Inheritance Tax Exemption Pennsylvania There are exceptions and assets not subject to Pennsylvania inheritance tax Pennsylvania includes assets that are not subject to inheritance tax including life insurance property jointly owned by spouses and charitable gifts

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania If there is no spouse or if the spouse has forfeited his her rights Secondly certain property is exempt from the tax altogether The most important exemption is for property that is owned jointly by a husband and wife Therefore if you and your spouse own all

Inheritance Tax Exemption Pennsylvania

Inheritance Tax Exemption Pennsylvania

https://i.ytimg.com/vi/9SXjrqe2dW0/maxresdefault.jpg

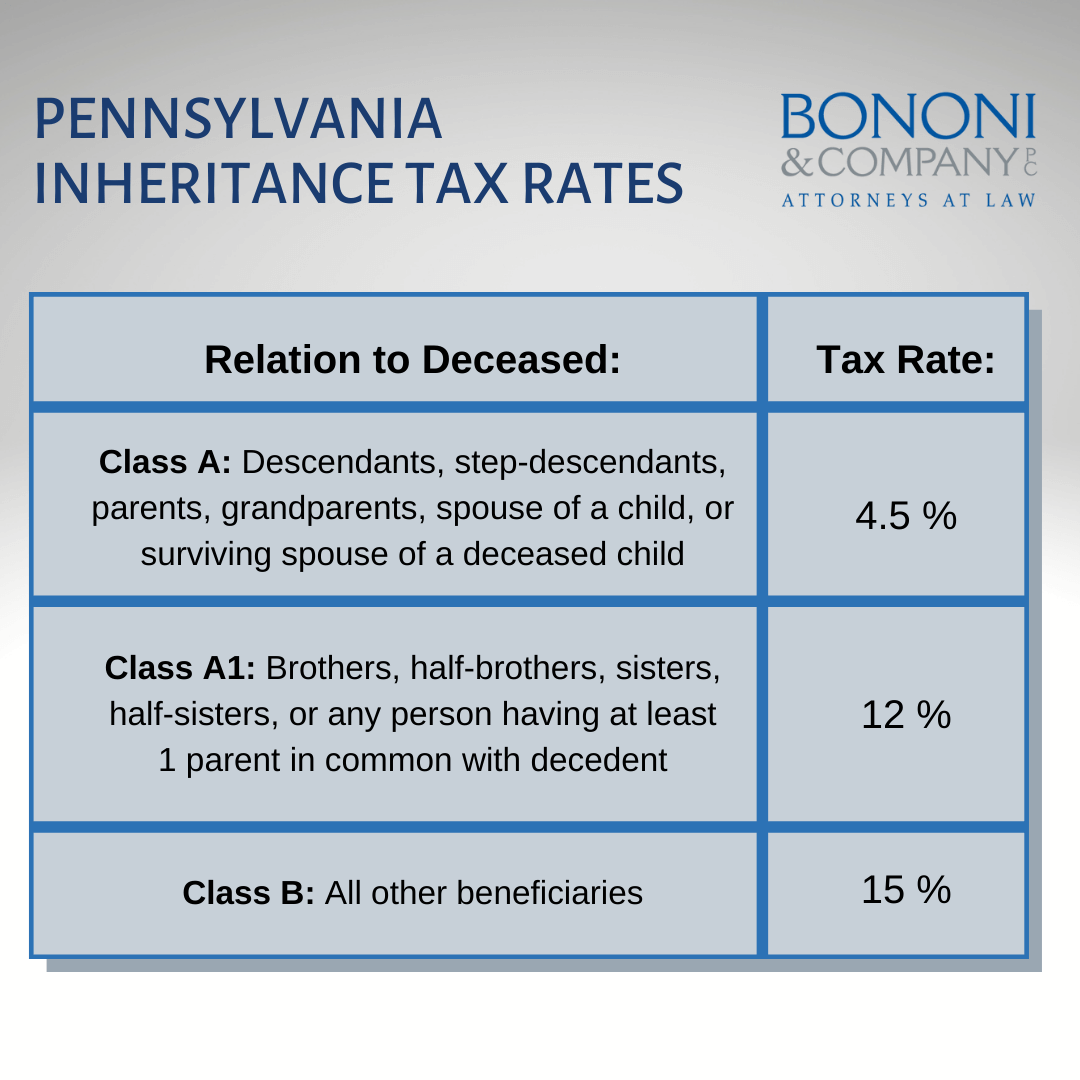

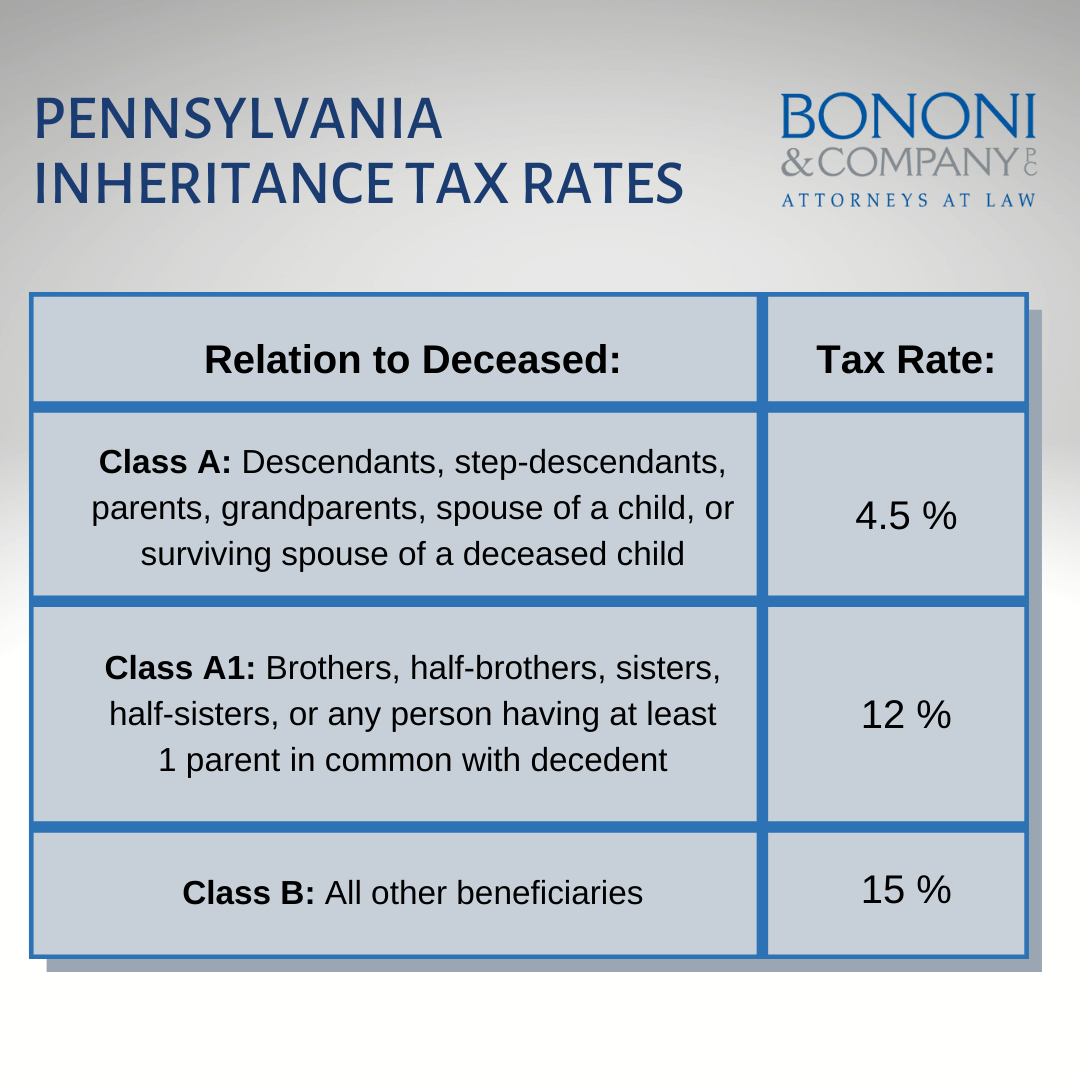

How To Avoid Pennsylvania Inheritance Tax Bononi And Company PC

https://bononiandbononi.com/wp-content/uploads/2022/02/20220221-PA-inheritance-tax-rates.png

How To Reduce Your Inheritance Tax Bill Your Money

https://www.yourmoney.com/wp-content/uploads/sites/3/oldimg/2243002-shutterstock-100556329.jpg

All real property and all tangible personal property of a resident decedent including but not limited to cash automobiles furniture antiques jewelry etc located in Pennsylvania Effective July 1 2013 a small business exemption from inheritance tax is available for a transfer of a qualified family owned business interest to one or more qualified

