Iras Company Tax Rebate Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

Web 10 janv 2023 nbsp 0183 32 Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign companies Corporate Web The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or assembled in

Iras Company Tax Rebate

Iras Company Tax Rebate

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

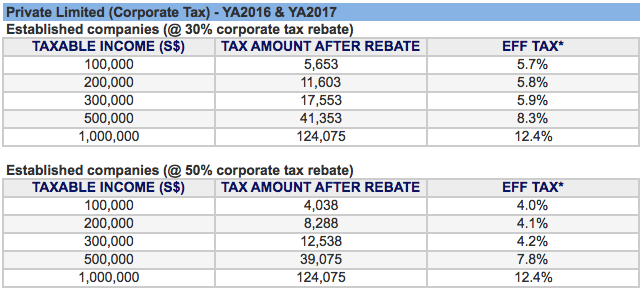

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

https://static1.squarespace.com/static/55b79c7fe4b0f338367f9329/t/56f7c11bac962c8475209b2d/1459077422156/50%25-corporate-tax-rebate-for-Singapore-companies

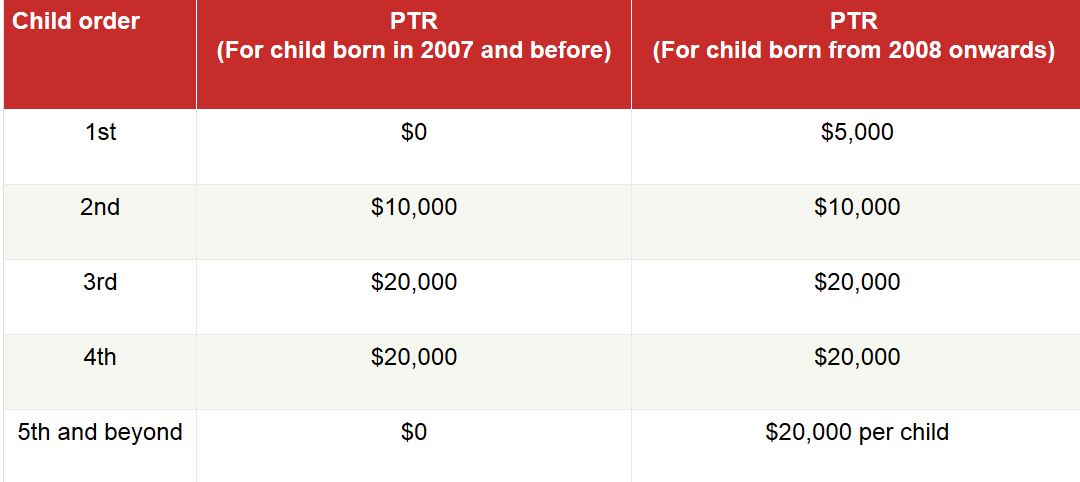

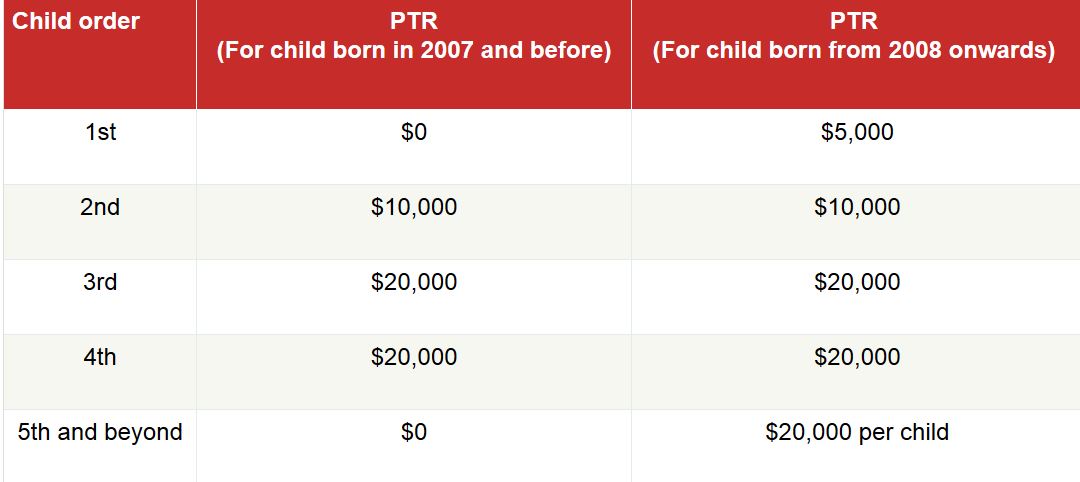

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Web 11 ao 251 t 2022 nbsp 0183 32 Why it matters For consumers the bill called the Inflation Reduction Act IRA has an array of rebates and tax breaks that will reduce green tech s upfront Web The annual contribution limit for 2015 2016 2017 and 2018 is 5 500 or 6 500 if you re age 50 or older Your Roth IRA contributions may also be limited based on your filing

Web 8 sept 2023 nbsp 0183 32 WASHINGTON Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Service Web The Inland Revenue Authority of Singapore IRAS reduces your tax bill based on your company s chargeable income amount and business status Corporate Income Tax

Download Iras Company Tax Rebate

More picture related to Iras Company Tax Rebate

