R D Tax Rebate Calculation Web 1 janv 2007 nbsp 0183 32 Research and Development R amp D tax relief supports companies that work on innovative projects in science and technology You may be able to claim Corporation

Web 1 juil 2022 nbsp 0183 32 Step 1 Identify your qualifying R amp D spend qualifying expenditure or QE The biggest part of an R amp D tax credit application is knowing which of your costs you can Web Our R amp D tax relief calculator helps you assess the indicative impact of changes to rates of relief introduced for expenditure from 1 April 2023 SME Fewer than 500 staff and either

R D Tax Rebate Calculation

R D Tax Rebate Calculation

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

10 Recovery Rebate Credit Worksheet

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Web 4 oct 2017 nbsp 0183 32 R amp D tax relief for small and medium sized enterprises SMEs SME R amp D tax relief allows companies to deduct an extra 86 of their qualifying costs in addition to the Web 1 ao 251 t 2023 nbsp 0183 32 operating costs equal to 75 of R amp D tax credit eligible depreciation and 43 of R amp D tax credit eligible researchers salaries 50 before FY20 and 100 of young

Web 23 d 233 c 2015 nbsp 0183 32 Calculate the enhanced expenditure Follow these steps to calculate the enhanced expenditure You can also find more information on how to convert tax relief Web Calculating the R amp D Tax Credit RandD Tax See how the R amp D tax credit calculation works with our handy guide At RandD Tax we will help you maximise your R amp D tax credit claim

Download R D Tax Rebate Calculation

More picture related to R D Tax Rebate Calculation

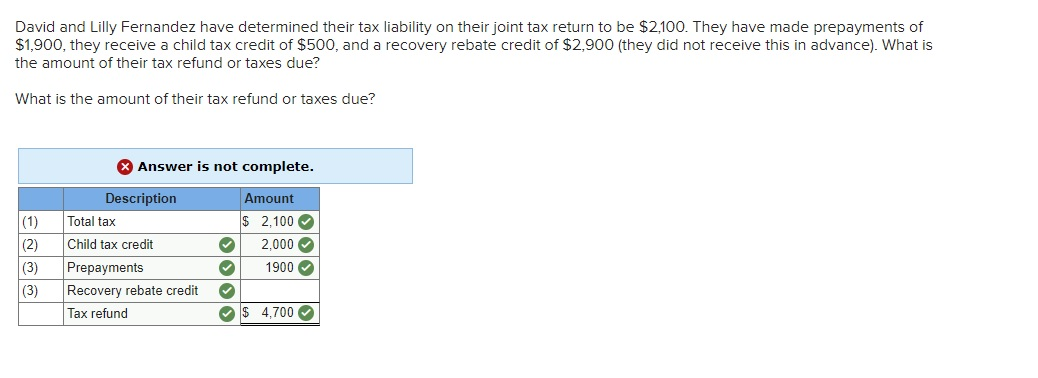

Solved No Idea How To Calculate Recovery Rebate Credit P Chegg

https://media.cheggcdn.com/media/073/0739c13b-61d5-43bf-a54e-96f389b6102a/phpgpDbyh.png

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

https://financialcontrol.in/wp-content/uploads/2018/06/How-to-calculate-rebate-us-87A.jpg

Web 1 janv 2007 nbsp 0183 32 The expenditure credit is calculated as a percentage of your qualifying R amp D expenditure the rates are 11 on expenditure incurred from 1 April 2015 up to and Web Calculate R amp D tax relief in under 3 minutes FREE to use Estimate R amp D tax relief for your business Supports Profit and Loss making companies Get a detailed R amp D calculations

Web 21 nov 2022 nbsp 0183 32 Details For expenditure on or after 1 April 2023 the Research and Development Expenditure Credit RDEC rate will increase from 13 to 20 the SME Web Research and development tax incentive calculator Use this calculator to help calculate your research and development R amp D tax incentive claim Before using this calculator

