What Is Investment Under 80c Web 8 Jan 2018 nbsp 0183 32 This article is about the Investment products and expenses that come under section 80C of income tax act Deduction under section 80C is available to all taxpayers Be it salaried business person or Retired huf all can make investments in the specified list of products and claim deduction under section 80C

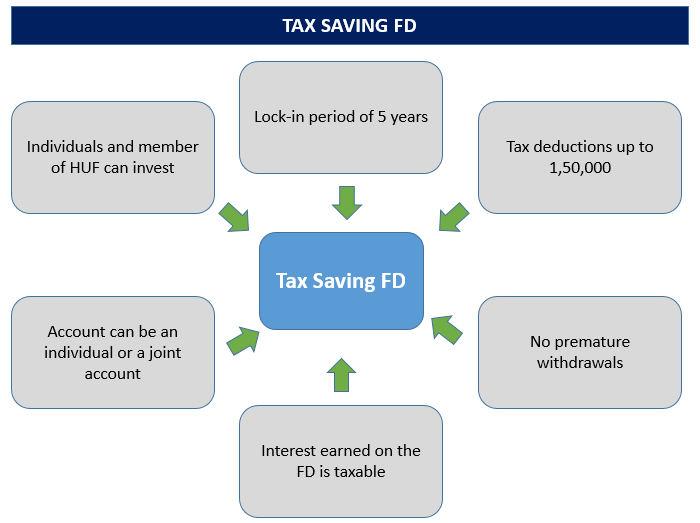

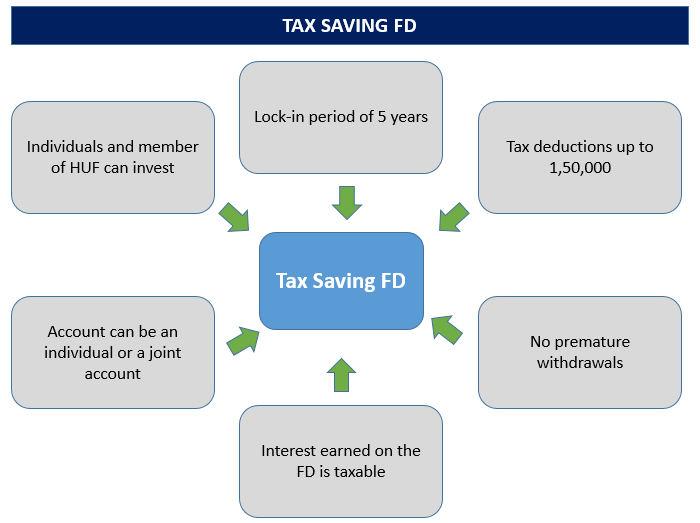

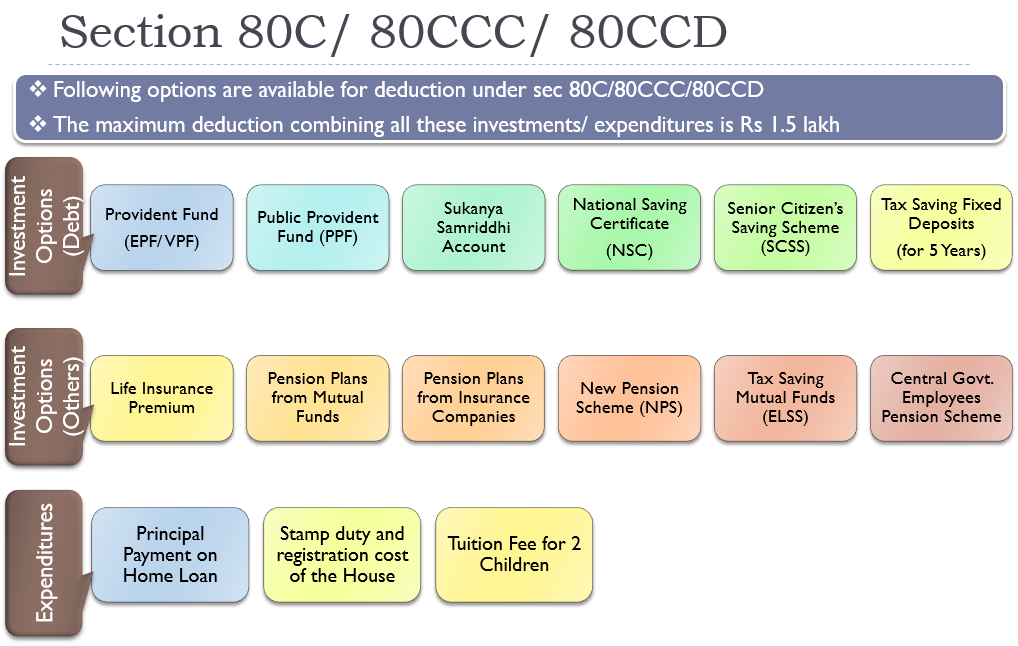

Web Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident Fund EPF National Savings Certificate NSC Tax Saving Fixed Deposits children s tuition fees etc Web A Deduction from the total taxable income is allowed for investments in certain specified instruments and this deduction can be claimed under Section 80C The maximum deduction which can be claimed under Section 80C is Rs 1 50 000

What Is Investment Under 80c

What Is Investment Under 80c

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Section 80C Everything To Know Deduction Under 80C Tax Saving

https://i.ytimg.com/vi/L1AUhzT9w0Y/maxresdefault.jpg

Web 28 Dez 2023 nbsp 0183 32 Section 80C is an income tax deduction that helps you reduce your taxable income and thus helps in reducing the tax outgo It covers specified investment and payment options that can reduce your taxable income by an amount of up to Rs 1 5 lakhs Web Vor 2 Tagen nbsp 0183 32 It is to be noted that deductions under Chapter VI A deduction Section 80C 80D 80E and so on are not available for taxpayers who opt for the New Tax regime However salaried individuals can

Web Deductions under Section 80C of the Income Tax Act of India are further categorized into sub sections which include Section 80C This covers investments in Provident Funds like EPF PPF payment of life insurance premiums Equity Linked Saving Schemes payment of home loan principal SSY NSC SCSS among others Web 11 Aug 2021 nbsp 0183 32 Eligible investments under section 80C Section 80C investments not only provide tax exemption but also offer returns that help in building wealth Some of the eligible financial products under this section are as follows Life insurance premiums Annual premium paid towards life insurance plans for you your spouse and your children is an

Download What Is Investment Under 80c

More picture related to What Is Investment Under 80c

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/TAXABILITY-OF-VARIOUS-INVESTMENTS-UNDER-SECTION-80C-1.png

Deductions U S 80C Under Schedule VI Of Income Tax India Financial

