Irs Car Mileage Reimbursement Rate IR 2023 239 Dec 14 2023 The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an

For the 2024 tax year taxes filed in 2025 the IRS standard mileage rates are 67 cents per mile for business 14 cents per mile for charity 21 cents per mile for The standard mileage rate is 17 cents per mile for use of an automobile 1 for medical care described in 213 or 2 as part of a move for which the expenses are deductible

Irs Car Mileage Reimbursement Rate

Irs Car Mileage Reimbursement Rate

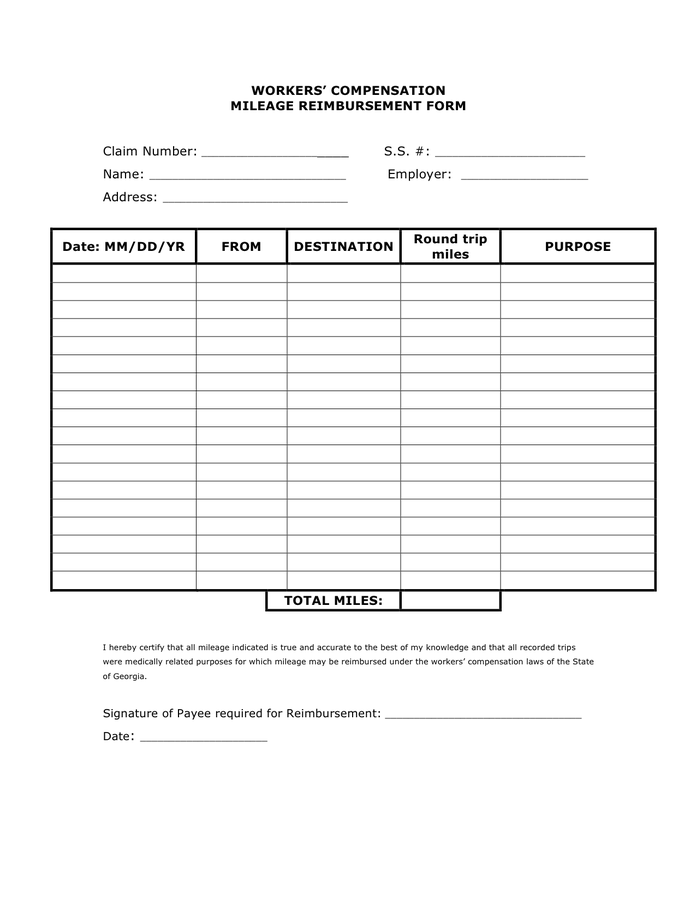

https://irs-mileage-rate.com/wp-content/uploads/2021/08/workers-compensation-mileage-reimbursement-form-in-word.png

