Indiana Solar Tax Credit 2023 As an Indiana homeowner the federal solar tax credit formerly known as the ITC is the most impactful way to reduce your solar costs The Residential Clean Energy Credit

Solar tax credits are a powerful inducement for any homeowner who wants to install solar panels reduce their utility bills and save money on their taxes With the solar tax credit you are able However residents can take advantage of renewable energy incentives in Indiana to save on solar panel costs Homeowners can save between 22 and 30 3 366 and 4590 on their

Indiana Solar Tax Credit 2023

Indiana Solar Tax Credit 2023

https://www.gov-relations.com/wp-content/uploads/2023/06/Indiana-Solar-Tax-Credit.jpg

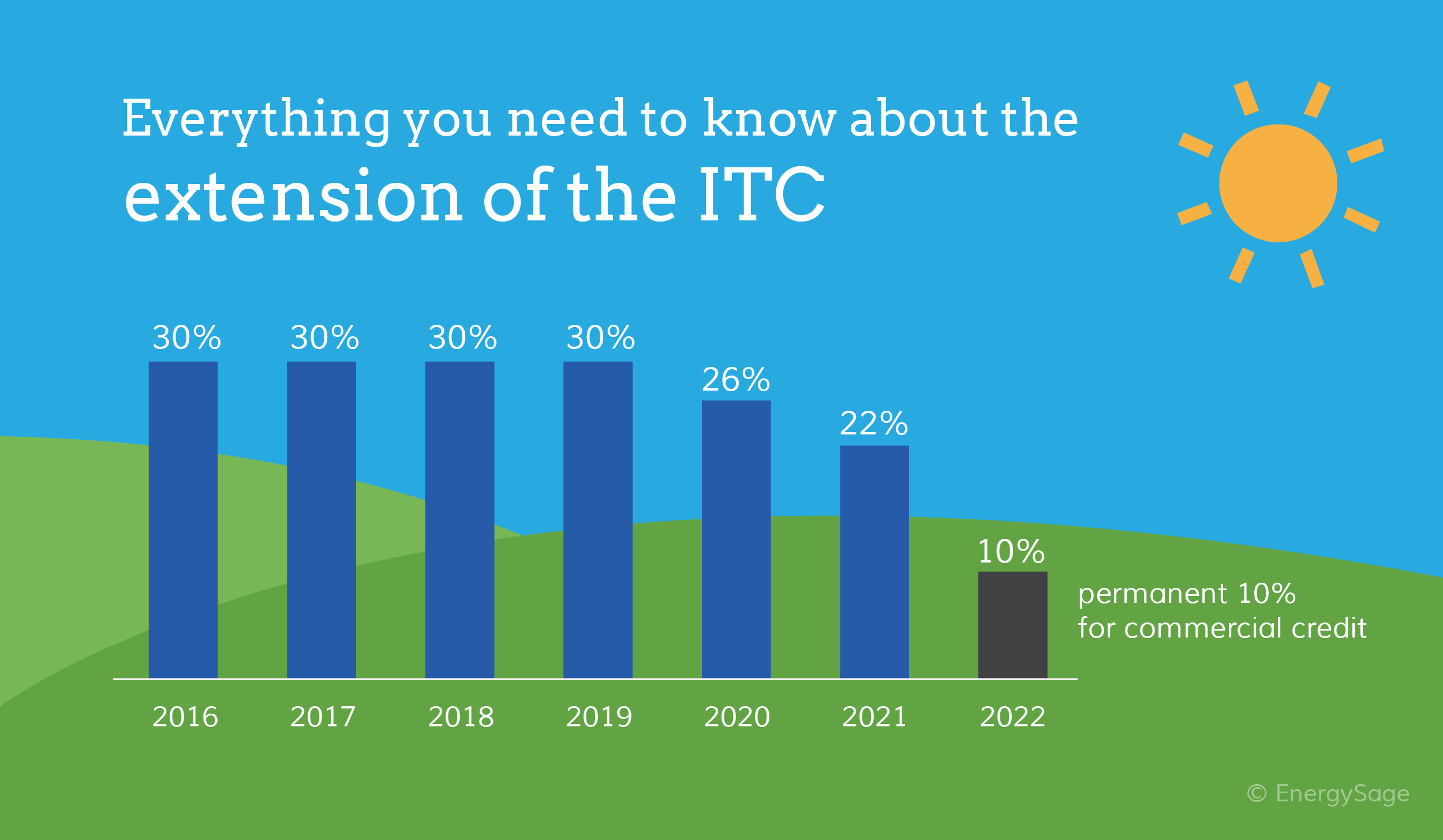

Federal Solar Tax Credit Guide 2021 Thru 2023 Investment Tax Credit

https://www.ussolarreport.com/wp-content/uploads/2020/07/Cost-of-a-Solar-Companies-8.4K-Solar-System.jpg

