India Tax Rebate On Home Loan Verkko 5 helmik 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan

Verkko 7 tammik 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Verkko 2 tammik 2019 nbsp 0183 32 A regular home loan offers various tax benefits These include a deduction of up to Rs 1 5 lakh on the principal repayment

India Tax Rebate On Home Loan

India Tax Rebate On Home Loan

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

https://feeds.abplive.com/onecms/images/uploaded-images/2022/04/02/f76f68da854ba91279b6eb80f97615cb_original.jpg?impolicy=abp_cdn&imwidth=1200&imheight=628

Tax Rebate Payments Begin Republic Times News

https://www.republictimes.net/site/wp-content/uploads/2022/09/tax-rebate.png

Verkko 3 maalisk 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Verkko Principal repayment of home loans can net annual tax deductions of up to Rs 1 5 lakh under Section 80C of the ITA On the interest payments for a home loan you can

Verkko 30 elok 2022 nbsp 0183 32 Rs 1 5 lakh is the maximum income tax benefit on a home loan in 2022 that can be claimed every year on the principal repayment portion of the home loan s Verkko Section 24 b offers income tax rebate on home loan but only on the interest part of the loan It is also applicable if you have taken a loan for home construction or

Download India Tax Rebate On Home Loan

More picture related to India Tax Rebate On Home Loan

Income Tax Rebate Astonishingceiyrs

https://www.aseanbriefing.com/news/wp-content/uploads/2018/08/asb-Partial-Tax-Exemption-Scheme-for-Companies-Available-for-All-Companies-YA-2018-002.jpg

Housing Loan Tax Benefit Provident Housing

https://www.providenthousing.com/wp-content/uploads/2017/10/house-2368389_1920-1536x1024.jpg

Can You Get Tax Rebate Mint

https://images.livemint.com/img/2019/02/05/600x338/taxbenefitspic_1549361416230.jpg

Verkko 31 maalisk 2019 nbsp 0183 32 Home Loan Tax Benefit Interest Paid on Home Loan Section 24 Under Section 24 of the Income Tax Act you can claim a deduction on the interest portion of your EMIs paid through a financial Verkko For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every year from taxable income on principal repayment

Verkko 20 lokak 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal Verkko 22 maalisk 2023 nbsp 0183 32 A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied