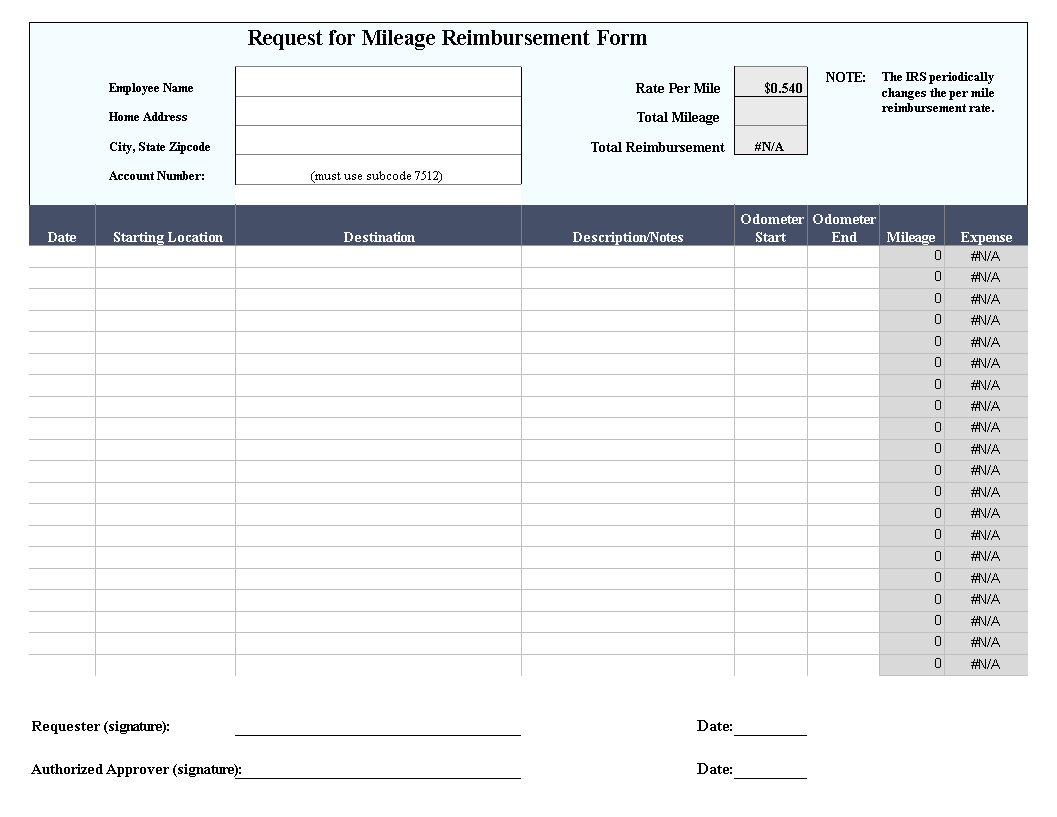

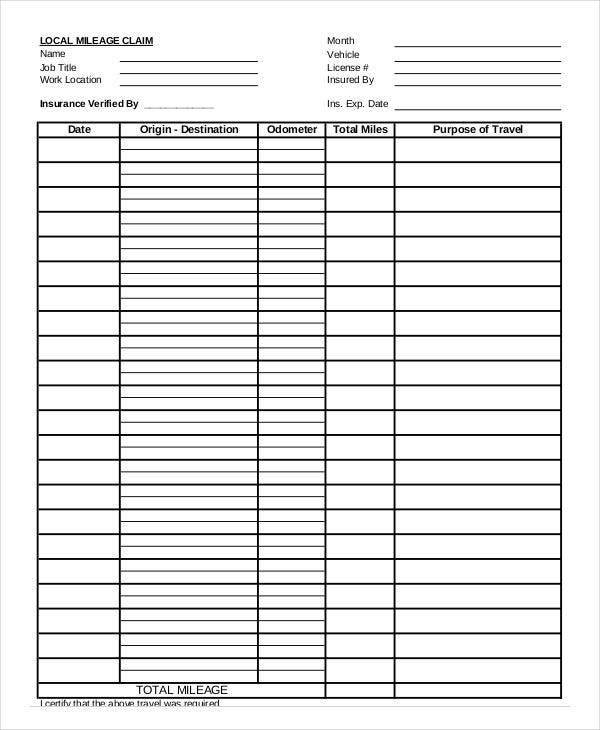

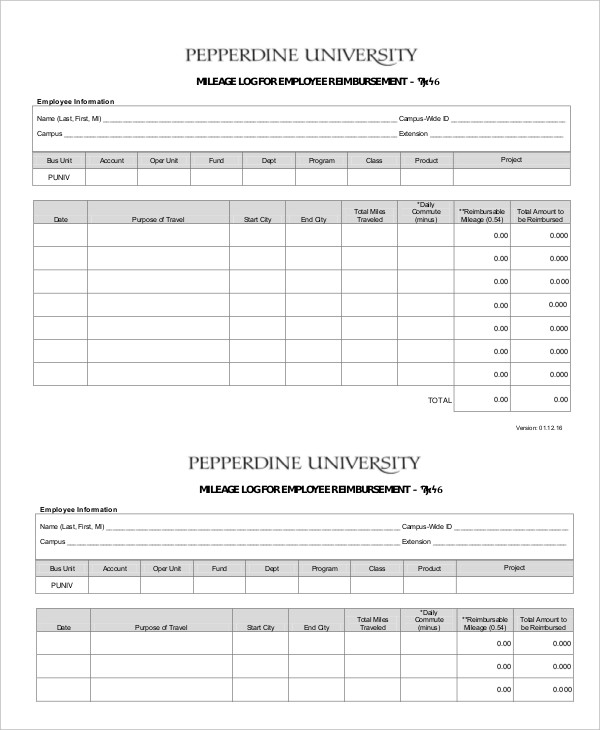

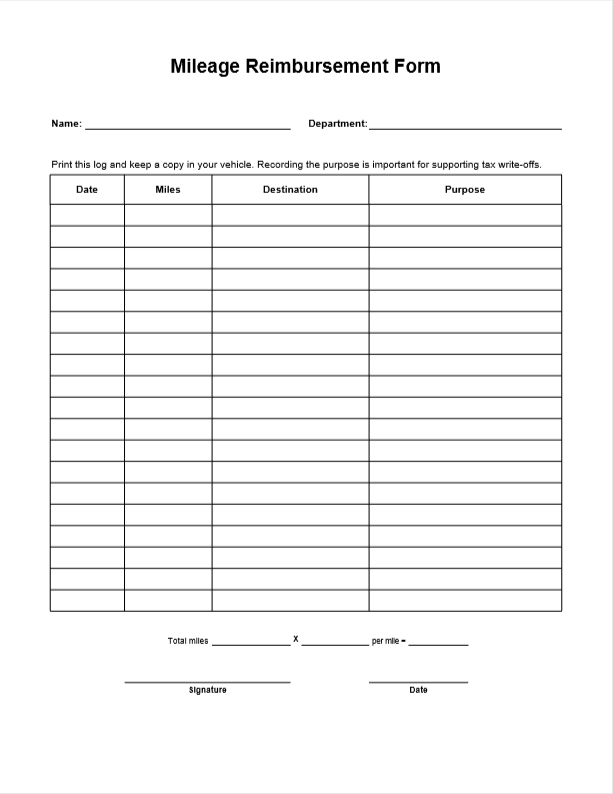

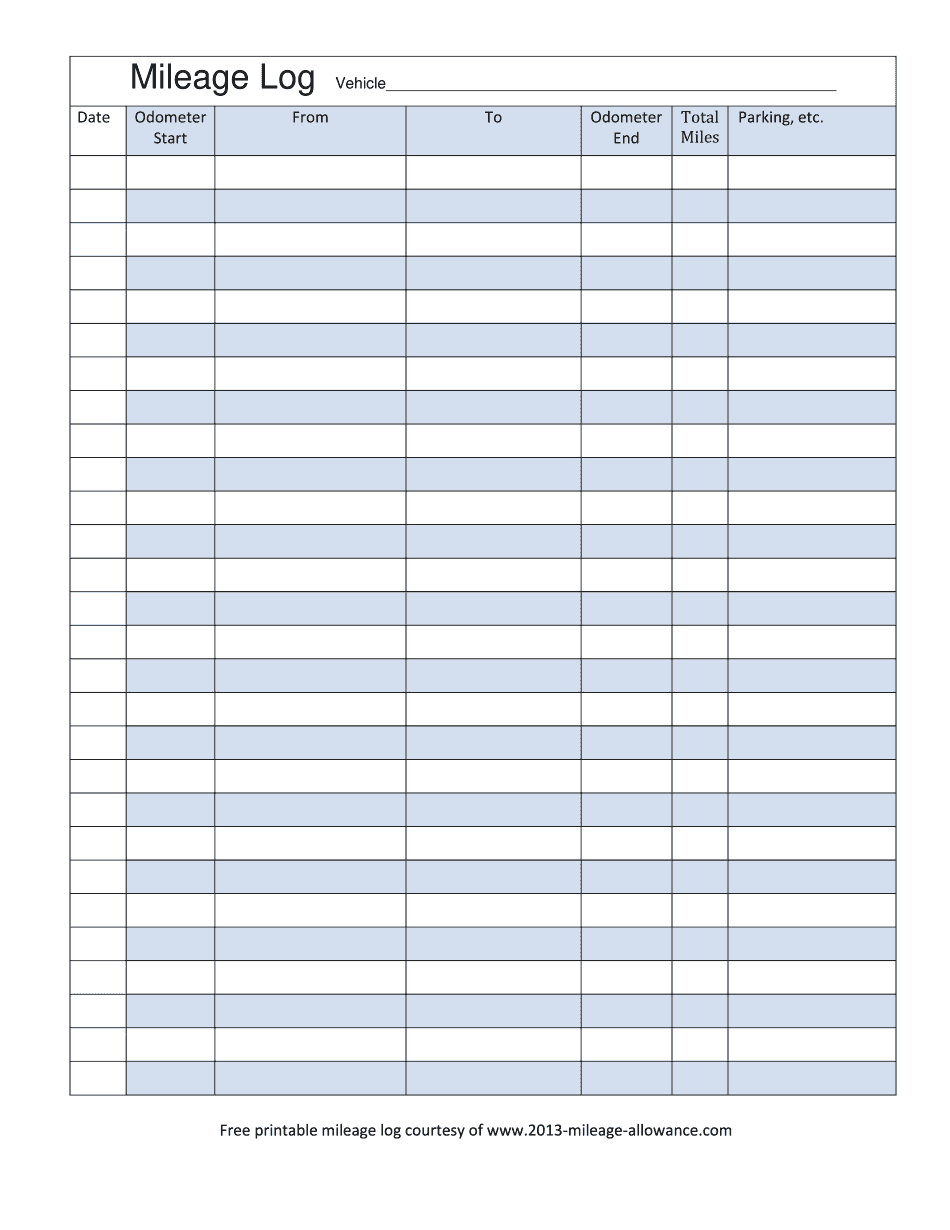

Example Of 25 Printable Irs Mileage Tracking Templates Gofar Mileage

https://i.pinimg.com/originals/5b/93/c0/5b93c0ebe22d3e39de585887378000ba.jpg

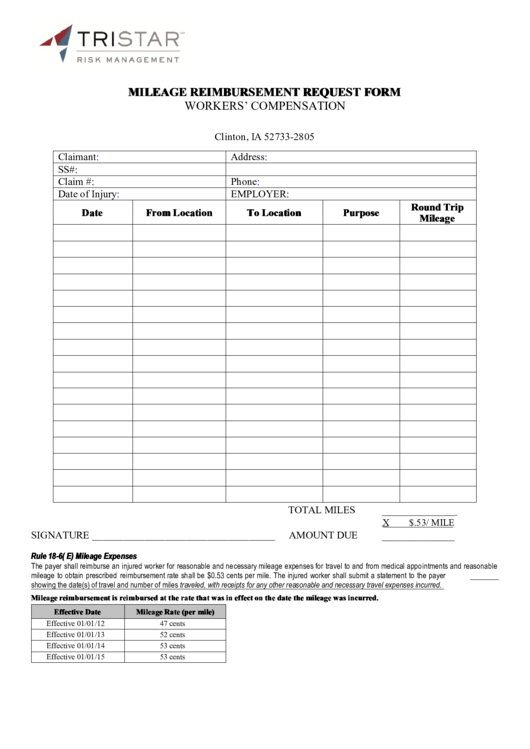