In this comprehensive guide we ll cover everything you need to know about the Pennsylvania inheritance tax including how it works current tax rates exemptions and strategies for minimizing your tax liability Use REV 1197 Schedule AU to claim an exemption from inheritance tax for real estate pursuant to either the business of agriculture exemption or the farmland other exemption

Download Inheritance Tax Exemption Pennsylvania

More picture related to Inheritance Tax Exemption Pennsylvania

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

https://www.brmmlaw.com/images/blog/iStock-1055975784.jpg

Who Can Receive An Inheritance Tax Refund In Pennsylvania

https://herrpottsandpotts.com/wp-content/uploads/2018/07/PA-Inheritance-Tax-Attorneys.jpg

17 States That Charge Estate Or Inheritance Taxes Alhambra Investments

https://i0.wp.com/alhambrapartners.com/wp-content/uploads/2020/11/2.png?ssl=1

The family exemption is a right given to specific individuals to retain or claim certain types of a decedent s property in accordance with Section 3121 of the Probate Estate and 15 on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax which are not subject to tax In addition to the flat rate there are also exemptions for certain

The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that person s assets or income to take up to 3 500 from the Instead of being imposed on the estate inheritance taxes are levied on the specific inheritances of each listed beneficiary The rates range from 4 5 to 15 but there are

Do Heirs Pay Inheritance Tax On IRAs In Pennsylvania