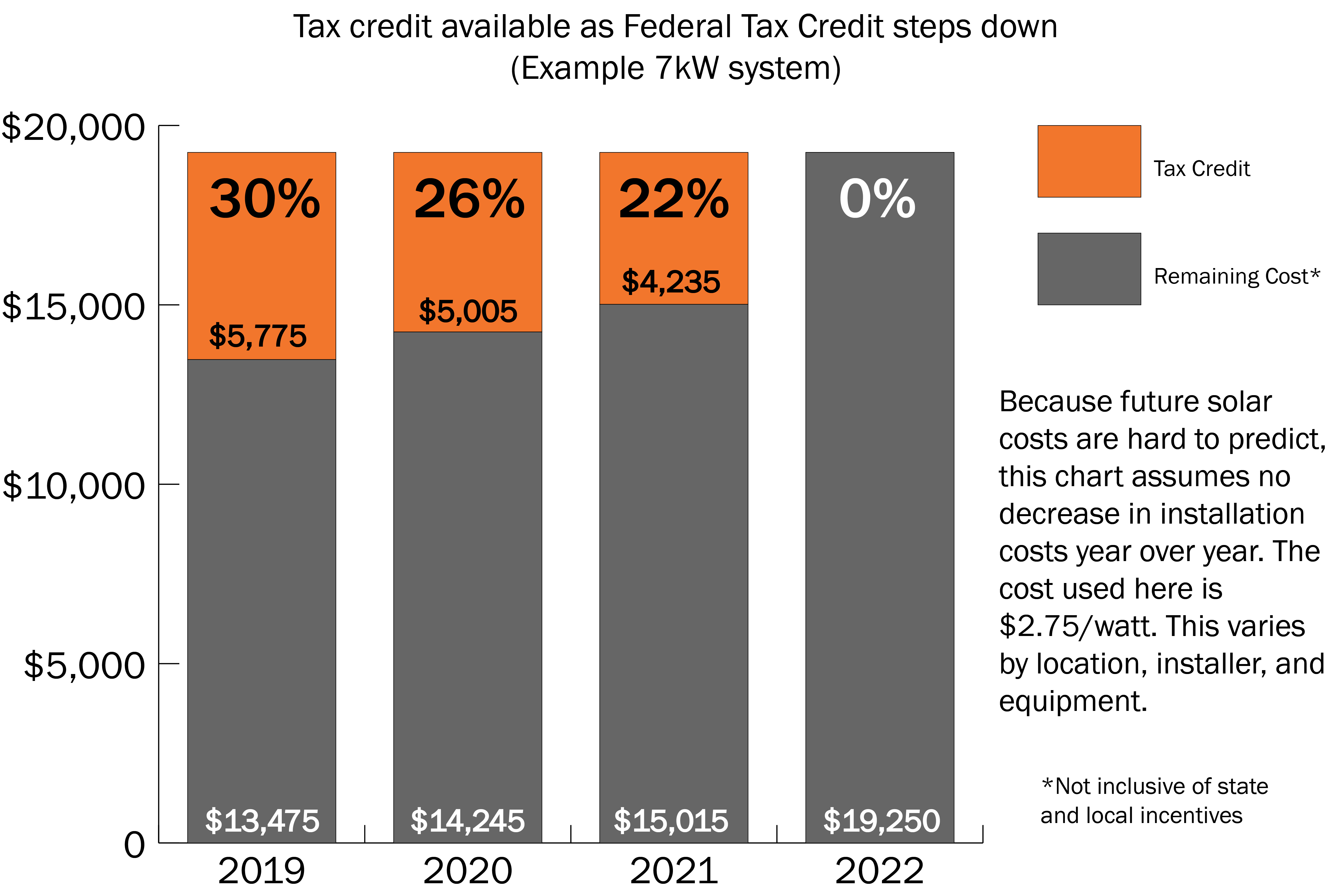

Solar Tax Credit Chart Energy Sage Sol Luna Solar

https://sollunasolar.com/wp-content/uploads/2018/01/Solar-Tax-Credit-Chart-Energy-Sage.png

