Is Any 5 Year Fd Tax Free Understand how 5 year fixed deposits offer tax benefits under Section 80C Learn about the rules interest rates and eligibility for tax saving FDs

Tax Saver FD also known as 5 Year Tax Saving FD offers a convenient way to save more while securing your financial future with tax free returns It is ideal for investors seeking low risk returns and reduced tax liabilities You can start A five year fixed tenure applies to tax saving FDs Section 80C of the Income Tax Act 1961 allows for a tax deduction of up to 1 5 lakh even though the interest earned on the

Is Any 5 Year Fd Tax Free

Is Any 5 Year Fd Tax Free

https://life.futuregenerali.in/media/qolbr5pc/tax-on-fix-deposits.jpg

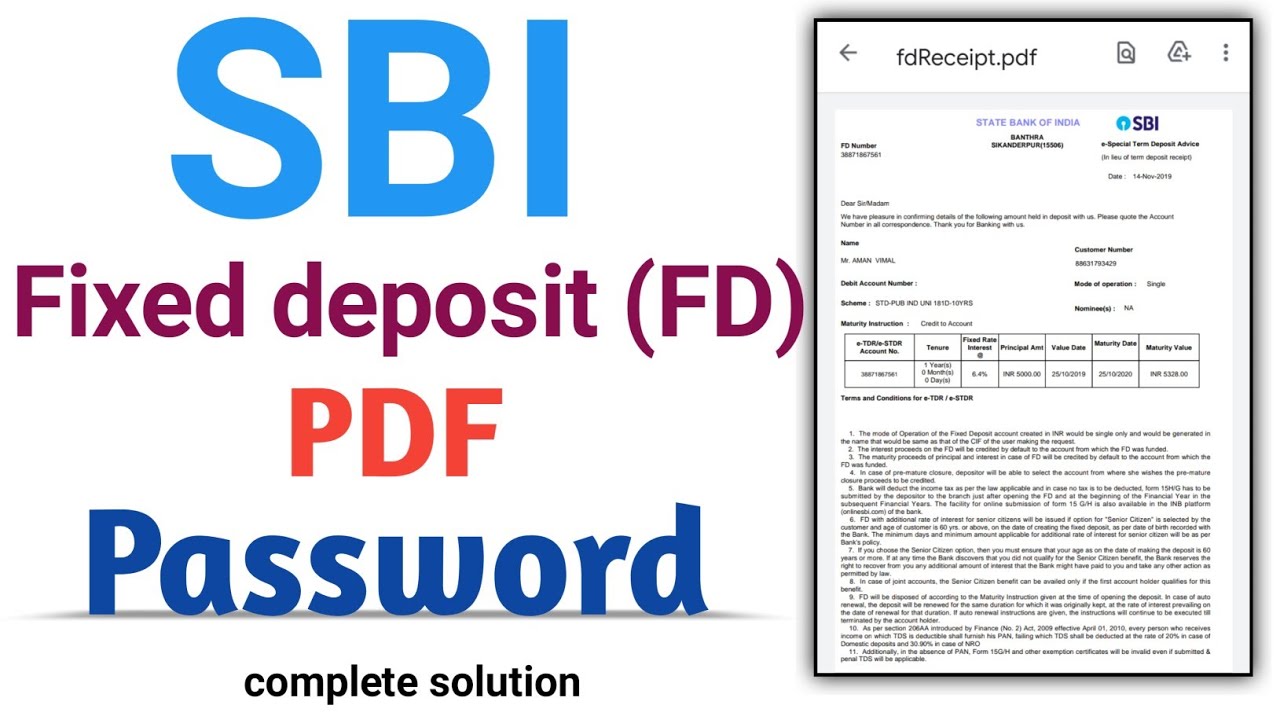

What Is Sbi Fd Receipt Pdf Password Password To Open SBI PDF Sbi Fd

https://i.ytimg.com/vi/_NX1rOfnsow/maxresdefault.jpg

How To Fill PNB Fixed Deposit Form In 2024 YouTube

https://i.ytimg.com/vi/JFdeTmY-VyU/maxresdefault.jpg

The tax saving FD schemes have a lock in period of 5 years and the deposit amount of up to Rs 1 5 lakh each financial year qualifies for tax deduction under Section 80C All banks provide tax saving fixed deposits FDs that come with a fixed rate of interest and also help taxpayers save income tax The amount invested up to Rs 1 50 000 per financial year in

