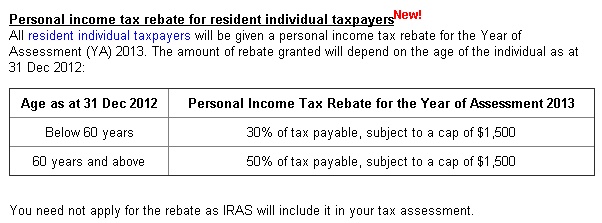

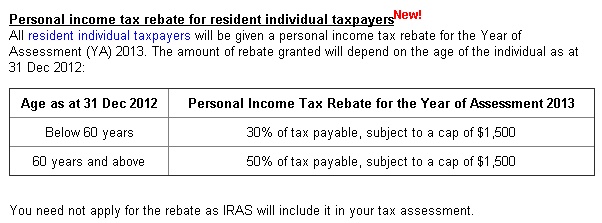

Iras Tax Rebate For Parents Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

Web Less Parenthood Tax Rebate 1 040 Mr and Mrs Chen are sharing the PTR of 5 000 for their first child born in 2022 i e 2 500 per person Any unutilised amount of PTR will Web IRAS The Parenthood Tax Rebate and Qualifying Child Facebook IRAS April 3 2022 183 The Parenthood Tax Rebate and Qualifying Child Relief Handicapped Child Relief are available to all eligible parents

