Housing Loan Income Tax Exemption Section Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations under home loan tax benefit 80c section

Housing Loan Income Tax Exemption Section

Housing Loan Income Tax Exemption Section

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

This deduction is over and above the Rs 2 lakhs for interest payments available under Section 24 b of the Income Tax Act Therefore taxpayers can claim a total deduction of Rs 3 5 lakh for interest on a home loan if they meet the conditions of section 80EEA for residential house property Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum deduction limits and conditions for claiming this tax benefit Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for loans that were received till 31 March 2024

Download Housing Loan Income Tax Exemption Section

More picture related to Housing Loan Income Tax Exemption Section

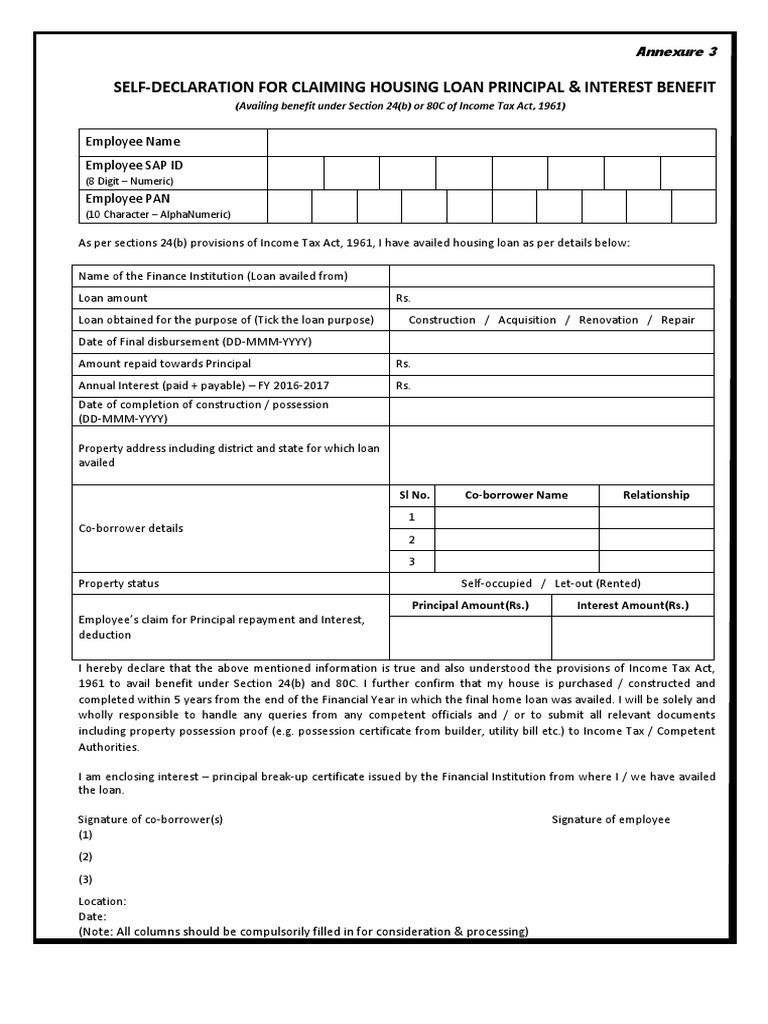

Self Declaration For Claiming Housing Loan Principal Interest Benefit

https://imgv2-2-f.scribdassets.com/img/document/558860084/original/8382a4f494/1672898190?v=1

Govt May Raise The Income Tax Exemption Level From The Current Rs 2 5

https://img.etimg.com/thumb/msid-96729952,width-1070,height-580,imgsize-790413,overlay-etwealth/photo.jpg

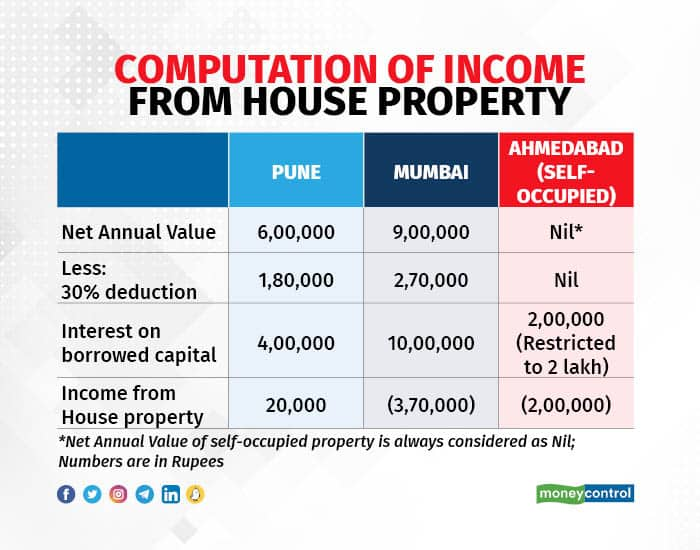

How To Maximise Tax Savings On Your House Property Income How To

https://images.moneycontrol.com/static-mcnews/2022/10/Computation-of-income-from-house-property.jpg

So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Income Tax Act Under Section 80C of the IT Act you can claim tax deductions on the principal amount you repay to your lender This deduction is also applicable to the registration and stamp duty charges of your home The maximum housing loan tax exemption under Section 80C is Rs 1 5 lakhs in a financial year

Get income tax benefits on Home Loan under Section 24 80EE and 80C Know how much income tax exemption on a housing loan you can claim in 2024 Q How much housing loan interest can be exempt from income tax The maximum interest deduction under Section 24 b is limited to Rs 2 lakh encompassing both current year interest and pre construction interest

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

https://housing.com/news/home-loans-guide-claiming-tax-benefits

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA

Church Law Center Exemption Requirements For Business Leagues Under IRC

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Understanding Section 24B Of Income Tax Act 1961 Deduction For

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Section 11 Of Income Tax Act 1961 Exemption For Trusts

Section 11 Of Income Tax Act 1961 Exemption For Trusts

Housing Loan 0363675100002233 Provisional Certificate 2017 18 PDF PDF

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Housing Loan Income Tax Exemption Section - Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for loans that were received till 31 March 2024