Is 5 Year Fixed Deposit Tax Free Check out the eligibility criteria for Five Year Tax Saving Fixed Deposit Deposits at HDFC Bank Know more about terms conditions charges other requirements

The National Savings Time Deposit Account popularly known as Post Office Fixed Deposit opened for 5 year tenure also qualifies for the same deduction However depositors should note that the interest income on FD is taxable and is taxed under Income from other sources in the IT return Tax Saver FD also known as 5 Year Tax Saving FD offers a convenient way to save more while securing your financial future with tax free returns It is ideal for investors seeking low risk returns and reduced tax liabilities You can start small with a

Is 5 Year Fixed Deposit Tax Free

Is 5 Year Fixed Deposit Tax Free

https://i.ytimg.com/vi/f-ea7XCUkUw/maxresdefault.jpg

NRI Fixed Deposit Tax Free Best Interest Rates Ask SBNRI Expert

https://i.ytimg.com/vi/chpCzZ70aDI/maxresdefault.jpg

Tax Saver FD 5 Year Fixed Deposit Tax Saving Scheme Income Tax Act

https://i.ytimg.com/vi/gH1zusmHV8A/maxresdefault.jpg

Fixed Deposits FDs under Section 80C can yield tax benefits but interest income is taxable TDS is deducted when interest exceeds Rs 40k or Rs 50k for senior citizens Reporting interest income is necessary to avoid higher tax slabs at maturity The amount invested up to Rs 1 50 000 per financial year in a 5 year tax saver FD qualifies for deduction from total gross income and thus reduces tax liability for that year The

Tax Deductible on Fixed Deposits Tax Saver Fixed Deposits yield higher interest rates than Savings Accounts and have a fixed tenure of five years Investors can claim deductions up to 1 50 000 annually under Section 80C of the Is a 5 year FD tax free for 5 years The 5 year locked tax free FD offers a tax deduction on investments deposited for up to a tax saving FD investment limit The minimum deposit amount in a tax saving FD is Rs 100 and thereafter in multiples of Rs 100

Download Is 5 Year Fixed Deposit Tax Free

More picture related to Is 5 Year Fixed Deposit Tax Free

Tax Saving 5 Year Fixed Deposits What You Should Know YouTube

https://i.ytimg.com/vi/qhWFETqQu58/maxresdefault.jpg

5 Year Fixed KDM Financial

https://kdmfinancial-web-22-use2.azurewebsites.net/wp-content/uploads/2022/12/Asset-2.png

Fixed Deposit Income Tax Exemption Quick Update

https://instafiling.com/wp-content/uploads/2023/02/Fixed-Deposit-Income-Tax-Exemption-980x551.png

Tax saving FD allows you to make an investment to save tax under section 80C of the Income Tax Act The minimum tenure for a term deposit under the Tax Saving Scheme is 5 years You can get a tax exemption of a maximum of Rs 1 5 lakh You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account The scheme ensures returns along with capital protection

[desc-10] [desc-11]

Looking To Park Your Savings Here Is A List Of The Best Fixed Deposit

https://static.toiimg.com/thumb/imgsize-23456,msid-95597300,width-600,resizemode-4/95597300.jpg

