Irs Child Tax Credit 2022 Chart Web 31 Jan 2022 nbsp 0183 32 Q A1 What is the 2021 Child Tax Credit added January 31 2022 Q A2 What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3 How much of the Child Tax Credit can I claim on my 2021 tax

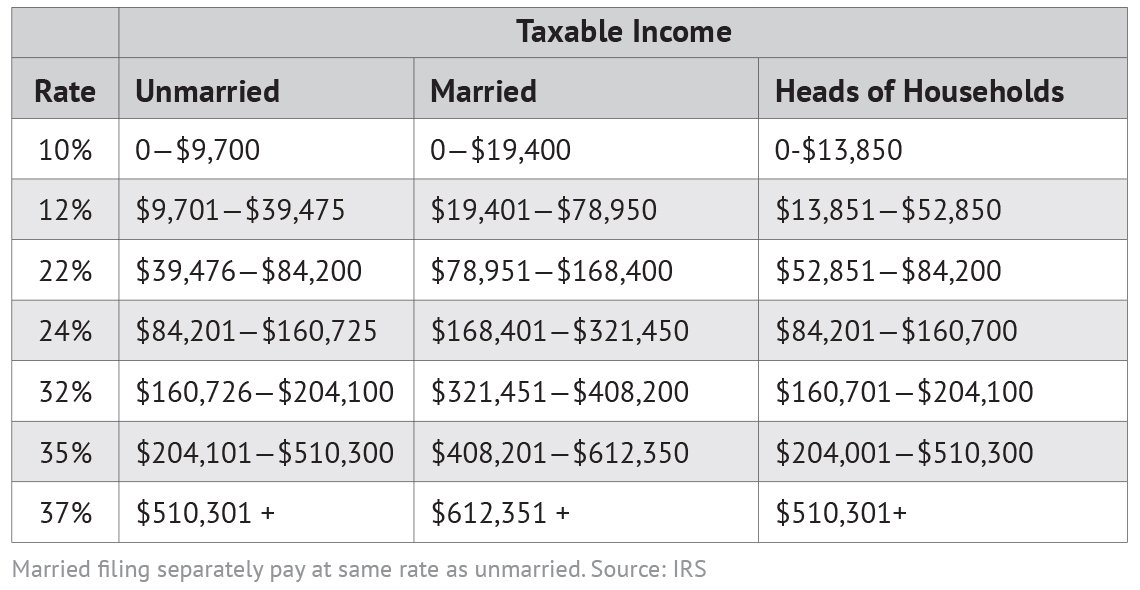

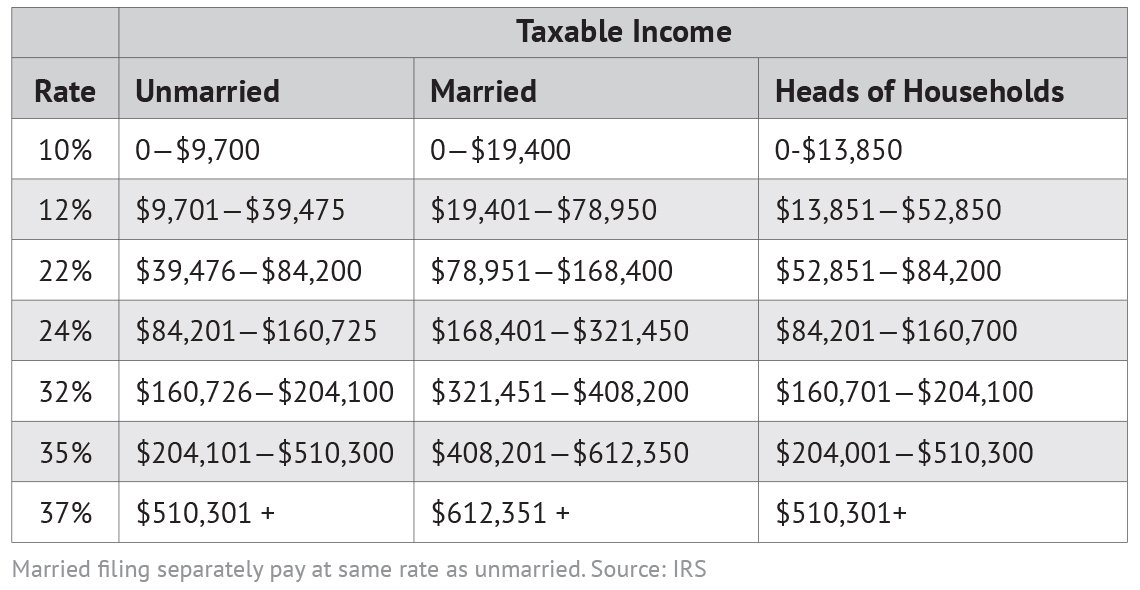

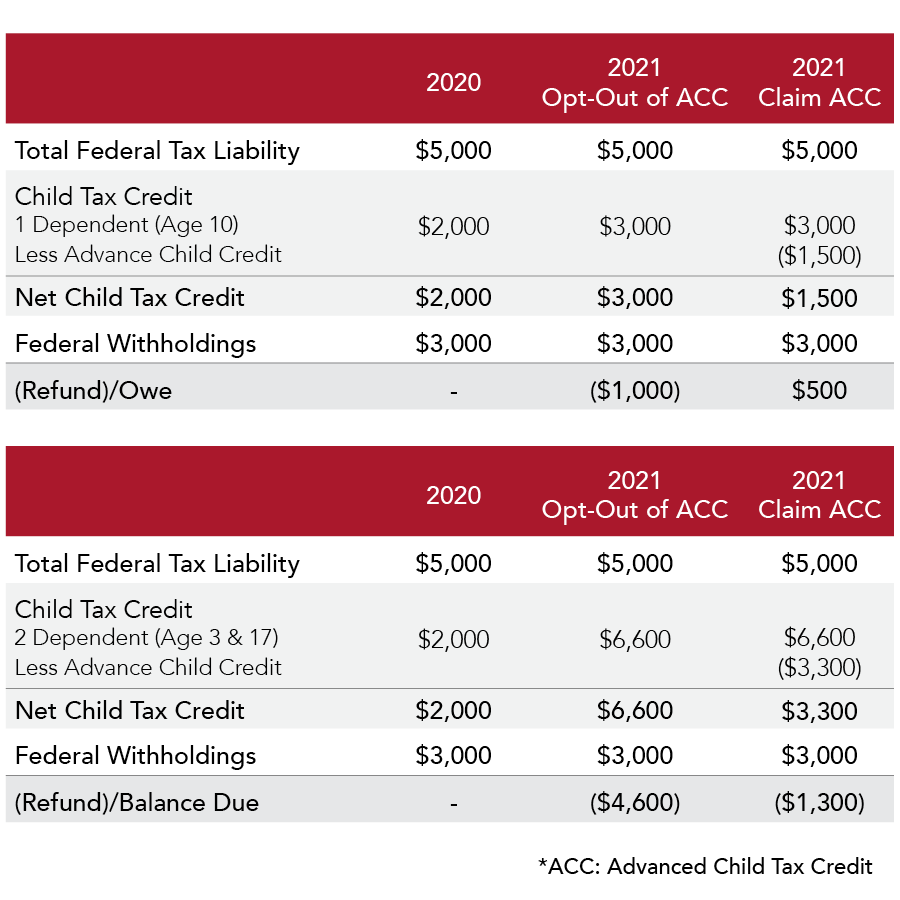

Web 24 Feb 2023 nbsp 0183 32 For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child Web Introduction Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC The CTC and ODC are nonrefundable credits The ACTC is a refundable credit

Irs Child Tax Credit 2022 Chart

Irs Child Tax Credit 2022 Chart

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T10-0248.GIF

Child Tax Credit 2022 Chart

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T11-0091.GIF

What Families Need To Know About The CTC In 2022 CLASP

https://www.clasp.org/wp-content/uploads/2022/04/CTC20_f202220Infographic_final_crop.png

Web Specifically the Child Tax Credit was revised in the following ways for 2021 The credit amount was increased for 2021 The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 Web 7 Jan 2022 nbsp 0183 32 A quick refresher Congress temporarily expanded the child tax credit for the 2021 tax year It made the credit more generous providing as much as 3 600 per child up from 2 000 And because it

Web For tax year 2022 the child tax credit pays up to 2 000 per eligible child That s a drop from 2021 levels That year the credit paid 3 600 per child for kids under age 6 For children ages Web 30 Okt 2021 nbsp 0183 32 For 2022 there would be 12 monthly payments under the Build Back Better plan but the maximums 250 or 300 per child would not change As with 2021 monthly payments it appears as if the IRS

Download Irs Child Tax Credit 2022 Chart

More picture related to Irs Child Tax Credit 2022 Chart

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

2022 Us Tax Brackets Irs

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

5 Ways Will There Be Child Tax Credit Payments In 2022 Outbackvoices

https://i2.wp.com/www.cpabr.com/assets/htmlimages/Articles/child tax credit payments chart.JPG

