Inflation Reduction Act Energy Rebates 2024 We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments

When it comes to the Inflation Reduction Act s home electrification program the rebates can be significant They include an 8 000 rebate for heat pumps that can warm and cool homes an Many assessments are eligible for federal tax credits of 30 percent off the assessment cost up to 150 Tax credits of 30 percent are also available for rooftop solar battery storage energy efficiency and electric upgrades heat pumps and other clean energy upgrades

Inflation Reduction Act Energy Rebates 2024

Inflation Reduction Act Energy Rebates 2024

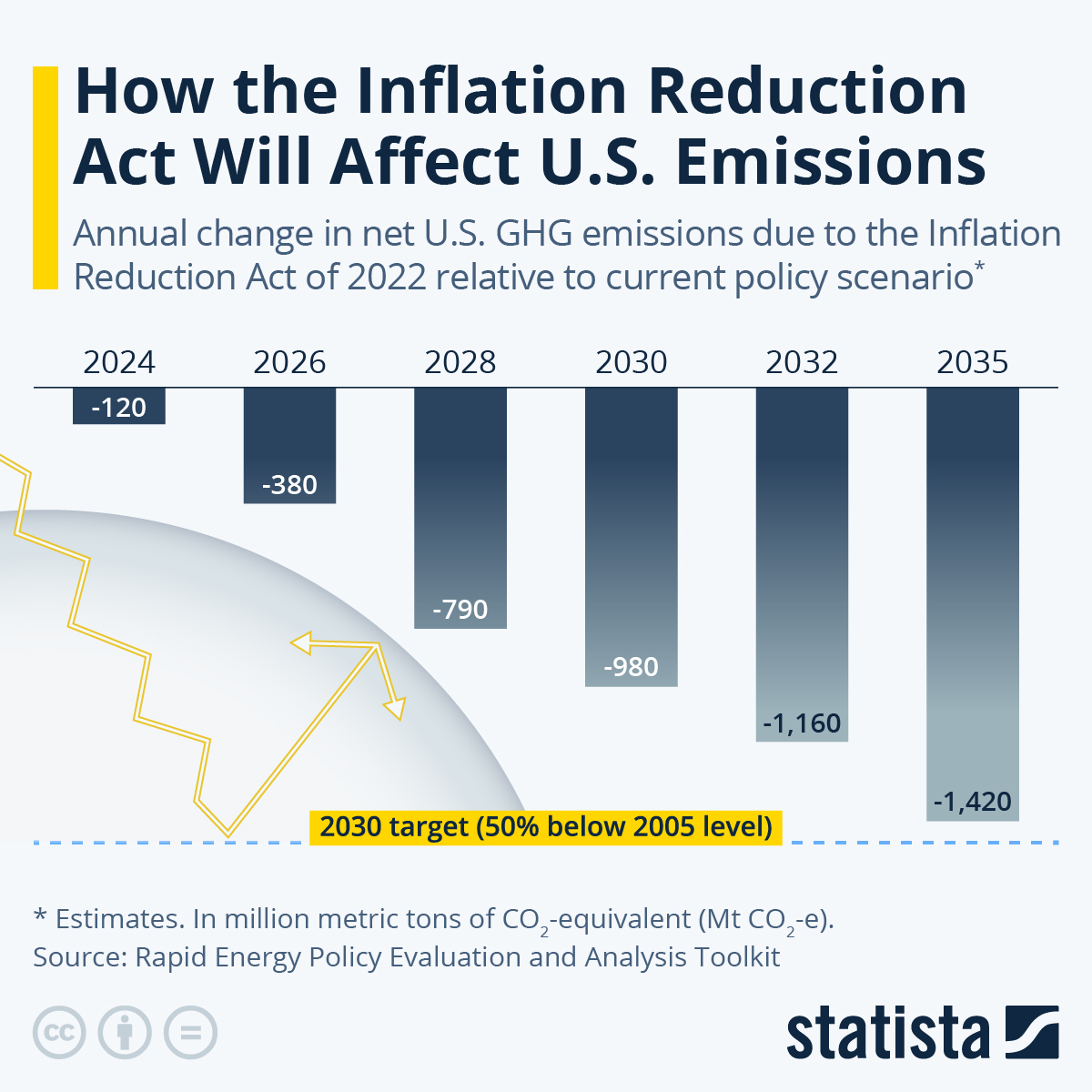

https://www.prismaphotonics.com/wp-content/uploads/2022/08/How-the-Inflation-Reduction-Act-Will-Affect-U.S.-Emissions.jpg

