Is 5 Year Fd Tax Free Verkko Minimum Amount Rs 100 amp in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In Can be booked with Monthly and quarterly payout In the case of joint deposits the Tax benefit under 80 c will be available only to the first holder of the deposit

Verkko Tax Benefit You can get a tax deduction under Section 80C of up to Rs 1 5 lakh when you make an investment on a tax saver FD scheme with a minimum lock in period of five years 10 Limitations of FD Verkko 18 maalisk 2022 nbsp 0183 32 The amount invested up to Rs 1 50 000 per financial year in a 5 year tax saver FD qualifies for deduction from total gross income and thus reduces tax liability for that year The

Is 5 Year Fd Tax Free

Is 5 Year Fd Tax Free

https://i.ytimg.com/vi/-5f7zy-s9VY/maxresdefault.jpg

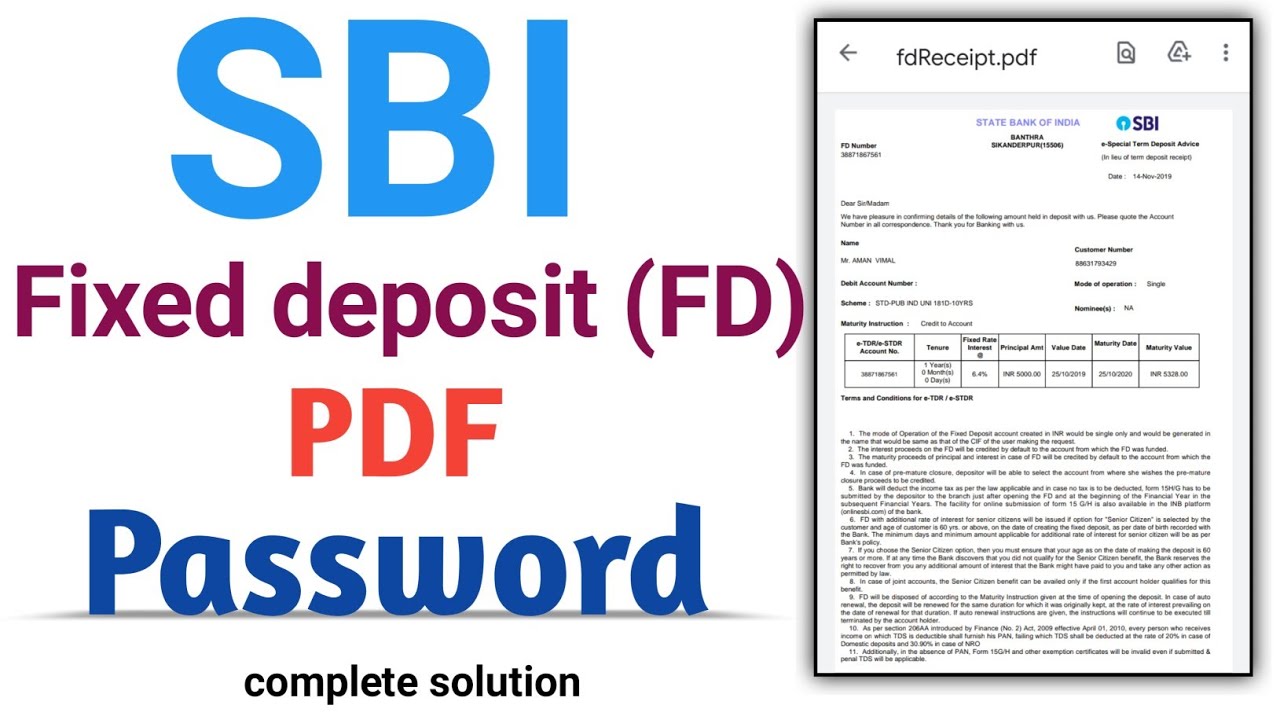

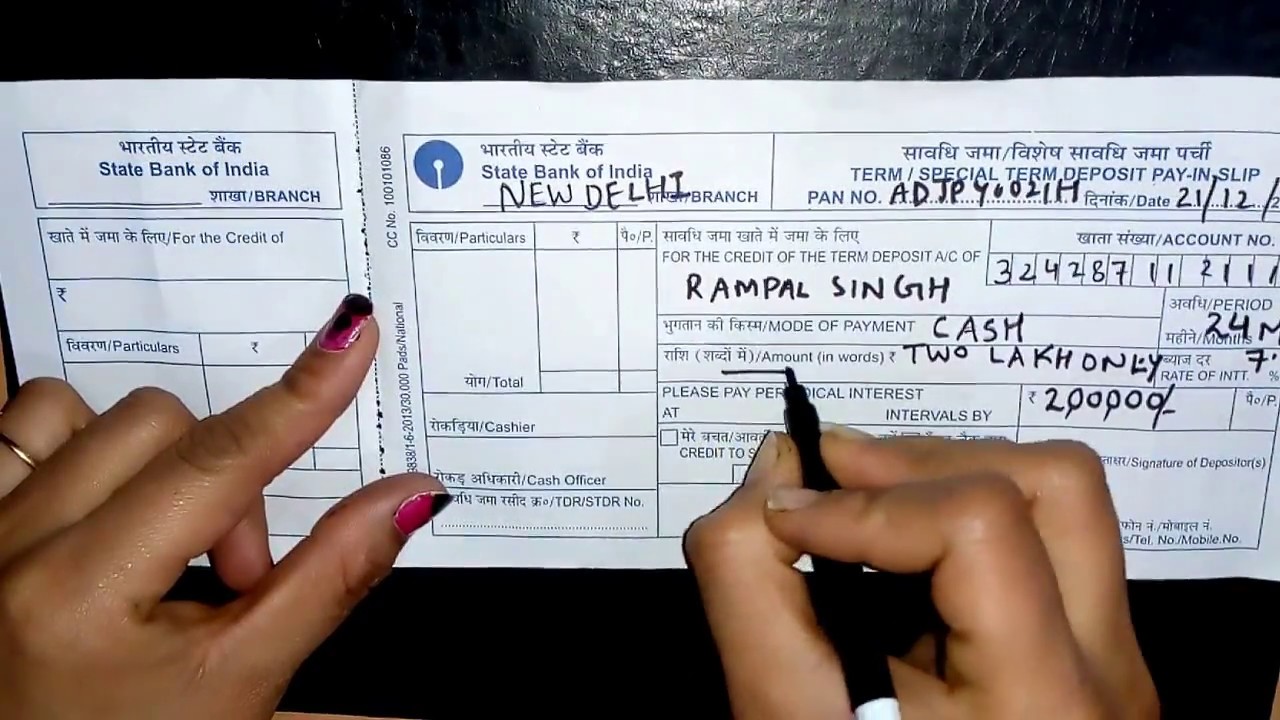

What Is Sbi Fd Receipt Pdf Password Password To Open SBI PDF Sbi Fd

https://i.ytimg.com/vi/_NX1rOfnsow/maxresdefault.jpg

NSC Vs 5 Year Tax Saving FD In Bank Which Is Better Option

https://myinvestmentideas.com/wp-content/uploads/2021/04/NSC-Vs-5-Year-Tax-Saving-FD-in-bank-–-Which-is-better-option.jpg

Verkko 4 helmik 2023 nbsp 0183 32 The term of the tax saving fixed deposit is 5 years Section 80C deductions are available for Hindu undivided families HUF and individuals Who are eligible for Tax Savings FD The following entities are eligible to open an FD Tax Savings Account Resident of India Individuals Hindu Undivided Families HUF Minors can Verkko Here are some of the key features of a tax saving FD 1 Tax Exemption With a tax saving FD you can avail of income tax exemption under Section 80C of the IT Act 1961 It can be claimed on investment of up to Rs 1 5 lakh 2 Lock in Period A tax saving fixed deposit has a lock in period of 5 years

Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 The tax saving FD schemes have a lock in period of 5 years and the deposit amount of up to Rs 1 5 lakh each financial year qualifies for tax deduction under Section 80C of the Income Tax Act The National Savings Time Deposit Account popularly known as Post Office Fixed Deposit opened for 5 year tenure also qualifies Verkko 24 lokak 2023 nbsp 0183 32 Is a fixed deposit tax free No an income from a fixed deposit is not tax free The interest on FD is chargeable to income tax at the slab rates Moreover an investment in a tax saving 5 year FD is eligible for a tax deduction under section 80C

