Income Tax Rules 2024 With higher standard deduction amounts expanded income tax brackets and changes to business write offs the 2024 tax season will look different Ready or not the 2024 tax filing season

The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative societies BOI and Artificial Juridical Person Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime

Income Tax Rules 2024

Income Tax Rules 2024

https://n3.sdlcdn.com/imgs/d/n/3/Income-Tax-Rules-5th-e-SDL076879114-1-da7d7.jpg

Zero Tax On Salary Income INR 20 Lakhs Legal Way Here

https://blog.saginfotech.com/wp-content/uploads/2021/07/how-to-save-income-tax.jpg

GARG INCOME TAX READY RECKONER 2022 2023 2023 2024 WITH RATES TABLES

https://www.poojalawhouse.in/577-large_default/garg-income-tax-ready-reckoner-2022-2023-2023-2024-with-rates-tables-illustrations-case-laws-for-income-tax.jpg

WASHINGTON The Internal Revenue Service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024 including the tax rate schedules and other tax changes Revenue Procedure 2023 34 provides detailed information about these annual adjustments There are seven federal tax brackets for tax year 2024 They are 10 12 22 24 32 35 and 37 The highest earners fall into the 37 range while those who earn the

The federal income tax has seven tax rates in 2024 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 609 350 for single filers and above 731 200 for married couples filing jointly The new Income tax slabs under the new tax regime for FY 2023 24 AY 2024 25 are Surcharge and Cess are to be added separately based on the taxable income over and above the tax rates mentioned above What Is Surcharge Amount Under Revised New Tax Regime Is That Change Applicable Only For Those With An Income

Download Income Tax Rules 2024

More picture related to Income Tax Rules 2024

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

Income Tax Statistics 2023 Tax Brackets USA UK And More

https://www.enterpriseappstoday.com/wp-content/uploads/2022/10/Income-Tax-Statistics.jpg

Taxmann s Income Tax Rules 2 Vols Buy Taxmann s Income Tax Rules 2

https://n4.sdlcdn.com/imgs/h/s/4/Taxmann-s-Income-Tax-Rules-SDL023588796-1-02ac7.jpg

FS 2024 02 Feb 2024 Most U S citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year The IRS has a variety of information available on IRS gov to help taxpayers including a special free help page You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket

[desc-10] [desc-11]

Old Tax Regime Vs New Tax Regime Which Is Better For You As Per Budget

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFzJwJHyVBIaFv0G0rI9CycAztACJH2ffDNgtSG3IRxDkB8E8neD3ScVZdjeaFsEGlRNFOqKLdxATPyE6sMa7P2WhsdLZv3UJrW1PuAJqOiUXvDtJ4GGzrXO4yvVbUK8NRVEwbATdQ9KZblStNks1dIgMF8yCHF-iAGrgmOApYakwfpsgcIG_WKP3T/s633/Tax Slab for A.Y.2024-25.jpg

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

https://www.gconnect.in/gc22/wp-content/uploads/2022/06/Tax1.jpg

https://www.forbes.com/advisor/taxes/2024-tax-changes

With higher standard deduction amounts expanded income tax brackets and changes to business write offs the 2024 tax season will look different Ready or not the 2024 tax filing season

https://www.incometax.gov.in/iec/foportal/help/individual/return...

The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative societies BOI and Artificial Juridical Person

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Old Tax Regime Vs New Tax Regime Which Is Better For You As Per Budget

