Individual Tax Return Mra In the context of the Individual Income Tax Returns e Filing Season 2023 taxpayers are required to submit their income tax returns and effect payment if any to the Mauritius Revenue Authority MRA by Monday 16 October 2023

Income Tax e Filing Season 2023 File and Pay Retrieve your TAN Retrieve your Password Application for TAN Individual 2005 2006 Individual Return 1A for Employees only Notes on Individual Return 1A Individual Return 1B for Self employed only Notes on Individual Return 1B Individual Return 01 mixed income Notes on Individual Return 01

Individual Tax Return Mra

Individual Tax Return Mra

https://cmsphoto.ww-cdn.com/resizeapi/9c66ba6eec9723c84103c7ea14ec941a90cc62fe/3200/-1/

Explanatory Video Individual Income Tax Returns E Filing Season 2022

https://i.ytimg.com/vi/xOlxPecuQH8/maxresdefault.jpg

MRA E Filing 2018 2019 Ashesh s Perso Blog

https://i1.wp.com/asheshr.com/wp-content/uploads/2018/09/MRA-efiling-tax-returns-mauritius.png?fit=1072%2C138&ssl=1

Pre filled return is a service provided by MRA only to facilitate the taxpayer The responsibility to make a correct and complete return remains on the taxpayer as per law Please note that for security reasons this system has been implemented with a MRA e Services is a secured online platform offering taxpayers the facility to file tax returns electronically The taxpayer may effect electronic payments through several payment options You are required to use your User ID and password to file your return CLICK HERE TO FILE YOUR RETURN

Goto Top Copyright 2024 Mauritius Revenue Authority All Rights Reserved HOME INDIVIDUAL BUSINESS VAT CUSTOMS e SERVICES MEDIA CENTRE The Income Tax Calculator is an easy to use online tool that helps you estimate your taxes based on your income deductions for the new financial year 2023 2024 Income and deductions in MUR for the Financial Year 2023 2024

Download Individual Tax Return Mra

More picture related to Individual Tax Return Mra

E Appointment Beneficie Assistans MRA Pou Fer Ou Return Income Tax

https://i.ytimg.com/vi/YYiVxSPIjEA/maxresdefault.jpg

Malawi Revenue Authority Online Return Filing

https://www.mra.mw/assets/upload/articles/DT-Filing_services.jpg

Malawi Revenue Authority Withholding Tax

https://www.mra.mw/assets/upload/articles/WHT1.jpg

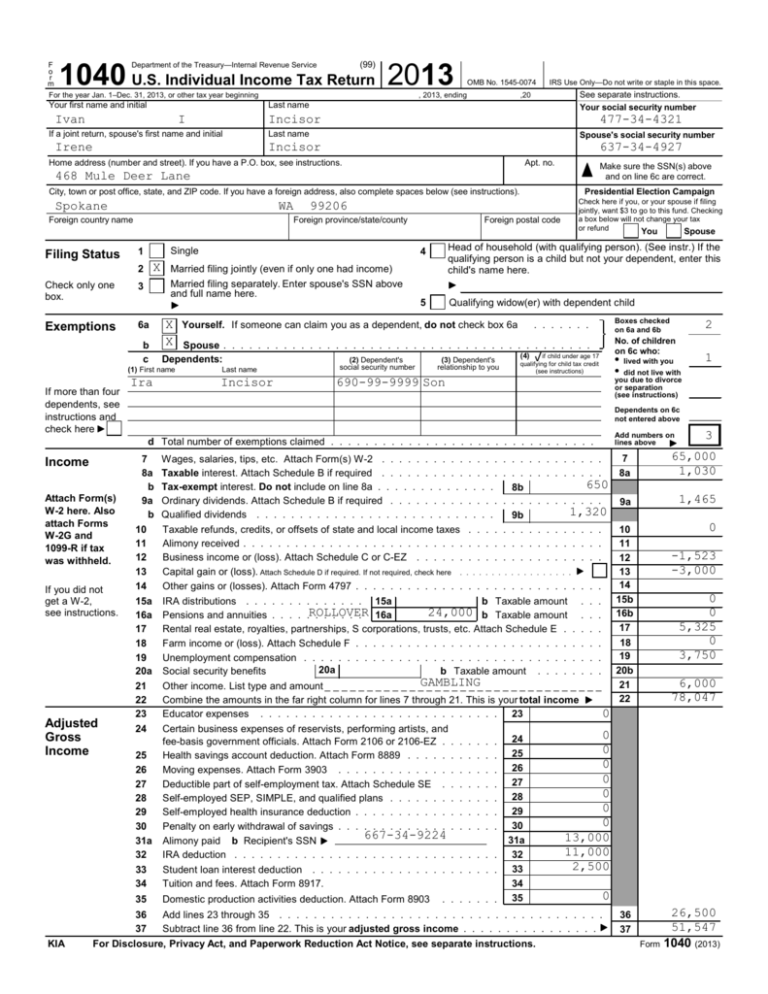

View your tax filing obligations and recent years returns View your transaction history including status of a refund repayment See your current tax position anytime anywhere ANNUAL INCOME TAX RETURN YEAR OF ASSESSMENT 2021 2022 INCOME FOR THE PERIOD 1 JULY 2020 TO 30 JUNE 2021 NOTES HOW TO FILL IN YOUR RETURN The due date for the submission of the return electronically and payment of tax if any is 15 October 2021 Note 1 Income from other sources

[desc-10] [desc-11]

Malawi Revenue Authority Roll out Of Filing Of Value Added Tax VAT

https://www.mra.mw/assets/upload/press_releases/MO_Banner.jpg

MRA Mauritius Revenue Authority E Filing Individual Tax Return Www

https://www.statusin.org/uploads/images2018/8560b.jpg

https://www.mra.mu/index.php/eservices1/individual/...

In the context of the Individual Income Tax Returns e Filing Season 2023 taxpayers are required to submit their income tax returns and effect payment if any to the Mauritius Revenue Authority MRA by Monday 16 October 2023

https://www.mra.mu/index.php/eservices1/individual

Income Tax e Filing Season 2023 File and Pay Retrieve your TAN Retrieve your Password Application for TAN

MRA Mauritius Revenue Authority E Filing Individual Tax Return Www

Malawi Revenue Authority Roll out Of Filing Of Value Added Tax VAT

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Printable Federal Tax Return Form Printable Forms Free Online

Malawi Revenue Authority MRA Dates Tax Return Preparers

U S Individual Income Tax Return

Malawi Revenue Authority REMINDER TO SUBMIT TAX RETURNS AND PAY TAXES

Malawi Revenue Authority REMINDER TO SUBMIT TAX RETURNS AND PAY TAXES

ESERVICES Electronic Payment

Individual Tax Return Online Filing Income Tax Online Through Easy

Take These Steps Now To Make The 2020 Tax Season Much Easier The

Individual Tax Return Mra - Goto Top Copyright 2024 Mauritius Revenue Authority All Rights Reserved HOME INDIVIDUAL BUSINESS VAT CUSTOMS e SERVICES MEDIA CENTRE