Web 24 Jan 2023 nbsp 0183 32 The Child Tax Credit for 2022 is worth up to 2 000 per child under the age of 17 Parents filing as single qualify for the full amount if their adjusted gross income is less than 200 000 Married taxpayers filing jointly get the whole credit if their income is less than 400 000 After those thresholds the credit is phased out Web 14 Dez 2023 nbsp 0183 32 Page Last Reviewed or Updated 14 Dec 2023 This table displays the basic eligibility rules for tax credits and benefits available to you if you have a dependent qualifying child We provide the rules for the following child related tax benefits

Web 15 Dez 2023 nbsp 0183 32 The child tax credit is limited to 2 000 for every you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers Web 2 M 228 rz 2020 nbsp 0183 32 2 000 The maximum amount of the child tax credit per qualifying child 1 400 The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax 500 The maximum amount of the credit for other dependents for each qualifying dependent who isn t eligible to be claimed for the

Child Tax Credit 2022 Income Phase Out Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t21-0190.gif

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/IG4VLKSRLRHOTKMRJGUAYSGUEA.jpg&w=1200

https://www.irs.gov/credits-deductions/tax-year-2021-filing-season...

Web 31 Jan 2022 nbsp 0183 32 Q A1 What is the 2021 Child Tax Credit added January 31 2022 Q A2 What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3 How much of the Child Tax Credit can I claim on my 2021 tax

https://theweek.com/finance/1021293/a-guide-to-the-2022-child-tax-credit

Web 24 Feb 2023 nbsp 0183 32 For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child

2022 Federal Tax Brackets And Standard Deduction Printable Form

Child Tax Credit 2022 Income Phase Out Latest News Update

Irs Earned Income Credit Worksheet 2022

Earned Income Credit 2022 Calculator INCOMEBAU

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Bestof You Federal Tax Withholding 2022 In The World The Ultimate Guide

Bestof You Federal Tax Withholding 2022 In The World The Ultimate Guide

2021 Child Tax Credit What Should I Know Collins Consulting

Earned Income Tax Credit Chart INCOBEMAN

2022 Child Tax Credit Chart Latest News Update

Irs Child Tax Credit 2022 Chart - Web 7 Jan 2022 nbsp 0183 32 A quick refresher Congress temporarily expanded the child tax credit for the 2021 tax year It made the credit more generous providing as much as 3 600 per child up from 2 000 And because it