Income Tax Rules Change Income Tax Has Made 3 Major Changes You Must

New Income Tax Rules Everything You Need To Know About Income Tax Rule

Income Tax Rates Free Of Charge Creative Commons Green Highway Sign Image

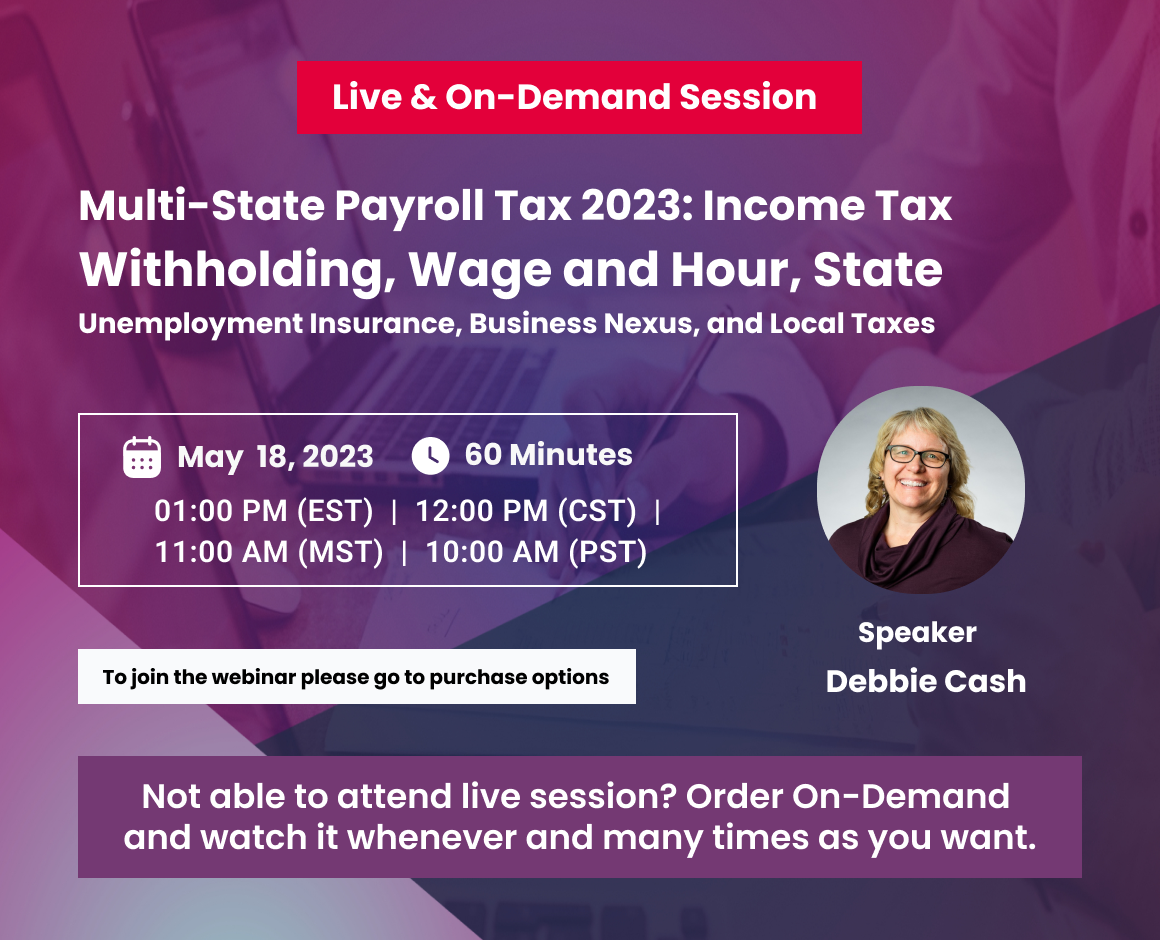

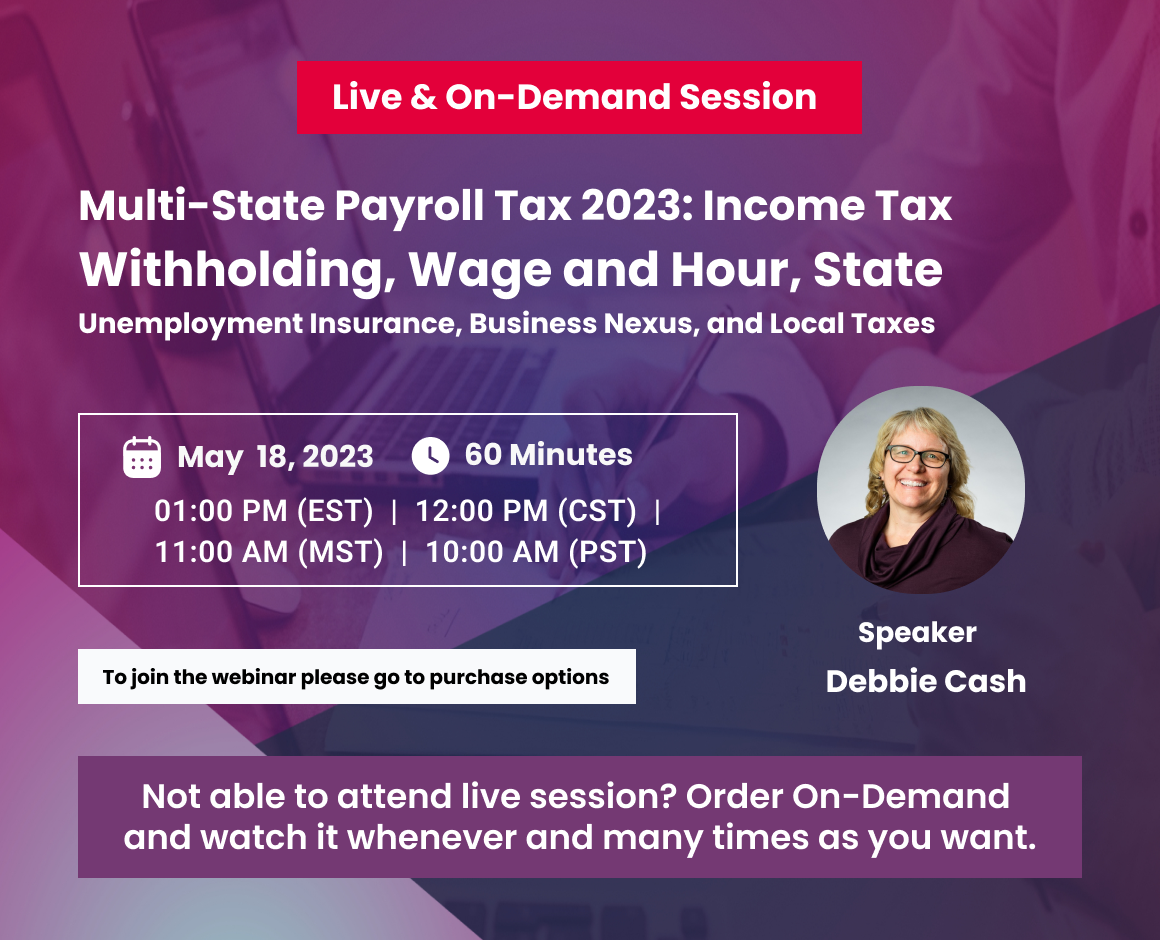

Multi State Payroll Tax 2023 Income Tax Withholding Wage And Hour

Multi State Payroll Tax 2023 Income Tax Withholding Wage And Hour

Highlights Of Tax Reform Law TRAIN See The Tax Rates For 2019

Who Should File A Revised ITR Is There A Penalty

How To Submit Your Personal Income Tax Return

Income Tax Rules 2024 - [desc-14]