Iras Donation Tax Rebate Web Corporate Income Tax Rebates Corporate Income Tax rebates are given to companies to ease their business costs and to support their restructuring These rebates are

Web 19 mars 2021 nbsp 0183 32 2 1 When a donor receives a benefit in return for the donation made to an IPC a 2 5 times tax deduction is granted only on the difference between the donation Web 2 mars 2023 nbsp 0183 32 2 1 IPCs and Grant makers may use this guide to determine whether the contribution which they receive should a be regarded as a donation or sponsorship

Iras Donation Tax Rebate

Iras Donation Tax Rebate

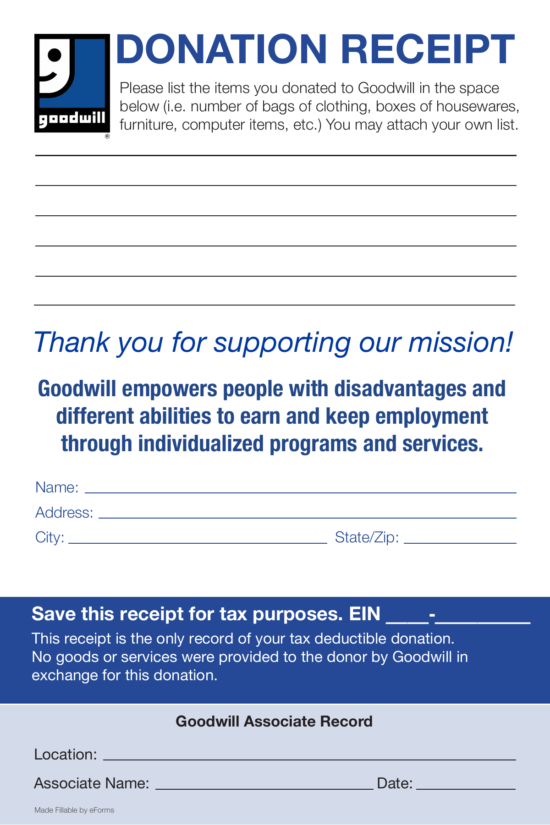

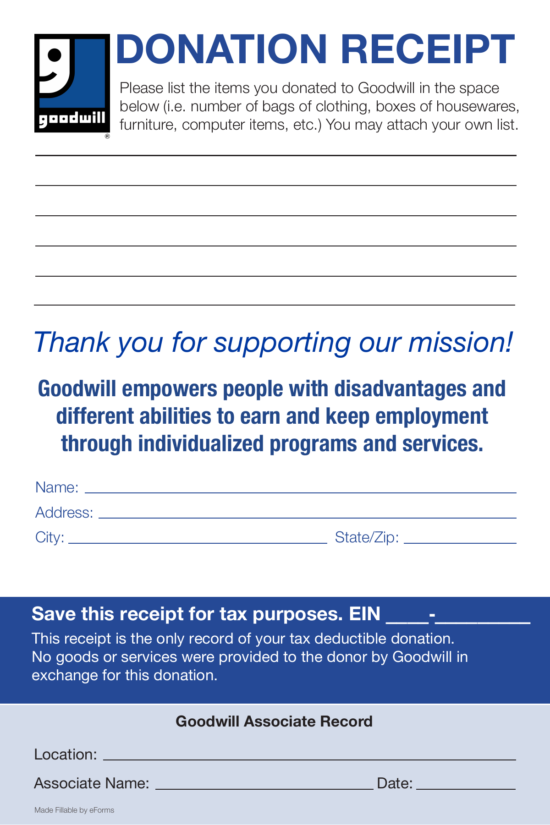

https://eforms.com/images/2018/05/Goodwill-Donation-Receipt-550x825.png

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Web 27 juil 2023 nbsp 0183 32 1 Cash Donations Cash donations made to an approved Institution of a Public Character IPC or the Singapore Government for causes that benefit the local Web 7 avr 2022 nbsp 0183 32 The TCJA significantly increases the standard deduction amounts For 2022 it is 25 900 for married joint filing couples 19 400 for heads of household and

Web 1 juil 2022 nbsp 0183 32 Leonard Sloane July 1 2022 1 00 pm ET Little known nuances with qualified charitable distributions can make a difference for your taxes Photo Getty Web 20 d 233 c 2022 nbsp 0183 32 For a retiree in the 24 tax bracket an IRA charitable contribution of 5 000 could reduce your income tax bill by 1 200 Even a 1 000 donation would save you

Download Iras Donation Tax Rebate

More picture related to Iras Donation Tax Rebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

Random Thoughts Does Donating Money Actually Save You More Money From

https://medicine.nus.edu.sg/giving/wp-content/uploads/sites/8/2020/04/Illustration-3-5-1024x558-1.jpg

Government Rebate Program Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/983/11983077/large.png

Web 21 juil 2020 nbsp 0183 32 While the QCD amount is not taxed you may not then claim the distribution as a charitable tax deduction Individual donors can transfer up to 100 000 per year or Web 25 f 233 vr 2023 nbsp 0183 32 But account holders aged 70 189 or older who make a contribution directly from a traditional IRA to a qualified charity can donate up to 100 000 without it being