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Web Some of the investments covered under section 80C are Exempt Exempt Exempt EEE meaning that the investment withdrawal and returns offer tax benefits Some examples of these investments are PPF and EPF For others like a Web The Public Provident Fund PPF is a government backed long term savings scheme offering tax benefits under Section 80C It allows contributions up to 1 5 lakh annually making the invested

Web Section 80 C Best Tax Saving Investment option under Sec 80C Invest in ELSS and save upto Rs 46 800 in taxes Lowest locking period of 3 years Delivered historically higher returns than FD PPF or NPS Interest earned is partially taxable Web 80C Investment for Senior Citizen 80C Investment Options for Hindu Undivided Family Eligible Payments 80C Investment Proof FAQs The Guide to Section 80C of Income Tax If you have an income you are required to pay income tax on it to the government But there are various ways in which you can reduce your tax liability

Deductions Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

https://www.goodmoneying.com/deduction-under-section-80c

Web 8 Jan 2018 nbsp 0183 32 This article is about the Investment products and expenses that come under section 80C of income tax act Deduction under section 80C is available to all taxpayers Be it salaried business person or Retired huf all can make investments in the specified list of products and claim deduction under section 80C

https://www.etmoney.com/blog/guide-to-section-80c-deduction

Web Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident Fund EPF National Savings Certificate NSC Tax Saving Fixed Deposits children s tuition fees etc

What Is An ELSS Fund Best Investment Under Section 80C

Deductions Under Section 80C Its Allied Sections

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

List Of Deductions Under Section 80C Bajaj Markets

List Of Deductions Under Section 80C Bajaj Markets

Section 80C Deduction For Tax Saving Investments Learn By Quicko

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Tax Saving Investment Options Under Section 80C Tax Saving Other Than 80c

What Is Investment Under 80c - Web 11 Aug 2021 nbsp 0183 32 Eligible investments under section 80C Section 80C investments not only provide tax exemption but also offer returns that help in building wealth Some of the eligible financial products under this section are as follows Life insurance premiums Annual premium paid towards life insurance plans for you your spouse and your children is an