Inflation Reduction Act Heat Pump Rebate Retroactive The Inflation Reduction Act IRA specifies a list of qualified products and building materials that may be eligible for a rebate and your State Energy Office SEO will determine which products and materials are eligible for rebates within your state or territory

IR 2024 202 Aug 7 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service today issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 The Inflation Reduction Act or IRA extended and expanded tax credits PDF that allow taxpayers to claim residential and energy efficient home energy credits The Inflation Reduction Act of 2022 allows new ways for ensuring eligible taxpayers receive their credits Elective payment and applicable credits and transfer of certain credits Register your dealership to enable credits for clean vehicle buyers Credits for individuals

Inflation Reduction Act Heat Pump Rebate Retroactive

Inflation Reduction Act Heat Pump Rebate Retroactive

https://i.pinimg.com/originals/fb/61/bf/fb61bf4026c6cc8694925f667f95c19e.png

The Inflation Reduction Acts Impact On HVAC Heat Pumps

https://whippleplumbing.com/wp-content/uploads/2023/02/1-768x994.jpg

Inflation Reduction Act Summary What It Means For New HVAC Systems

https://www.ecicomfort.com/hubfs/IRA Heat Pump Rebates %26 Tax Credits-png.png

The U S Department of Energy DOE developed this optional resource in relation to the Inflation Reduction Act IRA of 2022 section 501211 which established the Home Efficiency Rebates which operates under the umbrella of the Home Energy Rebates Families who install an efficient electric heat pump for heating and cooling can receive a tax credit of up to 2 000 and save an average of 500 per year on energy bills

Key Points The Inflation Reduction Act which President Biden signed into law Aug 16 offers tax credits and rebates to consumers who buy clean vehicles and appliances or take other steps to Laura Feiveson Deputy Assistant Secretary for Microeconomic PolicyMatthew Ashenfarb Research Economist Office of Climate Energy Economics The Inflation Reduction Act or IRA extended and expanded tax credits that help households invest in residential clean energy such as solar panels as well as home energy efficiency New data from the Internal

Download Inflation Reduction Act Heat Pump Rebate Retroactive

More picture related to Inflation Reduction Act Heat Pump Rebate Retroactive

How The Inflation Reduction Act May Impact Heat Pump Standards

https://cleantechnica.com/files/2022/10/How-a-Heat-Pump-Works-1024x576.jpg

Inflation Reduction Act Heat Pump Rebates Chesterfield Service

https://www.chesterfieldservice.com/wp-content/uploads/2023/01/Inflation-Reduction-Act-Heat-Pump-Rebates-scaled.jpeg

Are Heat Pumps Included In Inflation Reduction Act YouTube

https://i.ytimg.com/vi/Q6lHfCcH4rI/maxresdefault.jpg

Aug 8 2024 Americans claimed more than 8 billion in climate friendly tax credits under the Inflation Reduction Act last year according to new data released by the Treasury Department a The Inflation Reduction Act includes thousands of dollars in tax credits and rebates for consumers who buy electric vehicles install solar panels or make other energy efficient upgrades to

