Inflation Reduction Act Heat Pump Rebate Program The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S Department of Energy DOE to carry out two Home Energy Rebate programs Specifically IRA Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the

President Biden s Inflation Reduction Act takes on climate change by helping Americans reduce their carbon footprint A key element in that push is offering up to 14 000 in rebates and tax Through tax credits and rebates President Biden s Inflation Reduction Act IRA provides new opportunities to homeowners and renters to make energy efficient upgrades such as heat pump installations to their homes Heat pumps are a year round heating and cooling solution for many homes and climates they are energy efficient and save money

Inflation Reduction Act Heat Pump Rebate Program

Inflation Reduction Act Heat Pump Rebate Program

https://www.gridmatic.com/wp-content/uploads/2022/08/signing-inflation-reduction-act-01-gty-iwb-220817_1660745706279_hpMain_16x9_1600.jpeg

Inflation Reduction Act IRA The Ultimate Guide To Saving

https://elephantenergy.com/wp-content/uploads/2022/09/IRA-Summary-Image-by-Nicole-Kelner-Made-Exclusively-for-Elephant-Energy.jpg

How To Choose Between A Heat Pump Vs A Furnace

https://www.familyhandyman.com/wp-content/uploads/2022/11/furnace-vs-heatpump-FHMjpg.jpg

