Income Tax Rebate On 5 Year Fixed Deposit Web 29 juin 2022 nbsp 0183 32 Tax Benefit You can get a tax deduction under Section 80C of up to Rs 1 5 lakh when you make an investment on a tax saver FD scheme with a minimum lock

Web 8 sept 2023 nbsp 0183 32 Fixed Deposit Income Tax Deduction available under Section 80C The tax saving FD schemes have a lock in period of 5 years and the deposit amount of up to Web 14 avr 2017 nbsp 0183 32 Fixed Deposits FDs allow you to exploit the complete potential of Section 80C to deduct Rs 1 5 lakh from your taxable income It also ensures capital protection

Income Tax Rebate On 5 Year Fixed Deposit

Income Tax Rebate On 5 Year Fixed Deposit

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

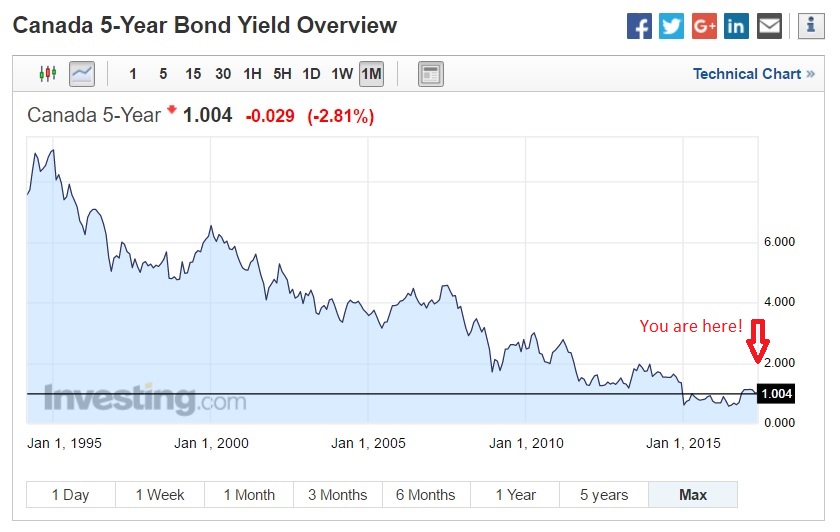

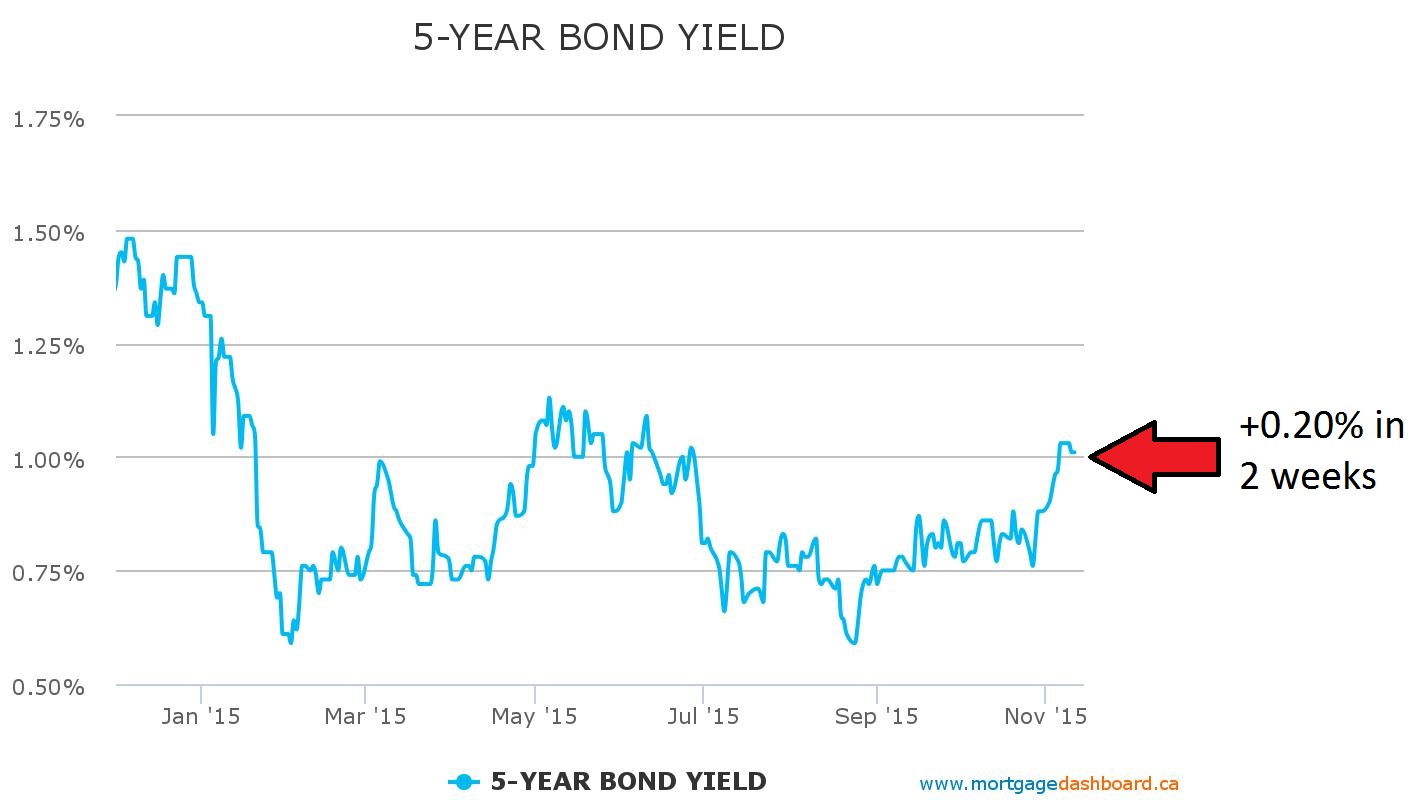

5 Year Fixed Rate Mortgage LowestRates ca

https://www.lowestrates.ca/resources/images/mortgage/graphs/help-centre/5-year-fixed-rate-vs-prime.png

