Income Threshold For Child Care Rebate The income cap for eligibility has been increased from 356 756 to 530 000 That will mean more higher income families will be eligible Caregivers don t need to do anything to get the increased rate Aboriginal and Torres Strait Islander children will get at least 36 hours of care subsidised each fortnight regardless of income or activity levels

This Child Care Subsidy Calculator CCS Calculator is developed for Australian parents to estimate their possible Child Care Subsidy payment amount from the Australian Government and out of pocket child care costs when using Centre Based Day Care Family Day Care or Outside School Hours Care Part of Tax Free Childcare You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of childcare This goes up to

Income Threshold For Child Care Rebate

Income Threshold For Child Care Rebate

https://www.weldchildcare.com/files/sharedassets/childcare/images/resources/cccap2.jpeg?w=1200

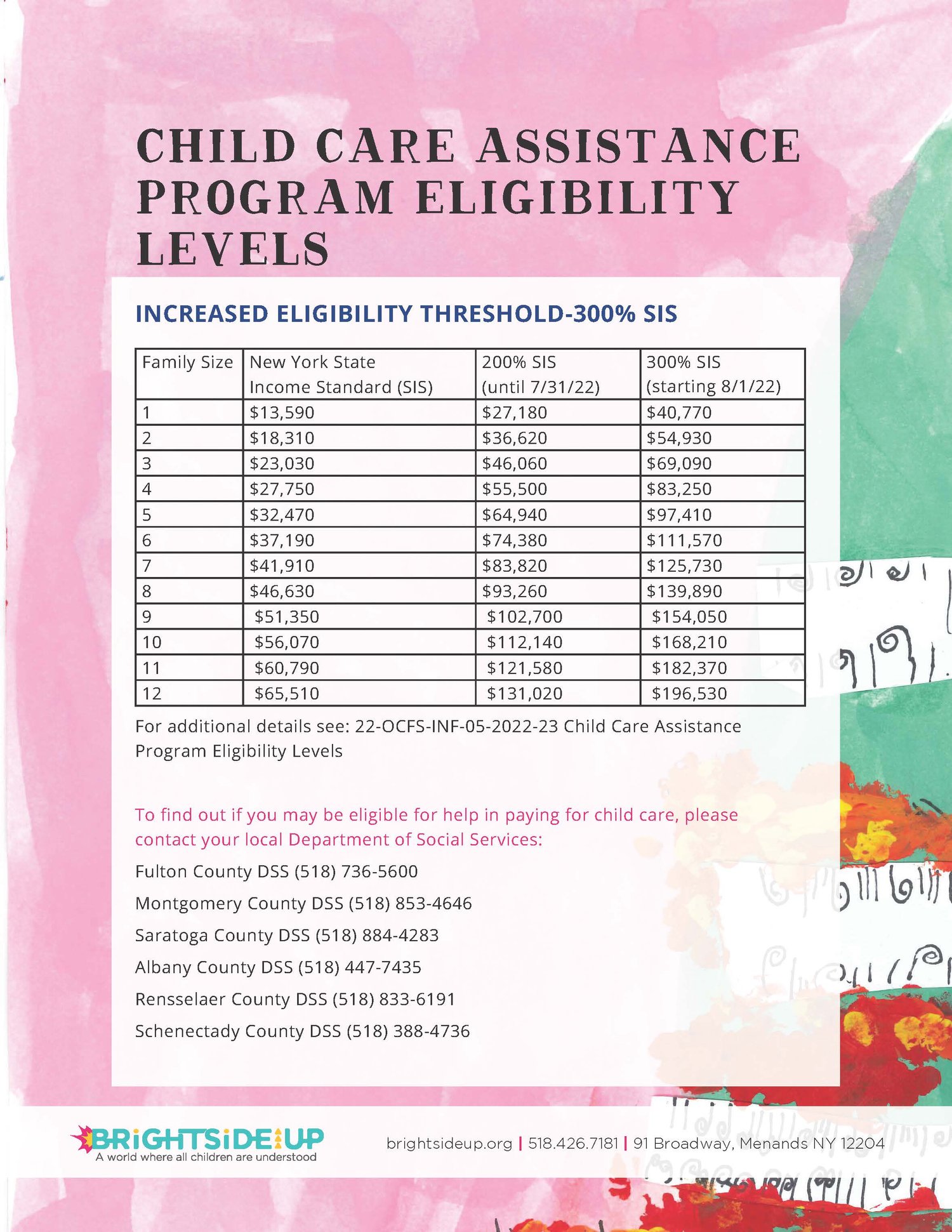

CHILD CARE ASSISTANCE PROGRAM ELIGIBILITY LEVELS Brightside Up

http://static1.squarespace.com/static/5d4dbe9778e49900019f60a6/t/62ded69bed15ac5d0572df4f/1658771186160/eligibility-threshold-chart_300%25SIS.jpg?format=1500w