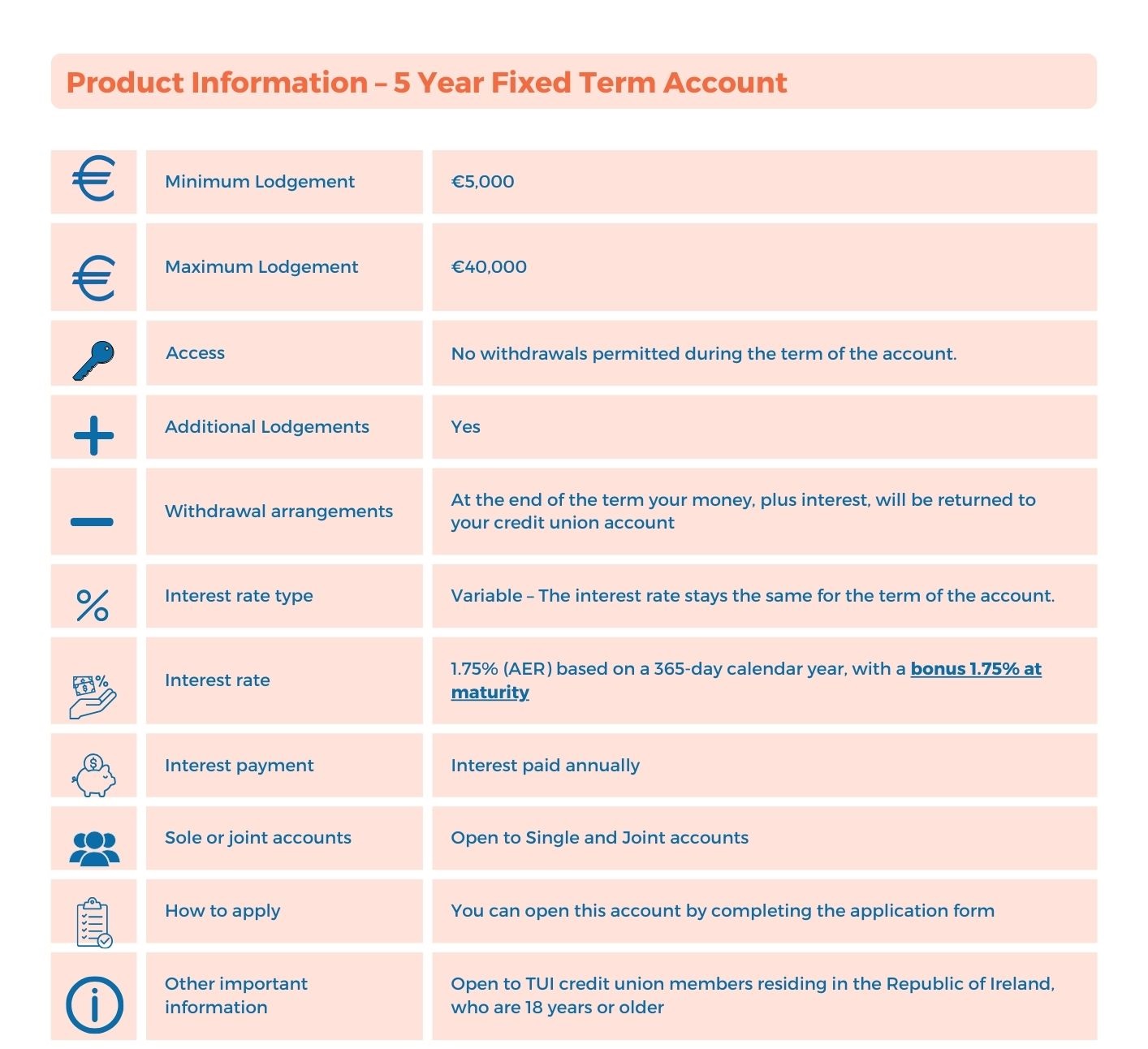

TUI Credit Union Deposit Accounts

https://tuicu.ie/media/1s0hcym5/5-year.jpg

https://www.hdfcbank.com/personal/save/deposits/...

Check out the eligibility criteria for Five Year Tax Saving Fixed Deposit Deposits at HDFC Bank Know more about terms conditions charges other requirements

https://www.paisabazaar.com/fixed-deposit/tax...

The National Savings Time Deposit Account popularly known as Post Office Fixed Deposit opened for 5 year tenure also qualifies for the same deduction However depositors should note that the interest income on FD is taxable and is taxed under Income from other sources in the IT return

Pre call Report 5 Year Fixed Rate Mortgage From Royal Bank FINA

Looking To Park Your Savings Here Is A List Of The Best Fixed Deposit

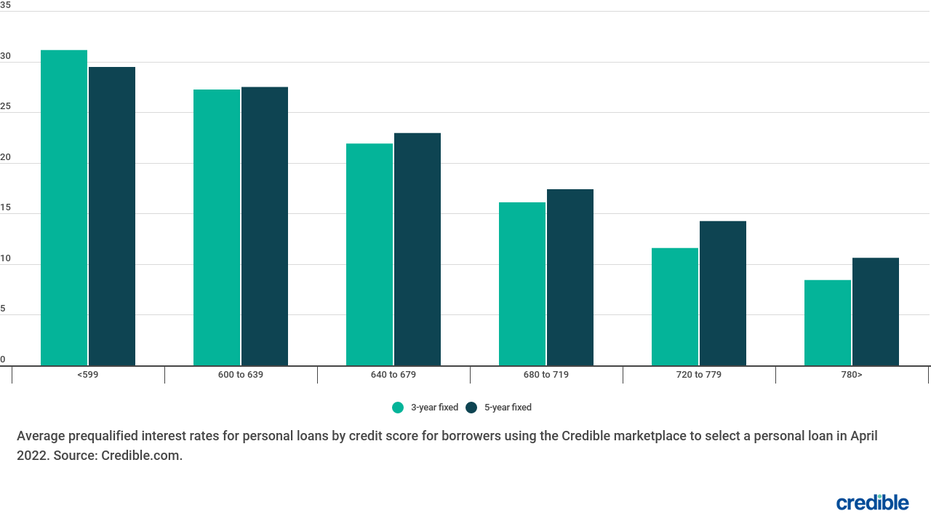

Personal Loan Rates Dip For 5 year Fixed rate Loans Manyweapons

Features Documents Required For Tax Saver Fixed Deposit Legacy

What Is A Savings Account Wish Great Inc

Which Is The Safest Investment Options Where I Could Invest Money With

Which Is The Safest Investment Options Where I Could Invest Money With

Canada s Neutral Rate Keeps Sliding RateSpy

Our yyj finance Team Has Informed Us 5 Year FIXED Insured 3 14

Tax savings FDs Are Fixed Deposits That Allow Investors To Claim Income

Is 5 Year Fixed Deposit Tax Free - Fixed Deposits FDs under Section 80C can yield tax benefits but interest income is taxable TDS is deducted when interest exceeds Rs 40k or Rs 50k for senior citizens Reporting interest income is necessary to avoid higher tax slabs at maturity