Inflation Reduction Act Gridmatic

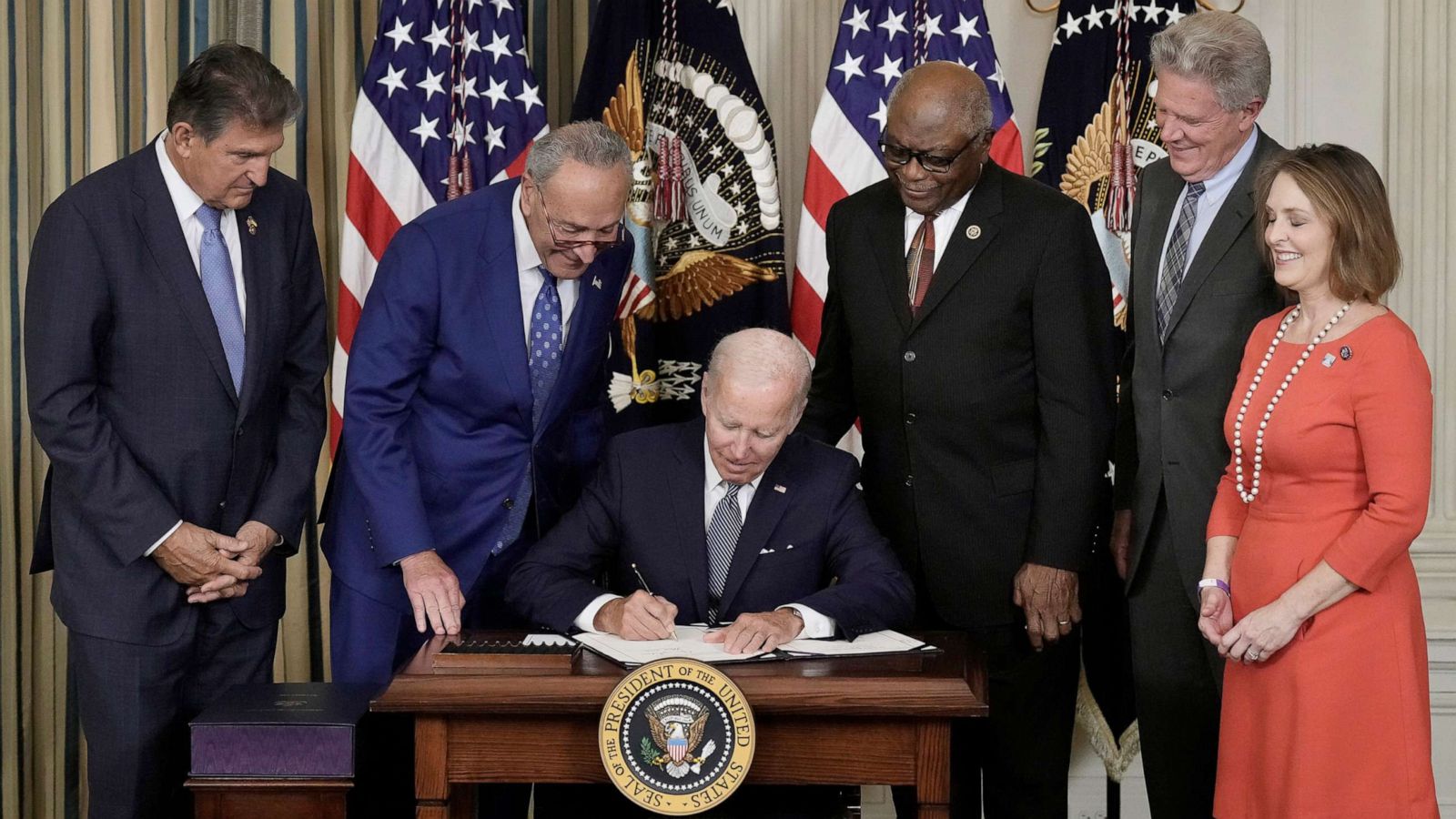

https://www.gridmatic.com/wp-content/uploads/2022/08/signing-inflation-reduction-act-01-gty-iwb-220817_1660745706279_hpMain_16x9_1600.jpeg

