Income Tax Return Form For Salaried Person Therefore a salaried person must file an income tax return using the ITR 2 form if they have income from both salary and capital gains such as from equity shares

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries For individuals being a resident other than not ordinarily resident having total income upto Rs 50 lakh having Income from Salaries one house property other

Income Tax Return Form For Salaried Person

Income Tax Return Form For Salaried Person

https://3.bp.blogspot.com/-RiR9rQUnXas/Xkf55my3CyI/AAAAAAAABJI/PD63PY5nLMEUSPbn1T-zh4EsGpoSz86pgCK4BGAYYCw/s1600/Scan1.JPG

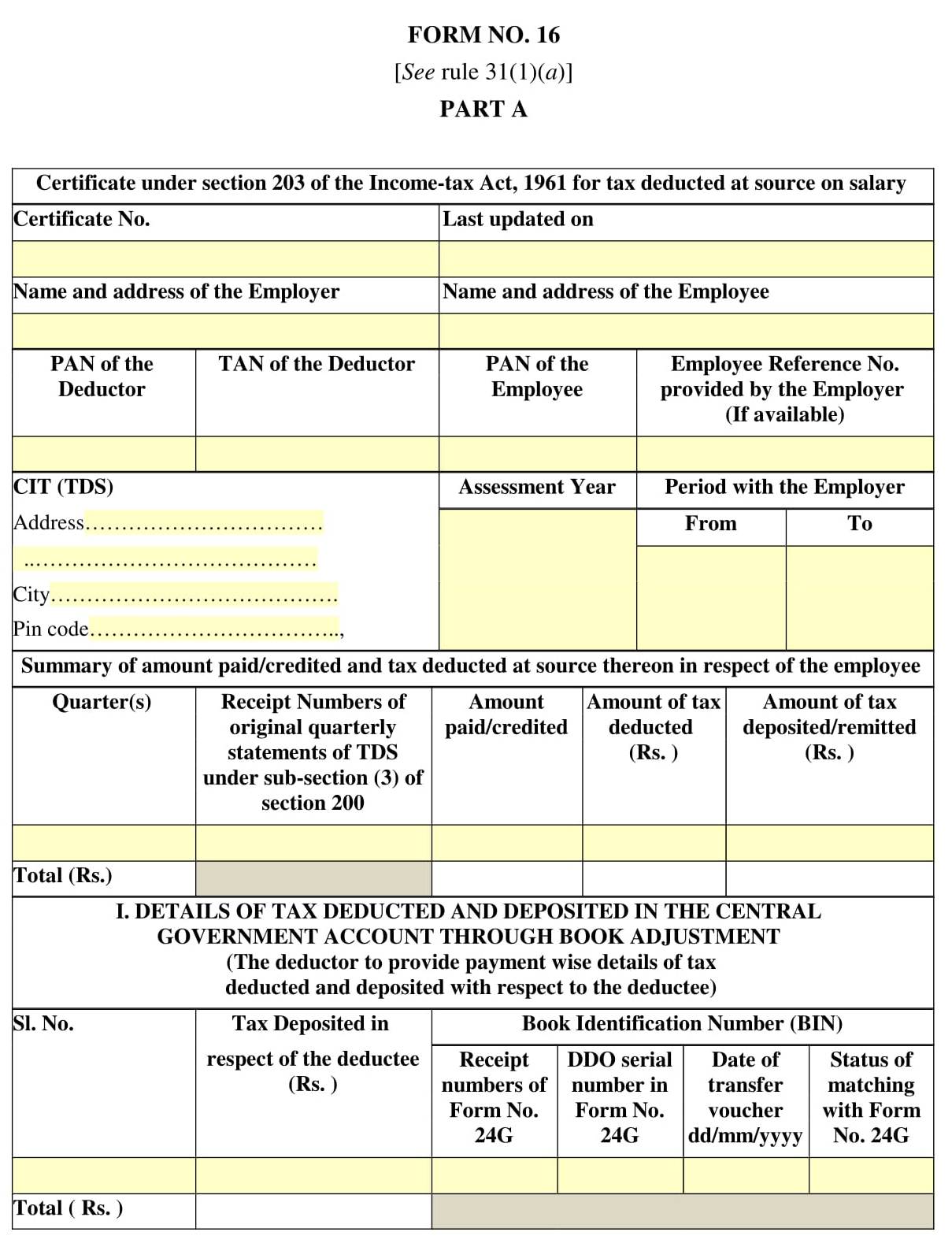

34 INCOME TAX 2019 20 HRMS HARYANA HRMS Haryana

https://2.bp.blogspot.com/-tdiReI7-VS4/Xkf6BFrMiiI/AAAAAAAABJQ/UcqfPh_7JVoQm_4zAdudfj00ETtJ8QWHgCK4BGAYYCw/s1600/Scan10001.JPG

