Input Tax Credit Rules Find out what is Input Tax Credit under GST how to calculate ITC how to claim ITC time limit to avail ITC common questions and much more

You cannot claim an ITC for the GST HST you paid for rent from January 1 to February 28 2023 because that amount relates to the period before you became a registrant Input credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs Input tax credit in realtion to GST to a registered person means the CGST SGST UTGST or IGST

Input Tax Credit Rules

Input Tax Credit Rules

https://i.pinimg.com/originals/ae/8e/50/ae8e50aea1951315b097a97da4d9023d.png

Input Tax Credit Under GST GST Rules SBSandCo LLP

https://www.sbsandco.com/images/2019/06/11/Input-Tax-Credit-Under-GST.jpg

Input Tax Credit Under GST ITC Meaning Rules And Guide With Example

https://i2.wp.com/www.gsthelplineindia.com/blog/wp-content/uploads/2017/09/uFEFFInput-Tax-Credit-under-GST.jpg?resize=1024%2C358&ssl=1

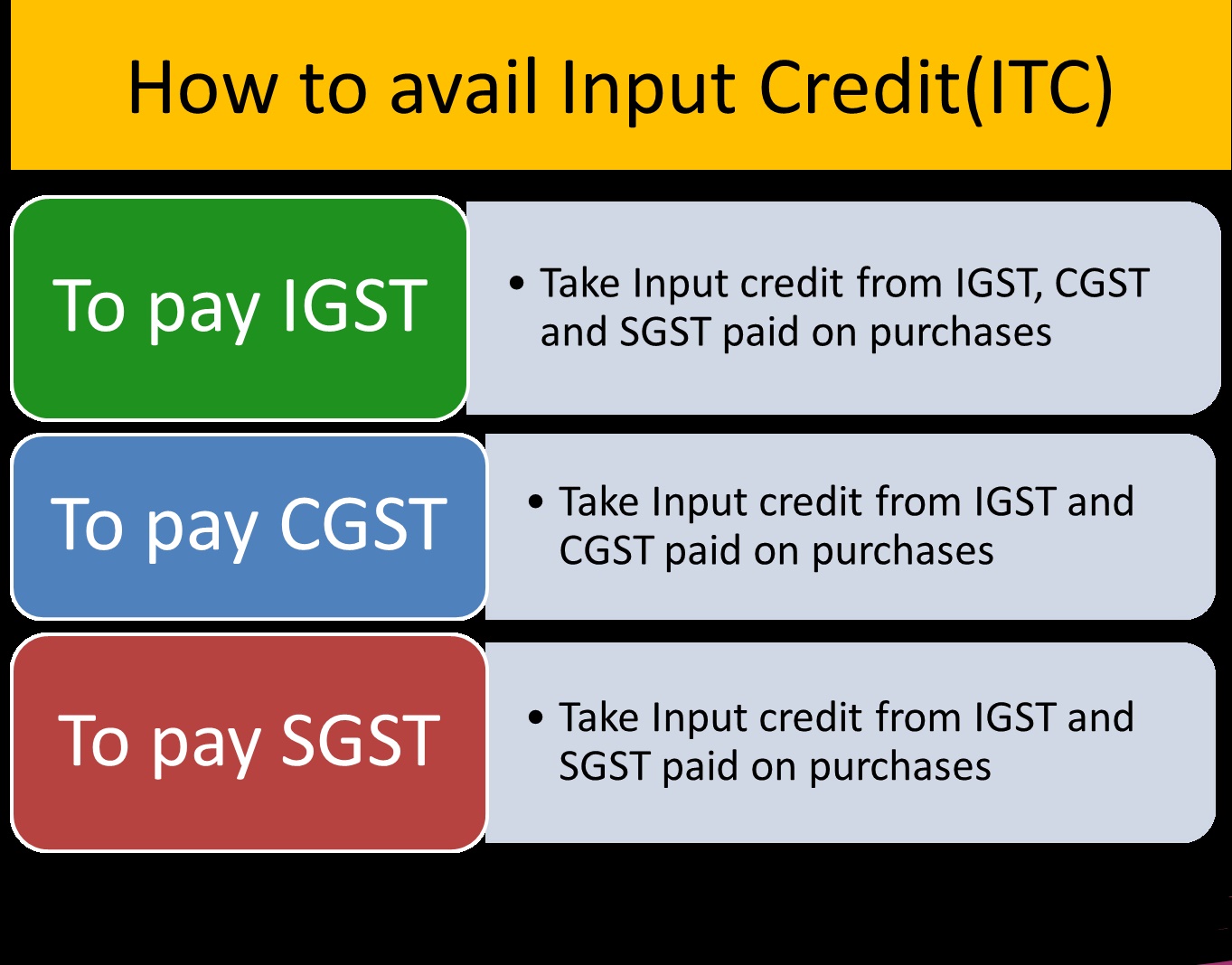

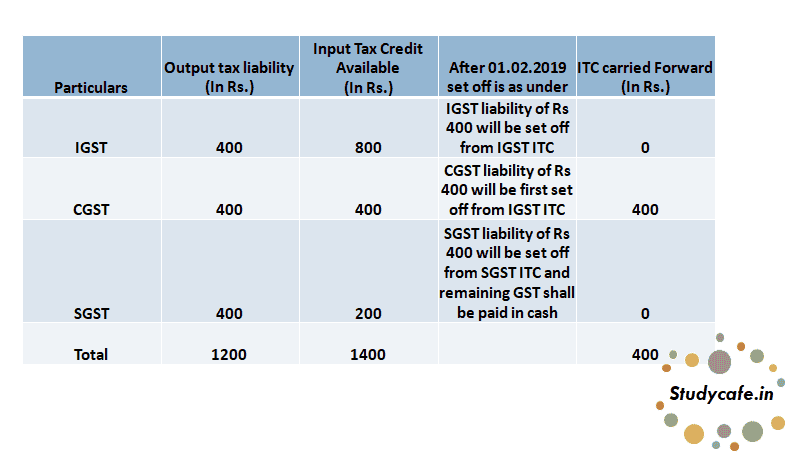

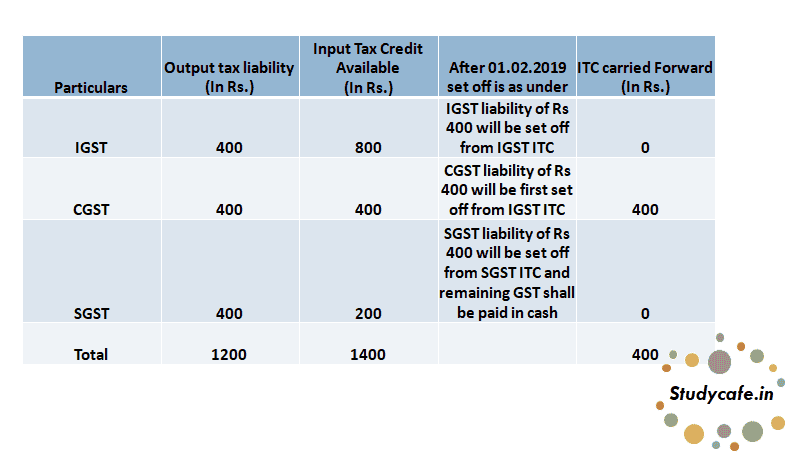

The Board clarified that ITC on account of IGST shall first be utilised towards payment of IGST and the amount remaining if any may be utilised towards the payment of CGST and SGST or UTGST as the case may Effective March 29 2019 the government revised the set off order for Input Tax Credits IGST aiming to optimize revenue sharing between the central and state

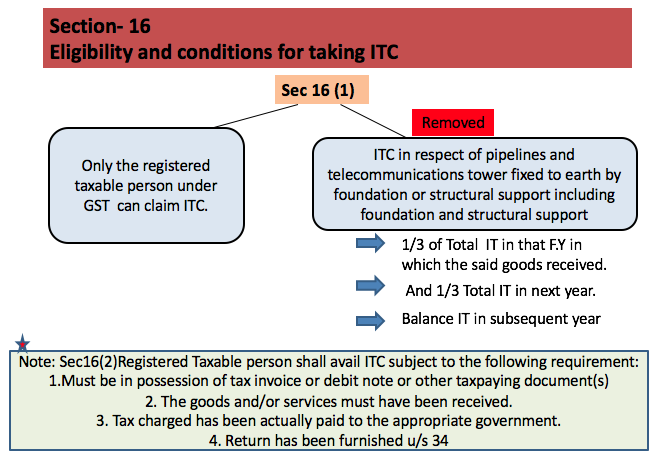

Rule 36 Documentary requirements and conditions for claiming input tax credit 1 The input tax credit shall be availed by a registered person including the Input Service Distributor on Legal position after insertion of rule 36 4 Rule 36 4 has been inserted with effect from October 9 2019

