File For Recovery Rebate Credit Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 A5 The only way to get a Recovery Rebate Credit is to file a 2021 tax return even if you are otherwise not required to file a tax return The fastest and most Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

File For Recovery Rebate Credit

File For Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

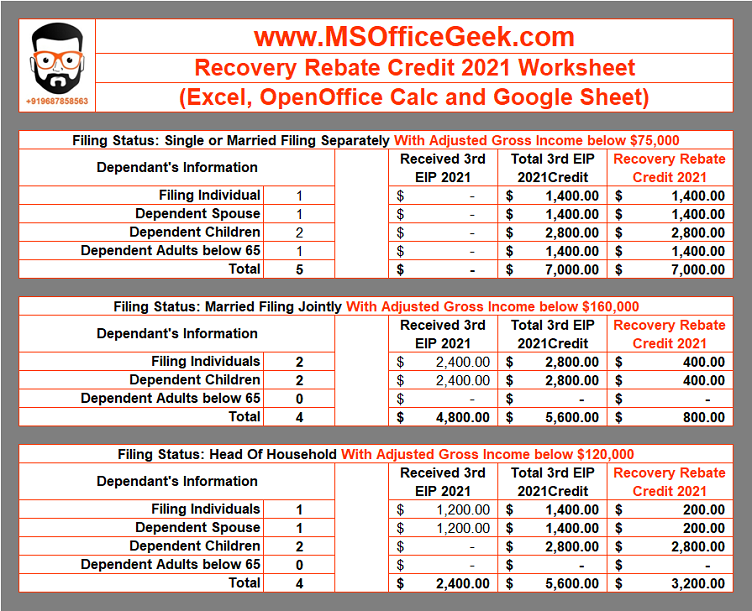

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Web 13 janv 2022 nbsp 0183 32 IRS Free File is a great option for people who are only filing a tax return even if you don t usually file taxes to claim the 2021 Recovery Rebate Credit Visit Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate

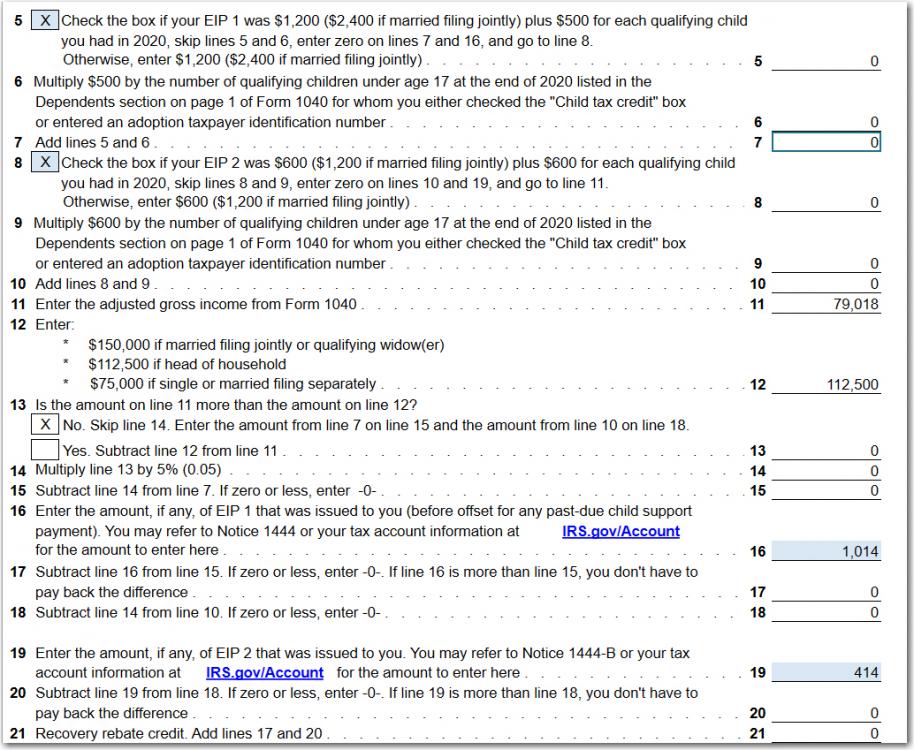

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early Web The Recovery Rebate Credit is figured like the EIPs except that the credit eligibility and the credit amount are based on the IRS s most recent information for you on file

Download File For Recovery Rebate Credit

More picture related to File For Recovery Rebate Credit

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Recovery Rebate Credit How Does It Work Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

The Recovery Rebate Credit Calculator MollieAilie

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 10 d 233 c 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040 SR

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim Web 17 ao 251 t 2022 nbsp 0183 32 The CARES Act provided economic relief payments known as Economic Impact Payments or stimulus payments valued at 1 200 per eligible adult based on

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-791x1024.png

Recovery Rebate Credit Taking Forever Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-credit-printable-rebate-form-4.png?w=670&h=627&ssl=1

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 A5 The only way to get a Recovery Rebate Credit is to file a 2021 tax return even if you are otherwise not required to file a tax return The fastest and most

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

What Is The Recovery Rebate Credit CD Tax Financial

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Recovery Rebate Credit Calculator EireneIgnacy

Recovery Rebate Credit Calculator EireneIgnacy

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

File For Recovery Rebate Credit - Web The Recovery Rebate Credit is figured like the EIPs except that the credit eligibility and the credit amount are based on the IRS s most recent information for you on file