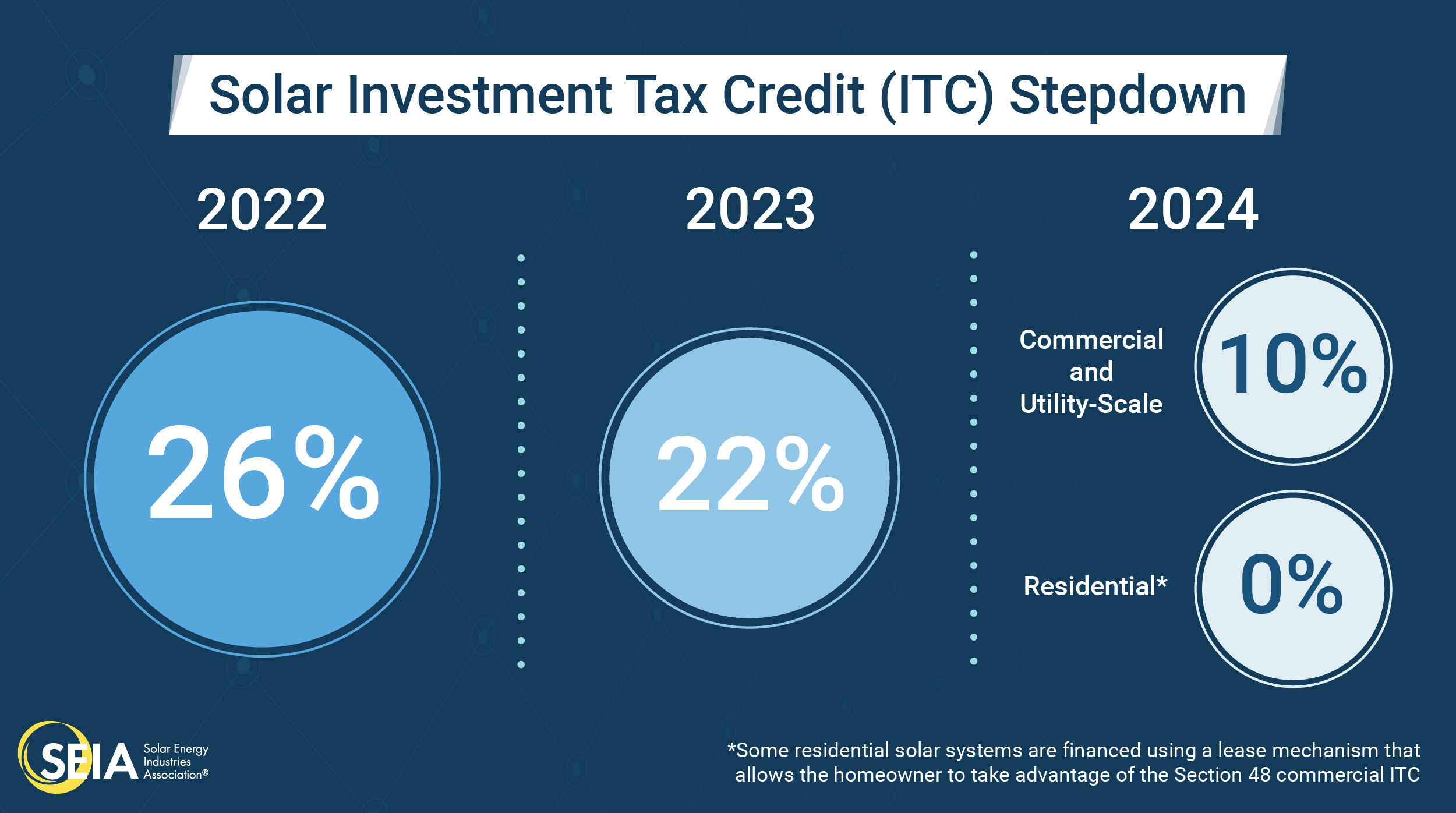

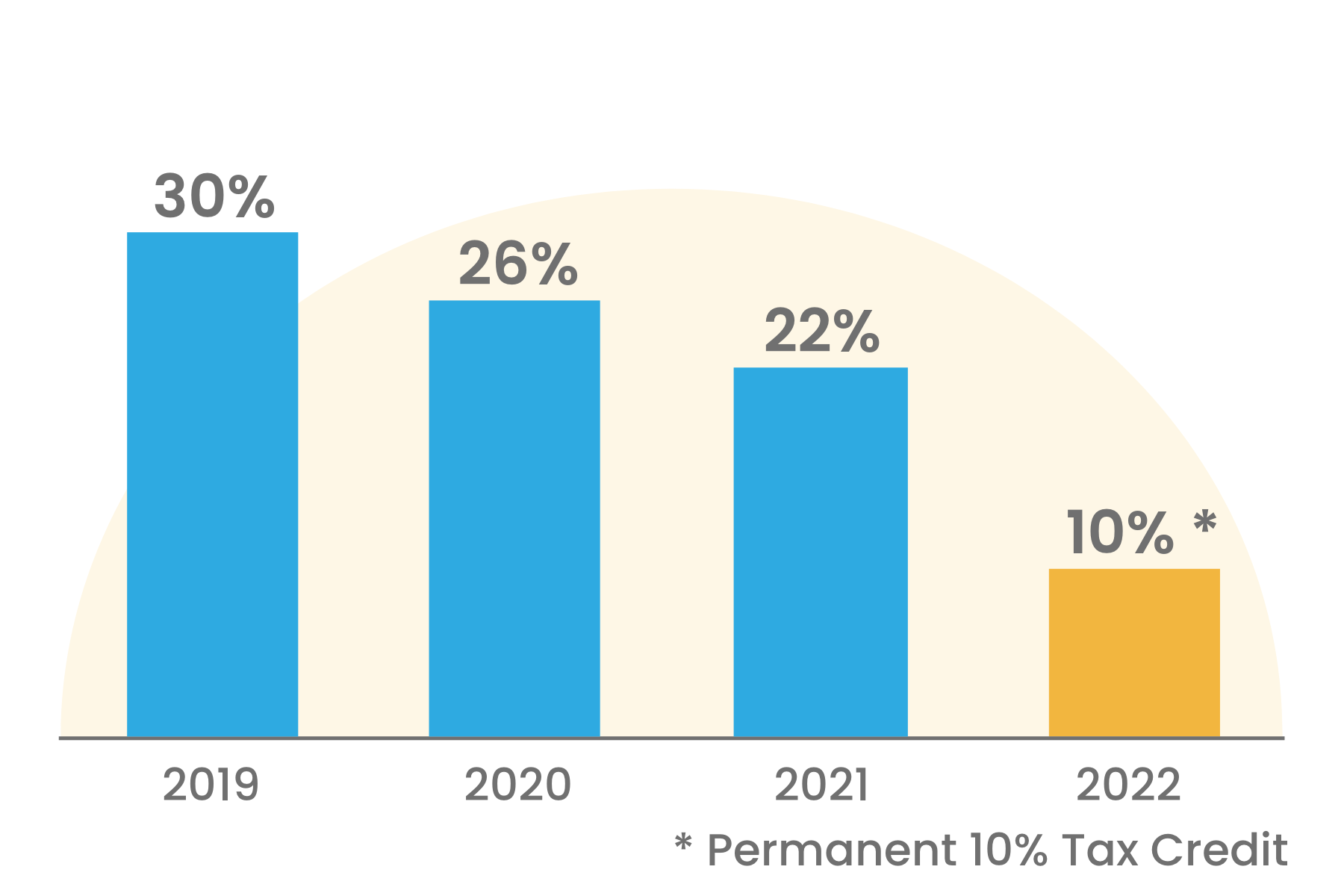

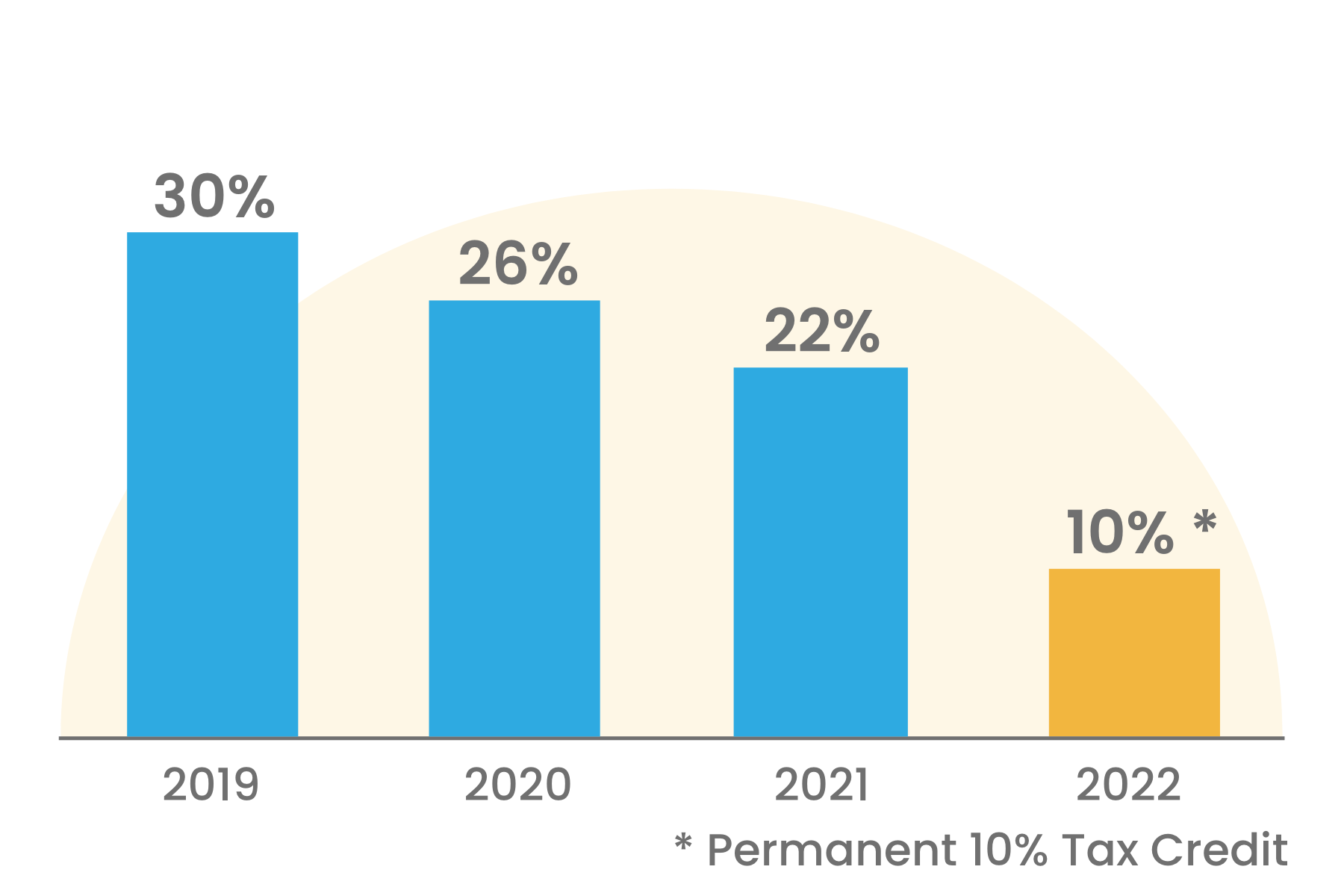

The ITC is a 26 percent tax credit for solar systems on residential under Section 25D and commercial under Section 48 properties The Section 48 commercial credit can be applied to The ITC is undoubtedly the significant tax solar incentive for Indiana This credit currently amounts to 26 of your solar system s cost In 2023 the tax credits for installations will drop to 22

This program offers a 30 tax credit on solar systems installed from 2022 through the end of 2032 Homeowners who complete a solar installation in 2033 can obtain a 26 tax credit and residents who install solar panels on their Indiana Solar Incentives Available in 2023 Indiana residents looking to take advantage of solar incentives in 2023 have a variety of options available to them One of the most popular incentives is the Investment Tax Credit ITC which

