Income Tax Saving Schemes Under 80c Verkko 26 jouluk 2022 nbsp 0183 32 Investment managed 800 Cr Monthly MF investment 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing

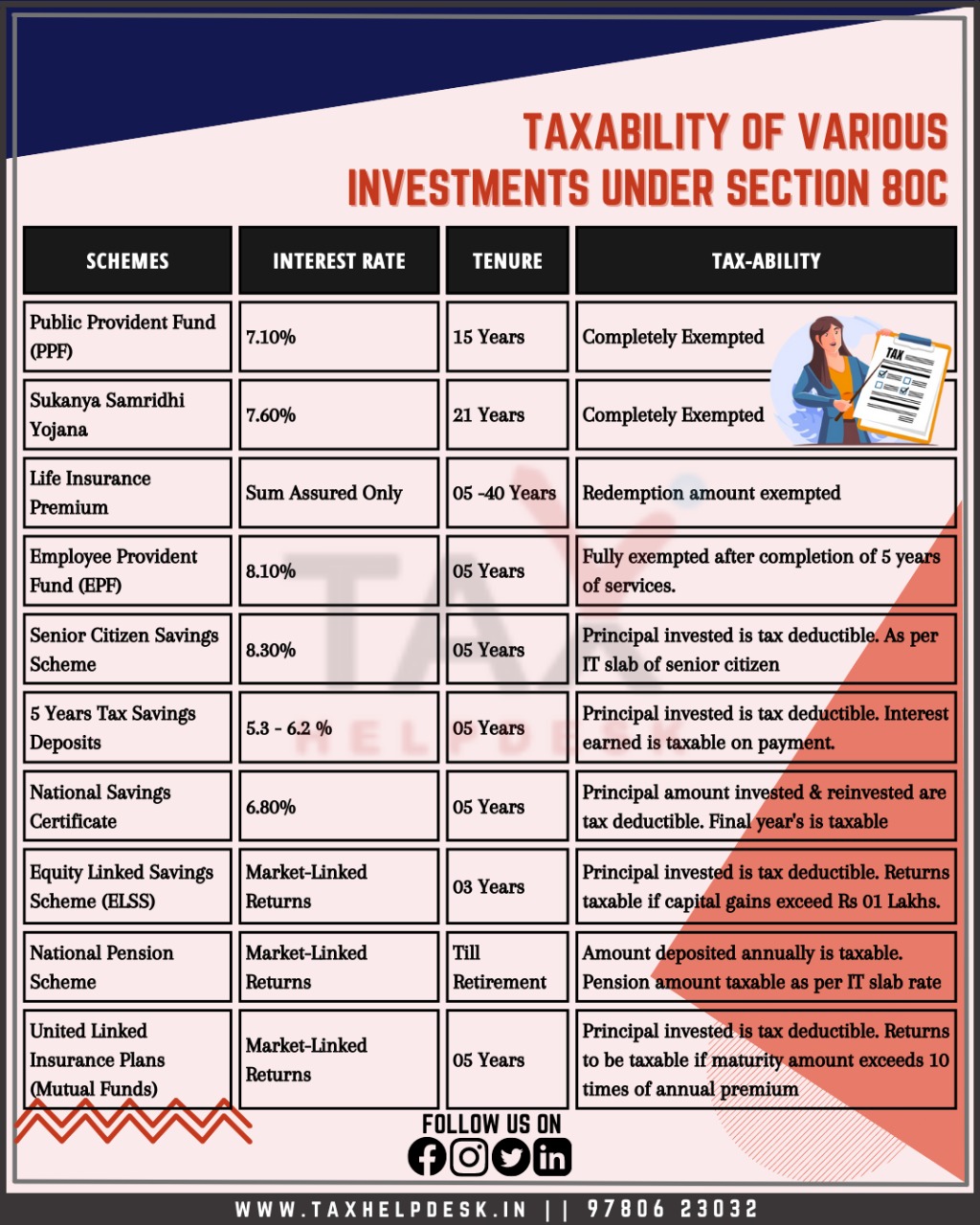

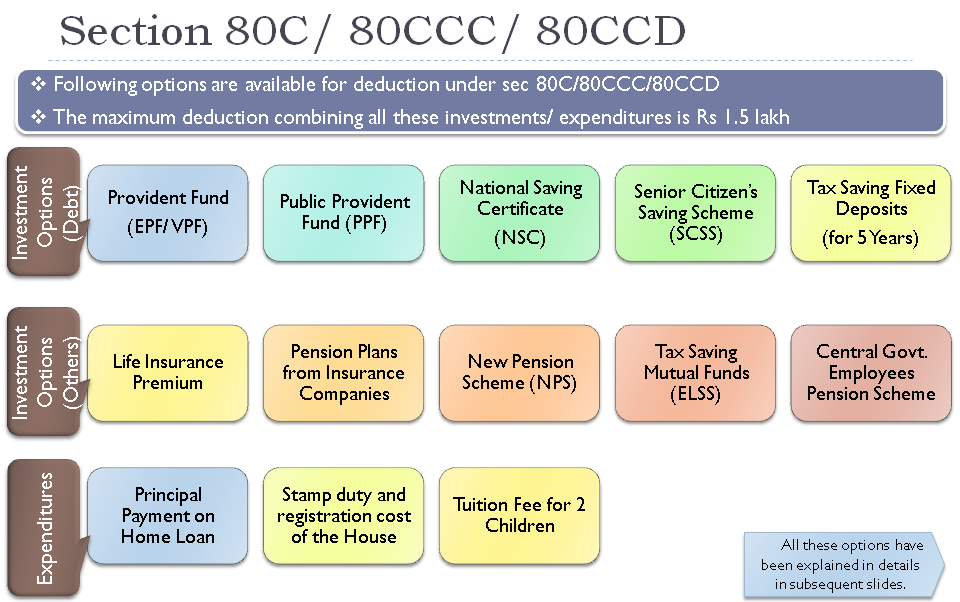

Verkko 23 lokak 2023 nbsp 0183 32 Savings With Section 80C of income tax act Investments Team Acko Oct 23 2023 Section 80C of the Income Tax Act 1961 allows individuals to claim Verkko 10 toukok 2023 nbsp 0183 32 Section 80C This covers investments in Provident Funds like EPF PPF payment of life insurance premiums Equity Linked Saving Schemes payment

Income Tax Saving Schemes Under 80c

Income Tax Saving Schemes Under 80c

https://www.financialexpress.com/wp-content/uploads/2022/12/tax-saving.jpg