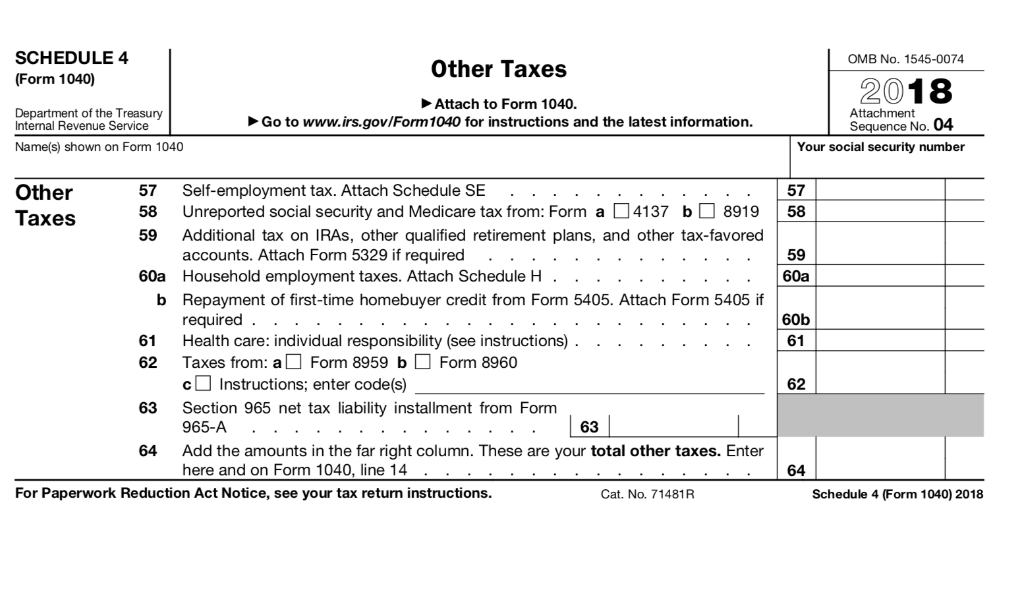

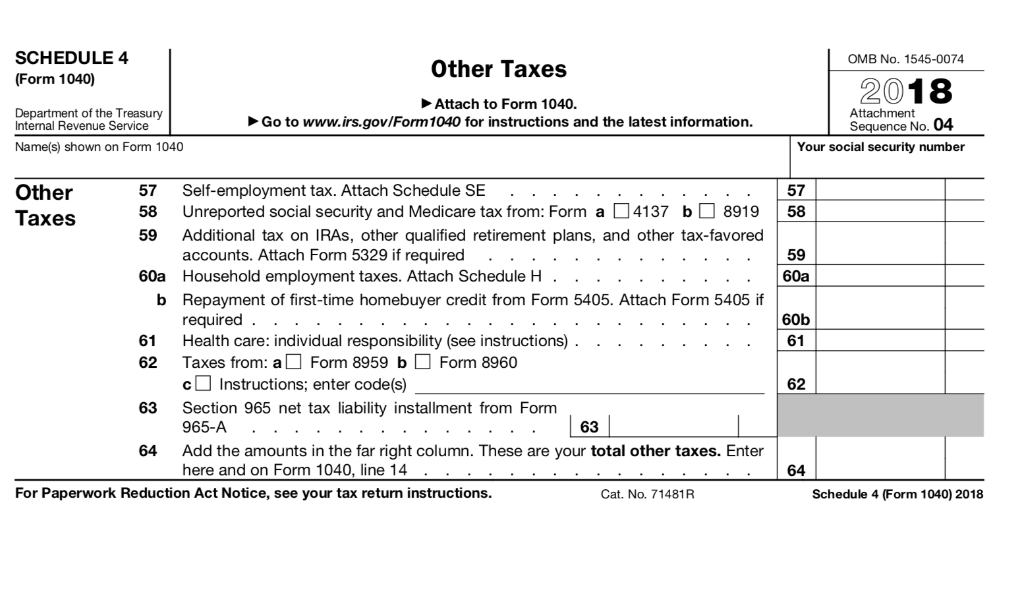

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Web 18 janv 2022 nbsp 0183 32 The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable To calculate income tax on Web 17 avr 2022 nbsp 0183 32 Tax saver FDR has a lock in period of 5 years How to save income tax on FDR You can open a fixed deposit in a Post Office rather than a bank to save TDS on