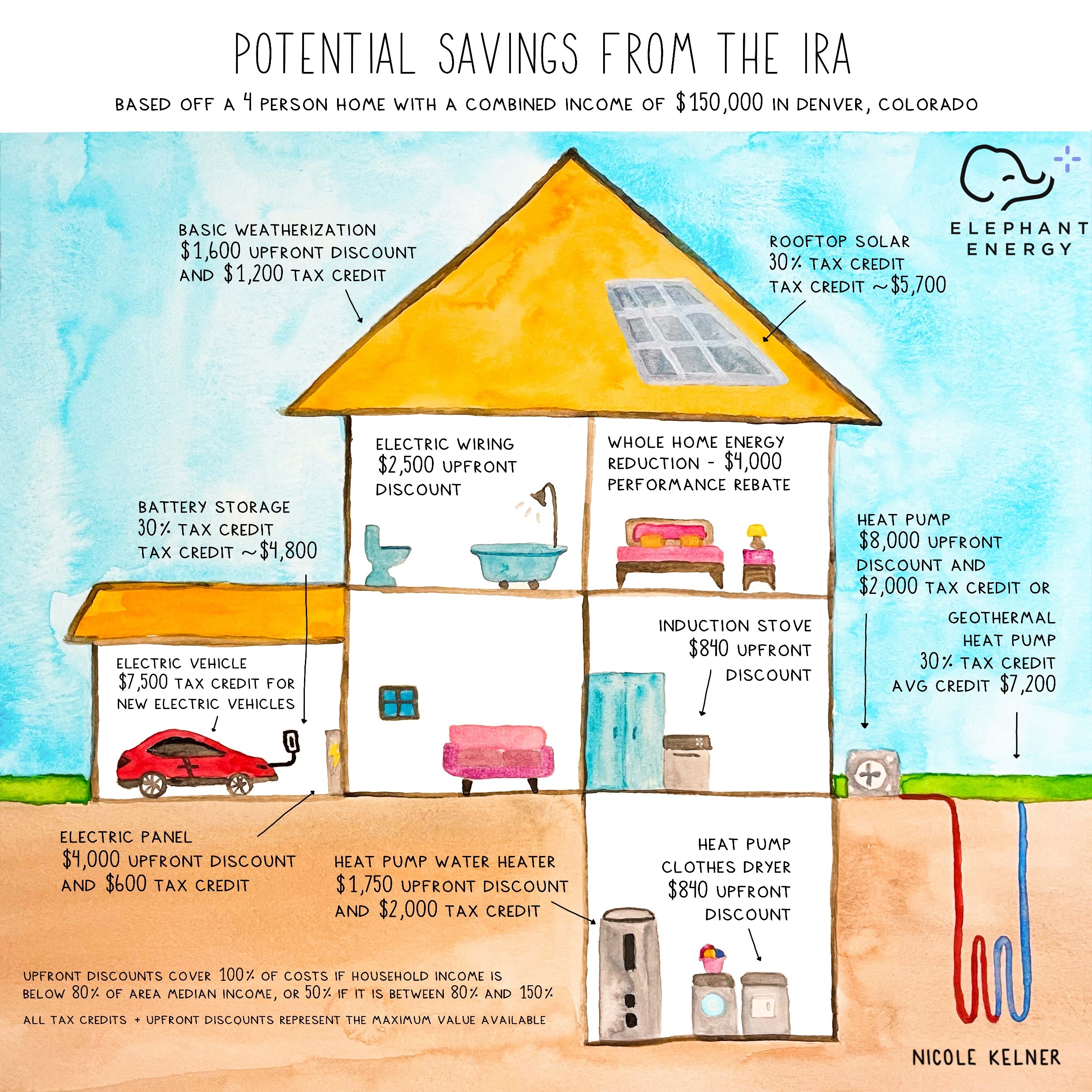

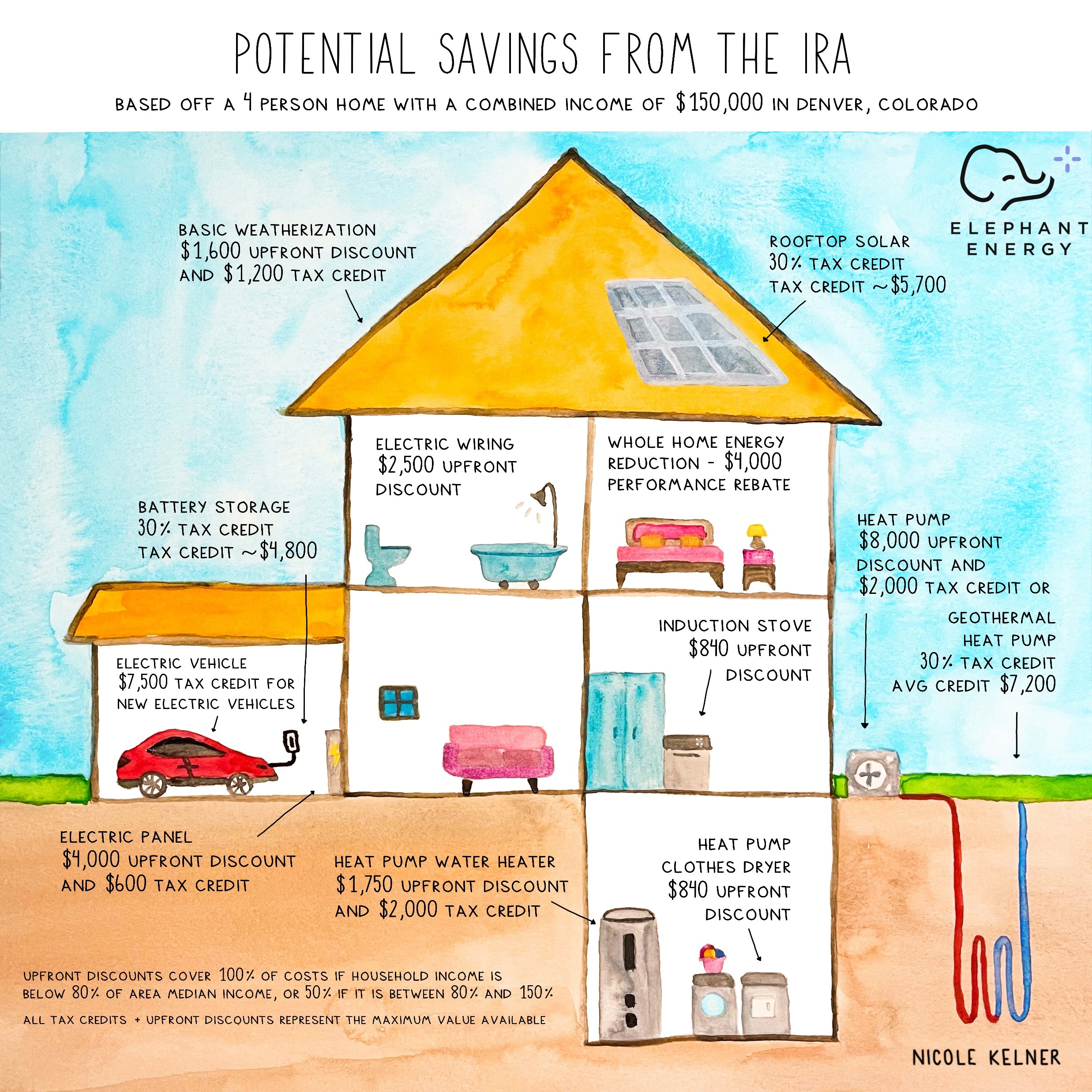

The Inflation Reduction Act includes thousands of dollars in tax credits and rebates for consumers who buy electric vehicles install solar panels or make other energy efficient upgrades to Families who install an efficient electric heat pump for heating and cooling can receive a tax credit of up to 2 000 and save an average of 500 per year on energy bills

The Inflation Reduction Act is packed with provisions to incentivize homeowners to make energy efficiency upgrades to their home including installing high efficiency heating cooling and Yes heat pumps are included in the Inflation Reduction Act Homeowners can qualify for a tax credit of 30 for the purchase and installation of a qualified heat pump up to 2 000 Through the High Efficiency Electric Home Rebate Act HEEHRA some homeowners may receive rebates of 100 or 50 off heat pump installation up to 8 000 if they

Download Inflation Reduction Act Heat Pump Rebate Program

More picture related to Inflation Reduction Act Heat Pump Rebate Program

Inflation Reduction Act Heat Pump Heat Pump Tax Credit

https://www.jdsplumbingservice.com/wp-content/uploads/2022/10/air-sourced-heat-pumps.jpg

Summary Of Tax Incentives In The Inflation Reduction Act Of 2022

https://cdn.catf.us/wp-content/uploads/2022/08/15115831/ira-tax-incentives_Page_1-scaled.jpg

The Inflation Reduction Act pumps Up Heat Pumps Hvac

https://www.hvac.com/wp-content/uploads/2022/09/heat-pump-rebates-2023.png

The Inflation Reduction Act can help renters afford plug ins like window unit heat pumps through rebates Otherwise success of the law will depend on landlords and property managers The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project costs up to 2 000 under the Inflation Reduction Act