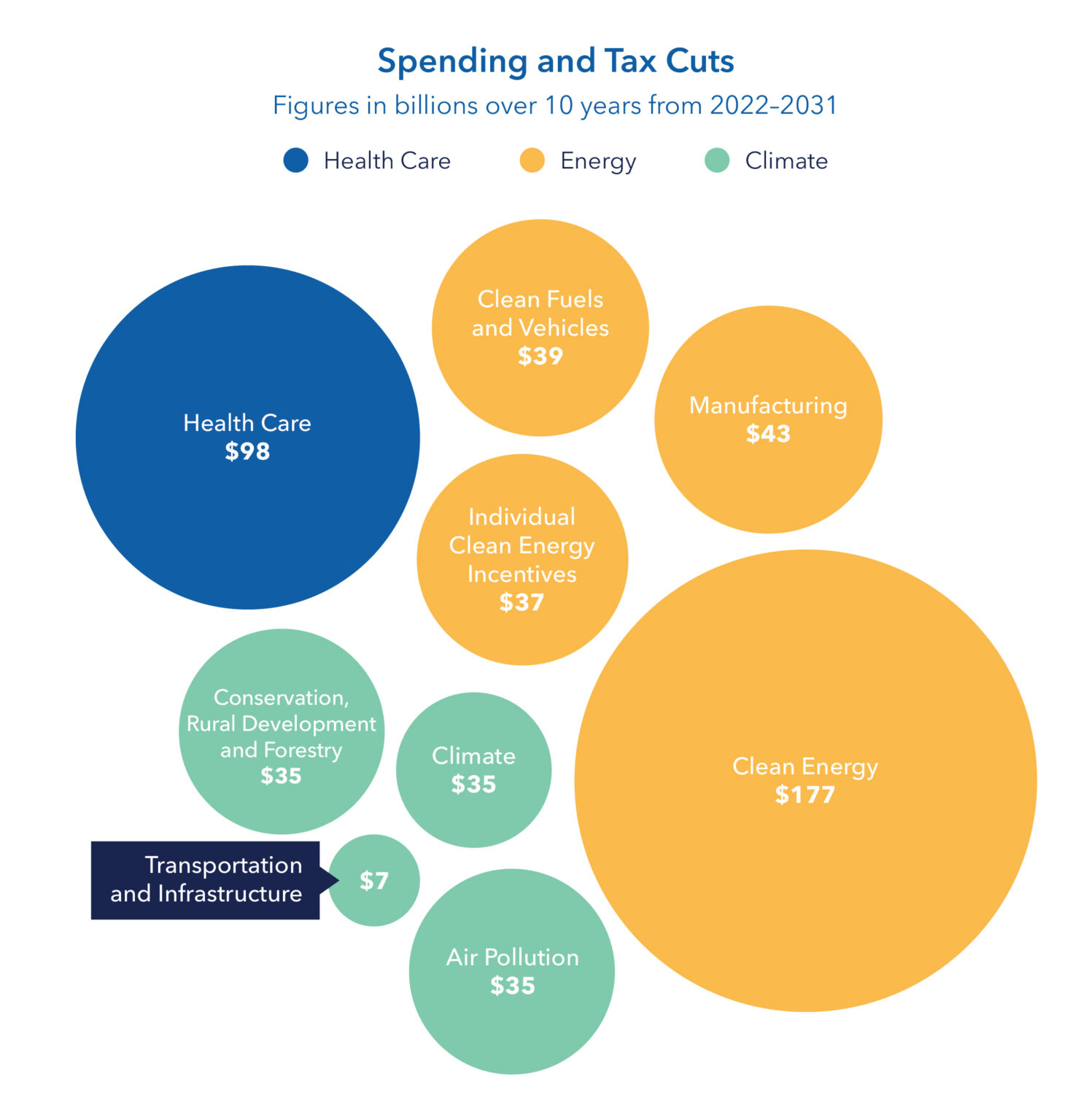

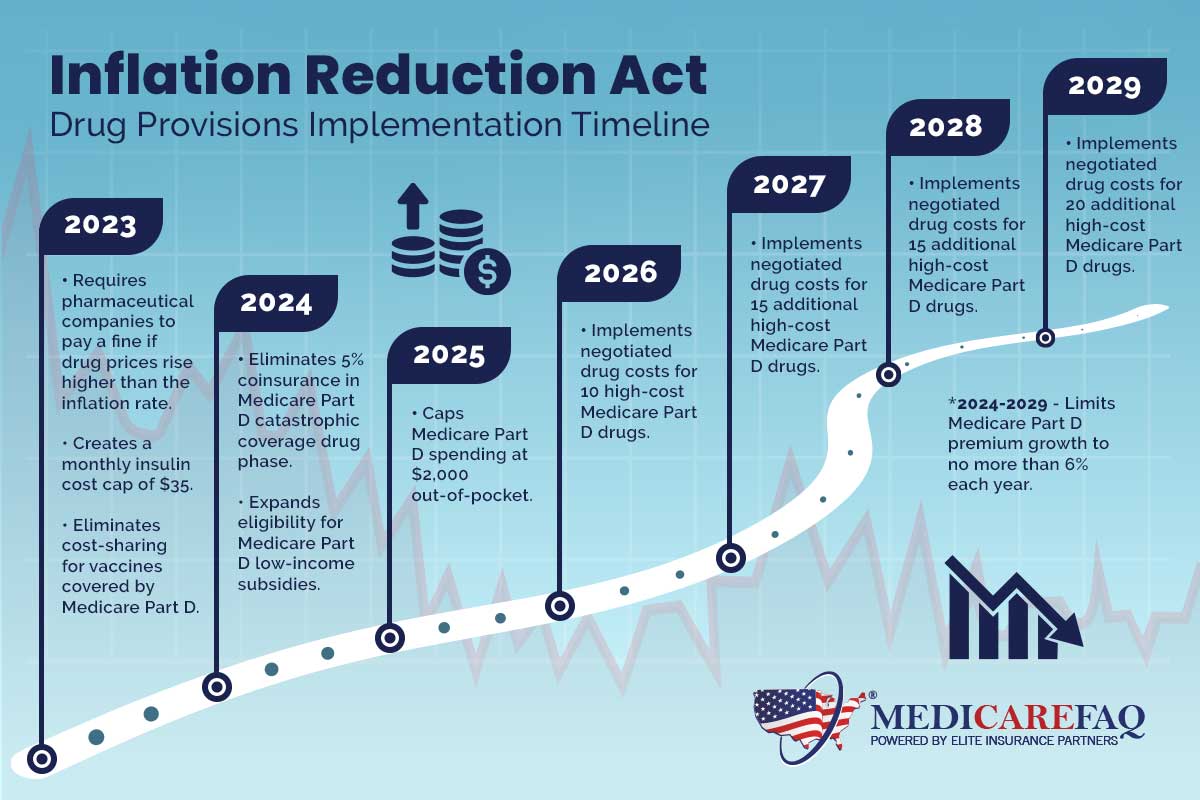

What s In The Inflation Reduction Act Committee For A Responsible Federal Budget

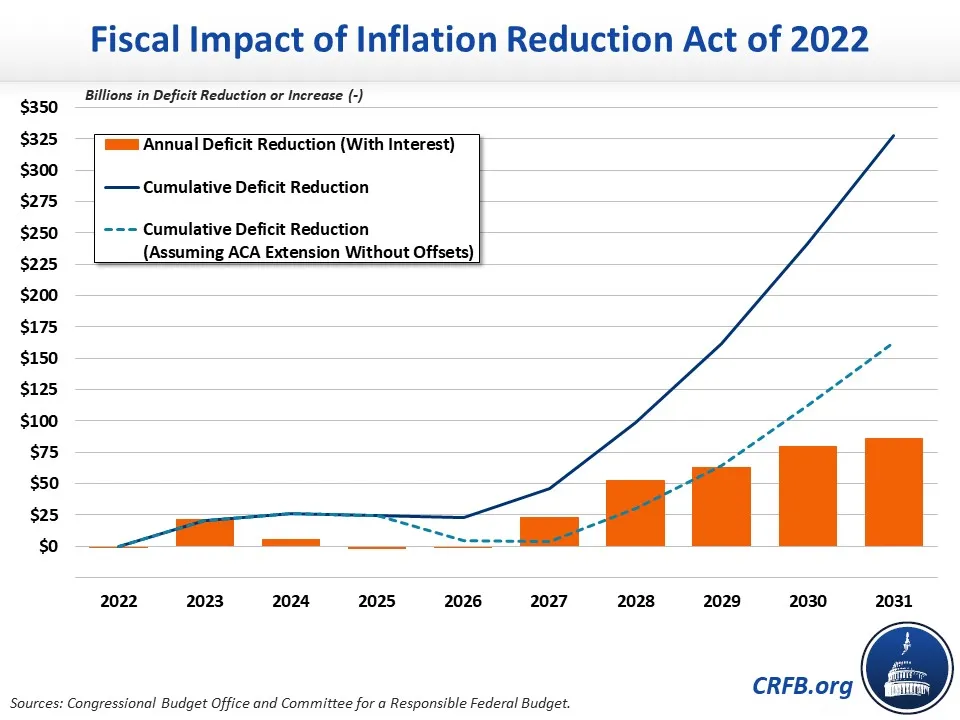

https://www.crfb.org/sites/default/files/styles/media_image_default/public/images/CBO Score of Inflation Reduction Act Chart.jpg.webp?itok=Y6xXa639

The federal Inflation Reduction Act will provide funding for whole house energy efficiency For households with low or moderate income LMI it will also fund point of sale rebates for panel upgrades and qualified high efficiency electric appliances such as heat pumps for space heating cooling The act includes funding for contractor training INFLATION REDUCTION ACT HOME ENERGY REBATES Home Efficiency Rebates Program Sec 50121 The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S 2024 3 the State s funding will be reallocated to other States 1 1 Introduction

The Inflation Reduction Act includes incentives for home owners to get their properties more energy efficient NPR s Ayesha Rascoe talks with Kara Saul Rinaldi of the AnnDyl Policy group IR 2024 14 Jan 18 2024 WASHINGTON The Internal Revenue Service and the Treasury Department reached a major milestone in implementation of key provisions in the Inflation Reduction Act with more than 1 000 projects registered through the new IRS Energy Credits Online ECO tool The Inflation Reduction Act created two new credit delivery mechanisms elective pay otherwise known as

