Is Post Office 5 Year Fd Tax Free A 5 year POFD cannot be withdrawn before the conclusion of four years Further if it is withdrawn after the conclusion of four years but before maturity then interest rate payable will be the PO savings account interest rate Applicable for 5 year POFD made after November 9 2023

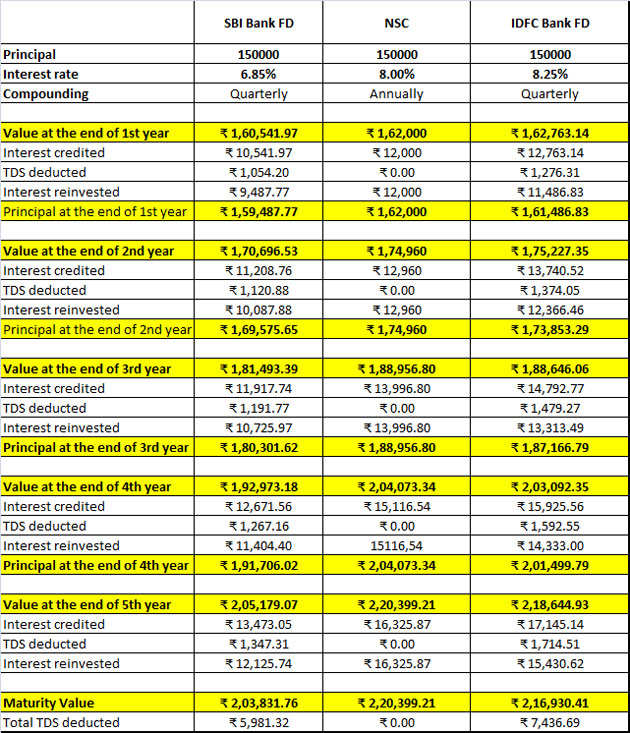

The current rate of interest for both NSC and 5 year Post Office Fixed Deposits is 7 p a From a tax benefit point of view both are eligible under 80C deduction of up to 1 5 lakhs as per Yes the post office fixed deposits are taxable for the interest paid but the tax deduction at source is not done by the post office One can save the tax by opting maturity period of five years for the deposits and get an exemption from taxation maximum upto Rs 1 50 000

Is Post Office 5 Year Fd Tax Free

Is Post Office 5 Year Fd Tax Free

https://img.etimg.com/photo/msid-66749547/nsc-vs-bankfd.jpg

Tax Saver FD 5 Year Fixed Deposit For Tax Saving Scheme Explained

https://i.ytimg.com/vi/Gj9lnrTvDSs/maxresdefault.jpg

Post Office Fixed Deposit FD Account How It Works Interest Rates

https://i.ytimg.com/vi/gFObktx0U7A/maxresdefault.jpg

Tax Benefits 5 year tax saving post office deposits are eligible for deduction under Section 80C of the Income Tax Act 1961 up to a limit of 1 5 lakhs in a financial year Premature withdrawal facility Premature withdrawal is The National Savings Time Deposit Account popularly known as Post Office Fixed Deposit opened for 5 year tenure also qualifies for the same deduction However depositors should note that the interest income on FD is taxable and is taxed under Income from other sources in the IT return

Is Post Office 5 year FD tax free The interest earned on a post office 5 year fixed deposit FD is taxable but the deposited amount qualifies for tax deduction under Section 80C allowing up to 1 5 Lakhs per financial year for exemption The 5 year Post Office FD aptly named the Post Office Tax Saving FD falls under the Exempt Exempt Exempt EEE category This feature means that the invested amount interest earned and

Download Is Post Office 5 Year Fd Tax Free

More picture related to Is Post Office 5 Year Fd Tax Free

Post Office FD Scheme 2023 Post Office FD Calculator Post Office Fd

https://i.ytimg.com/vi/GFxSoI7tAnw/maxresdefault.jpg

5 Year Best Tax Saving Fix Deposit FD Fixed Deposit Interest Rate

https://i.ytimg.com/vi/XFZkPKygGpg/maxresdefault.jpg

Post Office FD Interest And Maturity Value Calculator 2023

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/04/post-office-fd-calculator-1.jpg

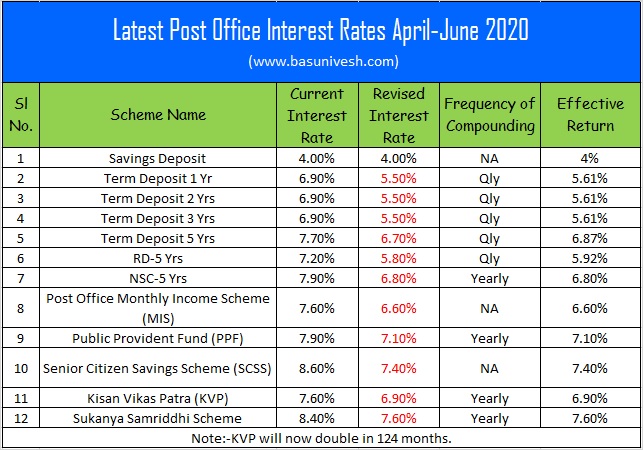

One can claim an income tax deduction by investing money in a five year FD scheme under Section 80C of the Income Tax Act 1961 The features benefits and terms associated with this type of account may not be completely the same as the normal FD accounts 5 Year Post Office Recurring Deposit Account RD As the name suggests the tenure of this RD account is fixed for five years You can agree to a fixed monthly deposit payment starting from Rs 100 and earn interest at 6 7 p a The interest is

