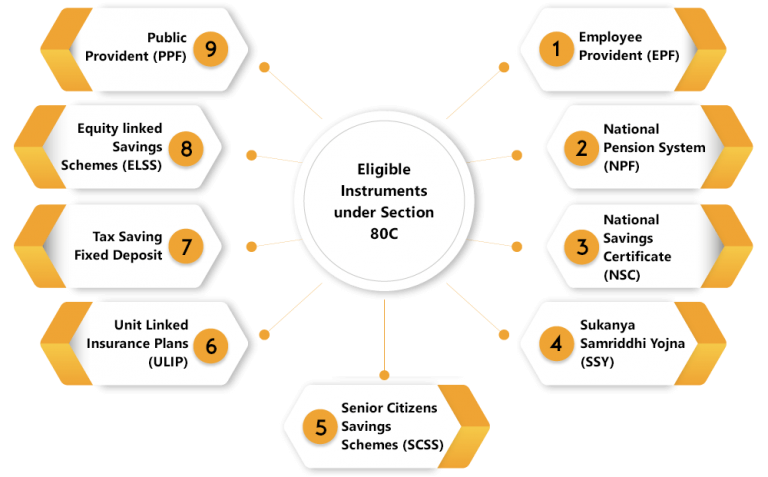

Investment Eligible For 80c Deduction Section 80C is one of the most popular and favorite sections amongst taxpayers as it allows them to reduce taxable income by making tax saving investments or incurring eligible expenses Who can claim Section 80C deduction Section 80C deduction can be claimed by Individuals and HUFs Maximum deduction allowed under section

Investors can invest up to 1 50 000 in an ELSS fund and deduct the investment from their taxable income under section 80C of Income Tax Act thereby effectively reducing their tax liability Long term capital gains and dividends received on these investments are tax free in the hands of the investor as per the current tax laws Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum deduction of up to Rs 1 5 lakh every year from an individual s total taxable income

Investment Eligible For 80c Deduction

Investment Eligible For 80c Deduction

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

All Deductions In Section 80C Chapter VI A FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/All-Deductions-in-Section-80C-80CCC-80CCD-80D-in-Hindi-Chapter-VI-A-1.webp

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

For deduction under section 80C you can invest in units of UTI or mutual funds specified u s 10 23D of Income Tax India 1961 Amount of Investment You can start investing from Rs 500 without an upper limit Investments Eligible Under 80C Numerous investment options qualify for deductions under section 80C These investments under 80C offer a variety of returns and have different lock in periods

Here is the list of investment options eligible for claiming deduction under section 80C only if opted for the Old Tax Regime 1 Contribution to ELSS Investment in Equity Linked Saving Scheme or a tax saving mutual fund attracts a Investment Eligible For Deduction Under Section 80 C The popular investments or expenses which are eligible for deduction u s 80C of the Act are discussed below 1 Recognized Provident Fund

Download Investment Eligible For 80c Deduction

More picture related to Investment Eligible For 80c Deduction

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C.jpg

Section 80C Deduction Income Tax IndiaFilings

https://www.indiafilings.com/images/Investments-Eligible-for-Section-80C.png

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident Fund EPF National Savings Certificate NSC Tax Saving Fixed Deposits children s tuition fees etc

The maximum deduction under Section 80C is capped at INR 1 50 000 which also includes contributions under Sections 80CCC and 80CCD 1 However deductions under Section 80CCD 1B and 80CCD 2 for contributions to the National Pension Scheme NPS can be claimed over and above the INR 1 5 lakh limit This The amount subscribed to NSC is eligible for 80C deduction The interest that accrued yearly ending 1st to 5th year though taxable is eligible for deduction in the year accrued being reinvested for 5 consecutive years and 6 year interest is taxable and no deduction whatsoever is available

Deduction Of 80C 80CCC 80CCD Under Income Tax

https://corpbiz.io/learning/wp-content/uploads/2020/06/Eligible-Instruments-under-Section-80C-1-768x477.png

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

https://cleartax.in/s/80c-80-deductions

Section 80C is one of the most popular and favorite sections amongst taxpayers as it allows them to reduce taxable income by making tax saving investments or incurring eligible expenses Who can claim Section 80C deduction Section 80C deduction can be claimed by Individuals and HUFs Maximum deduction allowed under section

https://taxguru.in/income-tax/investment-covered...

Investors can invest up to 1 50 000 in an ELSS fund and deduct the investment from their taxable income under section 80C of Income Tax Act thereby effectively reducing their tax liability Long term capital gains and dividends received on these investments are tax free in the hands of the investor as per the current tax laws

Top 5 Tax Benefits In Real Estate Investing In 2023 Investing Real

Deduction Of 80C 80CCC 80CCD Under Income Tax

Section 80C Deduction For Tax Saving Investments Learn By Quicko

Section 80C Deduction 9 Types Of Tax Saving Investments

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Investment Options To Avail Tax Deduction Under Section 80C

Investment Options To Avail Tax Deduction Under Section 80C

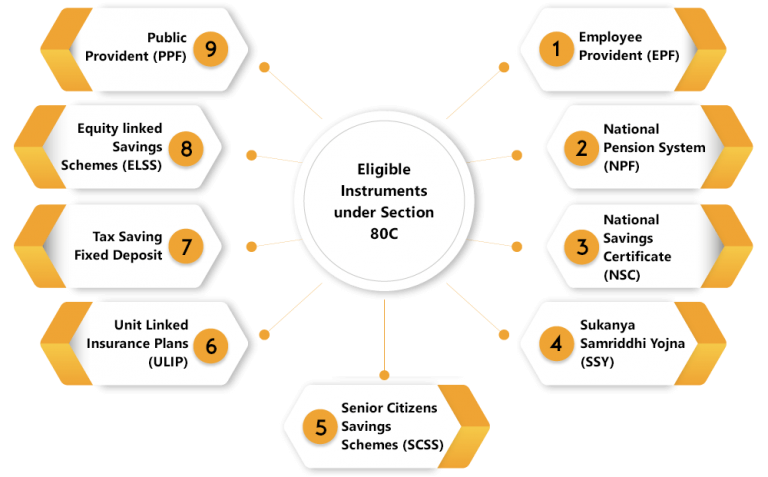

Brazil s Surprising Fintech Tailwind Andreessen Horowitz

Investment22

Section 80C Deduction Income Tax IndiaFilings

Investment Eligible For 80c Deduction - Investments Eligible Under 80C Numerous investment options qualify for deductions under section 80C These investments under 80C offer a variety of returns and have different lock in periods