4 Best Income Tax Saving Schemes Plans In 2021

https://www.meetrv.com/wp-content/uploads/2021/12/Best-Income-Tax-Saving-Schemes.jpg

Top 5 Post Office Tax Saving Schemes Offering Income Tax Deduction

https://www.goodreturns.in/img/1200x60x675/2022/11/india-post-ed-1667411005.jpg

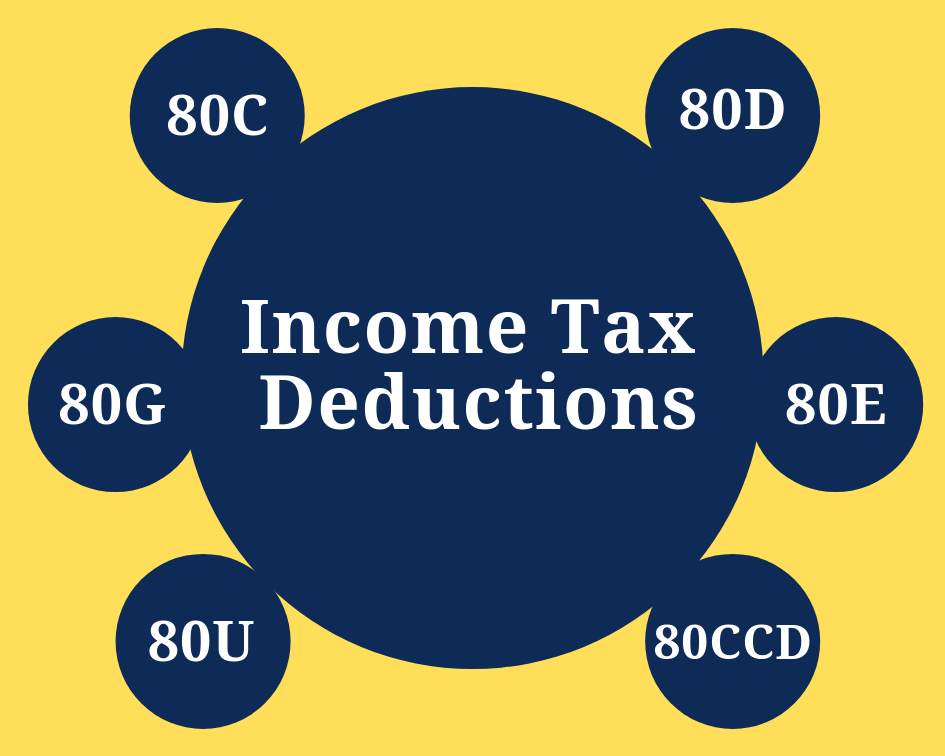

Verkko 8 tammik 2018 nbsp 0183 32 8 Senior Citizen Saving Scheme SCSS SCSS is a Small saving scheme meant for Senior Citizens above 60 years of age This is 5 years lock in Verkko 11 elok 2021 nbsp 0183 32 Section under the Income Tax Act 1961 Eligible investment schemes 80C Provident fund schemes like National Savings Certificate NSC Public Provident Fund PPF Sukanya