Individuals with a total taxable income of less than Rs 2 5 lakh are completely exempted from TDS on their FDs This exemption is a relief for individuals with lower incomes ensuring that When it comes to tax saver FD schemes you strictly cannot withdraw the funds within five years from the date of account opening In the case of other FD schemes

Download Is Any 5 Year Fd Tax Free

More picture related to Is Any 5 Year Fd Tax Free

NSC Vs 5 Year Tax Saving FD In Bank Which Is Better Option

https://myinvestmentideas.com/wp-content/uploads/2021/04/NSC-Vs-5-Year-Tax-Saving-FD-in-bank-–-Which-is-better-option.jpg

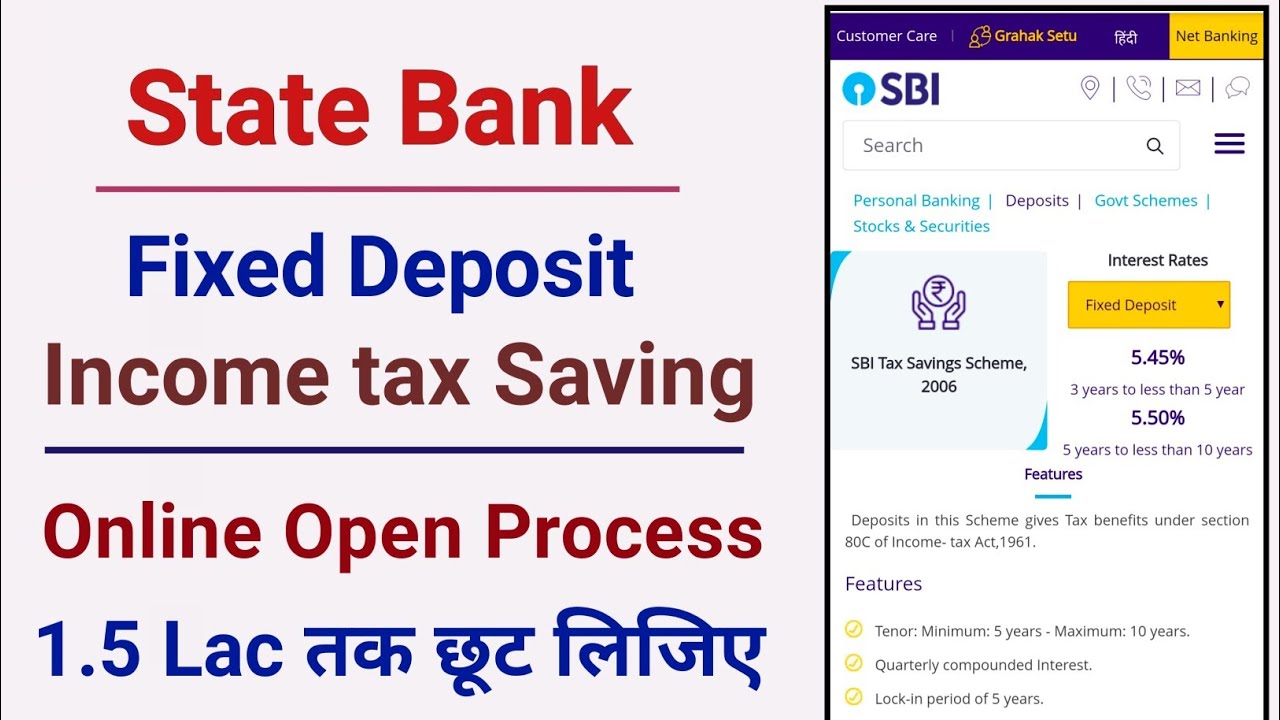

Sbi Tax Saver Fixed Deposit How To Open Tax Saver Fd In Sbi Online

https://i.ytimg.com/vi/MF15NuqozMg/maxresdefault.jpg

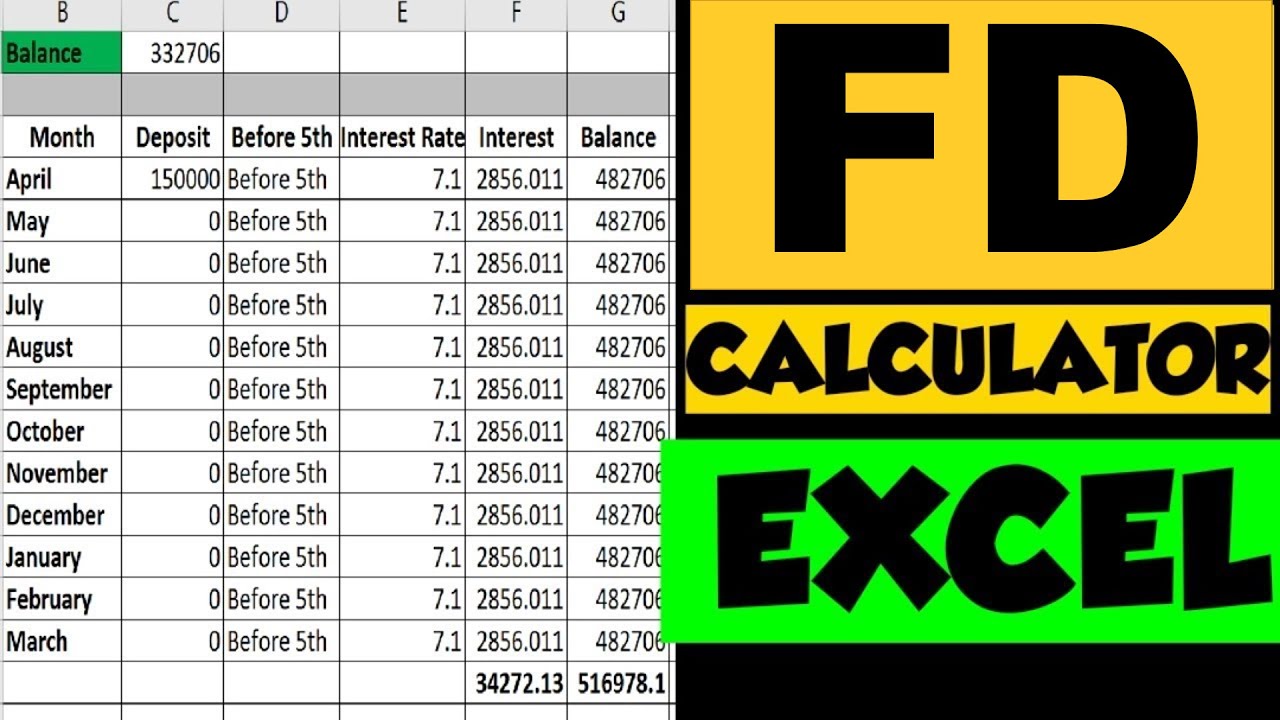

FD Calculator Fixed Deposit Interest Calculator FinCalC Blog

https://i.ytimg.com/vi/fZ0XcrgOmOk/maxresdefault.jpg

Is 5 years FD tax free No the interest in a 5 year tax saving FD is fully taxable and deducted at source However you can avail a tax deduction of up to Rs 1 5 lakh under Section 80C on making an investment Check out the fees you need to pay and the charges for maintaining your Regular Fixed Deposit at HDFC Bank Be aware of minimum balance other maintenance charges

Is 5 year FD interest tax free No the interest earned from 5 year or tax saving FD is subject to taxation However it offers a tax deduction of up to 1 50 000 in a financial year Tax saving FD allows you to make an investment to save tax under section 80C of the Income Tax Act The minimum tenure for a term deposit under the Tax Saving Scheme is 5

