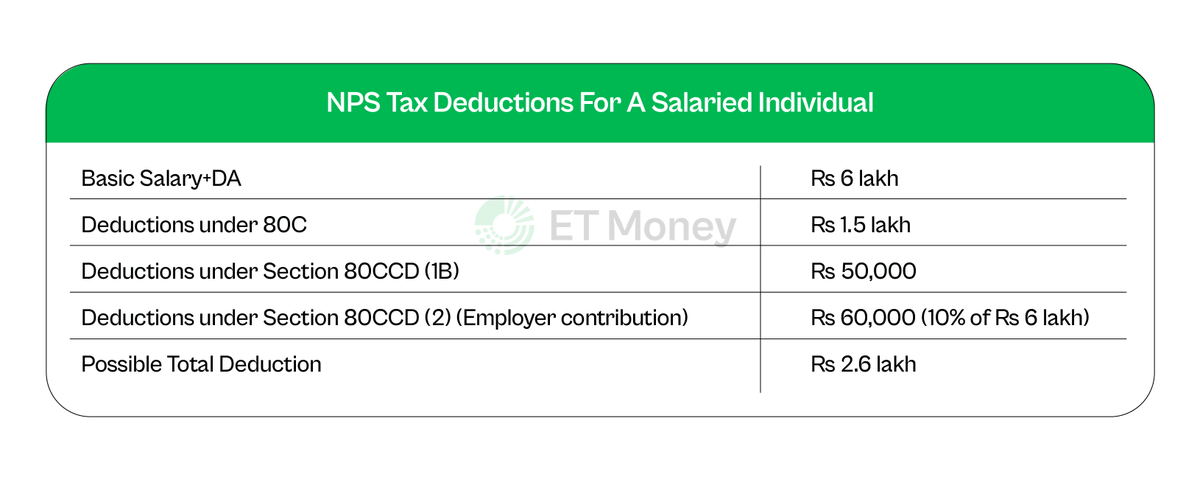

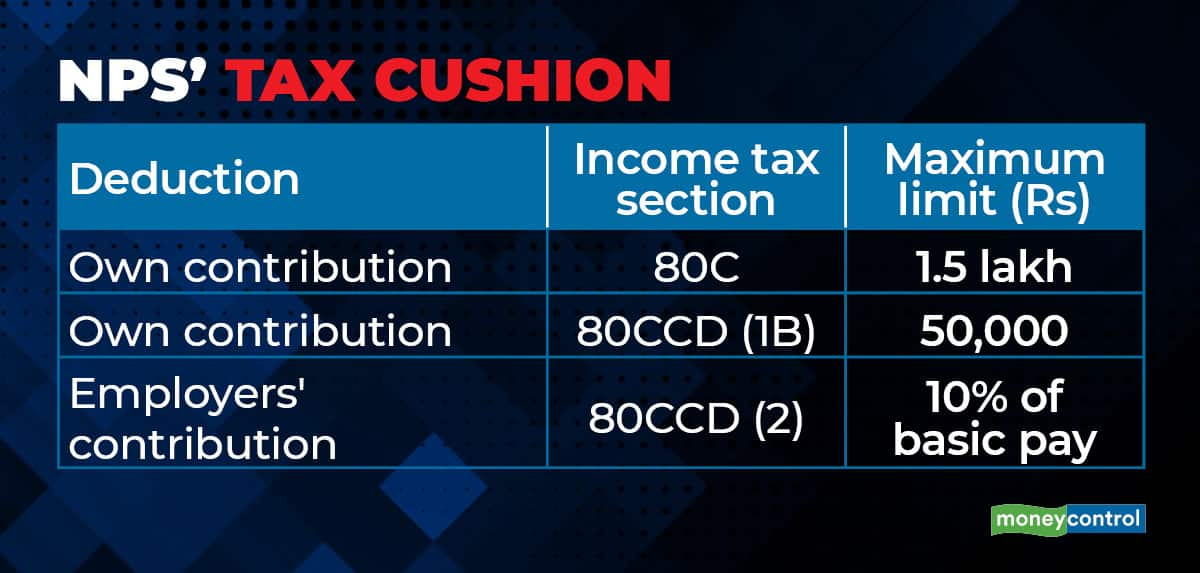

What Investment Comes Under 80ccd 1b However you may claim an additional deduction of Rs 50 000 allowed u s 80CCD 1B for contributions made to NPS National Pension Scheme Thus the maximum deduction limit is Rs 2 lakhs under Section 80C 80CCC 80CCD

