Rebate Taxable Web De tr 232 s nombreux exemples de phrases traduites contenant quot taxable rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises

Web These include If no itemized deduction was claimed for the premiums the rebate is not taxable If an itemized deduction was claimed for the premiums the rebate to the extent Web Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on your purchase

Rebate Taxable

Rebate Taxable

https://www.menardsrebateform.com/wp-content/uploads/2023/03/Menards-Rebates-Taxable-1024x414.png

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://i1.wp.com/myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-1-rev.jpg?resize=321%2C543&ssl=1

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

https://iimskills.com/wp-content/uploads/2021/07/ARE-GST-REBATES-TAXABLE-compressed-2048x779.jpg

Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds because governments can enact them Web 9 sept 2023 nbsp 0183 32 taxes taxable income Will Your State Rebate Check Be Taxed for 2023 Here s what the IRS says about taxing state stimulus checks and other special state

Web 17 f 233 vr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return Web 17 ao 251 t 2022 nbsp 0183 32 You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments Investing Stocks

Download Rebate Taxable

More picture related to Rebate Taxable

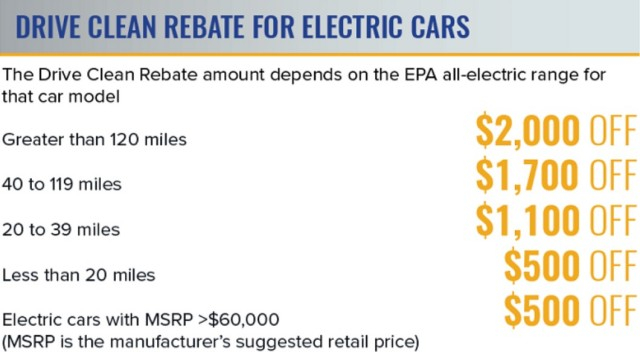

Ca Electric Car Rebate Taxable 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/california-electric-car-rebates-a-new-guide-to-saving-up-to-7-000-8.png

Mass Save Rebates BDL Heating And Cooling Mass Save Rebate

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2023/05/mass-save-rebates-bdl-heating-and-cooling.jpg?fit=800%2C657&ssl=1

California Lawn Rebate 2023 Taxable Californiarebates

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/california-lawn-rebate-2022-artificial-grass-rebates-purchase-green-1.png

Web 24 juil 2023 nbsp 0183 32 February 13th update On Friday evening the IRS announced that rebates in most states would not be taxed but that payments from Georgia Massachusetts South Web 10 f 233 vr 2023 nbsp 0183 32 Key Points If you received a state tax rebate or payment in 2022 it s unclear whether the funds are taxable on your federal return The IRS last week told affected

Web Are sales taxes calculated before or after a rebate or incentive is applied The short answer is it depends on the state Please see What Fees Should You Pay for detailed Web 9 f 233 vr 2023 nbsp 0183 32 The Tax Policy Center a nonprofit research group counts 18 states that sent one time income tax rebates in 2022 Arkansas California Colorado Connecticut

