What Is Section 80ccd Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below

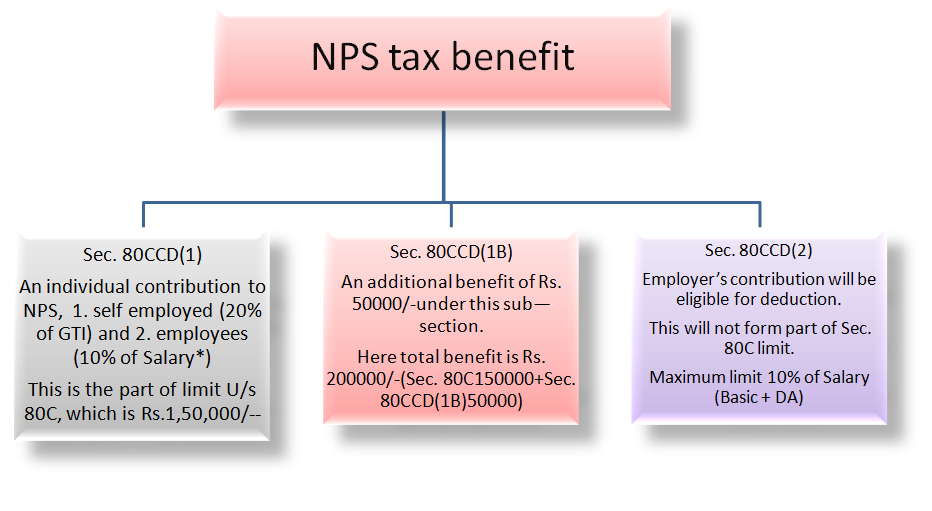

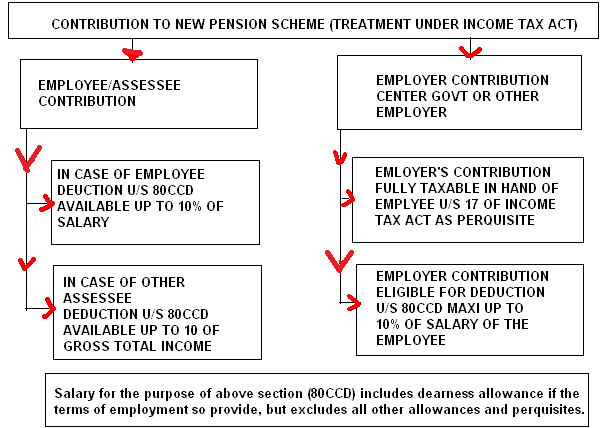

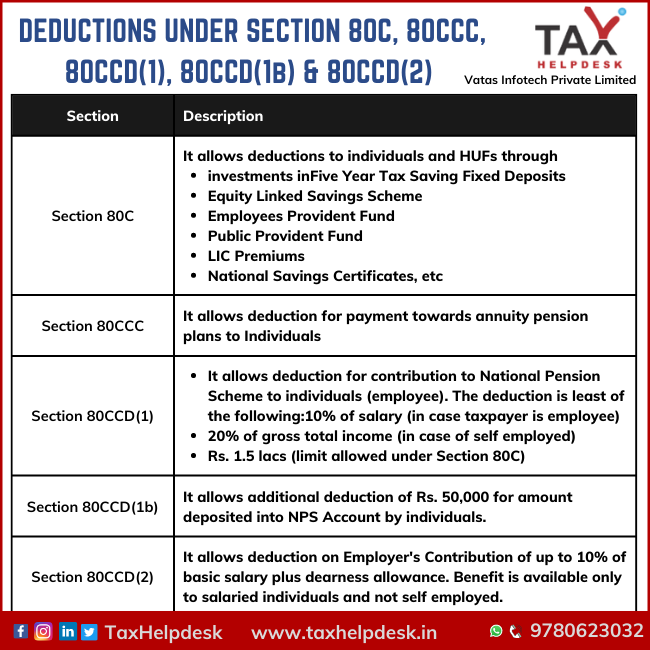

Under Section 80CCD personal and employer contributions made to specific government pension schemes are eligible for income tax deductions This helps to promote retirement savings through pension schemes as well as reduce tax liability Here are all the details that you need to know about Section 80CCD 1 What is Section 80CCD 1 Deduction for employee s own contribution to NPS is allowed as deduction u s 80CCD 1 to the maximum of 10 of salary Further a deduction u s 80CCD 1B is allowed to the maximum of Rs 50 000

What Is Section 80ccd

What Is Section 80ccd

https://s3-ap-south-1.amazonaws.com/rbl-prod-blog-bucket/wp-content/uploads/2020/02/06160323/section-80c-mob.jpg