Mileage Reimbursement Form Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/5f634cf1-5ca0-4565-ba45-295807c95ab4_1.png

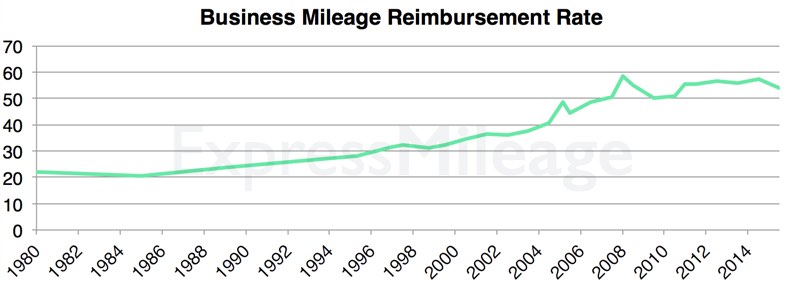

For 2023 the business standard mileage rate is 65 5 cents per mile a 3 cent increase from the 62 5 cent rate that applied during the second half of 2022 see our Checkpoint article The rate when an You can generally figure the amount of your deductible car expense by using one of two methods the standard mileage rate method or the actual expense method If

Notice 2023 3 PDF 105 KB provides that beginning January 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 65 5 cents per mile The IRS has increased the standard mileage rates to 65 5 cents per miles for business purposes in 2023 up from 58 5 cents in early 2022 and 62 5 cents in the