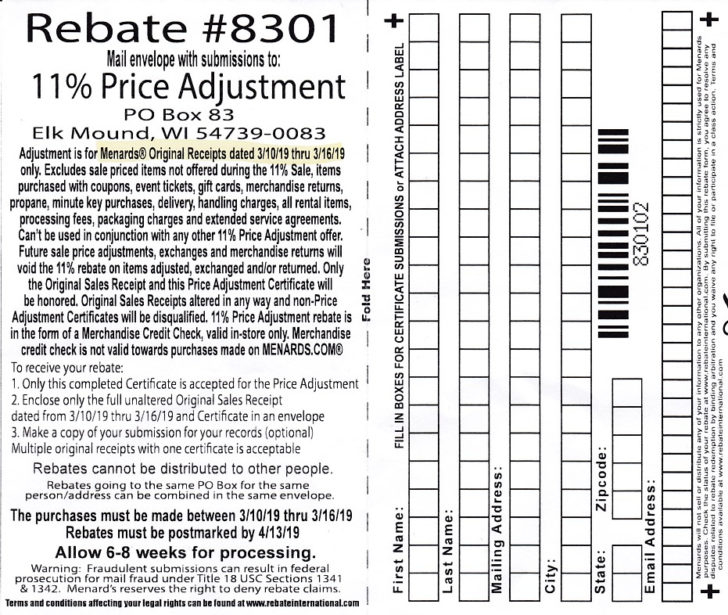

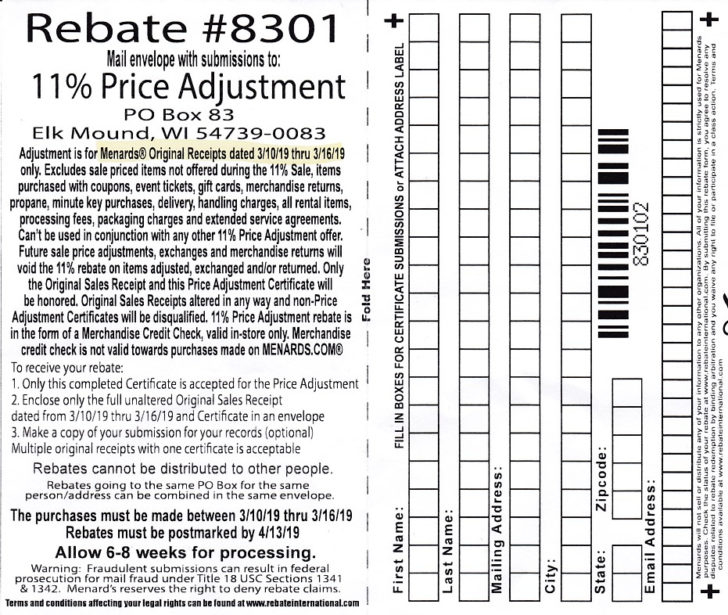

Menards 11 Price Adjustment Rebate 8301 Purchases 3 10 Printable

https://www.menardsrebate-form.com/wp-content/uploads/2023/05/menards-11-price-adjustment-rebate-8301-purchases-3-10-printable.jpg

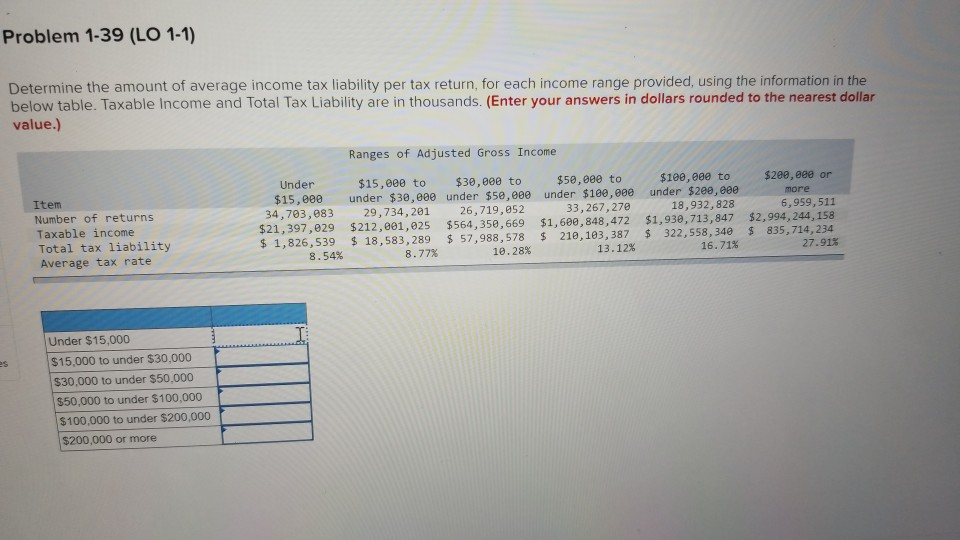

Solved Problem 1 39 LO 1 1 Determine The Amount Of Average Chegg

https://media.cheggcdn.com/media/9ec/9ec51619-cf20-4157-94f9-e208f37c3ee5/image.png

https://www.linguee.fr/anglais-francais/traduction/taxable+rebate.html

Web De tr 232 s nombreux exemples de phrases traduites contenant quot taxable rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises

https://donotpay.com/learn/are-rebates-taxable

Web These include If no itemized deduction was claimed for the premiums the rebate is not taxable If an itemized deduction was claimed for the premiums the rebate to the extent

Are Car Rebates Taxable In New York 2022 Carrebate

Menards 11 Price Adjustment Rebate 8301 Purchases 3 10 Printable

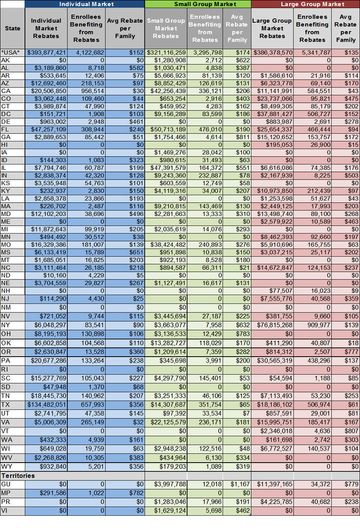

1 Billion In Health Insurance Rebates Taxable Or Tax free Kiplinger

Is Recovery Rebate Taxable Find All Answers

New Tax Regime Sec 87 A Rebate For Taxable Income More Than Rs 7

Is Your State Rebate Or Stimulus Taxable YouTube

Is Your State Rebate Or Stimulus Taxable YouTube

Are Car Rebates Taxable In New York 2022 Carrebate

Is CA EV Rebate Taxable

NYS Property Tax Rebate 2023 Eligibility Criteria And Application

Rebate Taxable - Web Tax rebate under Section 87A of the Income Tax Act is the final reduction from your tax liability up to Rs 12 500 The purpose of this rebate is to further reduce the tax burden of