Verkko 3 maalisk 2022 nbsp 0183 32 Under Section 80C Under this section you can invest an amount of 1 5 lakh rupees if you want to avail tax exemptions on your taxable income Further you can claim an added deduction of 50 000 Verkko The 80C investment options eligible for deduction under section 80C are categorized according to 80C s sub sections as well Here s a list we compiled for you to easily understand the eligible investments in 80C

Download Income Tax Saving Schemes Under 80c

More picture related to Income Tax Saving Schemes Under 80c

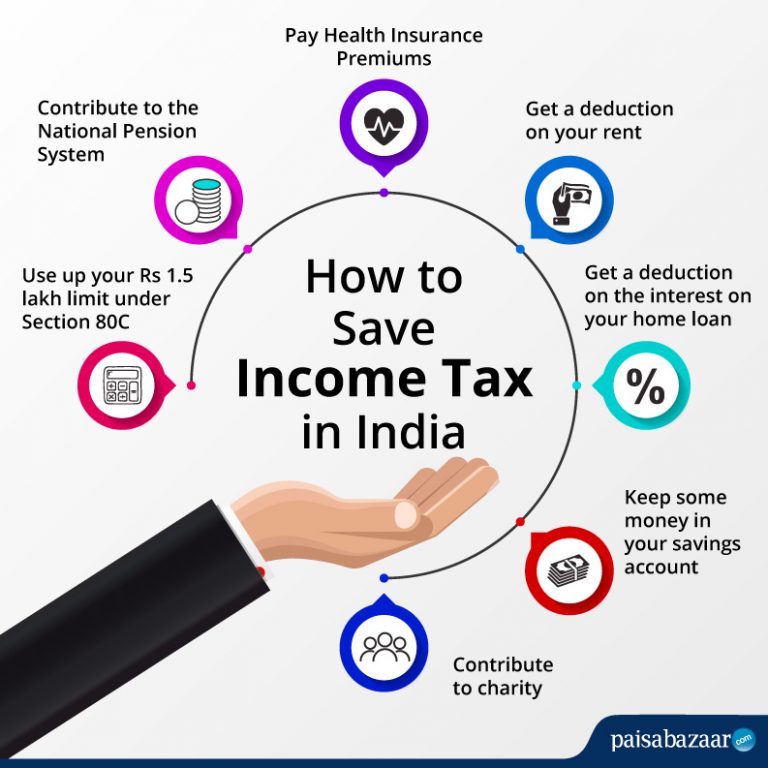

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/06/How-to-Save-Income-Tax-Photo-768x768.jpg

Best Income Tax Saving Schemes In India 2022

https://img.jagrantv.com/article/rc1028183/1645589067-best-tax-saving-schemes-in-india.jpg

Section 80C Everything To Know Deduction Under 80C Tax Saving

https://i.ytimg.com/vi/L1AUhzT9w0Y/maxresdefault.jpg

Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 The Income Tax department is scrutinizing the discrepancies between employer home loan expenditures and tax saving investments under section 80C Verkko 3 syysk 2019 nbsp 0183 32 Section 80C is one of the most popular tax saving sections of the Income Tax Act 1961 Under this section investments made up to Rs 1 5 lakh in a

Verkko Section 80C of the Income Tax Act allows you to claim deductions for various expenses A relatively lesser known option to save tax under Section 80C is payments towards Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 Demystifying the Deduction Maze A Comprehensive Guide to Section 80C Section 80C of the Income Tax Act a three letter code that triggers both

Best Tax Saving Investments Under Section 80c For FY 2019 20

https://www.paisabazaar.com/wp-content/uploads/2019/01/Tax-saving-schemes-under-section-80c.jpg

10 Best Income Tax Saving Schemes And Plans In 2022 India Today

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202203/financial-g599ec42b8_1920_1200x768.jpeg

https://www.etmoney.com/learn/saving-schemes/beyond-section-80c-10...

Verkko 26 jouluk 2022 nbsp 0183 32 Investment managed 800 Cr Monthly MF investment 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing

https://www.acko.com/income-tax/80c-deductions

Verkko 23 lokak 2023 nbsp 0183 32 Savings With Section 80C of income tax act Investments Team Acko Oct 23 2023 Section 80C of the Income Tax Act 1961 allows individuals to claim

A Guide To Investments In Indian Real Estate Rate exchange

Best Tax Saving Investments Under Section 80c For FY 2019 20

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Top 10 Best ELSS Funds 2020 Save Your Tax With Top ELSS Funds

Understand About Taxability Of Various Investments Under Section 80C

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

Top 7 Tax Saving Investments Under Section 80C

Income Tax Deductions In India Capitalante

Budget 2014 Impact On Money Taxes And Savings

Income Tax Saving Schemes Under 80c - Verkko 27 jouluk 2023 nbsp 0183 32 However only the latter qualifies for tax deductions under Section 80C of the Income Tax Act and the maximum amount that you can claim as deductions is