Interest On Refund Of Income Tax Is Taxable Or Not However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your income tax refund is eligible for interest

Yes interest received on income tax refund is taxable in the hands of the assessee Taxability of Interest on Income Tax Refund Interest on an income tax refund is paid by the Income Tax Department to the taxpayer Such interest on the

Interest On Refund Of Income Tax Is Taxable Or Not

Interest On Refund Of Income Tax Is Taxable Or Not

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Unless there is an exact indication in the Income Tax Act itself that interest payable on income tax refund amounts fulfill the basic character as income defined Most interest that you receive or that is credited to an account that you can withdraw from without penalty is taxable income in the year it becomes available to you

The average tax refund as of July 24 was 2 741 identical to the previous period in 2019 The IRS quarterly interest rate for refunds was 5 percent in the three Taxability of Interest on Income Tax Refund Question Whether the Interest on Income Tax Refund is chargeable to tax if yes under which head The amount

Download Interest On Refund Of Income Tax Is Taxable Or Not

More picture related to Interest On Refund Of Income Tax Is Taxable Or Not

Your Tax Refund Is The Key To Homeownership

https://files.mykcm.com/2019/03/25075643/20190325-MEM-ENG.jpeg

Taxable Vs Nontaxable Income Dalby Wendland Co P C

https://dalbycpa.com/wp-content/uploads/2016/03/taxable_nontaxable_income.jpg

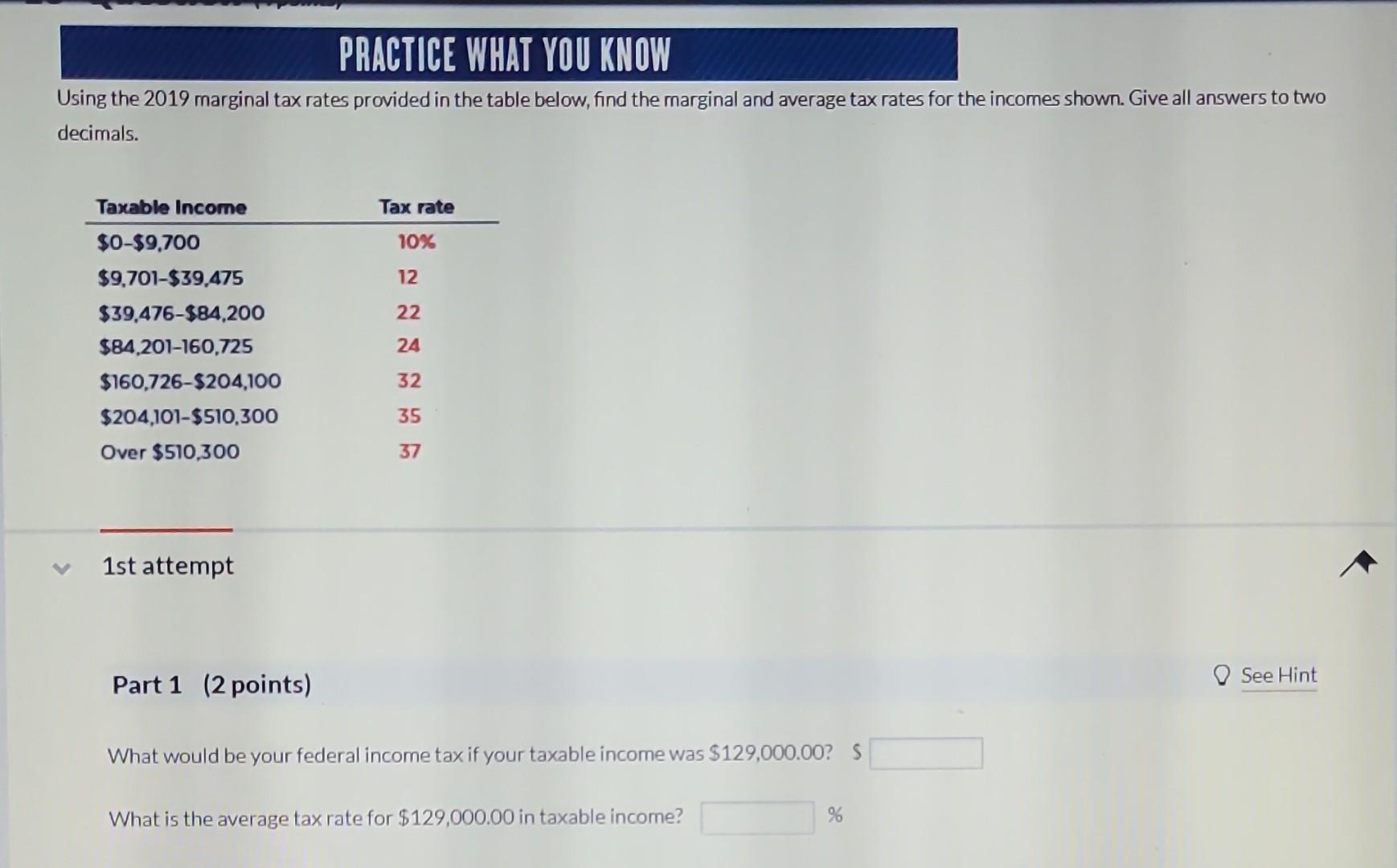

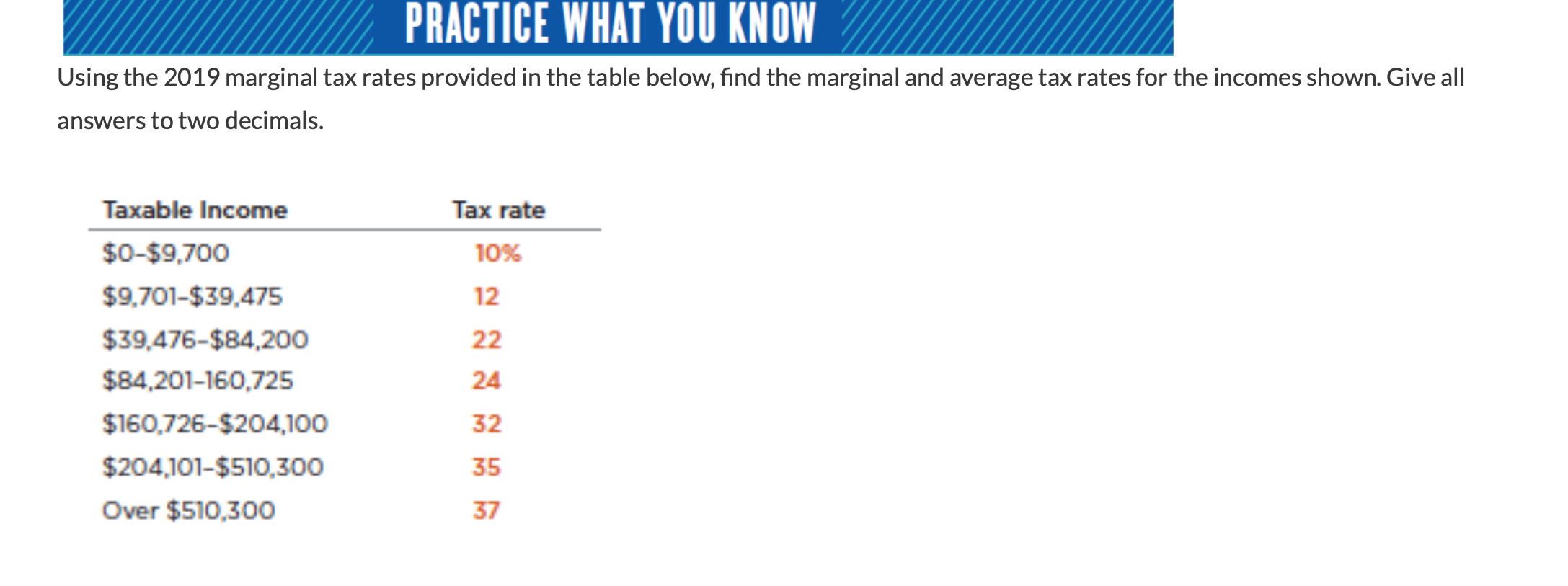

Solved Using The 2019 Marginal Tax Rates Provided In The Chegg

https://media.cheggcdn.com/study/5b4/5b4dbcf5-e834-4330-b487-1c17ab855fec/image.jpg

