Section 80c Deduction For Housing Loan Overall the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of INR 3 50 000 upto 2 00 000 in section 24 and upto

Tax deduction under section 80EEA is allowed for first time home buyers for the amount of interest paid towards the home loan under the affordable housing scheme The As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This may include stamp duty and registration fees but can be

Section 80c Deduction For Housing Loan

Section 80c Deduction For Housing Loan

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Section 80C allows the deduction for the amount paid towards the principal repayment of the home loan taken from the specified financial institutions This deduction is allowed under the overall umbrella limit of Rs 1 5 This deduction falls within the overall limit of 1 5 lakh under Section 80C and can be claimed in the same year the expenses are paid 5 Deduction for Joint Home Loans for Tax Exemption If you take a joint home

Section 80C of the IT Act provides a deduction of up to INR 1 5 lakh from the total taxable income of individuals and HUFs Here s all you need to know Is home loan covered under 80C Under section 80C a deduction of Rs 1 5 lakh can be claimed for the repayment of the home loan s principal amount where loan is taken for the construction

Download Section 80c Deduction For Housing Loan

More picture related to Section 80c Deduction For Housing Loan

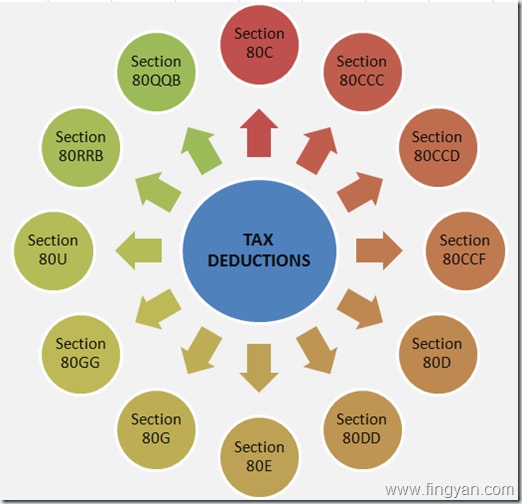

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

Module 05 Deduction Under Section 80C TO 80U Theory Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/281727b78d2cf4b9a82526ef57813f70/thumb_1200_1553.png

Section 80C Deduction Income Tax IndiaFilings

https://www.indiafilings.com/images/Investments-Eligible-for-Section-80C.png

Deduction Amount The deduction is available on the interest payable on the loan up to a maximum of Rs 50 000 per financial year This deduction is in addition to the The Principal portion of the EMI paid for the year is allowed as deduction under Section 80C The maximum amount that can be claimed is up to Rs 1 50 000 But to claim

A deduction of Rs 1 5 lakh can be claimed under section 80C for the repayment of the principal of a home loan taken for the purchase or construction of a new house only Deduction for the Principal Repayment on a Home Loan A deduction of Rs1 5 lakh can be claimed under Section 80C for the repayment of the principal of a loan taken for

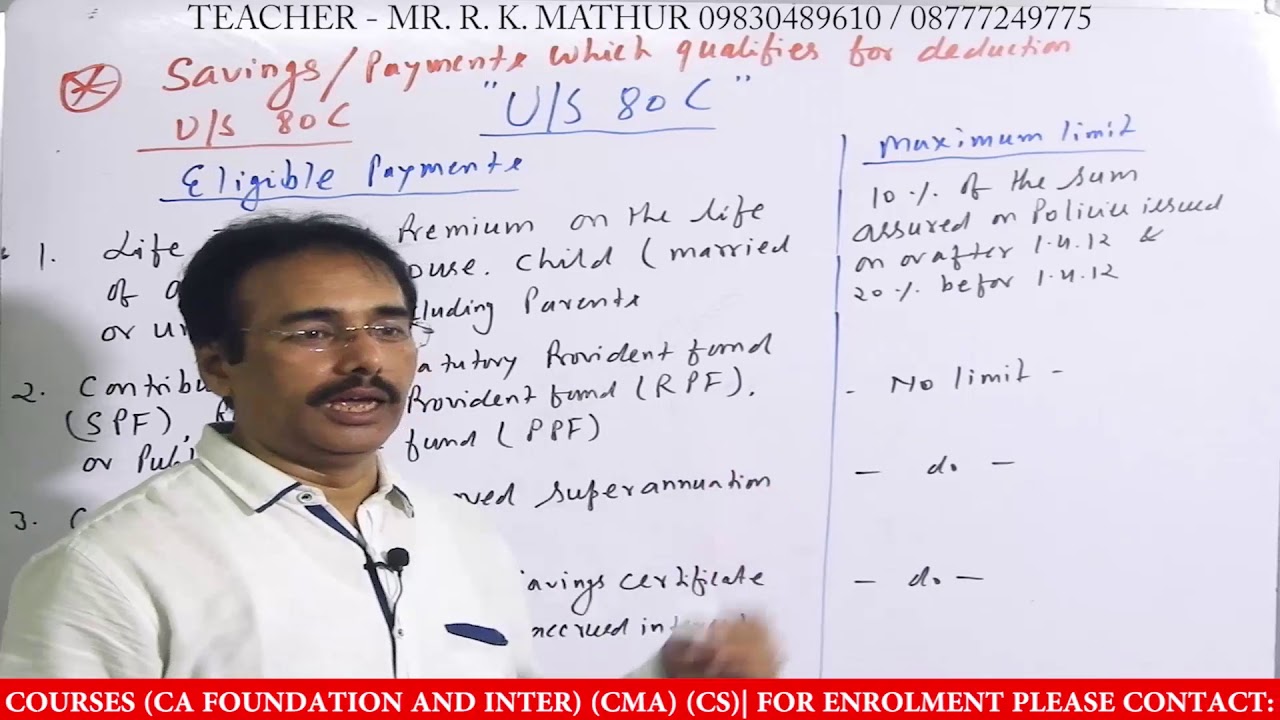

Deduction US 80C Deduction Under Section 80C Everything About

https://i.ytimg.com/vi/784UGSm-7B0/maxresdefault.jpg

Deduction From Gross Total Income Section 80C To 80U Graphical Table

https://incometaxmanagement.com/Images/Graphical-ITAX/Deduction-from-GTI/Section-80C.jpg

https://taxguru.in/income-tax/tax-benefit…

Overall the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of INR 3 50 000 upto 2 00 000 in section 24 and upto

https://cleartax.in/s/steps-claim-interest-home-loan-deduction

Tax deduction under section 80EEA is allowed for first time home buyers for the amount of interest paid towards the home loan under the affordable housing scheme The

Section 80C Deduction Under Section 80C In India Paisabazaar

Deduction US 80C Deduction Under Section 80C Everything About

7 Tax Provisions That Are Relevant To You Beyond Just Section 80C

Deductions Under Section 80C Benefits Works Myfinopedia

Section 80C Deduction Tax Saving Investment Options Under Section 80C

Deductions Under Section 80C Its Allied Sections

Deductions Under Section 80C Its Allied Sections

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

A Guide On Section 80C And Section 80D Deduction

Section 80c Deduction For Housing Loan - Is home loan covered under 80C Under section 80C a deduction of Rs 1 5 lakh can be claimed for the repayment of the home loan s principal amount where loan is taken for the construction