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

http://www.basunivesh.com/wp-content/uploads/2016/10/NPS-Tax-Benefits.jpg

Tax Benefits Under NPS Deductions Under Section 80CCD 1B Of Income

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80-ccd-1b.jpg

What is Section 80CCD 1B Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS The additional deduction of Rs 50 000 under Section 80CCD 1B is available over and above the benefit of Rs 1 50 lakh deduction under Section 80CCD 1 Section 80CCD of the Income Tax Act 1961 provides such an opportunity by allowing deductions on contributions made to the National Pension System NPS and other pension schemes This article delves into the intricacies of Section 80CCD explaining its provisions eligibility and

Section 80CCD 1 is a deduction for employees as well as self employed for making contributions to the National Pension scheme An employee can claim deduction under 80CCD 1 at a maximum of 10 of basic salary plus dearness allowance Section 80CCD1 allows every tax paying individual in India to get tax deduction benefits from the amount you deposit in your NPS account This tax benefit is open to both employed and self employed This section applies to all such individuals and is even open to

Download What Is Section 80ccd

More picture related to What Is Section 80ccd

Income Tax Information NPS Tax Benefit Sec 80CCD 1 80CCD 1B And

https://2.bp.blogspot.com/-M2x6C7-6FRs/Wv7FH91f_QI/AAAAAAAAAYA/a3qFywzgcPwMcFze1jMvhr6r0hgmni_hQCLcBGAs/s1600/NPS%2Bdeduction.png

Section 80CCD Deductions For NPS And APY Contributions

https://lh6.googleusercontent.com/sLD6yPeDVGnZYaY_9aKDOrAkHtuA8Jmkr12nF2ASHe-liyTJCr8yUoV0I4vLRSImN0-lQA60B2uySJtC6dCGaNlYKPAFENYO9A89pLTBKYLhMUN844JUwp9J02X8XkB6RmHDpyIB8717XGQn6Rq-8ro

Investing Can Be Interesting Financial Awareness Deduction Under

https://2.bp.blogspot.com/-I44oM_RBOng/T6L4-Z9ZHWI/AAAAAAAABYU/EgA-9BJYsgM/s1600/Screenshot_1.png

1 What is a deduction under section 80CCD Section 80CCD covers deduction towards the amount paid deposited by way of employer s contribution as well as employee s contribution to the notified pension scheme like National Pension Scheme 2 What is the maximum limit under section 80CCD What is Section 80CCD Section 80CCD of the Income Tax Act provides tax benefits for contributions to central government pension schemes It includes Section 80CCD 1 Deals with individual contributions both salaried and self employed to NPS or APY Section 80CCD 2 Covers employer contributions made to an employee s NPS account

Section 80CCD of the Indian Income Tax Act 1961 promotes retirement savings through the National Pension System NPS and Atal Pension Yojana APY This provision offers tax deductions to individuals providing significant incentives for contributing to Here s an in depth look at Section 80CCD 2 its benefits eligibility criteria and how you can maximize its potential What is Section 80CCD 2 Section 80CCD 2 pertains to the tax deduction available on the employer s contribution to an employee s NPS account

What Is Section 80CCD

https://shardaassociates.in/wp-content/uploads/2021/03/Section-80CCD-1024x576.jpg

Investing Can Be Interesting Financial Awareness Deduction Under

http://1.bp.blogspot.com/-jCZvm6QIpBA/T0feIJKL1ZI/AAAAAAAAA5Y/iylKs2iibKk/s1600/80C..jpg

https://www.etmoney.com › learn › income-tax

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below

https://www.bankbazaar.com › tax

Under Section 80CCD personal and employer contributions made to specific government pension schemes are eligible for income tax deductions This helps to promote retirement savings through pension schemes as well as reduce tax liability Here are all the details that you need to know about Section 80CCD 1 What is Section 80CCD

Section 80CCD Income Tax Deduction For NPS Scripbox

What Is Section 80CCD

Tax Information Deductions On Section 80C 80CCC 80CCD

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win

Section 80CCD List Of Deductions Covered Under Sec 80CCD

Regarding Government s Contribution Of NPS Income Tax

Regarding Government s Contribution Of NPS Income Tax

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

NPS 80CCD 1 AND SECTION 80CCD 1B YouTube

A Quick Look At Deductions Under Section 80C To Section 80U

What Is Section 80ccd - Section 80CCD is one of the sections under the act that allows individuals to lower their taxable income by claiming deductions on contributions made to two central government backed savings schemes Learn more about Section