Download Is 5 Year Fd Tax Free

More picture related to Is 5 Year Fd Tax Free

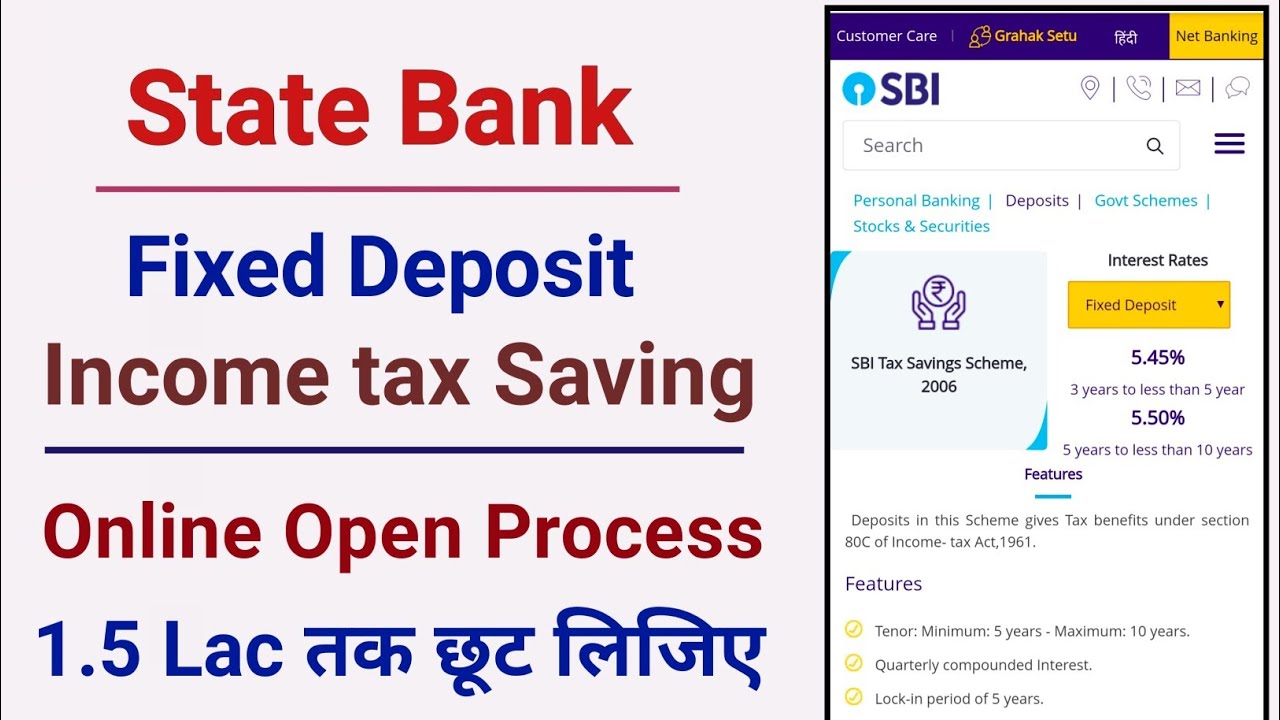

Sbi Tax Saver Fixed Deposit How To Open Tax Saver Fd In Sbi Online

https://i.ytimg.com/vi/MF15NuqozMg/maxresdefault.jpg

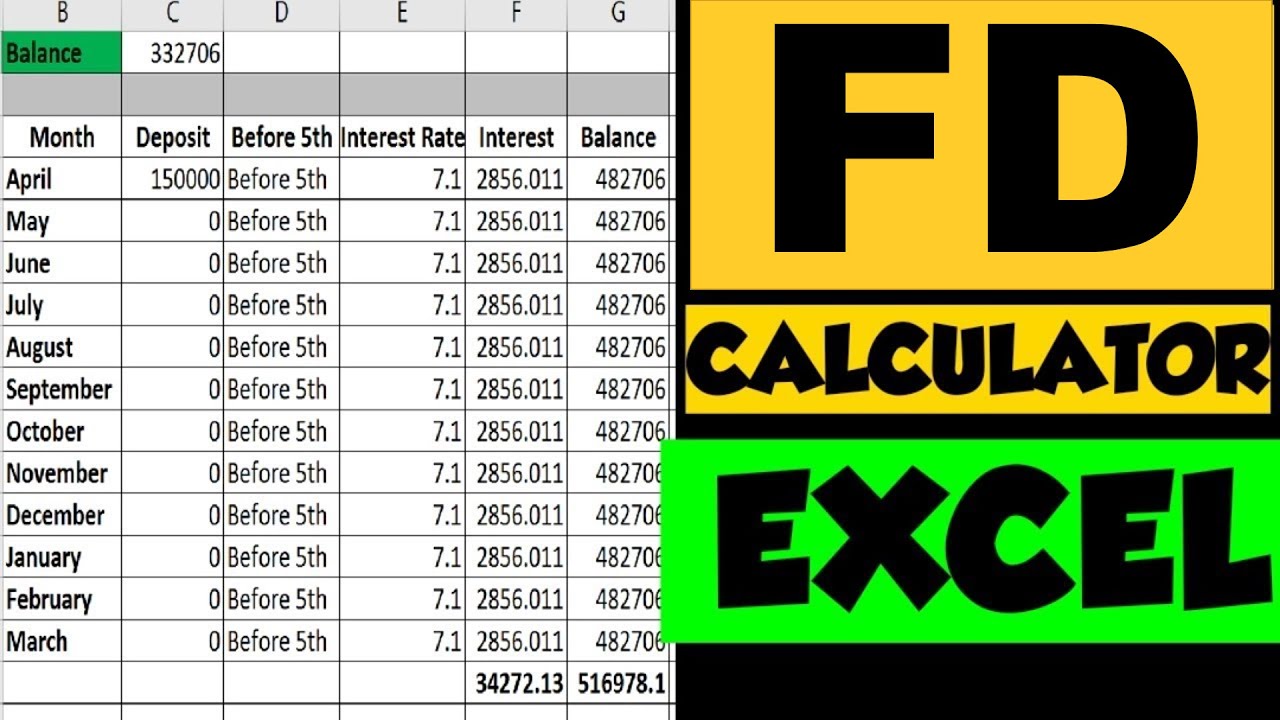

FD Calculator Fixed Deposit Interest Calculator FinCalC Blog

https://i.ytimg.com/vi/fZ0XcrgOmOk/maxresdefault.jpg

How To Fill Out Form 1040 For 2022 Taxes 2023 Money Instructor

https://i.ytimg.com/vi/dXjHkaNOFBo/maxresdefault.jpg

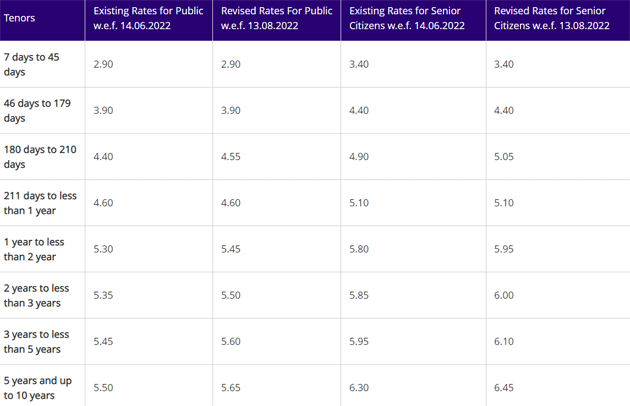

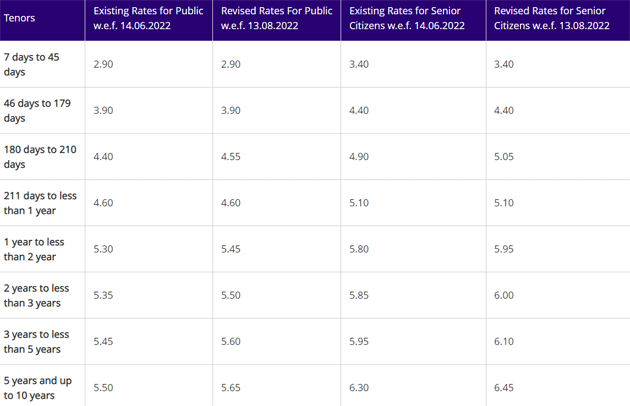

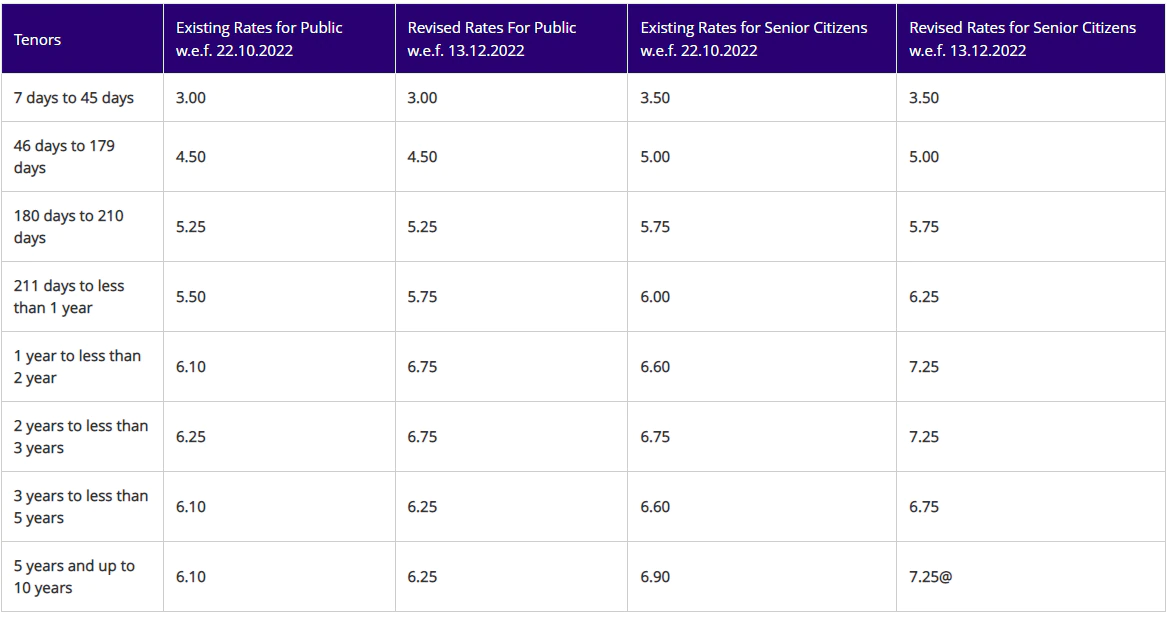

Verkko 27 maalisk 2023 nbsp 0183 32 A 5 year Fixed Deposit FD is not entirely tax free for 5 years While the investment qualifies for tax benefits under Section 80C the interest earned is taxable Disclaimer Fixed deposit products are generally considered safe investments as they are not subject to market fluctuations Verkko 23 helmik 2023 nbsp 0183 32 A tax saving fixed deposit has a tenure between five to ten years The available tax saving FD interest ratesfor the general public are between 5 30 per annum to 6 30 per annum However the FD tax saver interest rates vary depending on different banks The deposit range for tax savings deposits is between Rs 100 to Rs