Iras Tax Rebate For Parents

Iras Tax Rebate For Parents

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

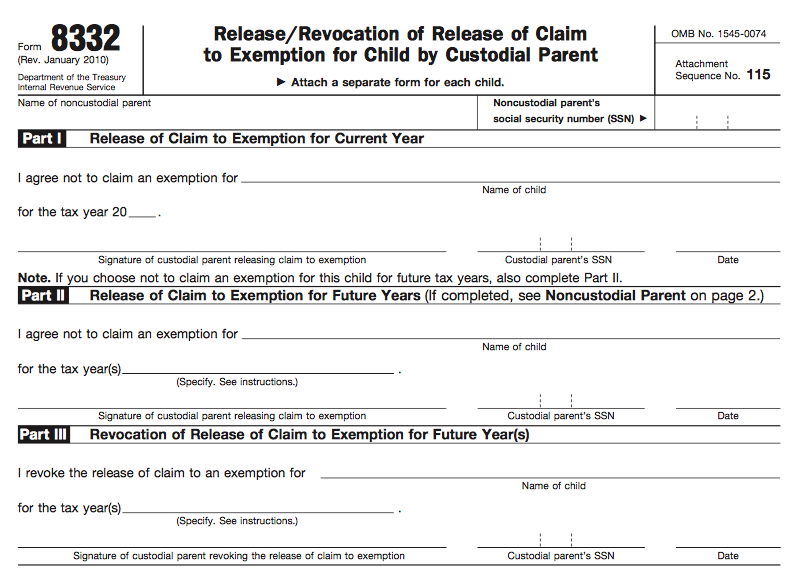

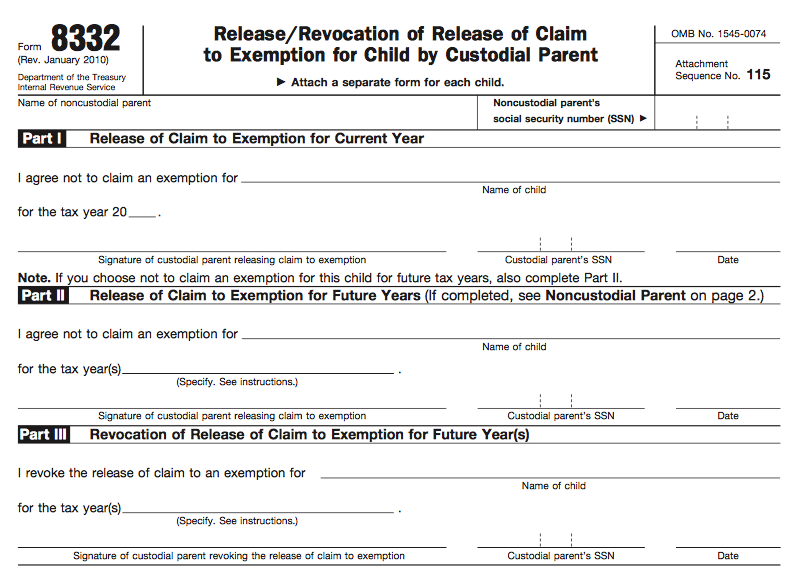

Printable 8332 Form Printable Forms Free Online

https://yourtaxmatterspartner.com/wp-content/uploads/2021/03/f8332.png

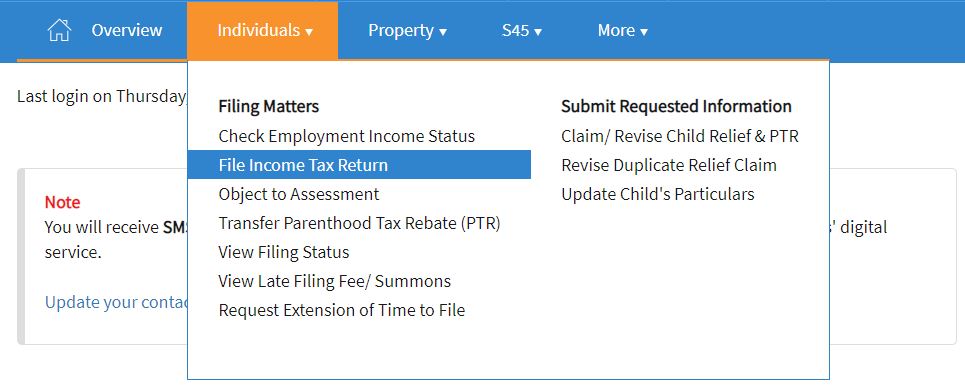

Parenthood Tax Rebate Guide For Singapore Parents

https://raisingangels.sg/wp-content/uploads/2021/11/PTR2.jpg

Web 26 janv 2022 nbsp 0183 32 Families who added a dependent such as a parent a nephew or niece or a grandchild on their 2021 income tax return who was not listed as a dependent on Web 18 ao 251 t 2021 nbsp 0183 32 Retirement and taxes Understanding IRAs IRS Tax Tip 2021 121 August 18 2021 Individual Retirement Arrangements or IRAs provide tax incentives for people

Web 26 juil 2021 nbsp 0183 32 The money doesn t need to come from the child Parents and grandparents can fund the IRA on behalf of the child as long as the amount is not greater than the Web May 3 2020 183 Parenthood Tax Rebate PTR can be shared between you and your spouse To transfer unutilised PTR to your spouse log in to myTax Portal gt Transfer PTR to

Download Iras Tax Rebate For Parents

More picture related to Iras Tax Rebate For Parents

IRAS Tax Savings For Married Couples And Families

https://www.iras.gov.sg/media/images/default-source/uploadedimages/pages/tax-savings.png?sfvrsn=80db0649_0

