Investment Rebate On Income Tax Web 15 juil 2020 nbsp 0183 32 The tax rate on capital gains for most assets held for more than one year is 0 15 or 20 Capital gains taxes on most assets held for less than a year

Web 16 avr 2014 nbsp 0183 32 HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms The guidance Web 14 juin 2022 nbsp 0183 32 Under the current provisions they are allowed to invest 25 or Tk1 50 000 on which they will get a rebate of 15 As such the amount of their rebate or tax credit will

Investment Rebate On Income Tax

Investment Rebate On Income Tax

https://i1.wp.com/myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-1-rev.jpg?resize=321%2C543&ssl=1

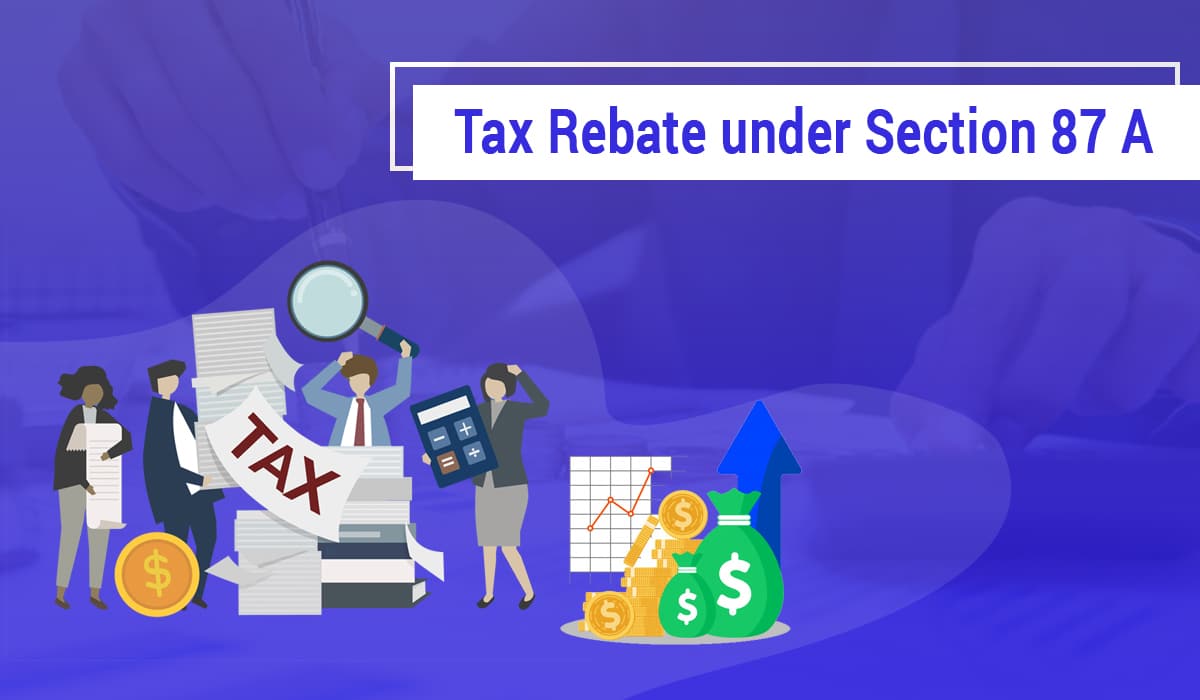

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A.jpg?ssl=1

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

https://vakilsearch.com/advice/wp-content/uploads/2019/07/Income-tax-rebate-under-Section-87A.jpg

Web 27 avr 2023 nbsp 0183 32 Individuals can claim up to Rs 1 5 lakh spent on such investments as tax waivers on total annual income under Section 80C of the Income Tax Act Tax Web 10 oct 2021 nbsp 0183 32 If your annual income is less than Tk15 lakh you will get 15 tax exemption of total investment and donation Tax exemption at the rate of 10 will be available if it

Web 5 Tax Rebate for investment Section 44 2 only allowable for Resident Non Resident Bangladeshi a Rate of Rebate Amount of allowable investment is actual Web 30 ao 251 t 2023 nbsp 0183 32 Maximum Exemption Limit in Salary Income Investment Rebate Calculation and Exemption of interest income on PF according to Income Tax Act 2023

Download Investment Rebate On Income Tax

More picture related to Investment Rebate On Income Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Where To Invest For Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Invest-for-Tax-Rebate.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web 11 juin 2022 nbsp 0183 32 Taxpayers having up to Tk15 lakh in annual taxable income are enjoying 15 rebate on their investments up to 25 of their annual taxable income while the rebate Web 11 juin 2021 nbsp 0183 32 The maximum ceiling on investment to claim a tax rebate was Tk 1 5 crore or 25 per cent of taxable income in the outgoing fiscal year The reduction is going to

Web 4 f 233 vr 2023 nbsp 0183 32 However currently according to the income tax rules 20 of total income is allowed to be invested in getting tax rebate benefits That means you can invest 20 Web Investors in government securities may experience a reduction in their investment rebate on tax filings starting from July 1 2023 According to the new Income Tax Bill 2023

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

https://www.nerdwallet.com/article/taxes/investment-taxes-basics-invest…

Web 15 juil 2020 nbsp 0183 32 The tax rate on capital gains for most assets held for more than one year is 0 15 or 20 Capital gains taxes on most assets held for less than a year

https://citywire.com/new-model-adviser/news/hmrc-issues-fresh-guidance...

Web 16 avr 2014 nbsp 0183 32 HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms The guidance

Section 87A Tax Rebate For Income Tax Payers In Budget 2019

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Tax Rebate Under Section 87A Investor Guruji Tax Planning

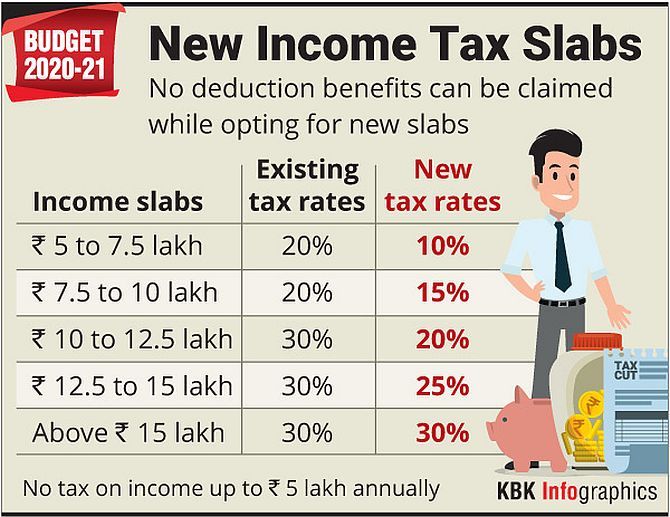

Income Tax Rates Cut Only If You Give Up Exemptions Rediff Business

Income Tax Rebate Under Income Tax Section 87 A For F Year 2017 18 AY 2

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Investment Rebate On Income Tax - Web 5 Tax Rebate for investment Section 44 2 only allowable for Resident Non Resident Bangladeshi a Rate of Rebate Amount of allowable investment is actual