Download Irs Car Mileage Reimbursement Rate

More picture related to Irs Car Mileage Reimbursement Rate

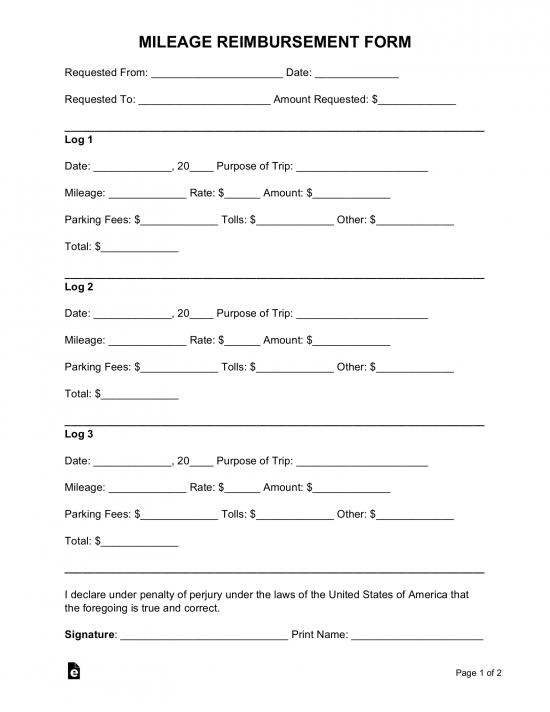

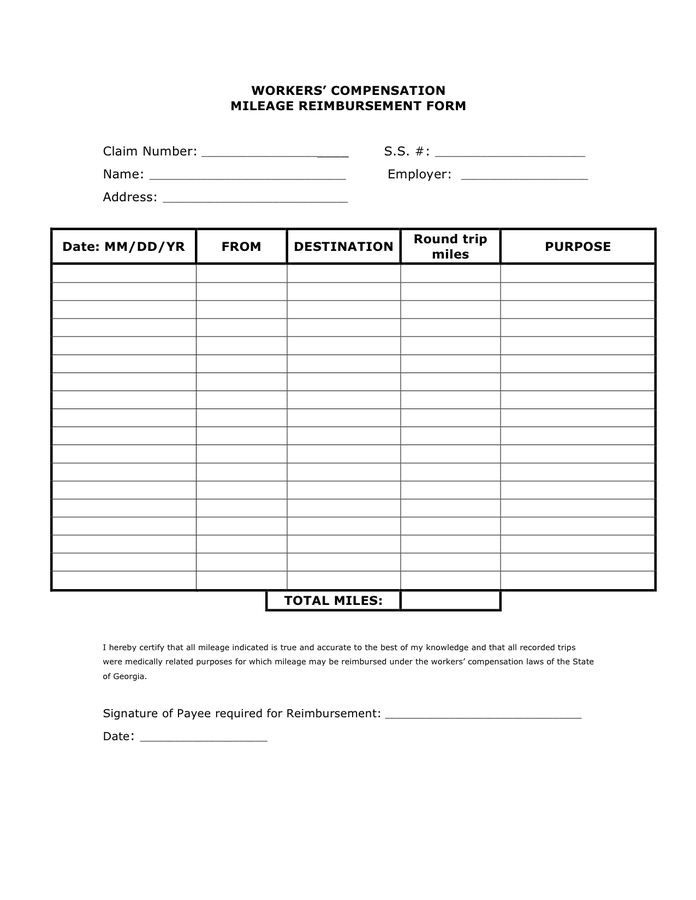

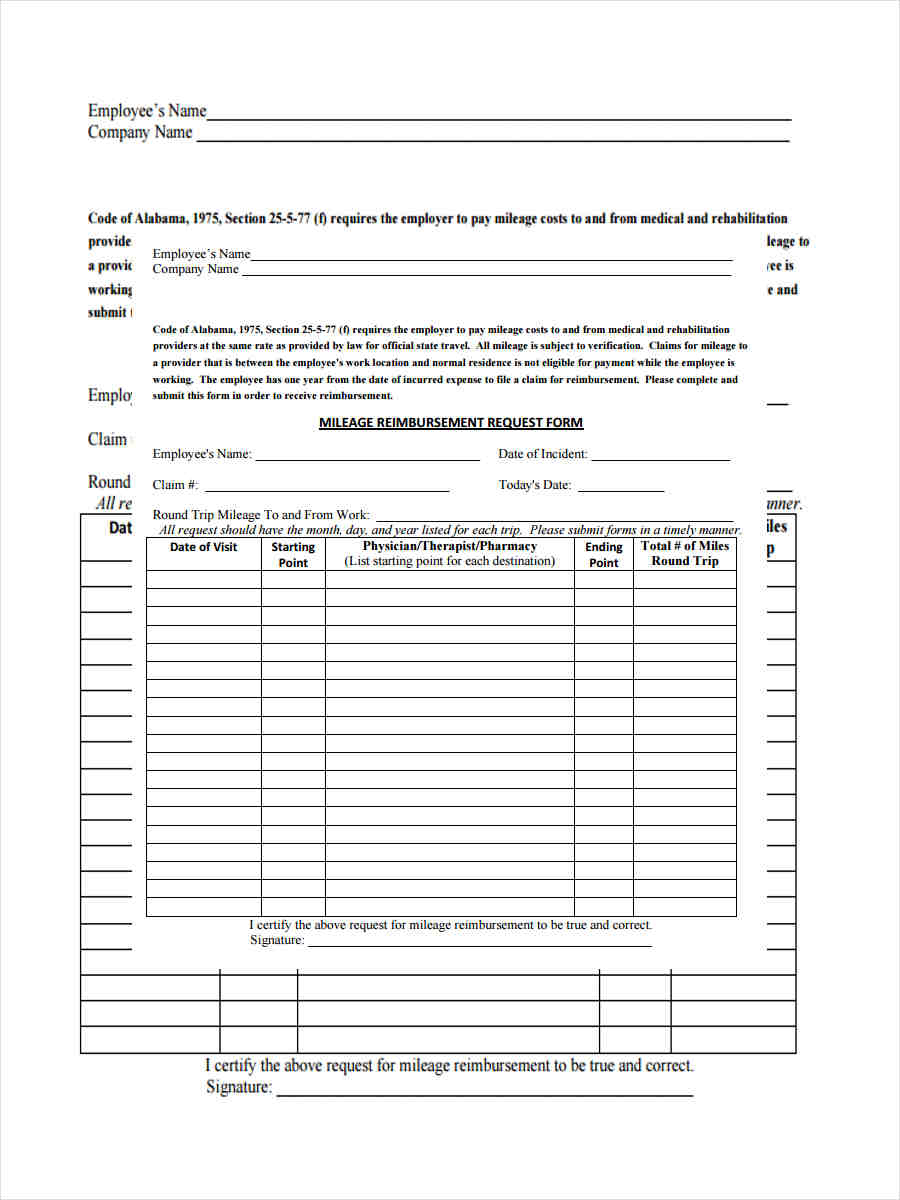

Free Mileage Reimbursement Form 2023 IRS Rates PDF Word EForms

https://eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form-550x712.png

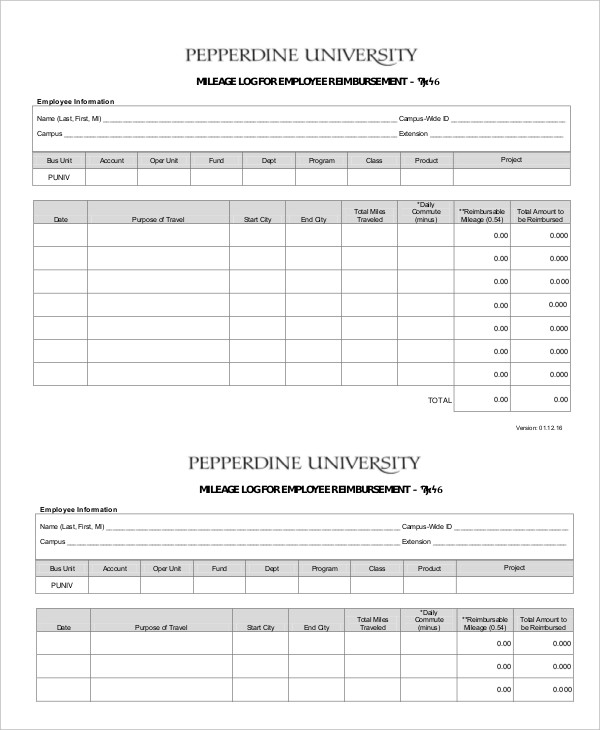

Free Mileage Log Templates Smartsheet

https://www.smartsheet.com/sites/default/files/IC-Standard-Milage-Rates.jpg

33 Calculate Mileage From Home To Work CaelybMylie

https://i.ytimg.com/vi/h1c1_mSK_LU/maxresdefault.jpg

The Internal Revenue Service IRS just released standard mileage rates that taxpayers must use when filing 2022 income taxes in 2023 if they are claiming a mileage deduction for a vehicle they The new 2023 standard mileage rate to deduct operating costs and expenses is 65 5 cents per mile and the maximum standard automobile cost for