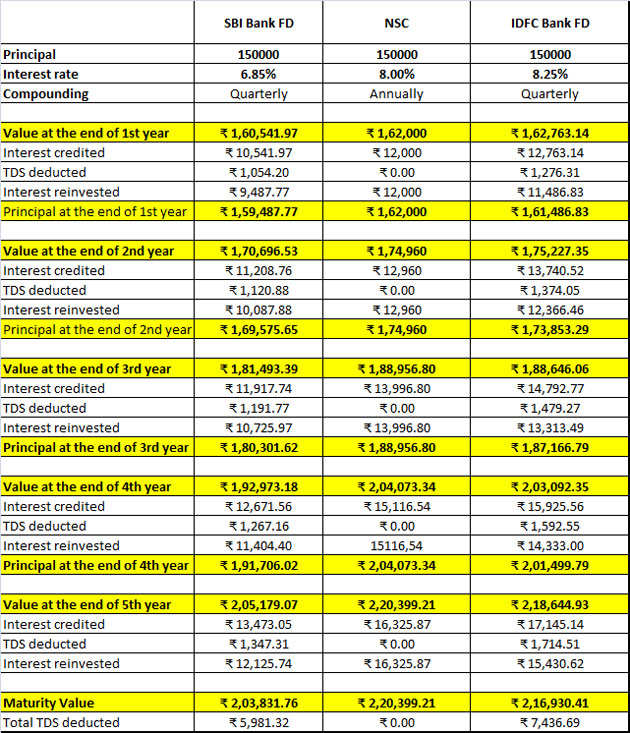

Web 19 d 233 c 2019 nbsp 0183 32 Although bank fixed deposits FDs with terms of 5 years or more also provide tax benefits u s 80C of the Income Tax Act but both NSC and 5 year POTD are Web 2 FD interest gained over Rs 5 lakh or 10 lakh is eligible for extra tax deductions of 10 and 20 respectively in addition to TDS as per the Income Tax Act 1961 3 For NRI citizens TDS on FD rate is 30