Download Input Tax Credit Rules

More picture related to Input Tax Credit Rules

Clarifying Input Tax Credit Claims Under New GST Rules Digitax Automation

https://www.digitaxindia.com/wp-content/uploads/2019/11/Clarifying-Input-Tax-Credit-Claims-under-New-GST-Rules.jpg

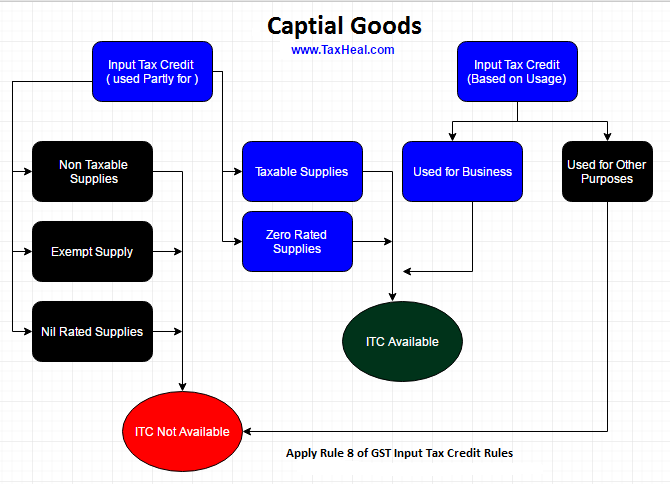

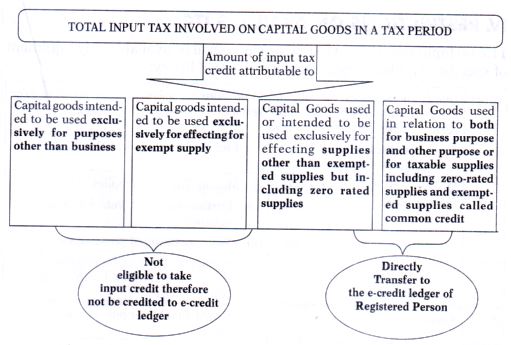

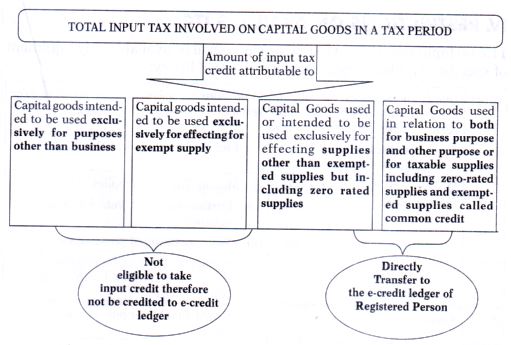

Example Rule 8 Of GST Input Tax Credit Rule Capital Goods Partly Used

https://taxheal.com/wp-content/uploads/2017/05/rule-8-Capital-Goods-partly-for-business-and-other-purposes.png

Apmh Reversal Of Input Tax Credit Under Rule Of Cgst Rules Hot My XXX

https://carajput.com/blog/wp-content/uploads/2018/09/ITC-1.jpg

Learn everything about Input Tax Credit ITC under GST including eligibility criteria key provisions conditions for claiming ITC and how it helps businesses reduce tax liability Understand the process for availing ITC Input means any goods other than capital goods used or intended to be used by a supplier in the course or furtherance of business

Rs 18 being known as tax paid on inputs or input tax Moreover on selling such product after value additions say for Rs 200 they collect certain taxes presumed 28 Discover the essential eligibility conditions for claiming Input Tax Credit ITC under GST Learn about required documents supplier compliance and key restrictions to maximize

GST Input Tax Credit Setting Off Rules Changed From 1st February 2019

https://studycafe.in/wp-content/uploads/2019/02/Capture-16.png

Gst Input Tax Credit Tax Credits Pie Chart Chart

https://i.pinimg.com/originals/cd/97/c5/cd97c5a66b6fc4e1352610160c602e36.png

https://cleartax.in › what-is-input-credit-and-how-to-claim-it

Find out what is Input Tax Credit under GST how to calculate ITC how to claim ITC time limit to avail ITC common questions and much more

https://www.canada.ca › en › revenue-agency › services › ...