The IRS charges underpayment interest when you don t pay your tax penalties additions to tax or interest by the due date The underpayment interest 30th Jun 2009 17 56 No is is not taxable Repayment supplement on PAYE NIC income tax and VAT refunds is not taxable The interest rates are set relatively low as they are

All earned interest needs to be reported on your tax returns as income Most all earned interest is taxable at both the federal and state levels in the year that it is Income tax refund is a process by which the Income Tax Department returns any excess tax paid by a taxpayer during a particular financial year FY This

Tax Refund 2019 Unexpected IRS Bills Burden Some Americans Budgets

https://www.gannett-cdn.com/-mm-/814224c6a7b3be66af1a00052e0f155ef15b6f90/c=0-91-1156-741/local/-/media/2019/02/17/USATODAY/usatsports/tax-refund-gettyimages-144229768.jpg?width=3200&height=1680&fit=crop

12 Non Taxable Compensation Of Government Employees 12 Non taxable

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

https://www.idfcfirstbank.com/finfirst-blo…

However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your income tax refund is eligible for interest

https://taxguru.in/income-tax/interest-e…

Yes interest received on income tax refund is taxable in the hands of the assessee

Solved Please Note That This Is Based On Philippine Tax System Please

Tax Refund 2019 Unexpected IRS Bills Burden Some Americans Budgets

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

What Is Taxable Income Explanation Importance Calculation Bizness

Here s The Average IRS Tax Refund Amount By State GOBankingRates

How To Calculate Your Marginal Tax Rate Haiper

How To Calculate Your Marginal Tax Rate Haiper

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

How Federal Income Tax Rates Work Full Report Tax Policy Center

8 2023 Social Security Tax Limit Ideas 2023 GDS

Interest On Refund Of Income Tax Is Taxable Or Not - Your refund isn t taxable if you took the standard deduction The State and Local Tax SALT Deduction You might also be safe from claiming your state tax refund