Is Property Tax Rebate Taxable Iras PRORFETY

https://www.growfinancial.org/wp-content/uploads/2021/02/TaxeStrategies_Newsletter_Header_012221-03.png

IRAS Tax Rebate And Defer Your Income Tax Payment

https://i0.wp.com/bensonkoh.com/wp-content/uploads/2009/02/iras-2.jpg?w=914

Is Property Tax Rebate Taxable Iras PRORFETY

https://i.pinimg.com/originals/37/a0/b0/37a0b0ad439c271a3fa2573bb9432a3b.png

Web 18 f 233 vr 2020 nbsp 0183 32 If a company s chargeable income is SGD250 000 for YA2020 the total income exempted from tax would be SGD125 000 SGD75 000 SGD 50 000 and final Web Il y a 1 jour nbsp 0183 32 California Times Sept 11 2023 2 14 PM PT California is eliminating its popular electric car rebate program which often runs out of money and has long

Web As announced in Budget 2023 under the Enterprise Innovation Scheme EIS an additional 300 tax deduction is granted on the first 400 000 of qualifying training expenditure Web 18 mars 2013 nbsp 0183 32 18 March 2013 As announced in Budget 2013 companies will receive a 30 Corporate Income Tax CIT Rebate for the Years of Assessment YA 2013 to

Is Property Tax Rebate Taxable Iras PRORFETY

https://d2vlcm61l7u1fs.cloudfront.net/media/502/50247e5c-d72c-4517-9924-8b71344944f7/phpBXgEDI.png

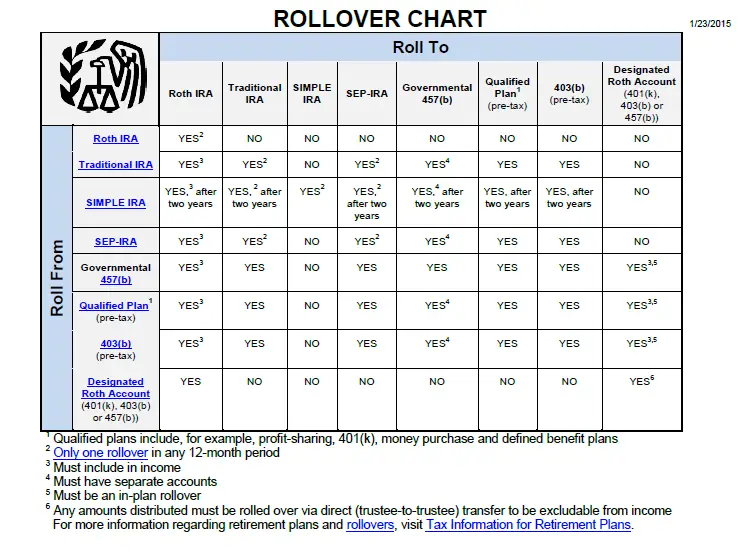

Can You Rollover A 401k Into A Simple Ira 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/irs_ira_rollover_chart_401k_sep_457_roth_simple-invest-with-steve.png