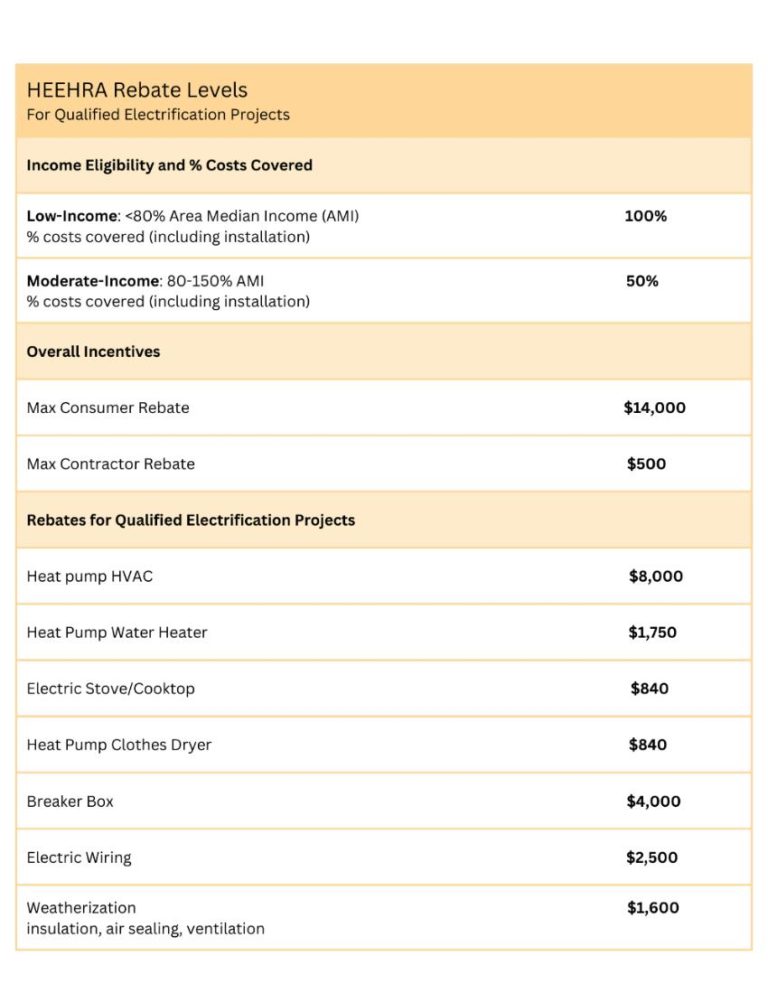

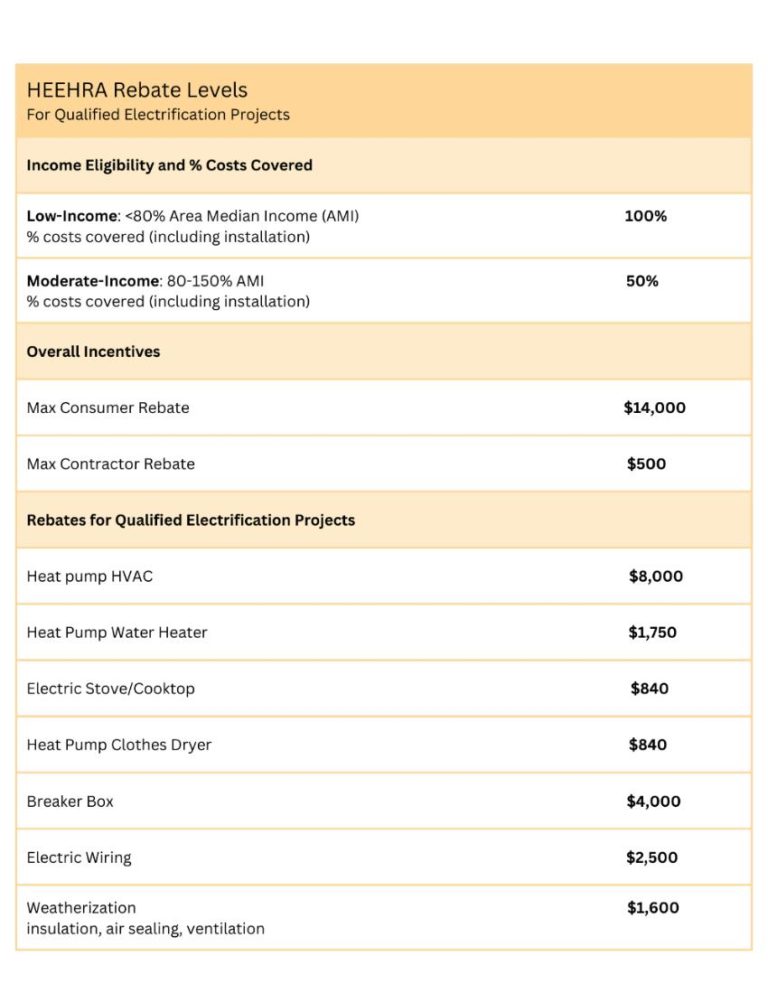

Yes heat pumps are included in the Inflation Reduction Act Homeowners can qualify for a tax credit of 30 for the purchase and installation of a qualified heat pump up to 2 000 Through the High Efficiency Electric Home Rebate Act HEEHRA some homeowners may receive rebates of 100 or 50 off heat pump installation up to 8 000 if they There s also a 1 750 rebate for heat pump water heaters 840 cash back for induction stoves and heat pump clothes dryers and 4 000 for electrical system upgrades

The Inflation Reduction Act And The New Tax Incentives Rebates For High

https://www.damarheating.com/wp-content/uploads/2022/10/Inflation-reduction-act-learn-more-New-Tax-Incentives-and-Rebates-for-High-Efficiency-Heat-Pumps-1030x476.jpg

Inflation Reduction Act Heat Pump Heat Pump Tax Credit PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/inflation-reduction-act-heat-pump-heat-pump-tax-credit-2.jpg?w=500&ssl=1

https://www.energy.gov/scep/home-energy-rebates...

The Inflation Reduction Act IRA specifies a list of qualified products and building materials that may be eligible for a rebate and your State Energy Office SEO will determine which products and materials are eligible for rebates within your state or territory

https://www.irs.gov/newsroom/department-of...

IR 2024 202 Aug 7 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service today issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 The Inflation Reduction Act or IRA extended and expanded tax credits PDF that allow taxpayers to claim residential and energy efficient home energy credits

The Inflation Reduction Act Pumps Up Heat Pumps HVAC Solutions

The Inflation Reduction Act And The New Tax Incentives Rebates For High

Inflation Reduction Act Heat Pump Rebate Heartland

Heat Pump Rebate Pge PumpRebate

Here s How The Inflation Reduction Act s Rebates And Tax Credits For

All100Senators On Twitter RT MartinHeinrich The Inflation Reduction

All100Senators On Twitter RT MartinHeinrich The Inflation Reduction

Graph Showing Heat Pump Rebates Inflation Reduction Act PowerRebate

Here S How The Inflation Reduction Act S Rebates And Tax Credits For

Inflation Reduction Act Can Save Consumers Thousands On Heat Pumps

Inflation Reduction Act Heat Pump Rebate Retroactive - Homeowners who do not qualify for the rebates can receive tax credits of up to 2 000 to install heat pumps and 1 200 a year for other energy saving improvements such as installing an induction stove or new windows and doors