What Investment Comes Under 80ccd What are covered under 80CCD Under Section 80CCD contributions towards National Pension Scheme NPS and Atal Pension Yojana APY are covered It also covers the employer s contribution to the NPS scheme You can avail of

An employee can claim deduction under 80CCD 1 at a maximum of 10 of basic salary plus dearness allowance For self employed the limit for deduction is 20 of their income subject to Rs 1 5 lakh maximum limit of section 80C Tax Benefits under Section 80CCD 1B NPS investors enjoy an additional tax benefit through Section 80CCD 1B Under this provision you are eligible to claim tax deductions on NPS investments of up to Rs 50 000 which is

What Investment Comes Under 80ccd

What Investment Comes Under 80ccd

https://www.indiafilings.com/learn/wp-content/uploads/2018/11/Section-80GGC.jpg

Infinite Banking Free Training Programs Banks Office Raising Capital

https://i.pinimg.com/originals/bb/1a/35/bb1a3588e3c5d84a7fa14e7c1ce73bf6.jpg

Canadian Investment Company Buys 2 5 Million Worth Of Virtual Real

https://www.tbstat.com/wp/uploads/2021/11/20211111_Metaverse.jpg

Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for Central Government made by the employer For someone in the 30 per cent tax bracket this is a clear benefit of Rs 15 000 on investment of Rs 50 000 over and above the Rs 1 5 lakh allowed under Section 80 C This article gives an overview of NPS explains NPS Tax Benefits answers frequently asked questions regarding NPS and tax NPS Tax Benefits Sections

Under APY tax deductions up to Rs 1 50 000 are eligible under section 80CCD 1 Note that an additional investment of up to Rs 50 000 is eligible for tax deduction under section 80CCD 1B Also a self employed person can claim a deduction of a maximum of Rs 1 50 000 for Atal Pension Yojana investments that are up to 20 of their annual income Besides wealth creation an NPS investment helps you save significantly on taxes every financial year You can claim tax deductions under Section 80C and Section 80 CCD of the Income Tax Act 1961 You can claim 1 5 lakh tax deduction under Section 80 CCE