Section 87A Income Tax Rebate

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

https://cleartax.in/s/home-loan-tax-benefit

Verkko 5 helmik 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan

https://economictimes.indiatimes.com/wealth/…

Verkko 7 tammik 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj

Income Tax Rebate On Home Loan 2022

Section 87A Income Tax Rebate

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

UP News

What Are The Tax Benefits On Home Loans

Home Buyer Rebates 2 5 Cash Back Of Total Purchase Price

Home Buyer Rebates 2 5 Cash Back Of Total Purchase Price

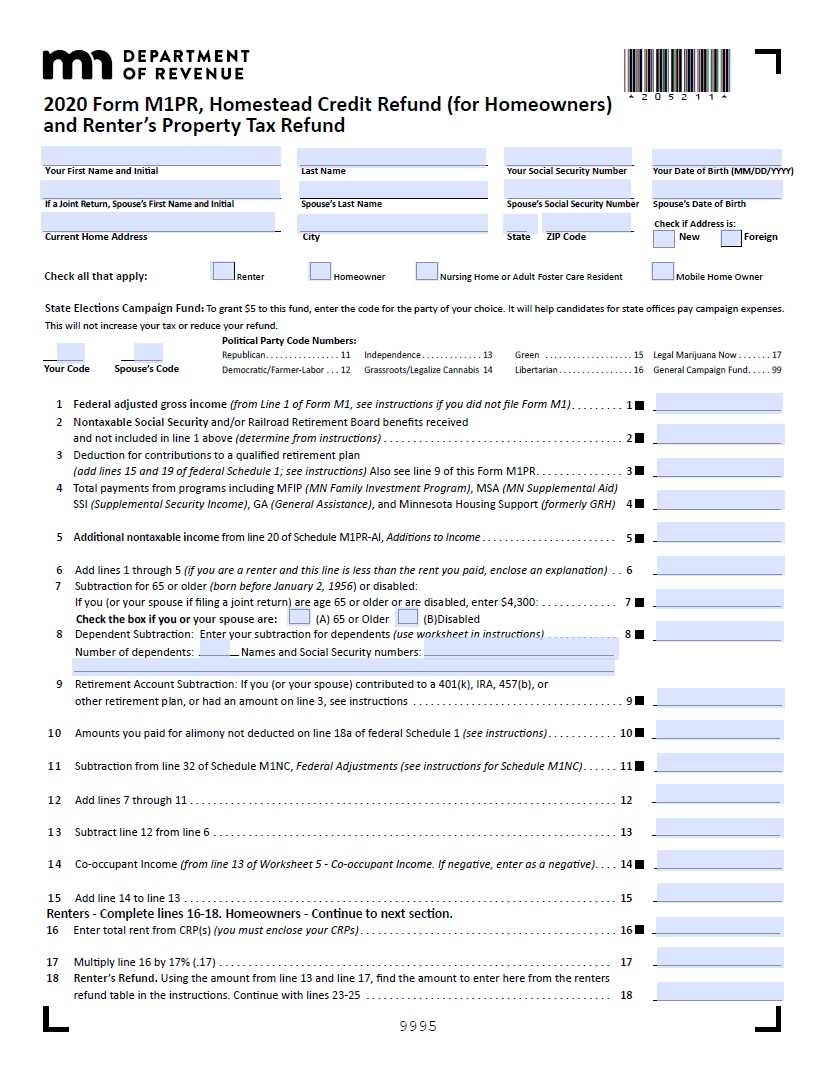

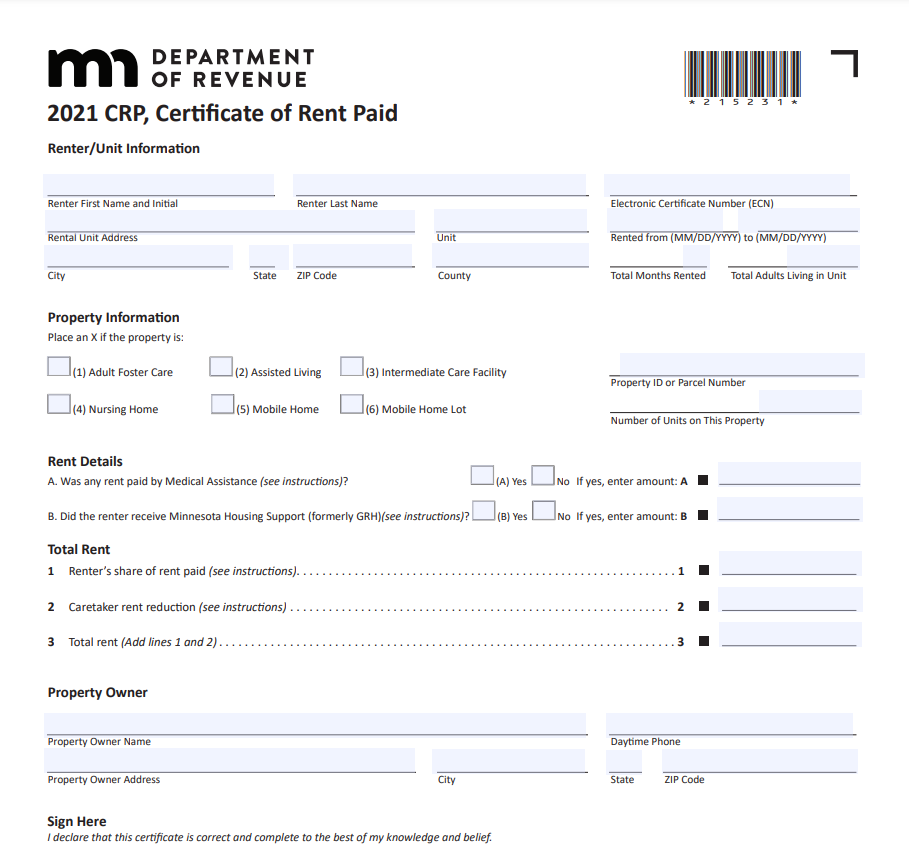

How To Fill Out Rent Rebate Form PrintableRebateForm

How To Calculate Interest On Housing Loan For Income Tax Haiper

Income Tax Benefits On Home Loan Loanfasttrack

India Tax Rebate On Home Loan - Verkko Section 24 b offers income tax rebate on home loan but only on the interest part of the loan It is also applicable if you have taken a loan for home construction or