[desc-10] [desc-11]

Post Office Fixed Deposit FD Form PDF Download Check Time Deposit

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiLJAkpU8ZN146i1Xk3zc2OlHl5QownoI7bv6M5H9lpHX2P8CN5ChmdRp6ytVxovlESVOqPGBHi7OVSAAGOSLXWbgiQPVIu3i2_H_6d4fvnolM45Z-ybe15-POkWACyDVNLmjWXM8m1ypmzTnyLVJTvd0c09DwdQjNEXBBamabIUhFueNULjr6aDkZWhw/s807/post-office-fixed-deposit-form-pdf-download.png

Post Office FD Form Kaise Bhare Post Office Fixed Deposit Form Fill

https://i.ytimg.com/vi/4PoZMYgRqtg/maxresdefault.jpg

https://cleartax.in/s/post-office-fixed-deposit

A 5 year POFD cannot be withdrawn before the conclusion of four years Further if it is withdrawn after the conclusion of four years but before maturity then interest rate payable will be the PO savings account interest rate Applicable for 5 year POFD made after November 9 2023

https://www.livemint.com/money/personal-finance/5-years-post...

The current rate of interest for both NSC and 5 year Post Office Fixed Deposits is 7 p a From a tax benefit point of view both are eligible under 80C deduction of up to 1 5 lakhs as per

.JPG)