Verkko Tax Saver FD also known as 5 Year Tax Saving FD offers a convenient way to save more while securing your financial future with tax free returns It is ideal for investors seeking low risk returns and reduced tax liabilities You can start small with a minimum investment of Rs 10 000 Verkko 22 helmik 2018 nbsp 0183 32 You will have to invest in tax saving saver fixed deposits that come with a five year tenure to claim a tax deduction under Section 80C of the Income Tax Act Tax saving fixed deposits have a lock in period of five years and they qualify for a tax deduction of up to 1 5 lakh under Section 80C

SBI FD Interest Rates This SBI FD Allows You To Withdraw Money Anytime

https://img.etimg.com/photo/msid-94049571/sbi.jpg

Recurring Deposit Rates Offer Online Save 66 Jlcatj gob mx

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2022/06/sbifdrate-1655200221.jpg

https://www.hdfcbank.com/.../five-year-tax-saving-fixed-deposit

Verkko Minimum Amount Rs 100 amp in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In Can be booked with Monthly and quarterly payout In the case of joint deposits the Tax benefit under 80 c will be available only to the first holder of the deposit

https://cleartax.in/s/fixed-deposit

Verkko Tax Benefit You can get a tax deduction under Section 80C of up to Rs 1 5 lakh when you make an investment on a tax saver FD scheme with a minimum lock in period of five years 10 Limitations of FD

Citizens Online And Mobile Banking Citizens Bank Certificate Of Deposit

SBI FD Interest Rates This SBI FD Allows You To Withdraw Money Anytime

How To Download ICICI Bank FD Advice Receipt FD Certificate From

SBI Released New FD Interest Rates 2023 Big News SBI Increased FD

Check If Your FD Can Get You Income Tax Benefit U s 80C PDF

RBI FD Rules 2021 Auto Renewal FDs Discontinued BasuNivesh

RBI FD Rules 2021 Auto Renewal FDs Discontinued BasuNivesh

Not Public Provident Fund Or 5 year FD This Is The Best Investment

Sbi Claim Form Pdf Designundbad

Tax On FD TDS On Fixed Deposit Interest 2024

Is 5 Year Fd Tax Free - Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 The tax saving FD schemes have a lock in period of 5 years and the deposit amount of up to Rs 1 5 lakh each financial year qualifies for tax deduction under Section 80C of the Income Tax Act The National Savings Time Deposit Account popularly known as Post Office Fixed Deposit opened for 5 year tenure also qualifies