The standard mileage rate is 22 cents per mile for use of an automobile 1 for medical care described in 213 or 2 as part of a move for which the expenses What is the 2024 federal mileage reimbursement rate According to the IRS the mileage rate is set yearly based on an annual study of the fixed and variable costs

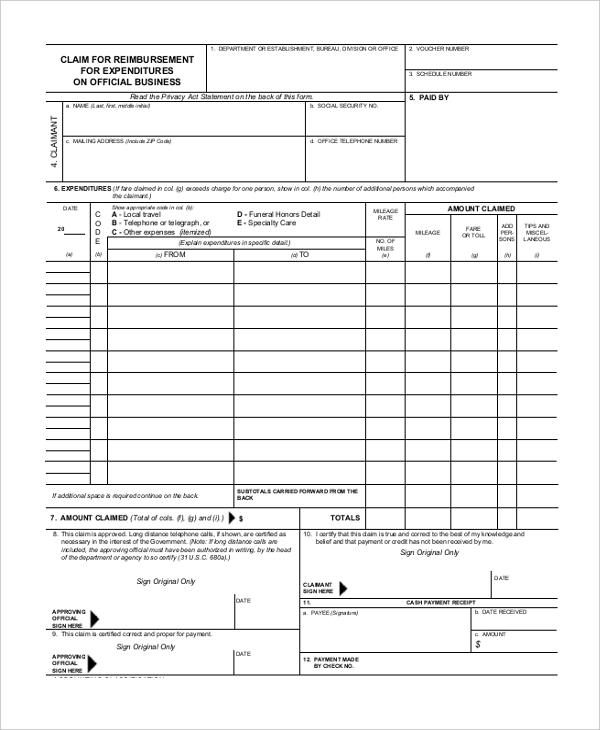

Mileage Reimbursement Form 10 Free Sample Example Format

https://images.template.net/wp-content/uploads/2016/12/20050052/Employee-Mileage-Reimbursement-Form.jpg

Mileage Reimbursement Form IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/mileage-reimbursement-form-9-free-sample-example-1.jpg

https://www.irs.gov/newsroom/irs-issues-standard...

IR 2023 239 Dec 14 2023 The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an

https://www.nerdwallet.com/article/taxes/irs-standard-mileage-rate

For the 2024 tax year taxes filed in 2025 the IRS standard mileage rates are 67 cents per mile for business 14 cents per mile for charity 21 cents per mile for

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

Mileage Reimbursement Form 10 Free Sample Example Format

2023 Standard Mileage Rates Released By IRS

Mileage Reimbursement Form Edit Forms Online PDFFormPro

Mileage Reimbursement Rates ExpressMileage

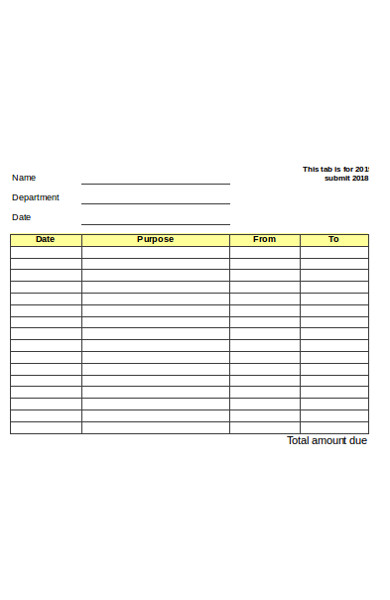

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

Irs Mileage Rate 2021 Form Mileage Reimbursement 2021

Fillable Mileage Reimbursement Form IRS Mileage Rate 2021

Federal Law On Mileage Reimbursement IRS Mileage Rate 2021

Irs Car Mileage Reimbursement Rate - You can generally figure the amount of your deductible car expense by using one of two methods the standard mileage rate method or the actual expense method If