You cannot claim an ITC for the GST HST you paid for rent from January 1 to February 28 2023 because that amount relates to the period before you became a registrant

Rules Related To Setting Off Of Input Tax Credit Hot Sex Picture

GST Input Tax Credit Setting Off Rules Changed From 1st February 2019

NEW RULES OF INPUT TAX CREDIT ITC UTILISATION Although There Has Not

Input Tax Credit Reversal Rules 42 And 43 Of The CGST Rules

Complete Guide To Input Tax Credit Under GST Busy

Determination Of Input Tax Credit ITC In Respect Of Capital Goods

Determination Of Input Tax Credit ITC In Respect Of Capital Goods

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

Input Tax Credit Under GST Law How To Claim ITC Under GST Law

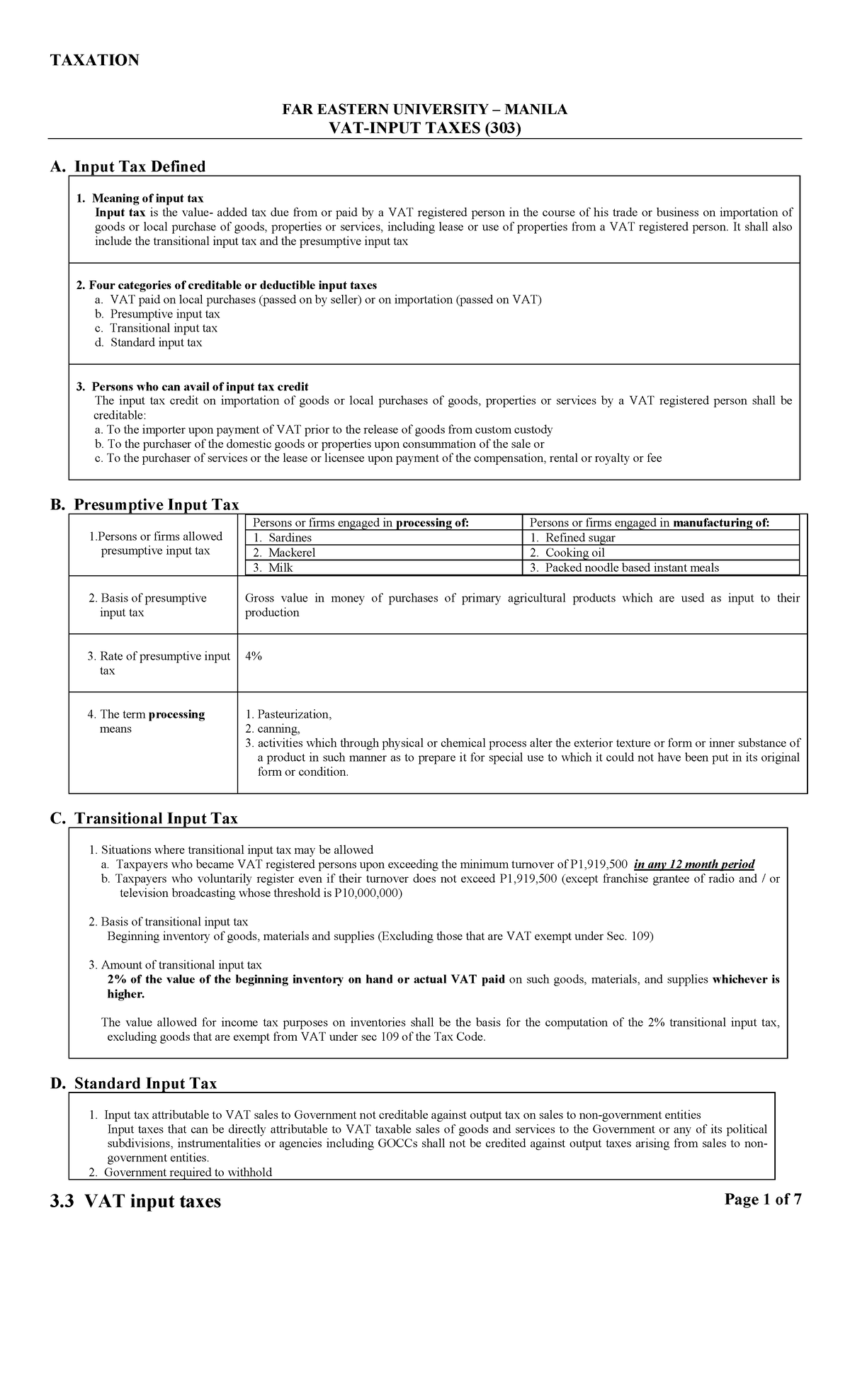

03 3 VAT Input Taxes Lecture Notes 3 TAXATION FAR EASTERN

Input Tax Credit Rules - Effective March 29 2019 the government revised the set off order for Input Tax Credits IGST aiming to optimize revenue sharing between the central and state