How Much Tax Savings For A Child Tax Walls

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.17-PM-1024x450.png

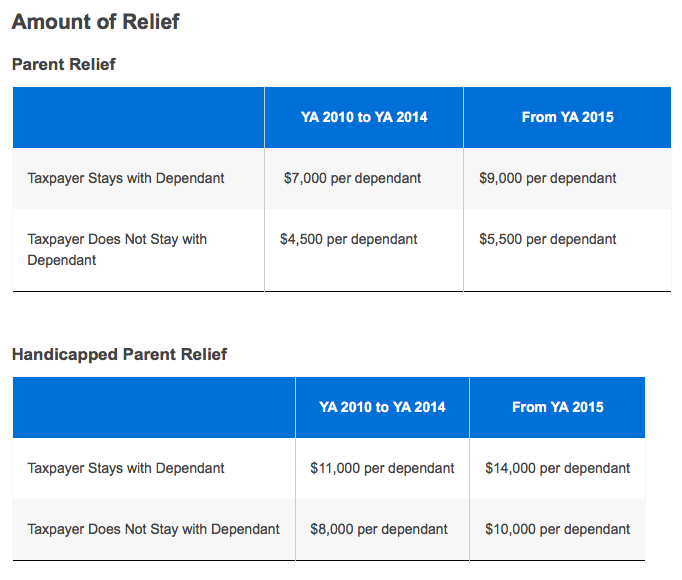

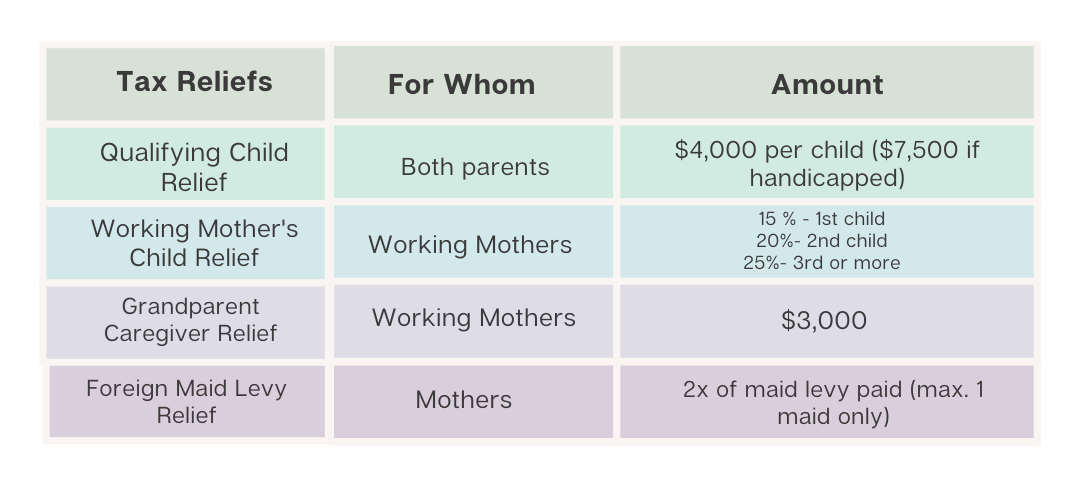

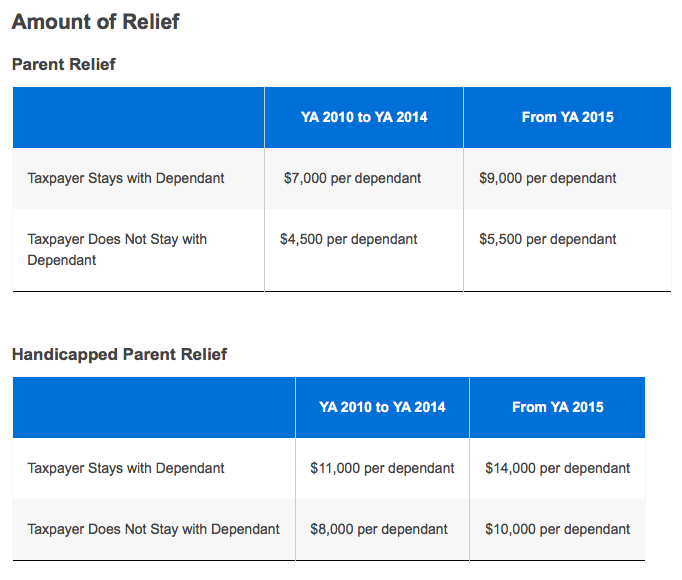

Web Parent Handicapped Parent Relief Grandparent Caregiver Relief Handicapped Brother Sister Relief CPF Provident Fund Life Insurance Course Fees Foreign Maid Levy Web 3 mars 2015 nbsp 0183 32 Taxpayers who support their parents can also enjoy an increase in parent relief of 1000 to 3000 In addition that parent relief can now be shared among

Web 1 janv 2010 nbsp 0183 32 Two 65 year old fathers in the 28 tax bracket have traditional IRAs each containing 100 000 Each parent also has 28 000 in a taxable account Each parent Web If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and

R Maximum Tax Savings Calculator For Shared Parent Relief The Boy

https://2.bp.blogspot.com/-J4HqjyEeagY/WsJOCs4AJvI/AAAAAAAAAK0/an0VKOEzNMkuvdV5TG9zQdp9wIrRFlkwgCLcBGAs/s1600/Screenshot%2B2018-04-02%2B23.35.56.png

6 Super Sources Of Tax Relief For Parents Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2019/04/tax_relief_for_parents.png

https://www.iras.gov.sg/.../tax-reliefs/parenthood-tax-rebate-(ptr)

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web Less Parenthood Tax Rebate 1 040 Mr and Mrs Chen are sharing the PTR of 5 000 for their first child born in 2022 i e 2 500 per person Any unutilised amount of PTR will

YA2023 Reducing Your Personal Income Tax In Six Ways SG Financial Advice

R Maximum Tax Savings Calculator For Shared Parent Relief The Boy

.png?sfvrsn=d0aa2658_3)

IRAS Parent Relief Handicapped Parent Relief 2022

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

Schemes And Benefits

Bulicenas Singapore Tax Rebates

Bulicenas Singapore Tax Rebates

1040 Worksheets

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

IRAs Demystified Roth IRAs Traditional IRAs 401Ks

Iras Tax Rebate For Parents - Web 26 janv 2022 nbsp 0183 32 Families who added a dependent such as a parent a nephew or niece or a grandchild on their 2021 income tax return who was not listed as a dependent on