Download Inflation Reduction Act Energy Rebates 2024

More picture related to Inflation Reduction Act Energy Rebates 2024

The Inflation Reduction Act Is A Victory For Working People AFL CIO

https://aflcio.org/sites/default/files/2022-08/inflation.png

Inflation Reduction Act Impact On Energy Transition

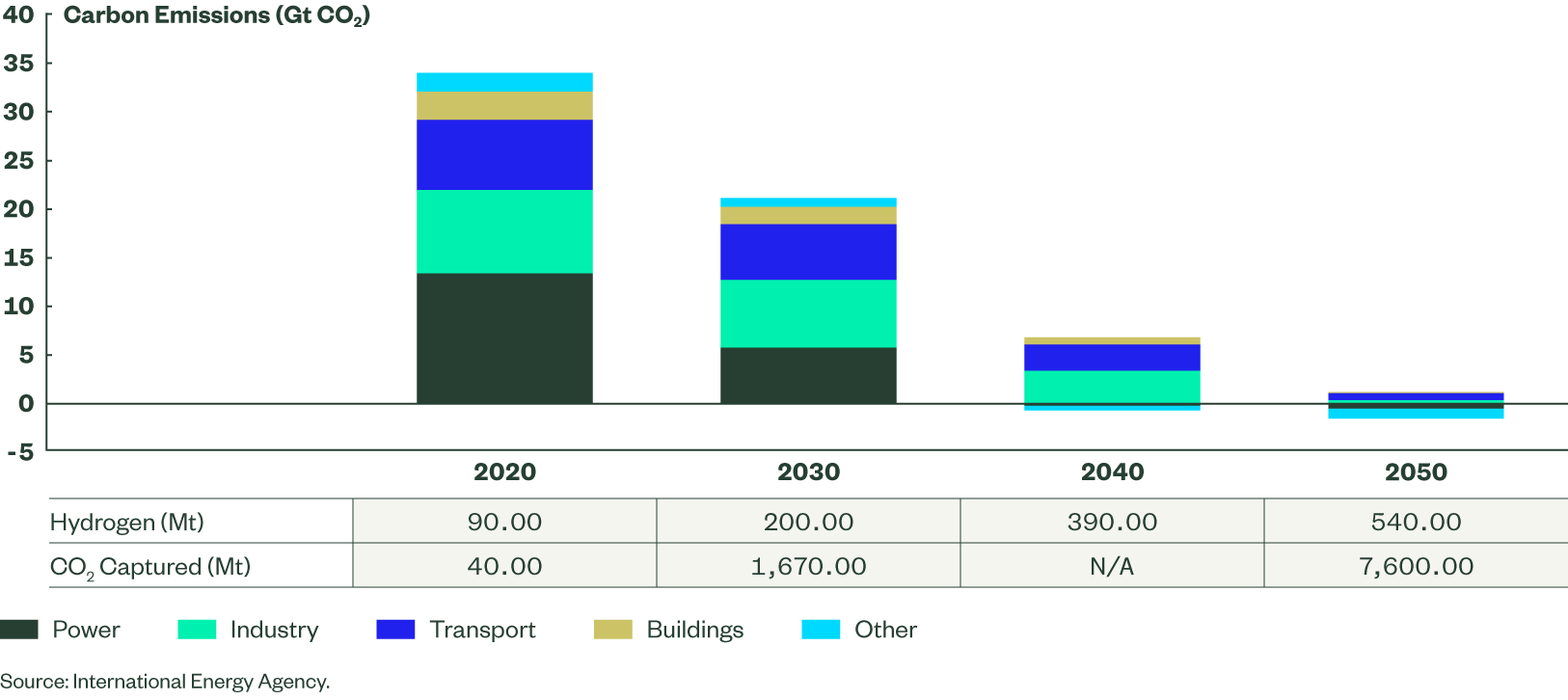

https://www.ssga.com/library-content/images/figure3-inflation-reduction-act-impact-on-energy-transition.png

Inflation Reduction Act Of 2022 Clean Vehicle Energy Credit Bregante Company LLP

https://bcocpa.com/wp-content/uploads/2022/10/AdobeStock_525155507-1-scaled.jpeg

On August 16 2022 President Biden signed the Inflation Reduction Act into law marking the most significant action Congress has taken on clean energy and climate change in the nation s history More than 1000 Projects Registered for New Direct Pay and Transferability Credit Monetization Provisions WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS announced reaching a major milestone in implementation of key provisions in the Inflation Reduction Act to expand the reach of the clean energy tax credits and help build projects more quickly and

Under the law the HOMES rebate should be available to whole house energy saving retrofits that begin after the Inflation Reduction Act became law on August 16 2022 and completed before Listen 4 57 For Americans with a New Year s resolution to trade in their gas furnace or water heater for climate friendly heat pumps a word of caution Generous Inflation Reduction Act

Inflation Reduction Act Contains Some Health Reforms The Benefit Works

https://thebenefitworks.com/eli/wp-content/uploads/2022/09/Spendingtax-cuts-22-31.jpg

Siting Policy Finding A Home For Renewable Energy And Transmission Energy Innovation Policy

https://energyinnovation.org/wp-content/uploads/2022/07/Inflation-Reduction-Act-emissions-reductions-to-2030.png

https://www.clearesult.com/insights/january-updates-on-inflation-reduction-act-home-energy-rebates

We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments

https://www.latimes.com/business/story/2023-01-27/looking-for-inflation-reduction-act-rebates-to-go-green-get-ready-to-wait