Web 22 oct 2018 nbsp 0183 32 With a QCD you can give up to 100 000 annually from your IRA to charity and have that count as your RMD The distribution isn t included in your adjusted gross Web Tax Deductibility of Donations Please visit the Inland Revenue Authority of Singapore IRAS website for more information on the various types of donations which will qualify

Donate Your Tax Return To UNICEF NZ

https://cdn.filestackcontent.com/cZXomloxQsCvENF8Me5N

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Corporate Income Tax Rebates Corporate Income Tax rebates are given to companies to ease their business costs and to support their restructuring These rebates are

https://www.iras.gov.sg/media/docs/default-source/e-tax/eta…

Web 19 mars 2021 nbsp 0183 32 2 1 When a donor receives a benefit in return for the donation made to an IPC a 2 5 times tax deduction is granted only on the difference between the donation

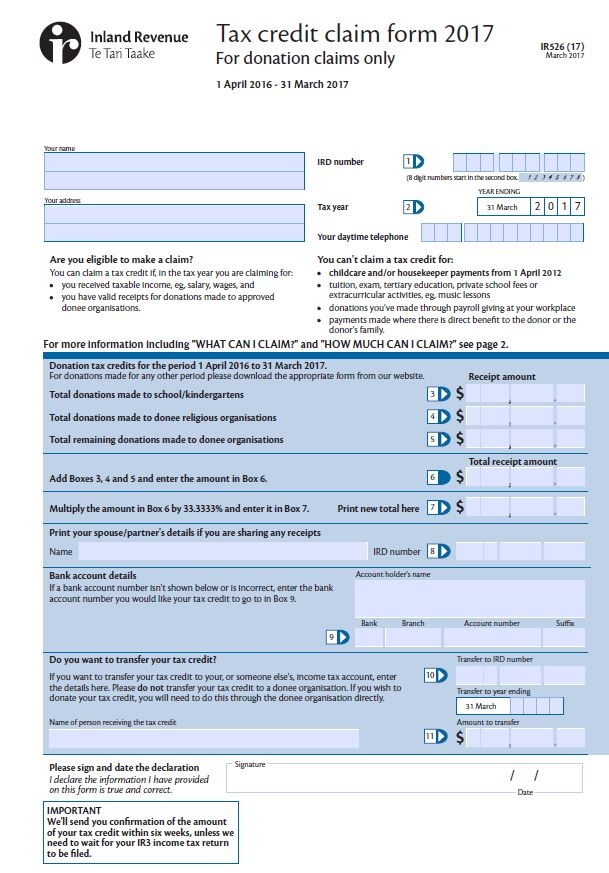

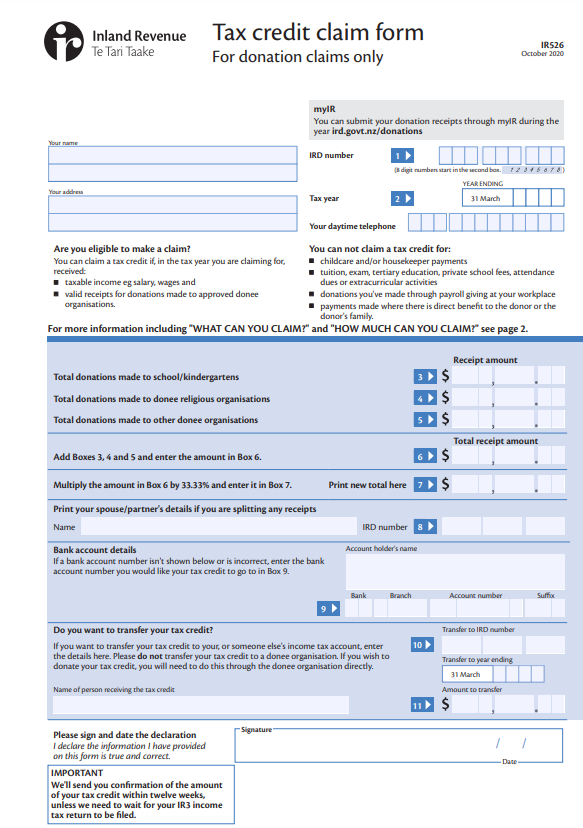

Emigrate Or Immigrate Ir526 Form

Donate Your Tax Return To UNICEF NZ

How To Get Maximum Tax Rebate On Donation In USA

Letter From IRAS On Tax Reliefs And Rebate

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

Donation Value Guide 2022 Spreadsheet Fill Online Printable

Donation Value Guide 2022 Spreadsheet Fill Online Printable

Ads responsive txt Goodwill Donation Form For Taxes Fresh Goodwill

Anne Sheets Non Cash Charitable Contributions Donations Worksheet 2019 Pdf

Tax Rebate For Individual Deductions For Individuals reliefs

Iras Donation Tax Rebate - Web 27 juil 2023 nbsp 0183 32 1 Cash Donations Cash donations made to an approved Institution of a Public Character IPC or the Singapore Government for causes that benefit the local