Intangible Tax Exemptions Georgia The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note The borrower and lender must remain unchanged

Rule 560 11 8 12 Instrument Securing Short Term and Long Term Notes Where a single instrument secures both long term and short term notes intangible recording tax is due Exemptions For Georgia Intangibles Tax Payment Rule 506 11 8 14 of the Rules and Regulations of the State of Georgia provides that any mortgage deed to secure debt purchase money deed to secure debt bond for title

Intangible Tax Exemptions Georgia

Intangible Tax Exemptions Georgia

https://i0.wp.com/www.printableaffidavitform.com/wp-content/uploads/2022/08/ga-t-23-2017-fill-out-tax-template-online-us-legal-forms.png

INTANGIBLE TAX Definition How It Works In Florida And Georgia GMU

https://gmuconsults.com/wp-content/uploads/2022/03/Intangible-Tax.jpg

Alternative Minimum Corporate Income Tax And Changes Regarding Limiting

https://www.krgroup.eu/wp-content/uploads/2021/11/krg-article-118.jpg

The tax is paid to the Clerk of Superior Court upon the filing of the mortgage instrument calculated roughly but not exactly at the rate of 3 00 per thousand based on the loan The Georgia intangible recording tax is not the same as the Georgia personal property tax Inquiries concerning specific exemptions should be addressed to the local tax officials of

Rule 560 11 8 14 Exemptions Any mortgage deed to secure debt purchase money deed to secure debt bond for title or any other form of security Transfer tax exemptions In Georgia some sellers may be eligible for exemptions from state transfer taxes depending on the specifics of the transaction

Download Intangible Tax Exemptions Georgia

More picture related to Intangible Tax Exemptions Georgia

Residence Income Exemptions Withholding Tax

https://lwfiles.mycourse.app/school157292-public/1f4243c072890a07595c2e611d7056c5.png

Income Tax Exemptions For Investment In Target Companies MPG

https://mahanakornpartners.com/wp-content/uploads/2022/08/Tax-Exemptions-for-Gains-2048x1351.png

Personal Income Tax Guide In Malaysia 2016 Tech ARP

https://www.techarp.com/wp-content/uploads/2016/03/lhdn.png

2023 CODE OF GEORGIA Title 48 REVENUE AND TAXATION 48 1 1 48 18 1 Chapter 6 TAXATION OF INTANGIBLES 48 6 1 48 6 98 Article 1 REAL Real estate transfer tax is an excise tax on transactions involving the sale of real property where title to the property is granted assigned transferred or otherwise conveyed from

There is imposed on each instrument an intangible recording tax at the rate of 1 50 for each 500 00 or fraction thereof of the face amount of the note secured by the recording Section 48 6 74 Distribution of revenues from intangible recording tax procedure when real property located in more than one county Section 48 6 75 Collection procedures

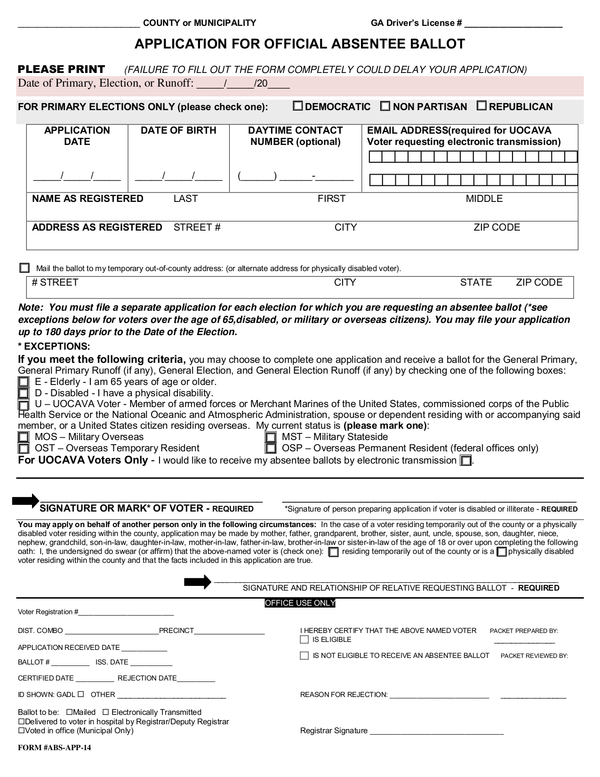

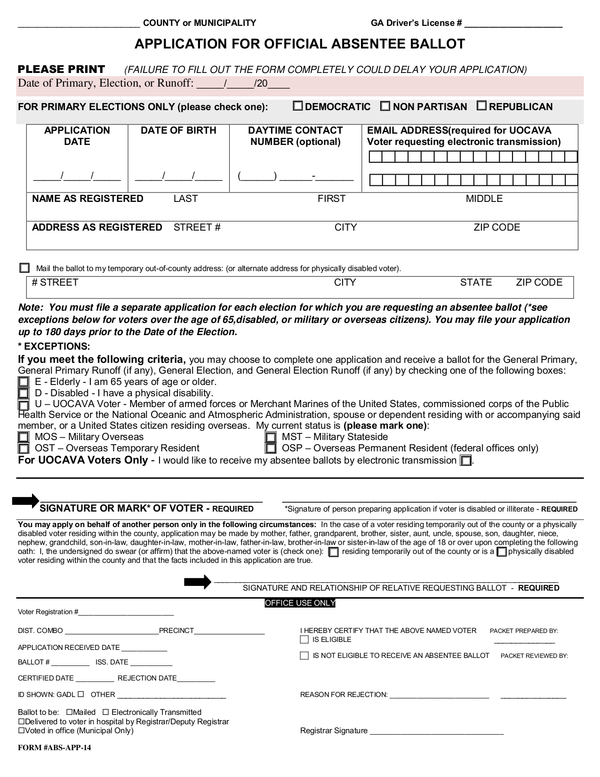

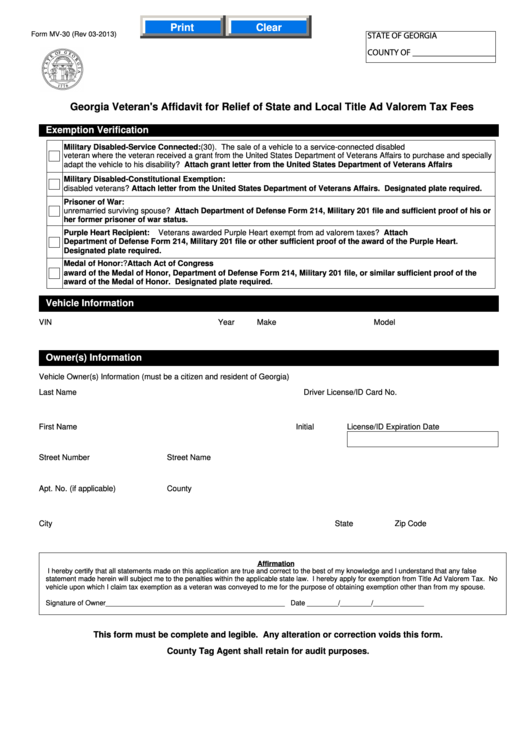

Georgia Intangible Tax County And City Affidavit Form 2024

https://www.printableaffidavitform.com/wp-content/uploads/2022/08/fill-free-fillable-georgia-gov-pdf-forms.png

15 Essential Guidelines For 1031 Exchange Tax Exemptions Invest In

https://investinmultifamily.com/wp-content/uploads/2023/11/fb9b269e-999f-4ebd-bda0-a3e8717ed895.jpg

https://georgiatitle.com › Real-Estate-Taxes › GA...

The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note The borrower and lender must remain unchanged

https://rules.sos.ga.gov › GAC

Rule 560 11 8 12 Instrument Securing Short Term and Long Term Notes Where a single instrument secures both long term and short term notes intangible recording tax is due

TAX EXEMPTIONS Georgia Department Of Economic Development

Georgia Intangible Tax County And City Affidavit Form 2024

TAX EXEMPTIONS ON CAPITAL GAINS Taxgoddess

Exemptions Webster NY Official Website

Georgia Intangible Tax County And City Affidavit Form 2024

FM Proposes To Do Away With Tax Exemptions On High Value Life Insurance

FM Proposes To Do Away With Tax Exemptions On High Value Life Insurance

Firstronic Llc 1655 Michigan Street Northeast Grand Rapids MI 49503

Democratic Plan Would Close Tax Break On Exchange traded Funds

Indiana Bankruptcy Exemptions Update Bymaster Bankruptcy Law

Intangible Tax Exemptions Georgia - Transfer tax exemptions In Georgia some sellers may be eligible for exemptions from state transfer taxes depending on the specifics of the transaction