https://herrpottsandpotts.com/wp-content/uploads/2018/07/Pennsylvania-Inheritance-Tax-Lawyers.jpg

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-rev-1220-pennsylvania-exemption-certificate-printable-pdf-download-1.png?w=950&ssl=1

https://www.paelderlaw.net › assets-not-sub…

There are exceptions and assets not subject to Pennsylvania inheritance tax Pennsylvania includes assets that are not subject to inheritance tax including life insurance property jointly owned by spouses and charitable gifts

https://revenue-pa.custhelp.com › app › answers › detail › a_id

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania If there is no spouse or if the spouse has forfeited his her rights

Pennsylvania Inheritance Tax 5 Simple Ways To Minimize The Tax Burden

Do Heirs Pay Inheritance Tax On IRAs In Pennsylvania

How Much Is Inheritance Tax Evolve Family Law

Dealing With Payment Of Inheritance Tax When Estate Funds Are Inaccessible

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Getting To Grips With Inheritance Tax Monarch Solicitors

Getting To Grips With Inheritance Tax Monarch Solicitors

State Tax Exemption Map National Utility Solutions

Succession Inheritance Law In Spain Spain Property Guides

Will Your Family Be Caught In The Inheritance Tax Net

Inheritance Tax Exemption Pennsylvania - Fortunately there are exemptions and exceptions to the inheritance tax in Pennsylvania These include Transfers to surviving spouses Generally transfers to a