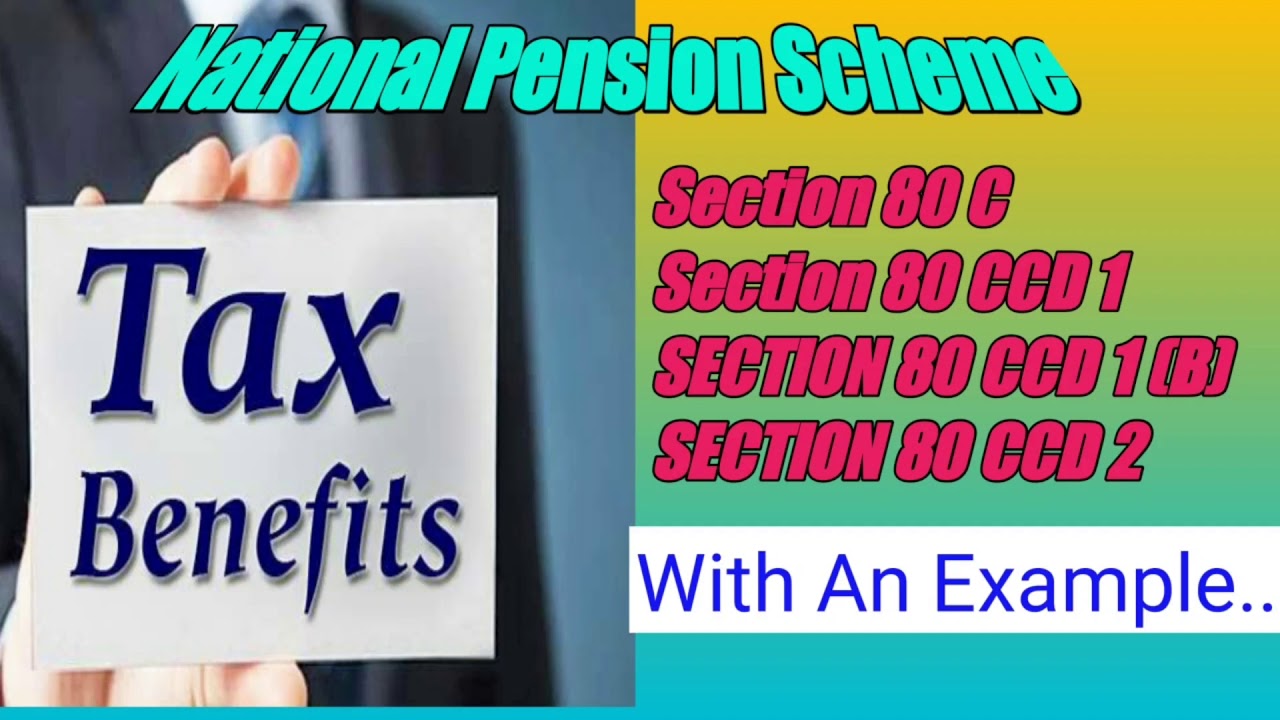

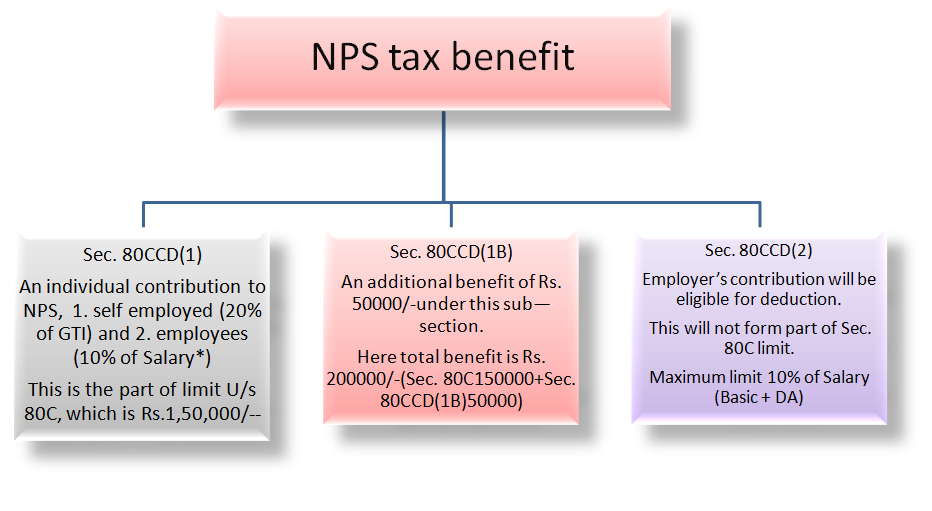

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS over and above the deductions available under Section 80CCD 1 provided if they opt for the old tax regime Section 80 CCD of the Income Tax Act provides deductions to individuals on the NPS contributions made by them and their employer if applicable Section 80 CCD 1 provides a maximum deduction of Rs 1 50

What Investment Comes Under 80ccd 1b

What Investment Comes Under 80ccd 1b

https://www.basunivesh.com/wp-content/uploads/2018/12/NPS-Tax-Benefits-2019-Sec.80CCD1-80CCD2-and-80CCD1B.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/11/Section-80GGC.jpg

Here s a brief overview of some key deductions available under Chapter VI A Section 80C Investments Individuals and Hindu Undivided Families HUFs can claim deductions for various investments and expenses Eligible One of the ways in which tax exemption on additional Rs 50000 income can be claimed under Section 80CCD 1B is by investment in NPS NPS or National Pension Scheme is a government backed annuity instrument

An individual who has made investments under specific instruments under 80C up to the maximum limit of 1 50 Lakhs can make an investment under NPS to claim an additional Section 80CCD 1B allows an extra deduction of up to 50 000 for contributions made to the National Pension System NPS NPS offers both tax savings and a steady retirement income It includes two account types

Download What Investment Comes Under 80ccd 1b

More picture related to What Investment Comes Under 80ccd 1b

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

https://pbs.twimg.com/media/FcI0Ex5aAAIs5Uy.png

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

https://i.ytimg.com/vi/PbIdrmlETqQ/maxresdefault.jpg

IT 80CCD 1B CPS

https://2.bp.blogspot.com/-T01obM7mFng/WJ-8zalbmaI/AAAAAAAAB6A/rV7GGIiPsoclni_phRUdkgpKpAKA7wLAgCLcB/s1600/IMG-20170212-WA0010.jpg