Eligible homeowners can get rebates as high as 8 000 for heat pump installation 1 750 for a heat pump water heater 840 to offset the cost of a heat pump clothes dryer or an electric stove Rebates for non appliance upgrades are also available up to the following amounts 4 000 for electrical panel upgrades The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S Department of Energy DOE to carry out two Home Energy Rebate programs Specifically IRA Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the IRA Home Electrification and Appliance Rebates collectively the

3 Ways To Exploit The Inflation Reduction Act Seeking Alpha

https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1415606890/image_1415606890.jpg?io=getty-c-w1536

Inflation Reduction Act Summary What It Means For New HVAC Systems

https://www.ecicomfort.com/hubfs/IRA Heat Pump Rebates %26 Tax Credits-png.png

https://www.energy.gov/sites/default/files/2023-10/...

The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S Department of Energy DOE to carry out two Home Energy Rebate programs Specifically IRA Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the

https://www.cbsnews.com/news/inflation-reduction...

President Biden s Inflation Reduction Act takes on climate change by helping Americans reduce their carbon footprint A key element in that push is offering up to 14 000 in rebates and tax

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

3 Ways To Exploit The Inflation Reduction Act Seeking Alpha

Inflation Reduction Act Heat Pump Rebates Chesterfield Service

Will The Inflation Reduction Act Raise Your Taxes

Your Guide To The Inflation Reduction Act Rewiring America Heat Pump

Inflation Reduction Act Heat Pump Rebate Heartland

Inflation Reduction Act Heat Pump Rebate Heartland

I Heart Amana Inflation Reduction Act I Heart Amana

The Impact Of The Inflation Reduction Act On Physicians Applied Policy

4 Step Inflation Reduction Act Guide

Inflation Reduction Act Heat Pump Rebate Program - 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes