Irs Child Tax Credit Rebate Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than Web 9 nov 2021 nbsp 0183 32 IR 2021 218 November 9 2021 The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Child Tax Credit and Advance

Irs Child Tax Credit Rebate

Irs Child Tax Credit Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/child-tax-credit-worksheet-claiming-the-recovery-rebate-credit.jpg?resize=791%2C1024&ssl=1

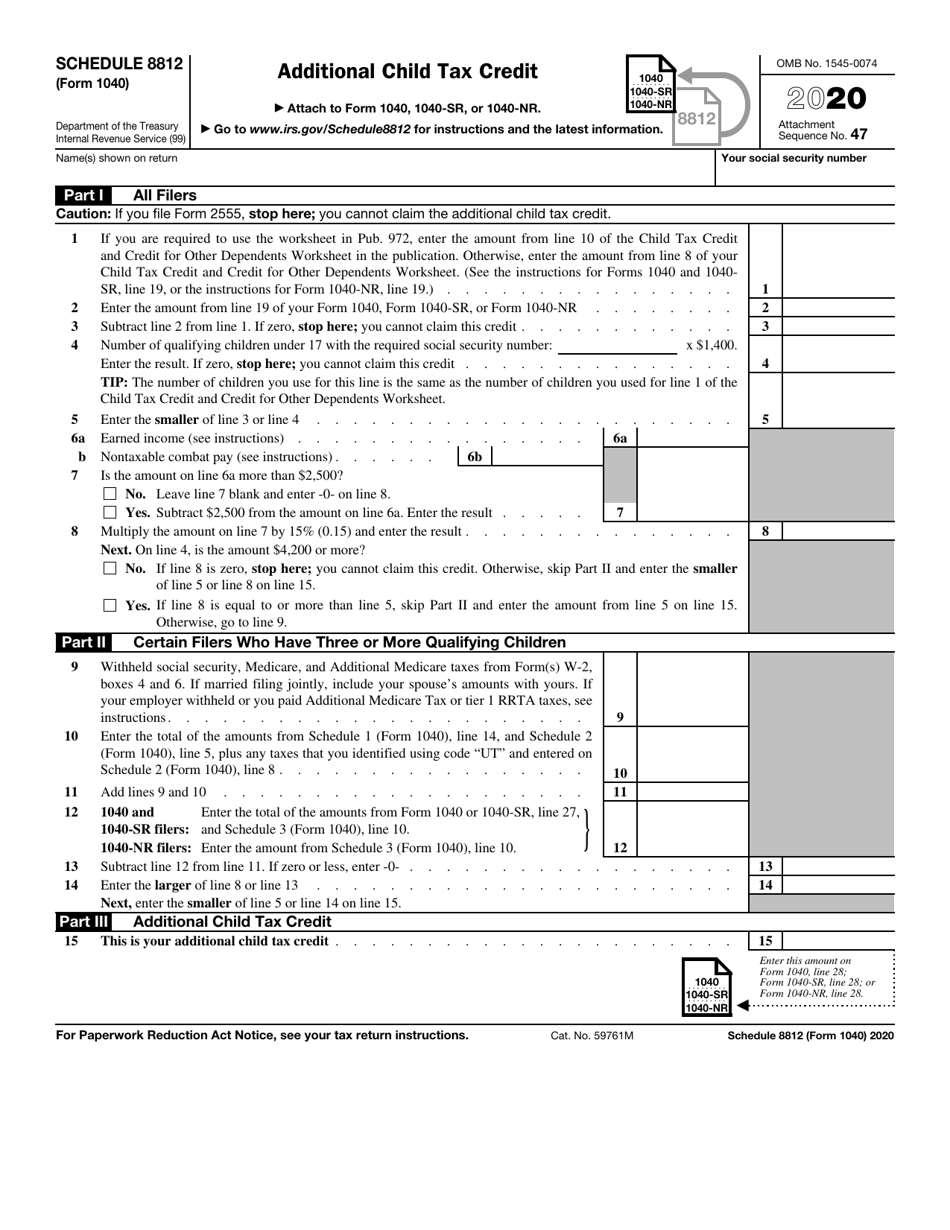

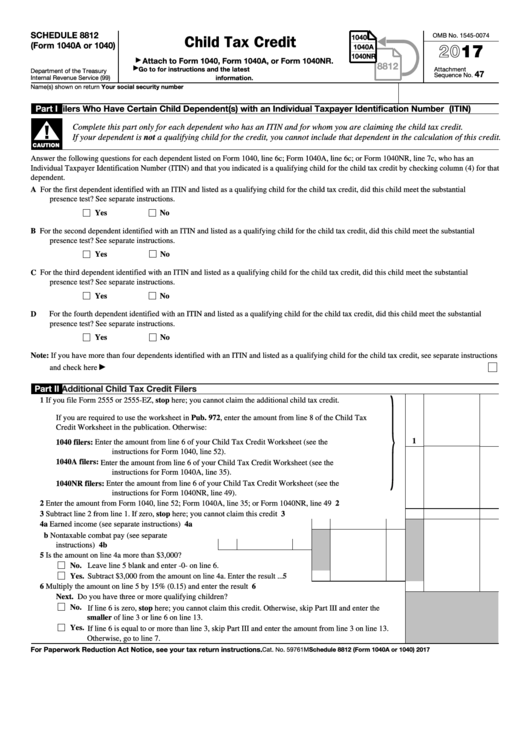

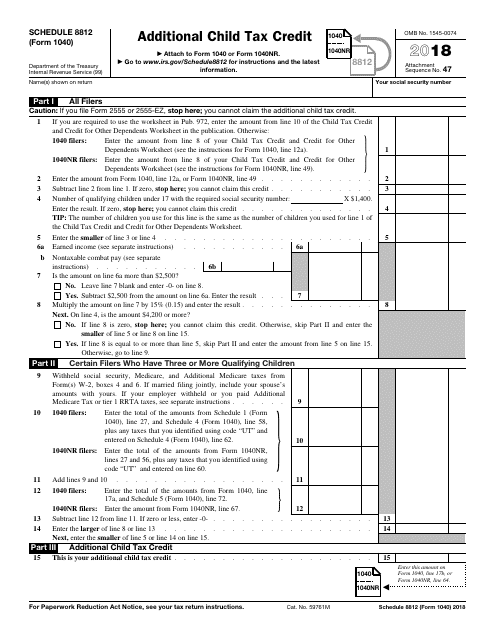

Child Tax Credits Form IRS Free Download

https://www.formsbirds.com/formimg/child-tax-credits-form/781/child-tax-credits-form-irs-l2.png

Child Tax Credit Form Free Download

http://www.formsbirds.com/formimg/tax-credit-form/4138/child-tax-credit-form-l4.png

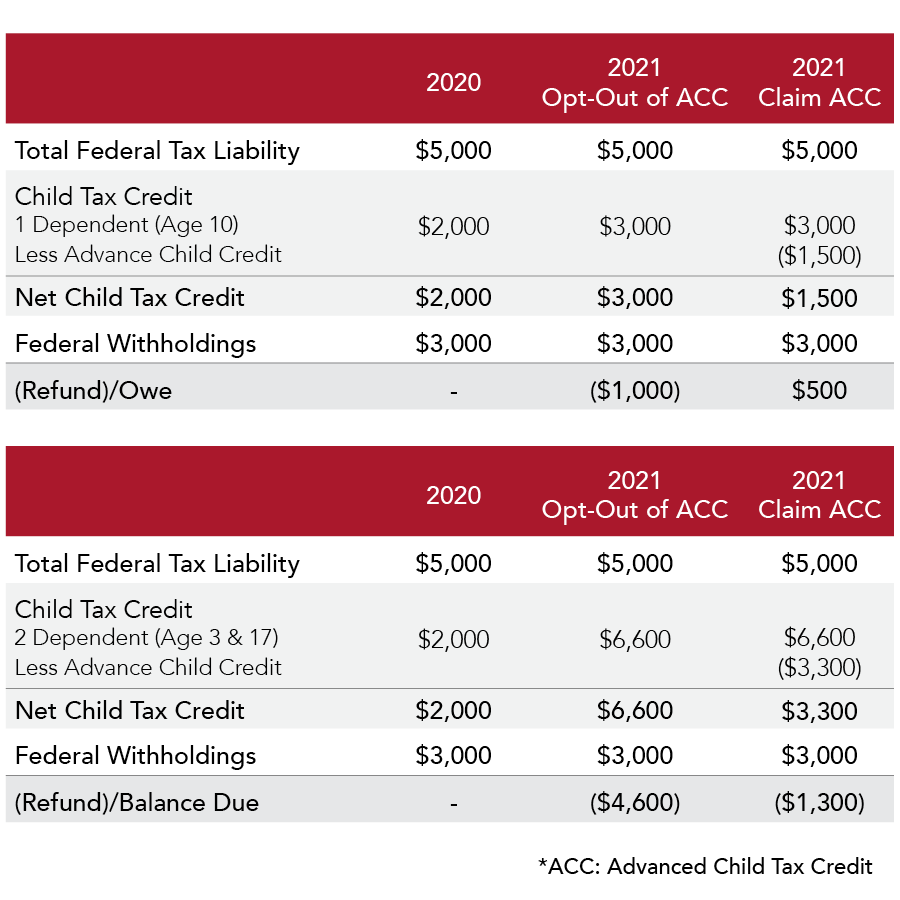

Web 11 janv 2022 nbsp 0183 32 IR 2022 10 January 11 2022 WASHINGTON The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Child Tax Credit Web 31 janv 2022 nbsp 0183 32 The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the

Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under Web 17 mai 2021 nbsp 0183 32 Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above The American

Download Irs Child Tax Credit Rebate

More picture related to Irs Child Tax Credit Rebate

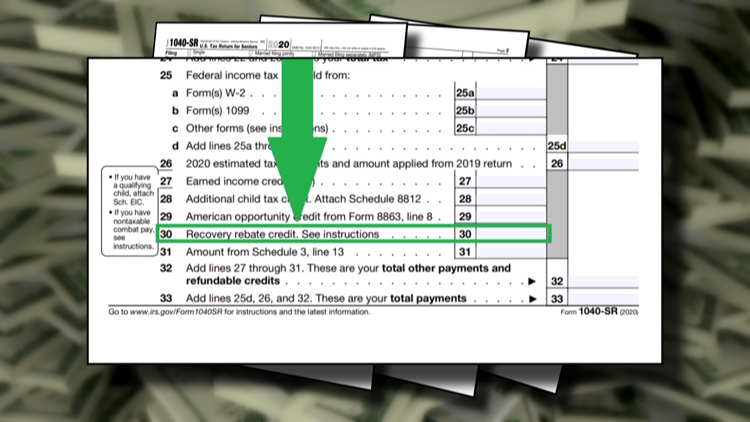

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Irs Child Tax Credit Form 2020 Trending US

https://data.templateroller.com/pdf_docs_html/2117/21172/2117245/irs-form-1040-schedule-8812-additional-child-tax-credit_print_big.png

Web IRS revises the 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions FS 2022 32 July 2022 Note These FAQs supersede earlier FAQs that Web 13 ao 251 t 2021 nbsp 0183 32 IR 2021 169 August 13 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now

Web 13 ao 251 t 2021 nbsp 0183 32 The first 1 600 of the CTC per qualifying child under age 6 and the first 1 000 per qualifying child age 6 through 17 phase out sequentially at a rate of 50 per Web 20 d 233 c 2022 nbsp 0183 32 Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how eligible

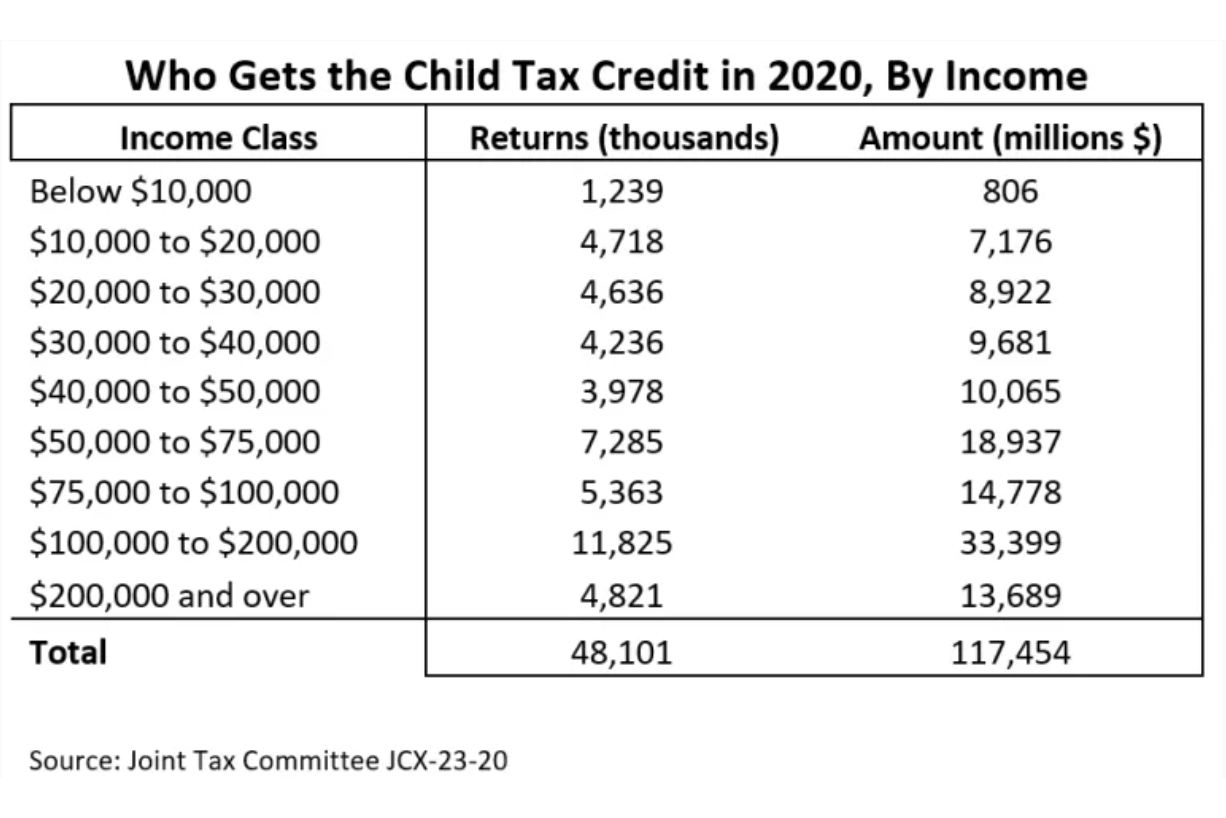

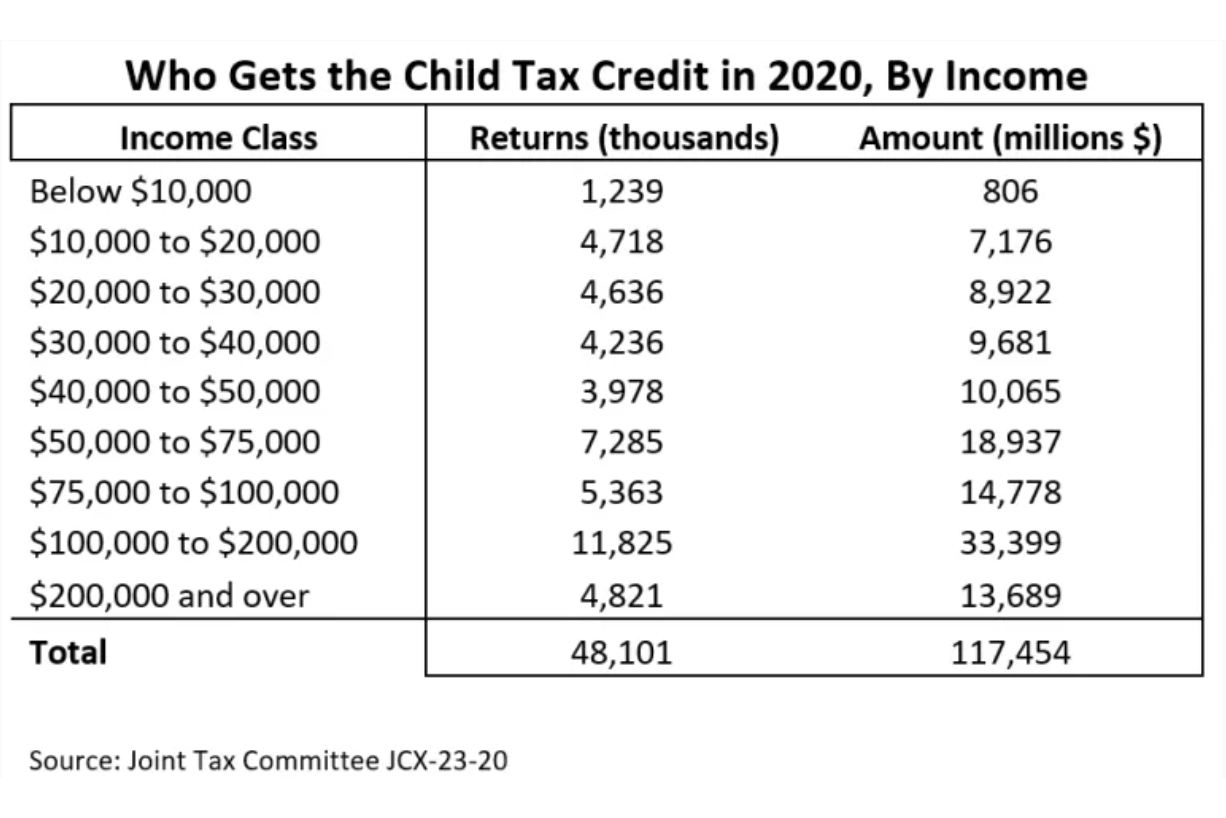

Child Tax Credit 2021 Income Limit Irs Tas Tax Tips Early Information

https://indianapublicmedia.org/images/news-images/child-tax-credit.jpg

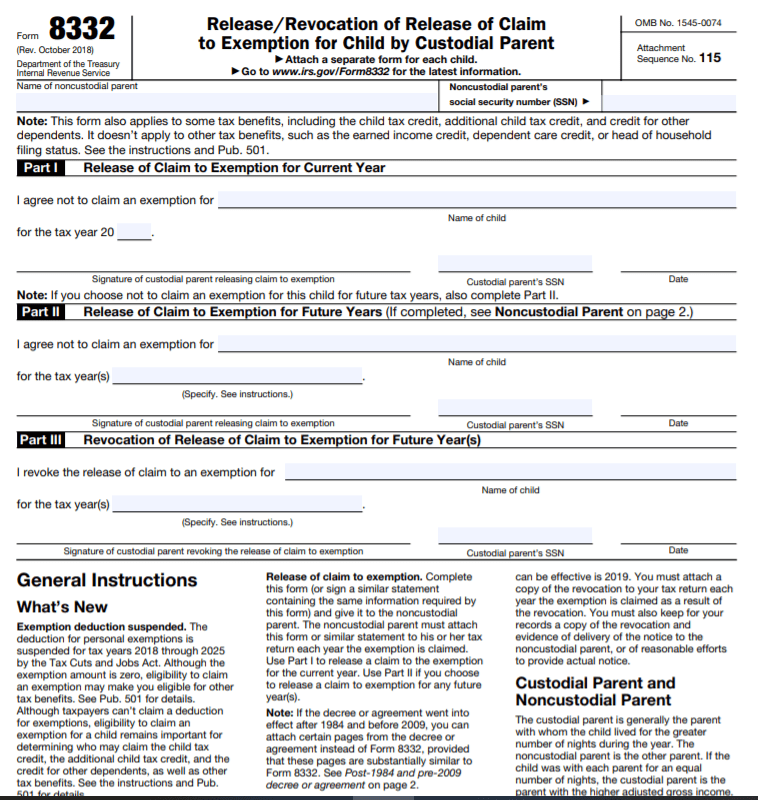

IRS Form 8332 How Can I Claim A Child The Handy Tax Guy

https://www.handytaxguy.com/wp-content/uploads/2020/07/IRS-Form-8332.png

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than

The Best 12 Child Tax Credits Irs Panditchpics

Child Tax Credit 2021 Income Limit Irs Tas Tax Tips Early Information

2021 Child Tax Credit What Should I Know Collins Consulting

Child Tax Credit 2020 Changes Bezyah

Form 8812 Additional Child Tax Credit

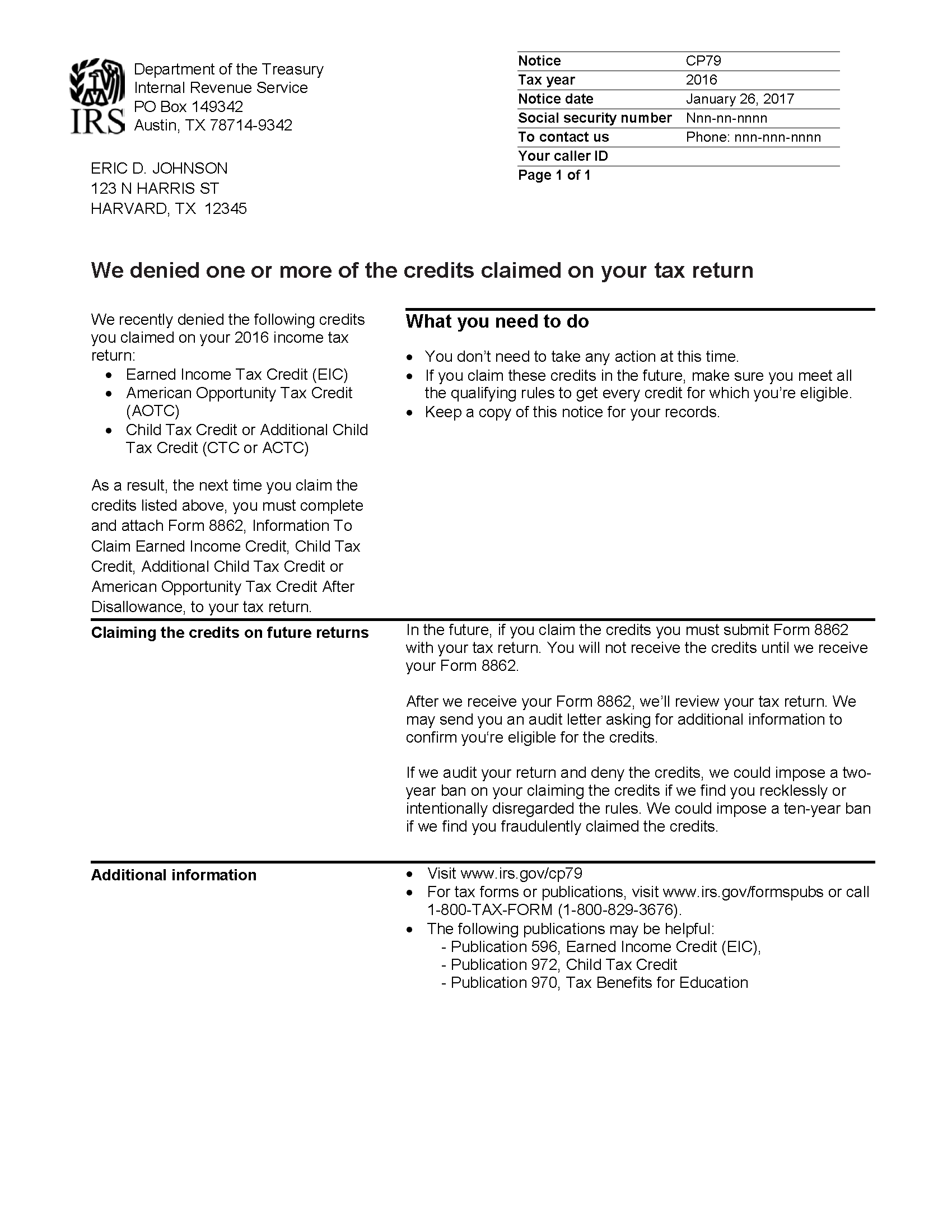

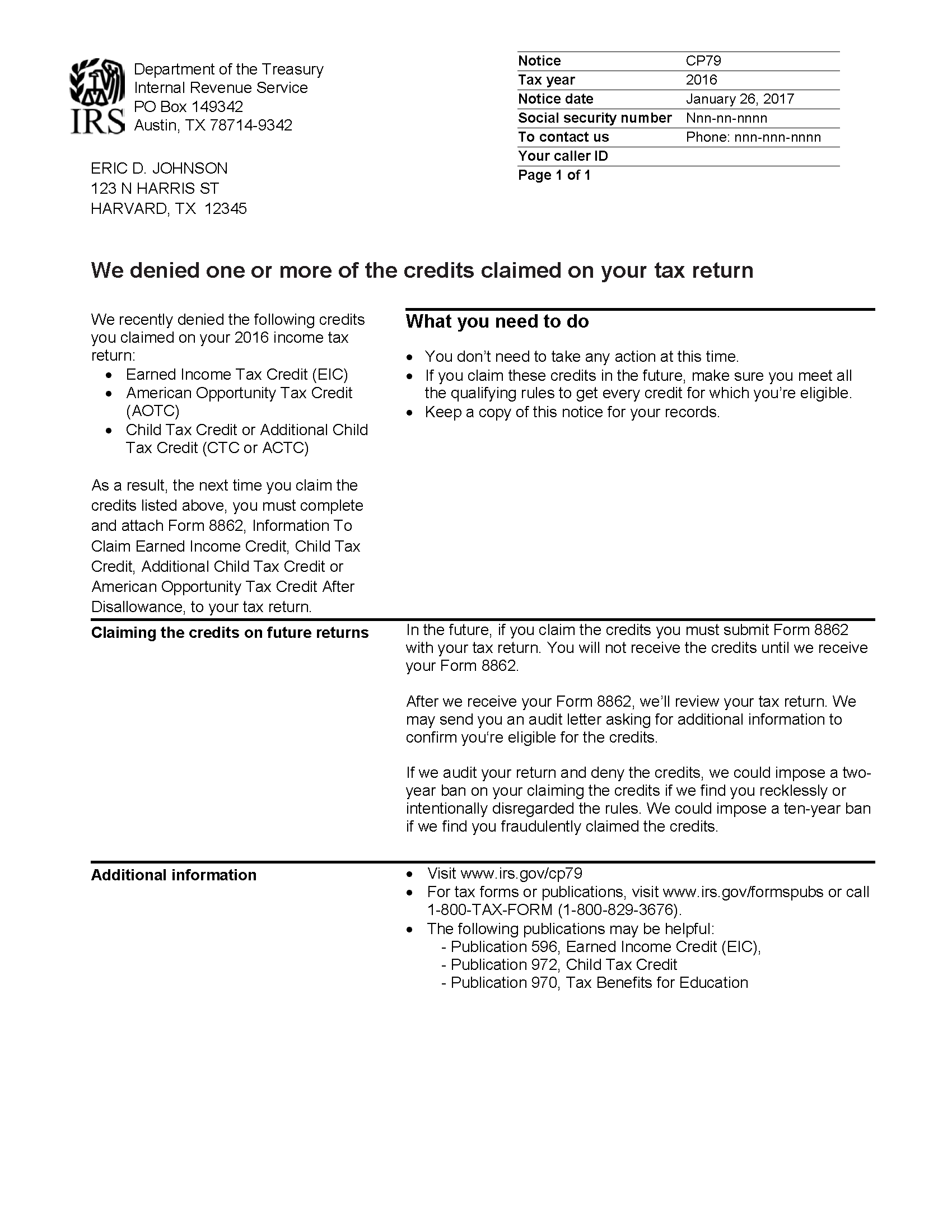

Irs Child Tax Credit Problems Alreda

Irs Child Tax Credit Problems Alreda

Worksheet 8812

Irs Child Tax Credit Child Tax Credit 2021 Jun 21 2021 Because

Irs Line 5 Worksheet

Irs Child Tax Credit Rebate - Web 15 nov 2022 nbsp 0183 32 The child tax credit included up to 3 600 for children under age 6 and 3 000 per child ages 6 through 17 Up to half of those amounts were paid in advance