Insurance Rebate In Income Tax Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income

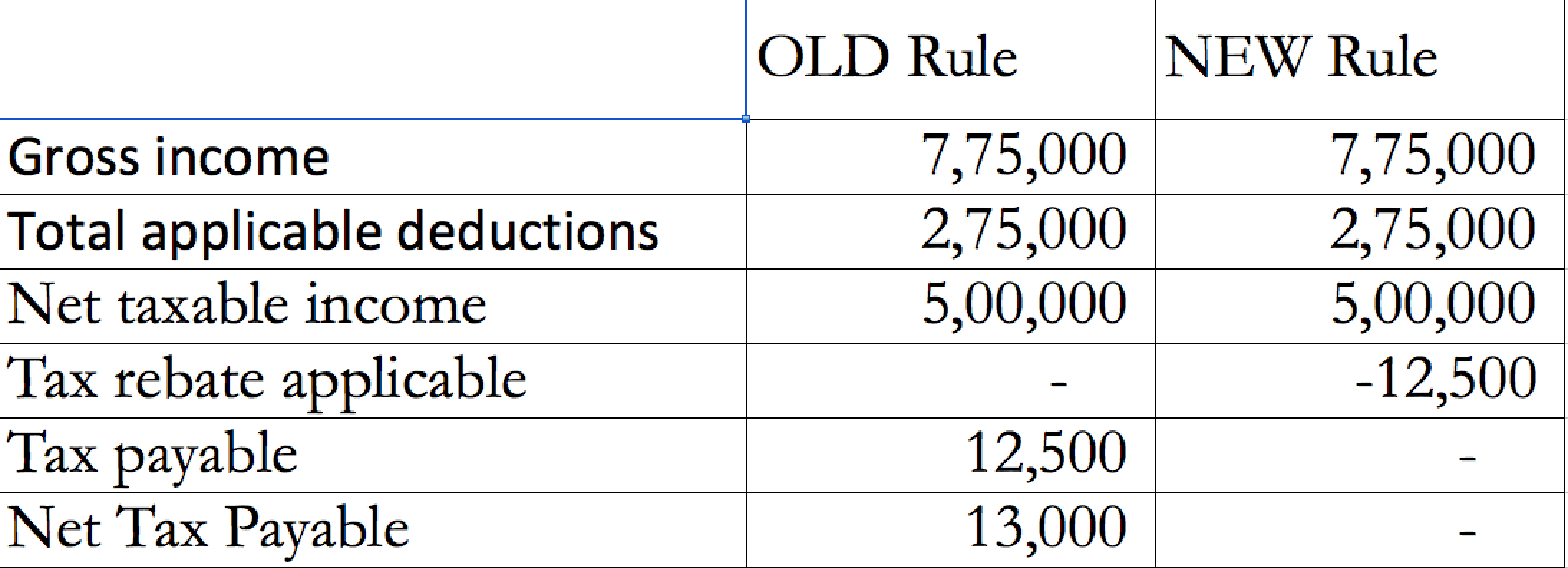

Web 14 juin 2018 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction from their total income for medical insurance premiums paid in any given year under Section Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to Rs

Insurance Rebate In Income Tax

Insurance Rebate In Income Tax

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

Medicare Levy Surcharge Private Health Insurance What s The Link

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

How Does Private Health Insurance Affect My Tax Return Compare Club

https://asset.compareclub.com.au/content/guides/health-insurance/tax-return/private-health-rebate-levels.jpg

Web Section 80 D of the Income Tax Act of 1961 provides for tax exemptions for payment of a premium of a medical insurance policy This payment can be carried out either by an Web Basics of Individual Income Tax Tax reliefs rebates and deductions Life Insurance Relief is given to individuals who paid annual insurance premiums on their own life insurance

Web To claim the private health insurance rebate depends on your circumstances regardless of your residency status in Australia You must have a Complying health insurance policy Web Choose 2022 health insurance status for steps amp tax forms If more than one situation applied at different times or for different household members start with one option and