Download Indiana Solar Tax Credit 2023

More picture related to Indiana Solar Tax Credit 2023

How To Claim The Solar Tax Credit Using IRS Form 5695

https://www.solarreviews.com/content/images/blog/irs_form2021.png

Solar Investment Tax Credit ITC SEIA

https://www.seia.org/sites/default/files/inline-images/ITC Step Down 2022-01.png

Federal Tax Credit For Saving Money On Solar Panels KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2019/06/Tax-Credit-Graphic.png

Solar financial and regulatory rebates and incentives available in the state of Indiana from State local and utility programs updated on a regular basis Indiana provides fantastic energy tax credits for solar energy wind turbines geothermal energy and energy efficiency Save money and go green

Under current federal law the credit is for 30 of the entire cost of your solar panel system including the equipment labor and permitting required for installation This By taking advantage of the ITC Indiana residents can enjoy a substantial reduction in the cost of their solar energy system installation This incentive allows you to claim a tax

Solar Tax Credit Guide And Calculator

https://www.solar-estimate.org/images/pages/solar-tax-credit/commercial-bar.png

2022 Solar Tax Credit Explained Get Solar Now Save Money

https://powur.solar-energy-quote.com/wp-content/uploads/2022/02/2022-Solar-Tax-Credit-Explained-scaled.jpg

https://www.energysage.com › local-data › solar-rebates-incentives › in

As an Indiana homeowner the federal solar tax credit formerly known as the ITC is the most impactful way to reduce your solar costs The Residential Clean Energy Credit

https://indiana.statesolar.org

Solar tax credits are a powerful inducement for any homeowner who wants to install solar panels reduce their utility bills and save money on their taxes With the solar tax credit you are able

Applying For The Solar Tax Credit Is As Easy As 123 ARE Solar

Solar Tax Credit Guide And Calculator

Solar Tax Credit Graph without Header Solar United Neighbors

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Understanding The Solar Tax Credit Or Investment Tax Credit Get Solar

How To Claim Your Solar Tax Credit ITC

How To Claim Your Solar Tax Credit ITC

Understanding The Solar Tax Credit

26 Federal Solar Tax Credit Extended SolarTech

Solar Tax Credit Extended For Two Years

Indiana Solar Tax Credit 2023 - All Indiana residents can qualify for the federal solar investment tax credit ITC This is a deduction on your owed federal taxes that equals 30 of your solar panel installation