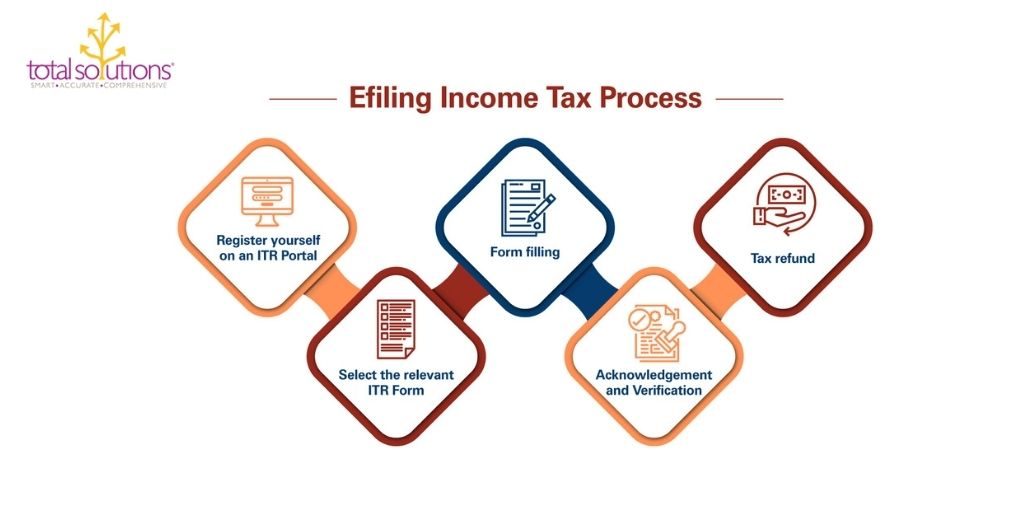

How To File Income Tax Return ITR Online For Salaried Employees

https://www.taxhelpdesk.in/wp-content/uploads/2021/03/ITR.jpg

This ITR filing guidelines for salaried employees aim to simplify the complex process of online tax filing specifically for salaried employees We ll walk you through Salaried individuals can file income tax returns ITR using the forms ITR 1 or ITR 2 ITR 1 applies to individual resident taxpayers with a total income of up to Rs

This article provides an overview and general guidance on the returns and forms applicable to salaried individuals for Assessment Year AY 2024 25 For exhaustive details and guidelines please refer to the Income Various ITR forms can be downloaded in PDF format for AY 2024 25 from the Income Tax website according to income slabs Taxpayers can conveniently file returns online by following specific steps The article

Download Income Tax Return Form For Salaried Person

More picture related to Income Tax Return Form For Salaried Person

Latest ITR Forms Archives Certicom

https://i0.wp.com/certicom.in/wp-content/uploads/2022/06/Understanding-updated-and-revised-income-tax-returns.jpg?fit=1920%2C1080&ssl=1

INCOME TAX RETURN OF SALARIED PERSON PART 1 SALARY BIFURCATION

https://i.ytimg.com/vi/tyO8zjVJHxY/maxresdefault.jpg

Easy Steps To File Income Tax Returns For Salaried Employees

https://total-sols.com/blog/wp-content/uploads/2021/02/REGISTRATION-2-1024x512.jpg

If you are a salaried employee you might be familiar with Form 16 when filing income tax returns Both employers and employees are required to understand its components eligibility and importance to ITR is a prescribed form through which you communicate the details of your income earned deductions claimed and taxes paid in a financial year to the Income Tax

As per the current income tax laws an individual below 60 years of age is required to file ITR if his her gross total income exceeds Rs 2 5 lakh in a financial year This service enables individual taxpayers to file ITR 1 either online through the e Filing portal or by accessing the offline excel and html utility This user manual covers the