Can Fixed Deposit Double In 5 Years In India Updated 2022 Stable

https://i0.wp.com/stableinvestor.com/wp-content/uploads/2022/06/Historical-FD-Rates-SBI.png?w=776&ssl=1

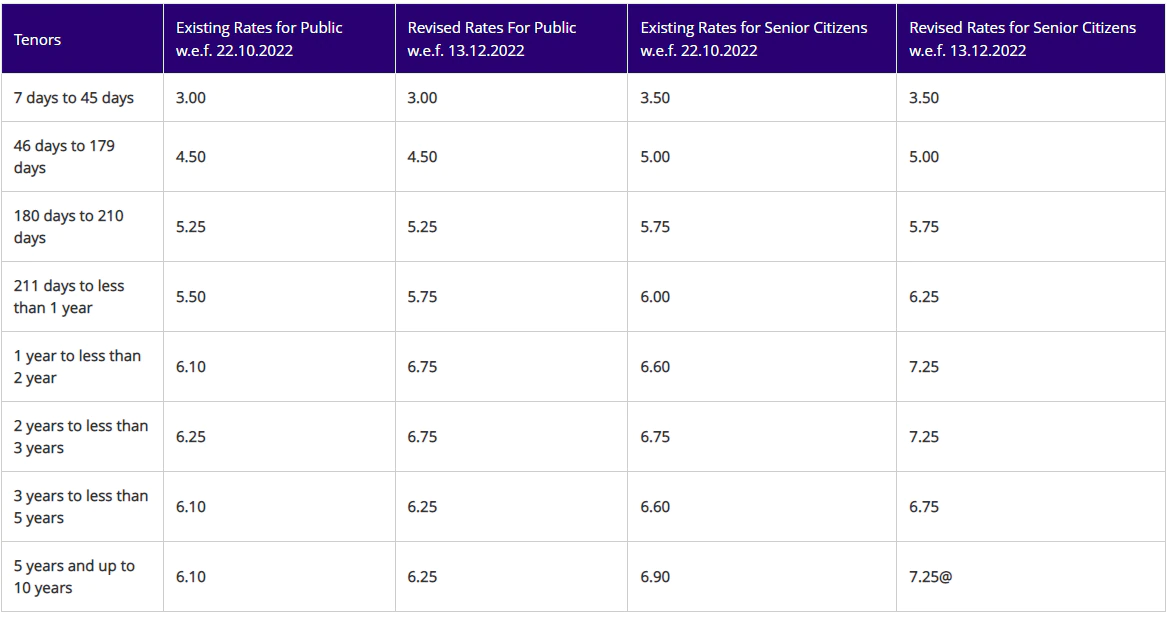

5 year FD Interest Rates From Top Banks

https://www.wintwealth.com/blog/wp-content/uploads/2022/12/5-Year-FD-Interest-Rates-in-India-for-2022.jpg

https://www.taxbuddy.com › blog

Understand how 5 year fixed deposits offer tax benefits under Section 80C Learn about the rules interest rates and eligibility for tax saving FDs

https://www.icicibank.com › ... › tax-saver …

Tax Saver FD also known as 5 Year Tax Saving FD offers a convenient way to save more while securing your financial future with tax free returns It is ideal for investors seeking low risk returns and reduced tax liabilities You can start

Citizens Online And Mobile Banking Citizens Bank Certificate Of Deposit

Can Fixed Deposit Double In 5 Years In India Updated 2022 Stable

FD Calculator These PSU Banks Give 7 Or More Return

How To Fill Out Form 1040 For 2022 Taxes 2023 Money Instructor

Not Public Provident Fund Or 5 year FD This Is The Best Investment

How To Download ICICI Bank FD Advice Receipt FD Certificate From

How To Download ICICI Bank FD Advice Receipt FD Certificate From

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Check If Your FD Can Get You Income Tax Benefit U s 80C PDF

SBI Released New FD Interest Rates 2023 Big News SBI Increased FD

Is Any 5 Year Fd Tax Free - When it comes to tax saver FD schemes you strictly cannot withdraw the funds within five years from the date of account opening In the case of other FD schemes