Download Insurance Rebate In Income Tax

More picture related to Insurance Rebate In Income Tax

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

https://i.pinimg.com/originals/04/6c/93/046c93de3420d11217b08ec3f970154b.png

ISelect What You Need To Know Tax Rebates On Health Insurance And

https://www.iselect.com.au/content/uploads/2017/06/Rebates-Table.jpg

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Web 23 mai 2023 nbsp 0183 32 Health insurers sent 1 billion in rebates to consumers in 2022 bringing 11 year total to 10 8 billion Rebate amounts vary considerably by state and insurer For people who get a premium Web 3 avr 2023 nbsp 0183 32 Income received from insurance policies issued on or after 1 April 2023 other than unit linked policies having a premium or aggregate of premium exceeding Rs 5

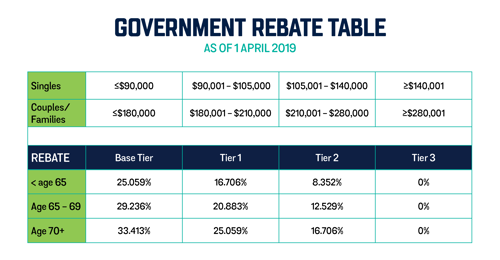

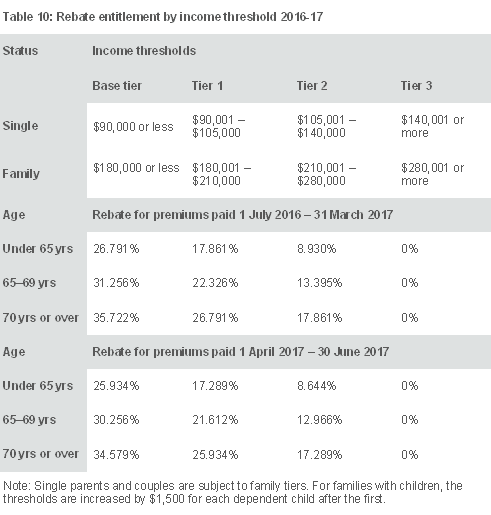

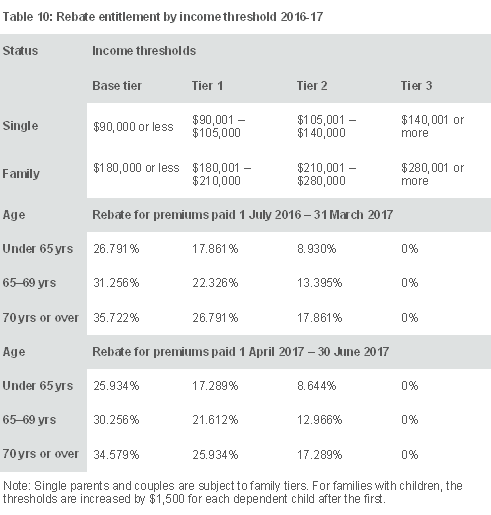

Web The private health insurance rebate is income tested This means that if your income is higher than the relevant income threshold you may not be eligible to receive a rebate Web 30 oct 2018 nbsp 0183 32 Moreover under Section 80C and 10D of the Income Tax Act there are income tax benefits on life insurance Under section 80C premiums that you pay

What s The Distinction Between PMI And Home Loan Defense Insurance

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

https://www.ato.gov.au/.../Private-health-insurance-rebate

Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income

https://cleartax.in/s/medical-insurance

Web 14 juin 2018 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction from their total income for medical insurance premiums paid in any given year under Section

Why Is Medicare

What s The Distinction Between PMI And Home Loan Defense Insurance

Private Health Insurance Rebate Navy Health

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Section 87A Tax Rebate Under Section 87A Rebates Financial

Insurance Rebate In Income Tax - Web Section 80D of the Income Tax Act 1961 allows individuals and Hindu Undivided Family HUF to avail health insurance tax benefit on the premium paid If your annual income