Section 80CCD 1B of the Income Tax Act provides an additional tax benefit for contributions to the National Pension System NPS Under this section an individual can claim a deduction of up to 50 000 from their Under Section 80C there are various investments and expenses that are eligible for deduction Let s take a closer look at each of these options Investment in Equity Linked Saving Schemes ELSS ELSS funds offer potential returns

Section 80 CCD 1B The 80CCD1B limit is Rs 50 000 This is an additional benefit The total tax benefit that you can claim from your contributions to pension fund schemes is Rs 2 lakh Rs The maximum deduction allowed under Section 80CCD is 2 00 000 You can claim up to 150 000 under Section 80CCD 1 and an additional 50 000 under Section

How To Claim Section 80CCD 1B TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/How-to-claim-Section-80CCD1B-600x750.jpeg

How To Claim Section 80CCD 1B TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/How-to-claim-Section-80CCD1B-National-Pension-Scheme.png

https://cleartax.in

However you may claim an additional deduction of Rs 50 000 allowed u s 80CCD 1B for contributions made to NPS National Pension Scheme Thus the maximum deduction limit is Rs 2 lakhs under Section 80C 80CCC 80CCD

https://cleartax.in

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS over and above the deductions available under Section 80CCD 1 provided if they opt for the old tax regime

What Are The Tax Benefits That NPS Offers

How To Claim Section 80CCD 1B TaxHelpdesk

Open ended Semi structure Interview Questions Download Scientific

Nps Tax Benefit U s 80ccd 1 80ccd 2 And 80ccd 1b Tax Benefits

NPS For NRI 2020 Indian National Pension Scheme SBNRI

Difference Between U s 80CCD 1 80CCD 1b 80CCD 2

Difference Between U s 80CCD 1 80CCD 1b 80CCD 2

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

Income Tax Information NPS Tax Benefit Sec 80CCD 1 80CCD 1B And

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

What Investment Comes Under 80ccd 1b - Section 80C of the Income Tax Act provides tax benefits to taxpayers for certain investments made during the year However section 80CCD 1B is an additional deduction