8 Incredible Tips What Is Dependent Care Credit Outbackvoices

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

For the 2014 2015 income year the CCR annual limit is 7500 per child per year You have the option to receive your CCR paid fortnightly either directly to your bank account or through your child care service provider as a fee reduction Calculate your subsidy estimate in under 30 seconds with this FREE Child Care Subsidy CCS Calculator and save up to 90 on child care costs

If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund The hourly rate for the subsidy will be capped at 11 77 per hour for centre based childcare 10 90 per hour for family daycare 10 29 per hour for Outside School Hours Care and 25 48 per hour for in

Download Income Threshold For Child Care Rebate

More picture related to Income Threshold For Child Care Rebate

Need For Child Care Isn t Going Away New Survey EducationNC

https://www.ednc.org/wp-content/uploads/2020/02/shutterstock_546389527-scaled.jpg

Choosing Quality Child Care Seminar Child Care Services Association

https://18.235.122.25/wp-content/uploads/WMC-Event-Image-Choosing-Quality-Child-Care-Seminar.jpg

The Child Care Rebate Should Not Be Paid To Anti vaxxers

http://cdn.mamamia.com.au/wp/wp-content/uploads/2015/01/childcarepicfacebook-720x377.png

Your family income may be over the lower income threshold resulting in the rate of your Child Care fee reduction being reduced to zero The income limit will vary depending upon your circumstances Family income does July 15 2022 CCS rates have increased in line with the Consumer Price Index Child Care Subsidy CCS rates are adjusted each July based on the Consumer Price Index CPI for the previous December The following rates will take effect the first day of the CCS fortnight which is 11 July 2022 Combined annual income

Your family s combined income is under 362 408 you have more than one child aged five or younger in childcare Higher Child Care Subsidy CCS rates for higher rate children Learn more about how the calculation works in examples of various circumstances How much you can get How to apply Reviews and changes Childcare Subsidy is a payment that helps families with the cost of pre school childcare

Child Care Receipt daycare Payment Form daycare Tax Form printable

https://i.etsystatic.com/22031907/r/il/73cebf/2860281221/il_fullxfull.2860281221_3tny.jpg

Child Care Stabilization Grant Overview For Child Care Providers YouTube

https://i.ytimg.com/vi/9KLukKxRido/maxresdefault.jpg

https://www.abc.net.au/news/2023-07-10/childcare...

The income cap for eligibility has been increased from 356 756 to 530 000 That will mean more higher income families will be eligible Caregivers don t need to do anything to get the increased rate Aboriginal and Torres Strait Islander children will get at least 36 hours of care subsidised each fortnight regardless of income or activity levels

https://www.childcaresubsidycalculator.com.au

This Child Care Subsidy Calculator CCS Calculator is developed for Australian parents to estimate their possible Child Care Subsidy payment amount from the Australian Government and out of pocket child care costs when using Centre Based Day Care Family Day Care or Outside School Hours Care

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

Child Care Receipt daycare Payment Form daycare Tax Form printable

US Parents Pay Nearly Double The affordable Cost For Child Care And

What Is Poverty Level Income INVOMERT

Child Care Rebate Tax Brackets 2024 Carrebate

Fernwood NRG Supporting Child Care Professionals

Fernwood NRG Supporting Child Care Professionals

How To Get Your Child Care License In Massachusetts Wonderschool

Child Care Tax Rebate Payment Dates 2022 2024 Carrebate

Celebrating New Benefits For Child Care Employees Kentucky Youth

Income Threshold For Child Care Rebate - Print or Download Income thresholds The private health insurance rebate is income tested This means that if your income is higher than the relevant income threshold you may not be eligible to receive a rebate Your rebate entitlement depends on your family status on 30 June