Tds Slab Rate For Ay 2019 20

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

National Budget Speech 2022 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/tax-rate-tables.png

https://www.gov.uk/.../corporation-tax-research-and-development-rd-relief

Web 1 janv 2007 nbsp 0183 32 Research and Development R amp D tax relief supports companies that work on innovative projects in science and technology You may be able to claim Corporation

https://kene.partners/insights/rd-tax-credit-calculation

Web 1 juil 2022 nbsp 0183 32 Step 1 Identify your qualifying R amp D spend qualifying expenditure or QE The biggest part of an R amp D tax credit application is knowing which of your costs you can

Bonus Tax Rate 2018 Museumruim1op10 nl

Tds Slab Rate For Ay 2019 20

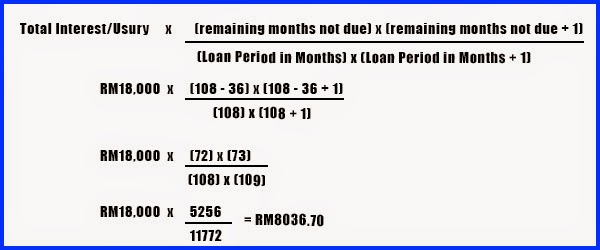

Debt Tales The Bank And You 2014

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

If The Income On The Return Is Over The Applicable Phase out

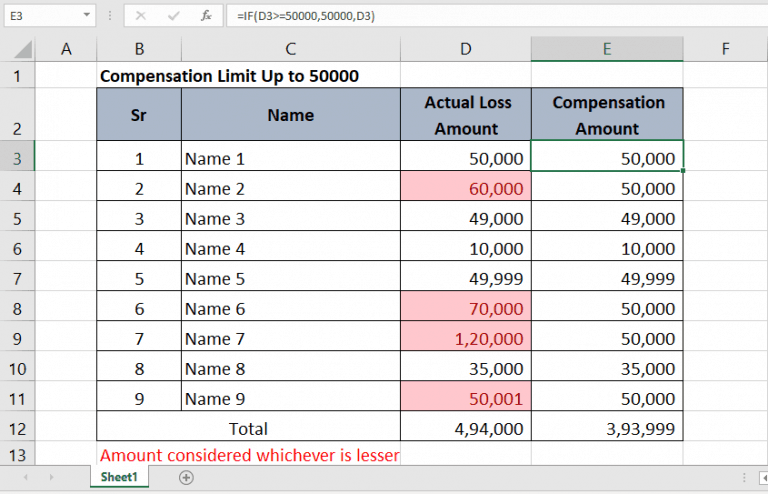

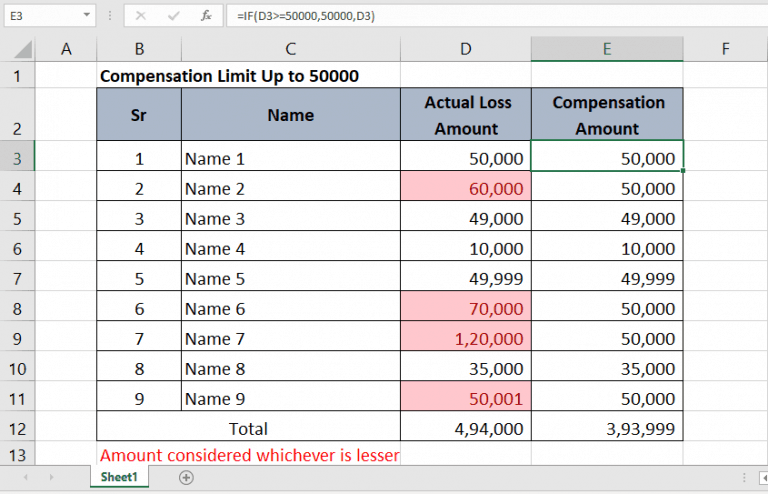

IF Formula In Excel Example For Value Base Calculation Tax Rebate

IF Formula In Excel Example For Value Base Calculation Tax Rebate

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Tax Returns Calculator

R D Tax Rebate Calculation - Web Step 2 50 of 48 333 is 24 167 Step 3 70 000 minus 24 167 is 45 833 Step 4 45 833 multiplied by 14 is 6 417 this is your R amp D tax credit amount Related How