.com/vi/7ByPXA4eiU8/maxresdefault.jpg

Unemployed India YouTube

https://i.ytimg.com/vi/fVw79yMQwUQ/maxresdefault.jpg

Blank Income Tax Forms American 1040 Individual Income Tax Return Form

https://thumbs.dreamstime.com/z/blank-income-tax-forms-american-individual-return-form-pen-glasses-221962153.jpg

This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a If a person s gross annual income exceeds 2 50 000 under the new tax regime in a fiscal year submitting a tax return is required per tax regulations Individual

ITR Filing for FY 2023 24 AY 2024 25 e Filing of Income Tax Returns online made easy with ClearTax to get maximum tax refund Income Tax login upload Form 16 Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number

Tax Table Internal Revenue Code Sales Revenue Net Income Tax

https://i.pinimg.com/originals/a7/27/c9/a727c9c920e10cfc64068765bcaac683.png

Income Tax Return

https://im.indiatimes.in/content/2018/Apr/income_tax_return_form_1522998544.jpg

https://www. incometax.gov.in

Offline Utilities for filing ITR 1 2 4 and 6 for AY 2024 25 are live now 3 ITR 1 ITR 2 and ITR 4 for AY 2024 25 are enabled for filing in Online mode at e filing portal 4 Eligible

https:// economictimes.indiatimes.com /wealth/tax/...

Who is required to file nil income tax return If your gross total income in FY 2022 23 AY 2022 23 is less than the basic exemption limit then it is not mandatory for

Income Tax Returns 2023 Pay Rs 5 000 If Itr Filing Deadline Is Missed

Tax Table Internal Revenue Code Sales Revenue Net Income Tax

CBDT Notifies ITR Forms And Income Tax Return Acknowledgement For AY

Individual Income Tax Return Bangla Form

I m Unemployed And Owe Taxes What Should I Do SH Block Tax Services

File Income Tax Income Tax Return Values Examples Economic Times

File Income Tax Income Tax Return Values Examples Economic Times

The CAP Blog New Income tax Return Forms Huge Data Mining Exercise

Income Tax E filing In India US Tax Filing

No State Income Tax Relief For Unemployed Hoosiers In Bill Headed To

Income Tax Return For Unemployed India - Updated on Mar 12th 2024 11 min read Switch Language An Income Tax Return ITR is a form that enables a taxpayer to declare his income expenses tax deductions investments taxes etc The