Are You A Salaried Person Tax App Income Tax Return Wealth Management

https://i.pinimg.com/736x/40/69/bf/4069bf2d919b6a1eba012677f664e510.jpg

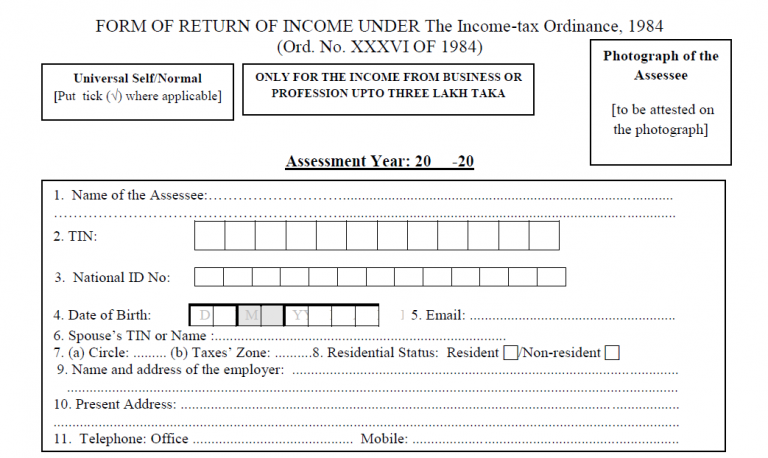

1 Page Income Tax Return Form BD 2021 22 PDF Excel Format Protibad Com

https://allresultbd.com/wp-content/uploads/2021/07/1-Page-Income-Tax-Return-Form-768x458.png

https://economictimes.indiatimes.com/wealth/tax/...

Therefore a salaried person must file an income tax return using the ITR 2 form if they have income from both salary and capital gains such as from equity shares

https://www.incometax.gov.in

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Are You A Salaried Person Tax App Income Tax Return Wealth Management

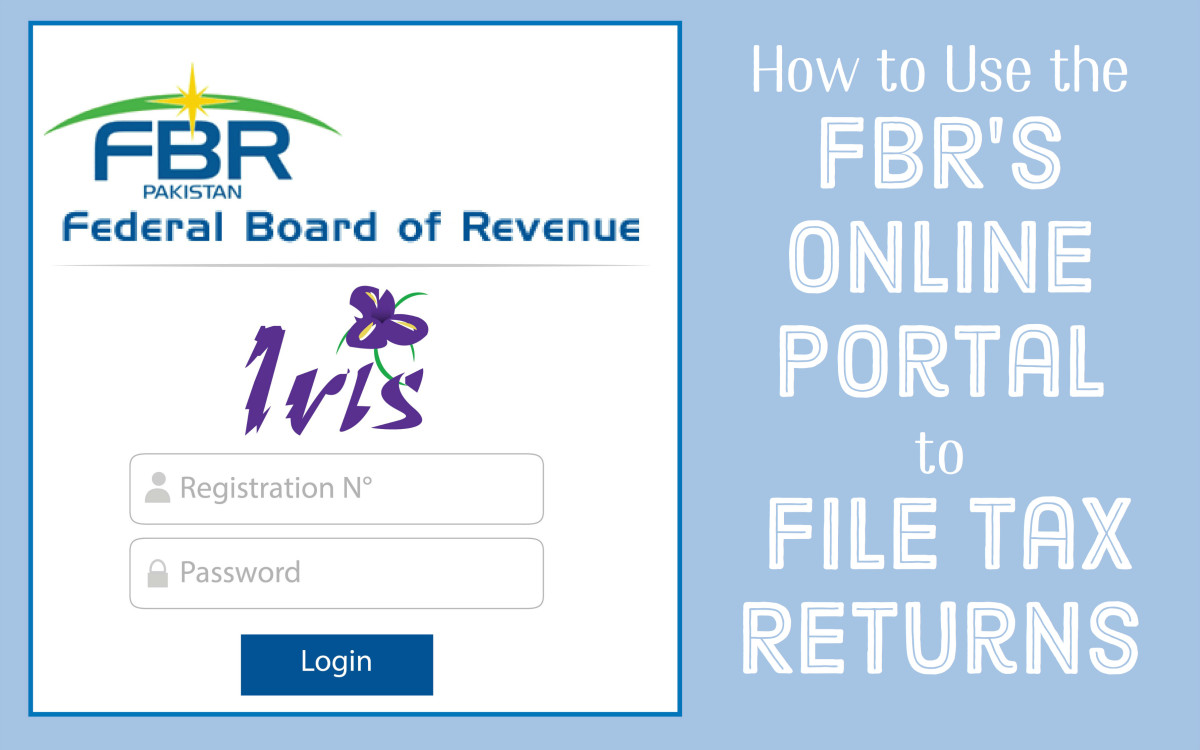

How To EFile Your Income Tax Return And Wealth Statement Online With

How To Create Login Form With Visual Studio And Sql Server Avaxhome

How To File Income Tax Return Online For Salaried Employee

How Salaried Employees Can File Income Tax In Pakistan

How Salaried Employees Can File Income Tax In Pakistan

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Everything About Draft Common ITR Form Issued By CBDT Legal Suvidha Blog

Income Tax Return Form For Salaried Person - This ITR filing guidelines for salaried employees aim to simplify the complex process of online tax filing specifically for salaried employees We ll walk you through