Download What Investment Comes Under 80ccd

More picture related to What Investment Comes Under 80ccd

3P Investment Managers

https://3pim.in/images/logo_png.png

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/12/section-80ccd.jpg

What Investment Strategy Is Best In This Real Estate Market Visit Http

https://i.pinimg.com/originals/09/f5/b2/09f5b279811cea3db3743f3f64a12a73.jpg

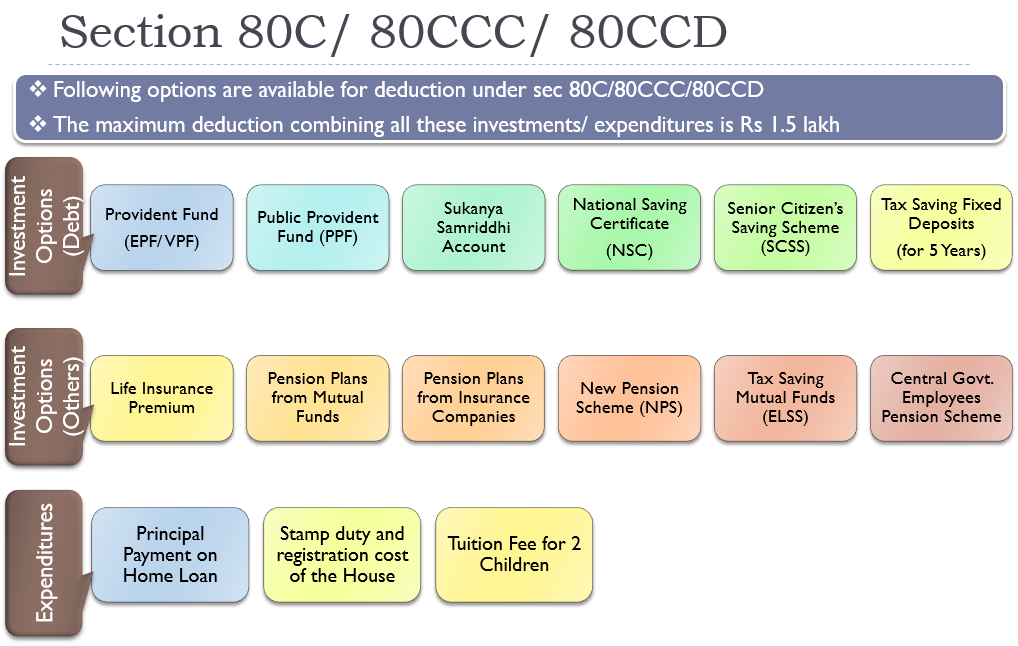

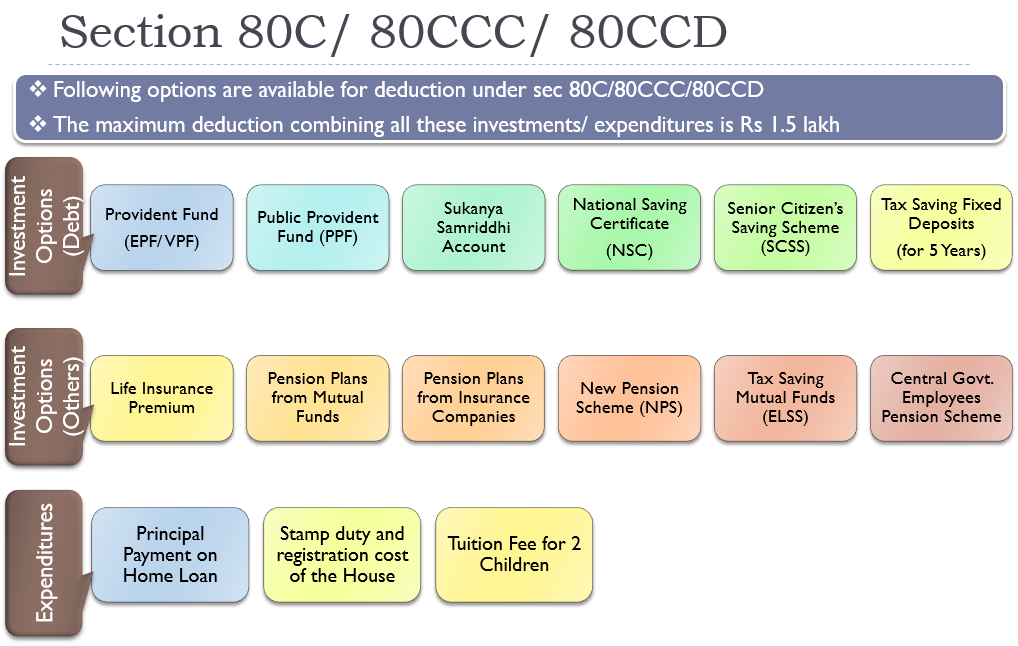

The NPS allows tax deductions under three sections of the Income Tax Act Before you claim these amounts you must keep a few things in mind The maximum total deduction available under Section 80CCD is Rs 2 lakhs which includes the additional deduction available under 80CCD 1b Section 80 investments refer to the investments made under Section 80C Section 80D Section 80E Section 80GG etc of the Income Tax Act 1961 These investments are eligible for tax deductions of up to Rs 1 5 lakh annually

Deductions under Section 80CCD 1 are capped at INR 1 5 Lakhs However an additional deduction of up to INR 50 000 may be claimed under Section 80CCD 1B bringing the maximum deduction limit to INR 2 Lakhs There are various tax saving options available such as ELSS Public Provident Fund National Pension Scheme etc It is a wise move to start your tax planning early and thus invest in tax saving schemes We have compiled a list of best Tax Saving Investment options for you to choose from

7 Easiest Ways Of Saving Tax In India Smart Investment Ideas

https://1.bp.blogspot.com/-yALAALtZTUs/XO69hhHkQ7I/AAAAAAAAKSc/6NOCgY2CBWYqFsoAsDPp2kjXaXAjcUEowCLcBGAs/s1600/tax%2Bsaving.jpg

80CCD Income Tax Deduction Under Section 80CCD 1 2

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80ccd.jpg

https://www.etmoney.com › learn › income-tax

What are covered under 80CCD Under Section 80CCD contributions towards National Pension Scheme NPS and Atal Pension Yojana APY are covered It also covers the employer s contribution to the NPS scheme You can avail of

https://cleartax.in

An employee can claim deduction under 80CCD 1 at a maximum of 10 of basic salary plus dearness allowance For self employed the limit for deduction is 20 of their income subject to Rs 1 5 lakh maximum limit of section 80C

Income Tax Deduction Under 80C 80D And 80CCD Overview Types And

7 Easiest Ways Of Saving Tax In India Smart Investment Ideas

Jaxsen Property Investment Consultant Johor Bahru

Real Estate Investment Private Club

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Deduction Under Section 80CCD 2 For Employer s Contribution To

Section 80C Deduction Under Section 80C In India Paisabazaar

What Is Section 80CCD Sharda Associates

What Investment Comes Under 80ccd - Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for Central Government made by the employer