Download Income Tax Rebate On 5 Year Fixed Deposit

More picture related to Income Tax Rebate On 5 Year Fixed Deposit

5 year Tax Saver Fixed Deposit Latest Interest Rates Yadnya

https://i0.wp.com/blog.investyadnya.in/wp-content/uploads/2020/02/Savings-Account-Interest-Rate-of-Small-Finance-Banks-February-2020.png?resize=720%2C380&ssl=1

TAX FREE 5 YEAR FIXED DEPOSIT IN BANKS All Private Banks Fd Interest

https://i.ytimg.com/vi/-5f7zy-s9VY/maxresdefault.jpg

Top 18 5 Year Fixed Deposit Tax Free Calculator En Iyi 2022

https://img.etimg.com/photo/msid-66749547/nsc-vs-bankfd.jpg

Web 18 mars 2022 nbsp 0183 32 The amount invested up to Rs 1 50 000 per financial year in a 5 year tax saver FD qualifies for deduction from total gross income and thus reduces tax liability for Web 6 avr 2022 nbsp 0183 32 In other words only specific five year tax saving fixed deposits which do not allow premature closure are eligible for a deduction from taxable income under section

Web 4 juil 2023 nbsp 0183 32 You can claim income tax deduction under Section 80C of the Income Tax Act of India 1961 only on the deposit you have made in the 5 year fixed deposit account Web You can claim the tax benefits under Section 80C of maximum up to Rs 1 50 lakhs per annum Special features of 5 years tax saver fixed deposit Here are some of the special

All About 5 Year Fixed Deposit Rates In Sri Lanka YouTube

https://i.ytimg.com/vi/6ENGZOkfLtw/maxresdefault.jpg

5 Year Fixed Deposit Tax Free Calculator Tax Walls

https://lh4.googleusercontent.com/proxy/BGoorbiuUH8rQ1IVsu8iyT0O7eSDK6rjp1iMoFEkjm5OW4kgXIo_3pjH2T7ZYdM36kbZD5SXlnjDRG3ZtNBHvPzUYYs2CCaJYENb8OsCVJ21ceCe7zXQEFsDSUTOMmux2YCbeRkPL4e-NhBNqEOS4IOeAPc=w1200-h630-p-k-no-nu

https://cleartax.in/s/fixed-deposit

Web 29 juin 2022 nbsp 0183 32 Tax Benefit You can get a tax deduction under Section 80C of up to Rs 1 5 lakh when you make an investment on a tax saver FD scheme with a minimum lock

https://www.paisabazaar.com/fixed-deposit/tax-exemption-on-fixed-dep…

Web 8 sept 2023 nbsp 0183 32 Fixed Deposit Income Tax Deduction available under Section 80C The tax saving FD schemes have a lock in period of 5 years and the deposit amount of up to

Solved Janice Morgan Age 24 Is Single And Has No Chegg

All About 5 Year Fixed Deposit Rates In Sri Lanka YouTube

Best 5 Years Fixed Deposit Rate To Get Monthly Passive Income Latest

Fixed Mortgage Five Year Fixed Mortgage Rates

Best 5 Year Fixed Mortgage Rates In Canada 2021

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Fixed Mortgage Td 5 Year Fixed Mortgage Rate

A Free Tab For Five Years Fixed Deposits From Sampath Bank SynergyY

Highest fixed deposits interest rate for 1year and 5 year fixed deposit

Income Tax Rebate On 5 Year Fixed Deposit - Web 8 d 233 c 2022 nbsp 0183 32 Is a fixed deposit tax free No an income from a fixed deposit is not tax free The interest on FD is chargeable to income tax at the slab rates Moreover an