When it comes to the Inflation Reduction Act s home electrification program the rebates can be significant They include an 8 000 rebate for heat pumps that can warm and cool homes an

The Inflation Reduction Act What It Means For Business Owners And The Solar Economy Geoscape

Inflation Reduction Act Contains Some Health Reforms The Benefit Works

Inflation Reduction Act Green Credits And Rebates Green Mountain Energy

Inflation Reduction Act Key Takeaways Entegrity Energy Partners

Inflation Reduction Act Deadlines Unison Energy LLC

Understanding The Inflation Reduction Act The Council Of State Governments

Understanding The Inflation Reduction Act The Council Of State Governments

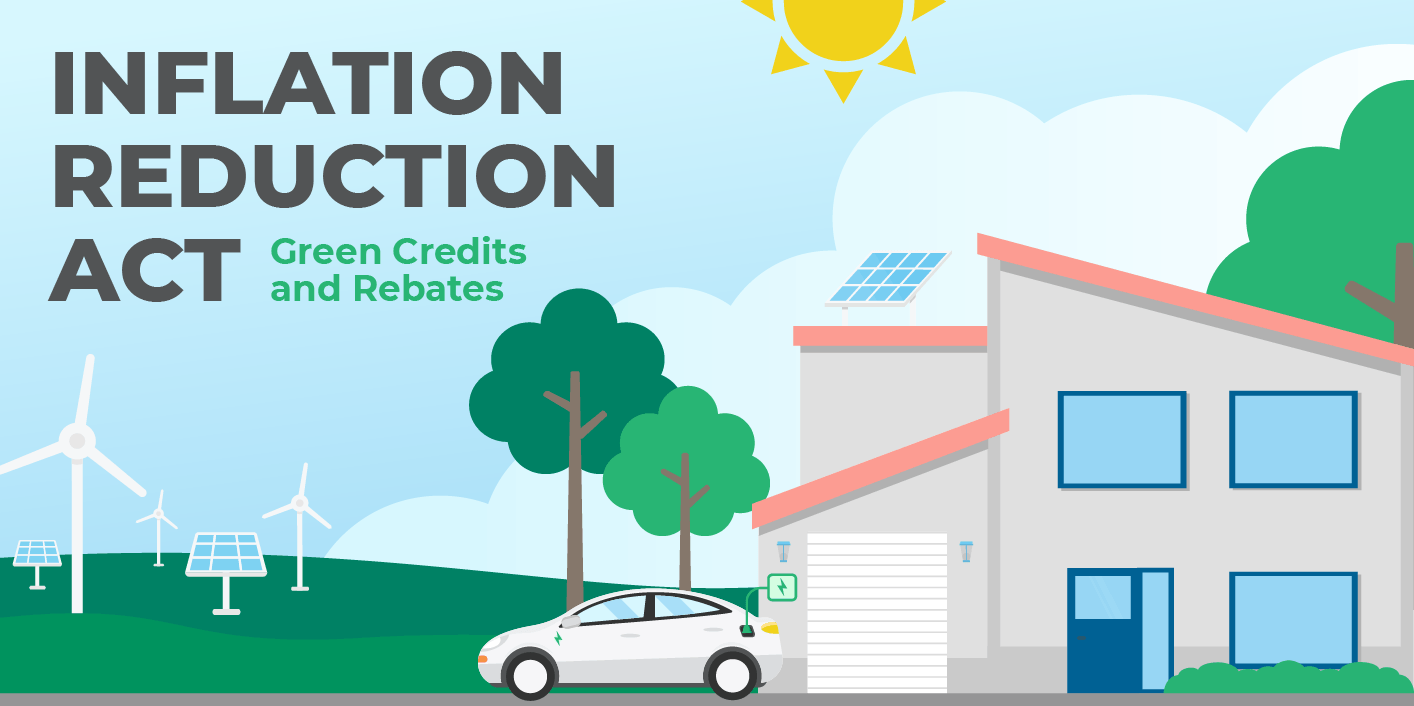

The Inflation Reduction Act And Medicare Part D

US Inflation Reduction Act A Catalyst For Climate Action

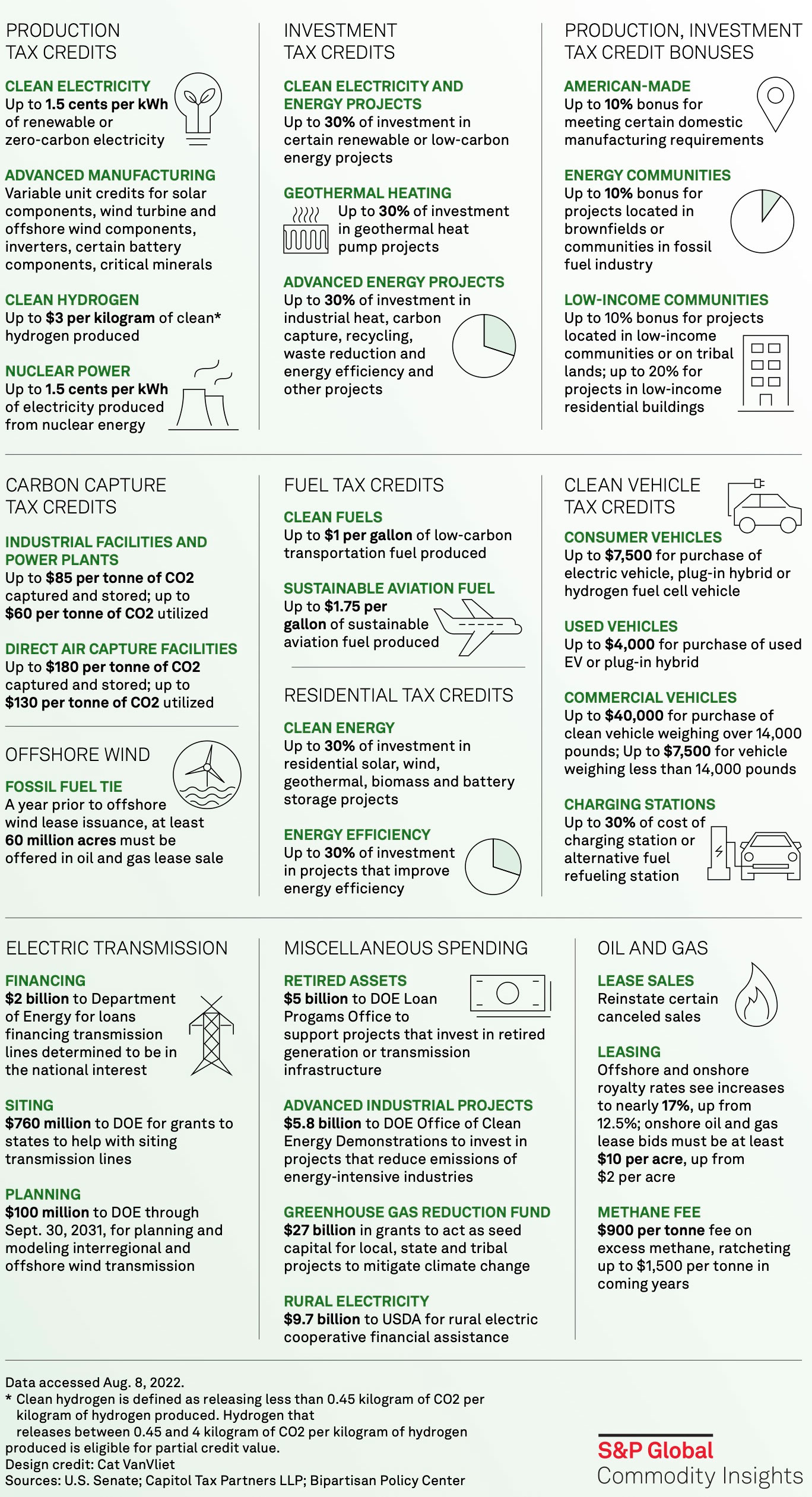

Inflation Reduction Act S P Global

Inflation Reduction Act Energy Rebates 2024 - INFLATION REDUCTION ACT HOME ENERGY REBATES Home Efficiency Rebates Program Sec 50121 The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S 2024 3 the State s funding will be reallocated to other States 1 1 Introduction