Insulated Garage Door Tax Credit 2022 Energy Efficient Home Improvement Credit The Energy Efficient Home Improvement Credit is now equal to 30 of what homeowners pay for various types of home energy efficiency improvements including exterior windows skylights and doors home insulation heat pumps water heaters central air conditioners furnaces and hot

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Insulated Garage Door Tax Credit 2022

Insulated Garage Door Tax Credit 2022

https://thegaragedoorguys.com.au/wp-content/uploads/2022/05/custom-insert-peppermint-1a_external-005-1200x800.jpg

Top 4 Ideas To Decorate Your Garage Door This Christmas

https://www.doddsdoors.com/wp-content/uploads/2021/12/Insulated-Garage-Door-2.png

How To Receive The Employee Retention Tax Credit ERTC For Law Firm

https://smbteam.com/wp-content/uploads/2022/10/Artboard1_5-1.png

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving money on home energy upgrades clean vehicles and more Equipment type Tax Credit Available for 2022 Tax Year Updated Tax Credit Available for 2023 2032 Tax Years

2022 Tax Credit Information Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Tax Credit 10 of cost up to 500 or a specific amount from 50 300 Expires December 31 2022 The Inflation Reduction Act of 2022 P L 117 169 expanded and renamed the nonbusiness energy property credit as the energy efficient home improvement credit

Download Insulated Garage Door Tax Credit 2022

More picture related to Insulated Garage Door Tax Credit 2022

3 Steps Most EFFECTIVE Way To Insulate Your Garage Door To Reduce

https://content.instructables.com/ORIG/FCB/DULM/I2F1Z3XS/FCBDULMI2F1Z3XS.jpg?auto=webp&frame=1&width=2100

Official Toyota s 7 500 Federal Tax Credit Phaseout Is Underway

https://cdn.motor1.com/images/custom/thumbnail/toyota-us-federal-tax-credit-q2-2022-20220723.png

Owens Corning Garage Door Insulation Kit 8 Panels GD01 The Home Depot

http://www.homedepot.com/catalog/productImages/1000/bc/bc34e1da-f8bf-4d9c-bfb2-ec0f00095b76_1000.jpg

How to Get Tax Credits for Insulation and Home Energy Upgrades The Inflation Reduction Act is about more than just solar panels and EVs It can help you pay for that new water heater or Credits are typically applied to a taxpayer s income tax liability and thereby can offset the cost of energy saving improvements such as insulation windows and doors solar panel systems or other qualifying renewable energy sources

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 How much is the insulation tax credit 2022 and 2023 Good news here thanks to the Energy Efficient Home Improvement Credit you can now get a tax credit of up to 1200 depending on when your installation was installed

Tax Break For Insulated Garage Doors Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/171/217/86517333.jpg

Steel And Insulated Garage Door Installation Salem OR

https://le-cdn.hibuwebsites.com/46d3885785674a8d9a5239f61b5b7ed5/dms3rep/multi/opt/superior-garage-door-hero-home-1920w.jpg

https://www.nolo.com/legal-updates/energy-related...

Energy Efficient Home Improvement Credit The Energy Efficient Home Improvement Credit is now equal to 30 of what homeowners pay for various types of home energy efficiency improvements including exterior windows skylights and doors home insulation heat pumps water heaters central air conditioners furnaces and hot

https://www.irs.gov/credits-deductions/frequently...

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

What Are The Benefits Of An Insulated Garage Shutter By United

Tax Break For Insulated Garage Doors Sapling

Benefits Of Garage Door Insulation TLS Insulation

Technical Information Insulation Garage Door

Insulated Garage Door Replacement Panels BigIron Auctions

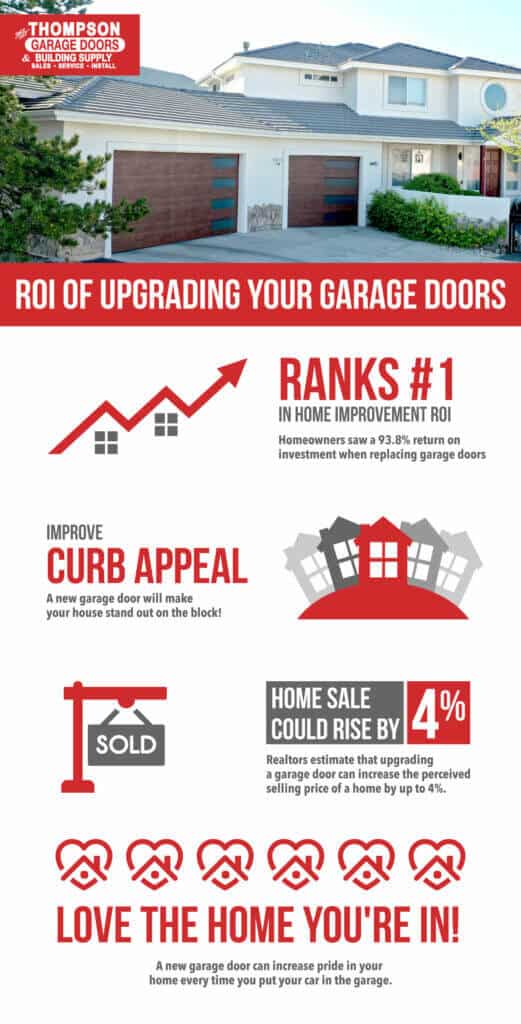

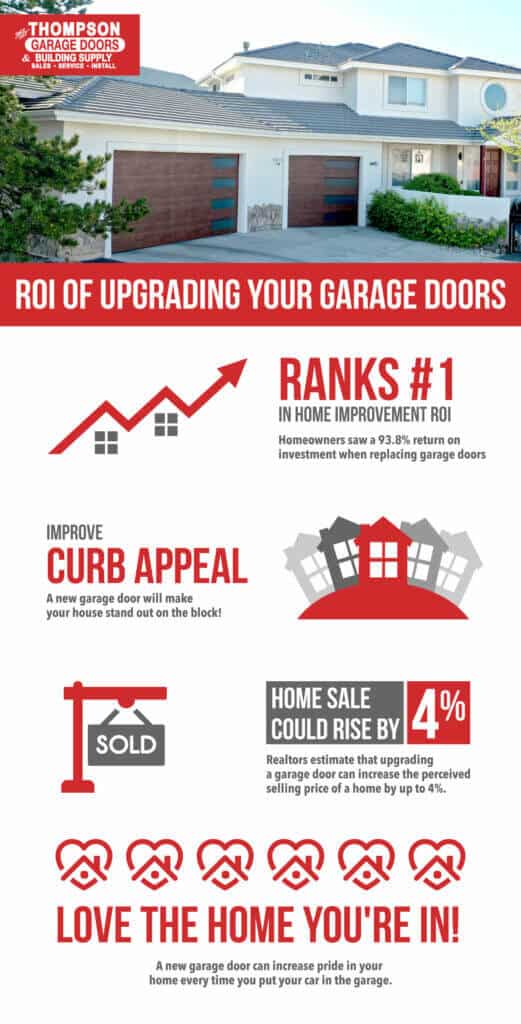

Replace Your Garage Doors With Your Tax Return Thompson Doors

Replace Your Garage Doors With Your Tax Return Thompson Doors

Garage Door Insulation Part 2 Reflectix Radiant Heat Barrier Jay

10 Things You Need To Know About Wooden Garage Heating Pineca

Pin On Building Home

Insulated Garage Door Tax Credit 2022 - 2022 Tax Credit Information Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Tax Credit 10 of cost up to 500 or a specific amount from 50 300 Expires December 31 2022