Post Office Fixed Deposit Scheme 2023 Post

Post Office Fixed Deposit FD Form PDF Download Check Time Deposit

Post Office Fixed Deposit Calculator NIVAFLOORS COM

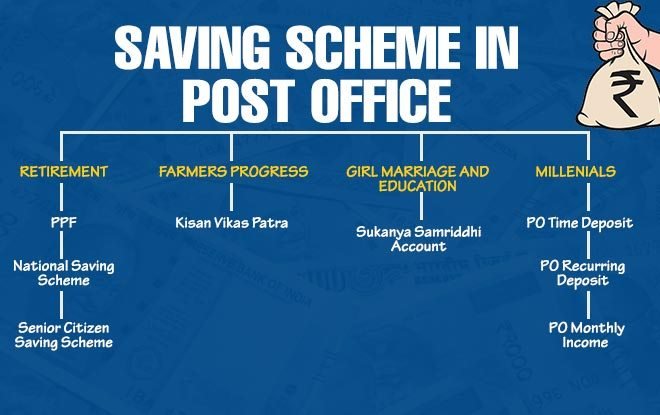

Post Office Saving Scheme 2023 PPF NSC FD RD MIS Interest Rate

FD Calculator Post Office FD SBI FD YouTube

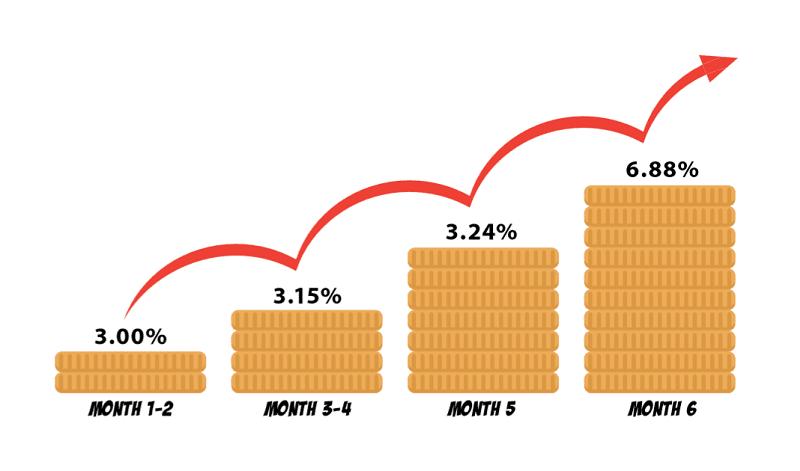

How To Grow Your Fixed Deposit In 5 Years Know About Bajaj Finance FD

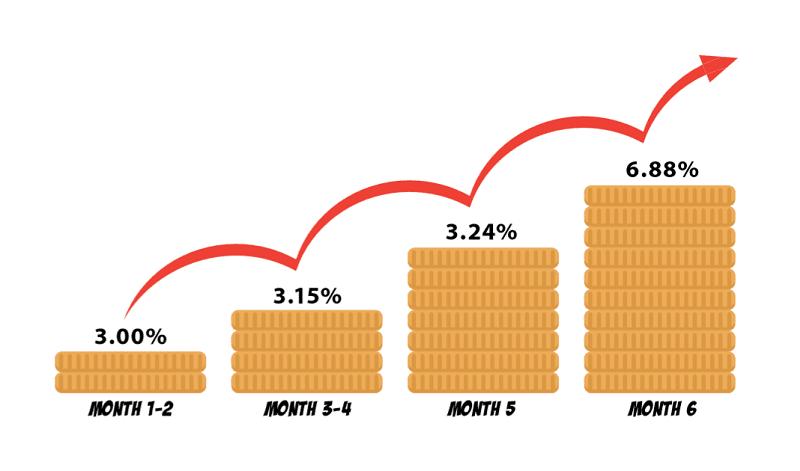

How To Grow Your Fixed Deposit In 5 Years Know About Bajaj Finance FD

Fixed Deposit FD Taxes Explained Sqrrl

Top 5 Post Office Schemes To Get Tax Benefits Under Section 80C

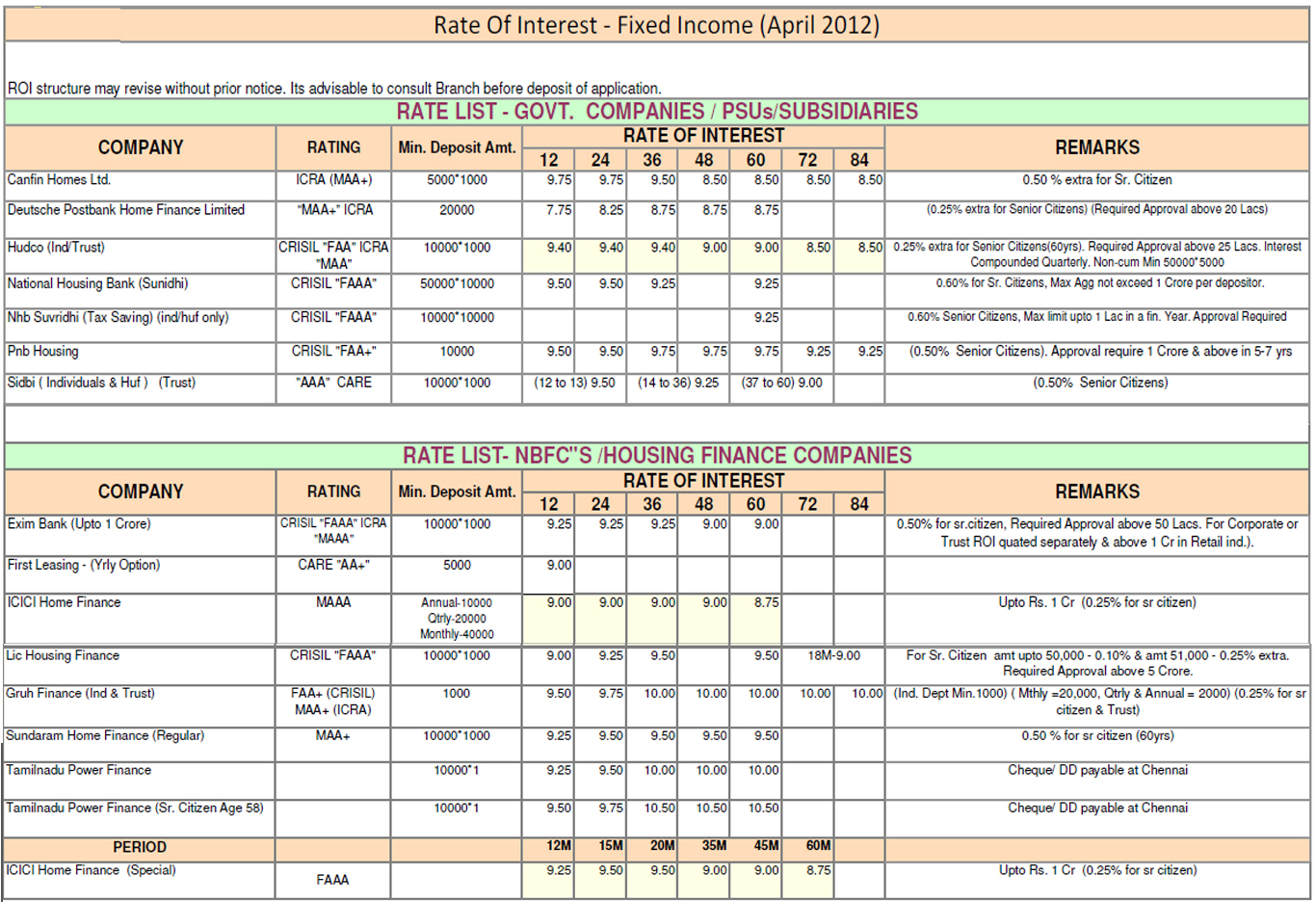

Kapil Investments A Complete Solution For FD

Is Post Office 5 Year Fd Tax Free - Is Post Office 5 year FD tax free The interest earned on a post office 5 year fixed deposit FD is taxable but the deposited amount qualifies for tax deduction under Section 80C allowing up to 1 5 Lakhs per financial year for exemption