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

https://joduct.com/article/iras-corporate-tax-rates

Web 10 janv 2023 nbsp 0183 32 Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign companies Corporate

3 Ways For Fast And Easy Filing This Corporate Tax Season 2022 SME

Is Property Tax Rebate Taxable Iras PRORFETY

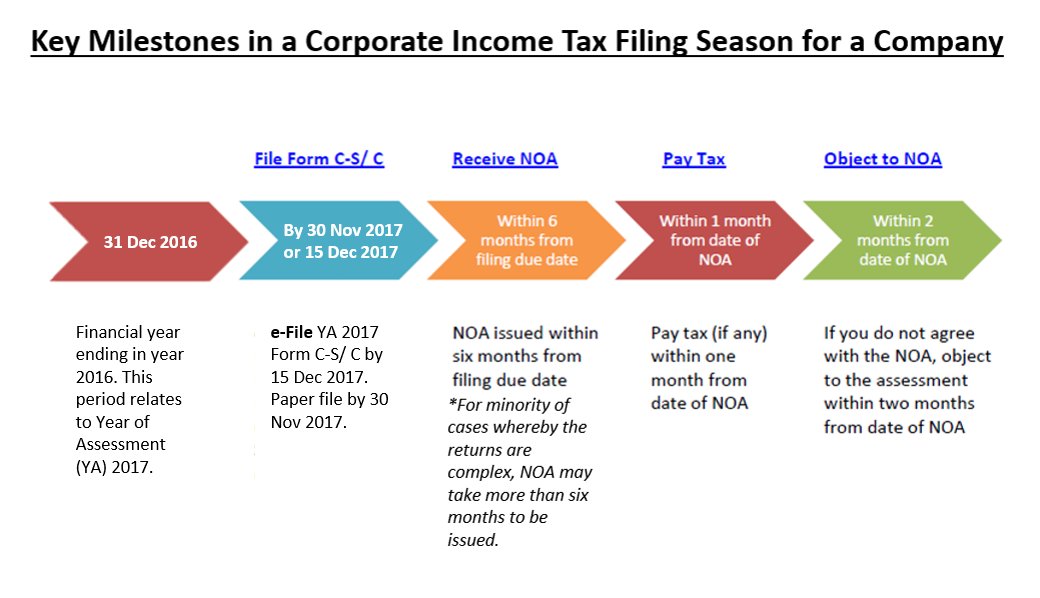

IRAS On Twitter Filed Your Company s Income Tax And Not Sure What s

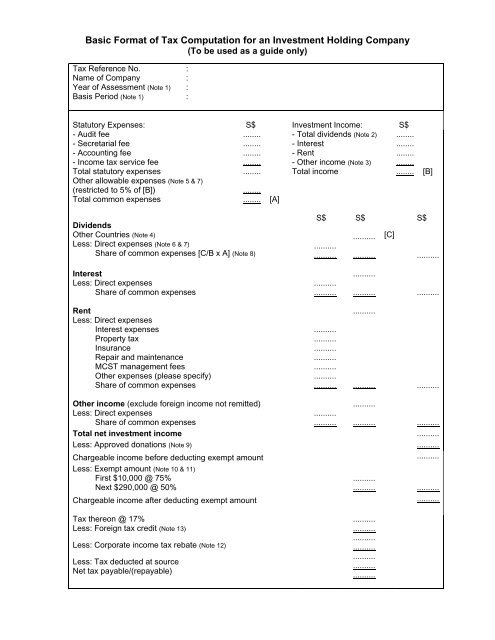

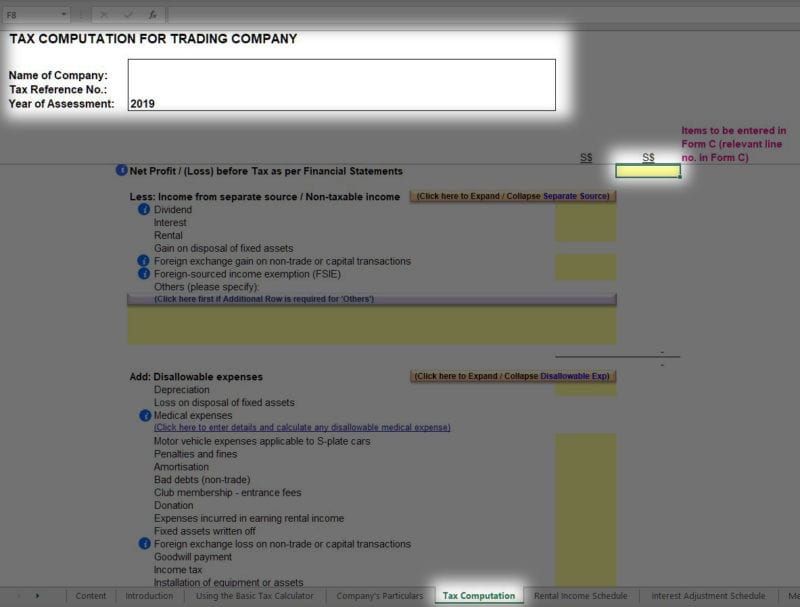

