House Loan Income Tax Rebate Web Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan Web Income tax rebate on home loan Joint mortgage deductions Borrowers may deduct up to Rs 2 lakhs in interest and Rs 1 5 lakh in principle from their house loan but only if they

House Loan Income Tax Rebate

House Loan Income Tax Rebate

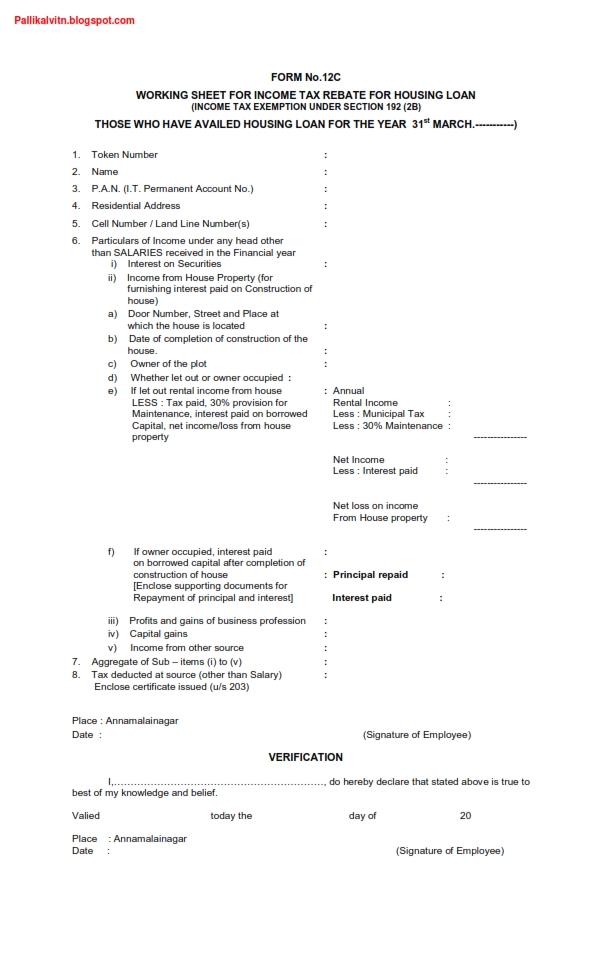

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

Web Section 80C Deductions under this section can help you with tax benefits of up to Rs 1 5 lakhs on the principal amount Section 24 Under this section you are allowed to enjoy Web As per the new income tax rule starting April 2023 no new home loans sanctioned in FY23 24 will be eligible to claim the tax benefits under section 80 EEA Sections of the

Download House Loan Income Tax Rebate

More picture related to House Loan Income Tax Rebate

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/line_Rebate-on-Home-Loan-for-Interest-Paid.png

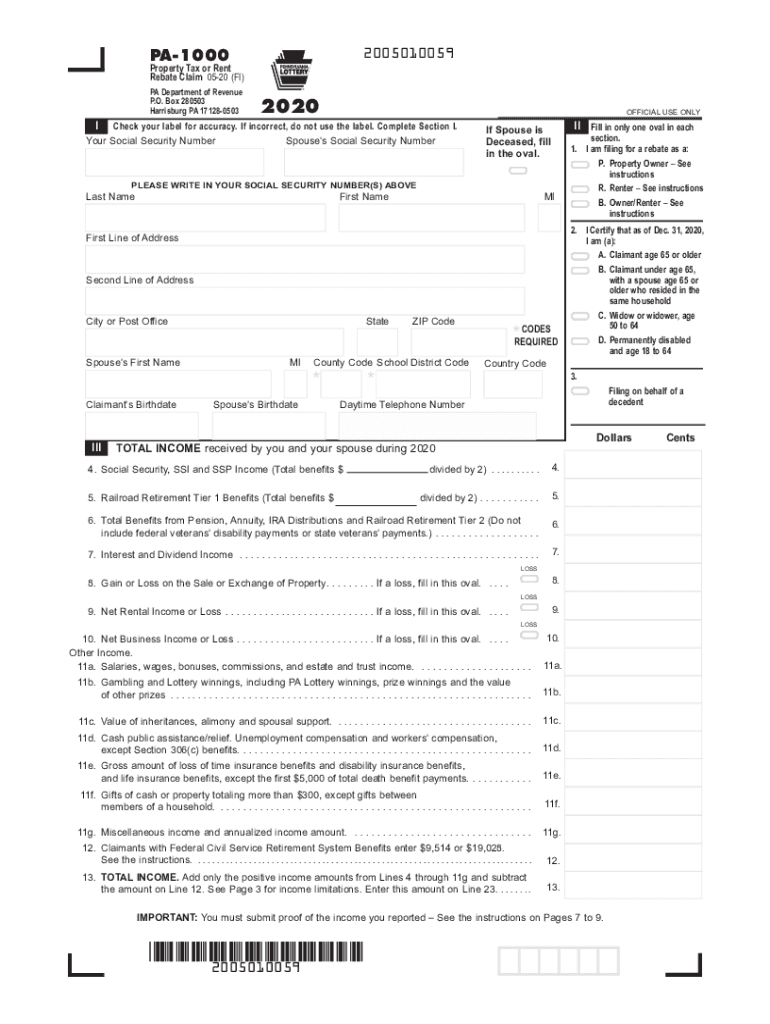

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Web 28 janv 2014 nbsp 0183 32 The rebate is for combined amount and there is no additional rebate for pro rated amount For example you have begun payments from say Oct 2013 You have Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI Web 10 sept 2021 nbsp 0183 32 The tax exemption for the home buyer as per section 24 of the income tax act would be an exemption of up to Rs 2 lakh This exemption would be under the home

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

https://i.pinimg.com/originals/07/68/e8/0768e843fce468a6a866abfdec4820d1.jpg

Home Loan Rebate In Income Tax In Hindi

https://expertkamai.com/wp-content/uploads/2023/05/Home-Loan-Rebate-In-Income-Tax-In-Hindi-768x431.jpg

https://www.bankbazaar.com/tax-benefit-on-home-loan.html

Web Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax-benefits

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Latest Income Tax Rebate On Home Loan 2023

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

2007 Tax Rebate Tax Deduction Rebates

Joint Home Loan Declaration Form For Income Tax Savings And Non

Home Loan Loan Income Tax Tax Saving Many Types Of Income Tax

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Section 87A Tax Rebate Under Section 87A

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

House Loan Income Tax Rebate - Web Income Tax Benefits on Home Loans The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a