Basic Format Of Tax Computation For An Investment Holding IRAS

Government Rebate Program Fill Out Sign Online DocHub

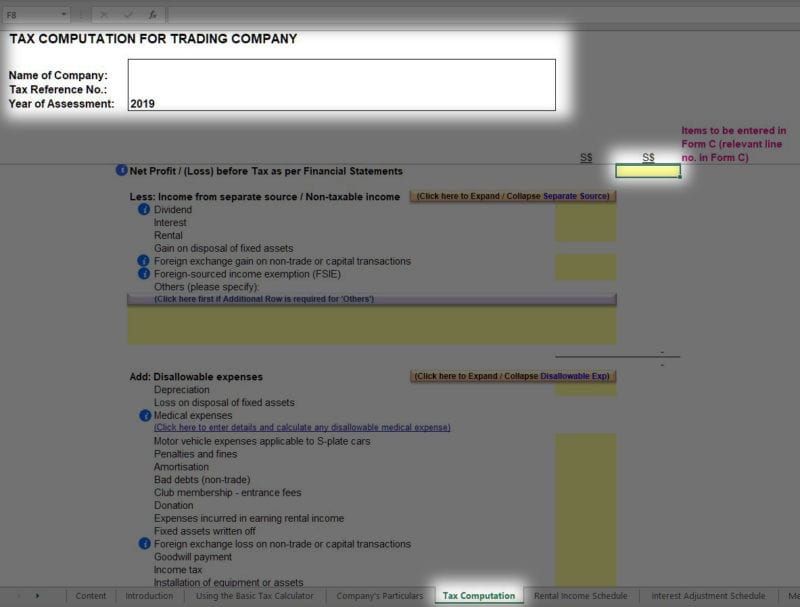

Singapore Tax Guide IRAS Corporate Tax Calculator Paul Wan Co

Singapore Tax Guide IRAS Corporate Tax Calculator Paul Wan Co

Pin On Tigri

Donation Exemption For Income Tax Malaysia Amy Dyer

Singapore Income Tax Calculator CorporateGuide Singapore

Iras Company Tax Rebate - Web 8 sept 2023 nbsp 0183 32 WASHINGTON Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Service