Child Tax Rebate Payment Schedule 2023 Web 14 avr 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of

Web 1 ao 251 t 2023 nbsp 0183 32 Democrats seek a complete return of the expanded child tax credit from President Joe Biden s COVID 19 stimulus bill while Republicans are spearheading their Web 20 janv 2023 nbsp 0183 32 All payment dates July 12 2023 October 12 2023 January 12 2024 Haven t received your payment Wait 10 working days from the payment date to

Child Tax Rebate Payment Schedule 2023

Child Tax Rebate Payment Schedule 2023

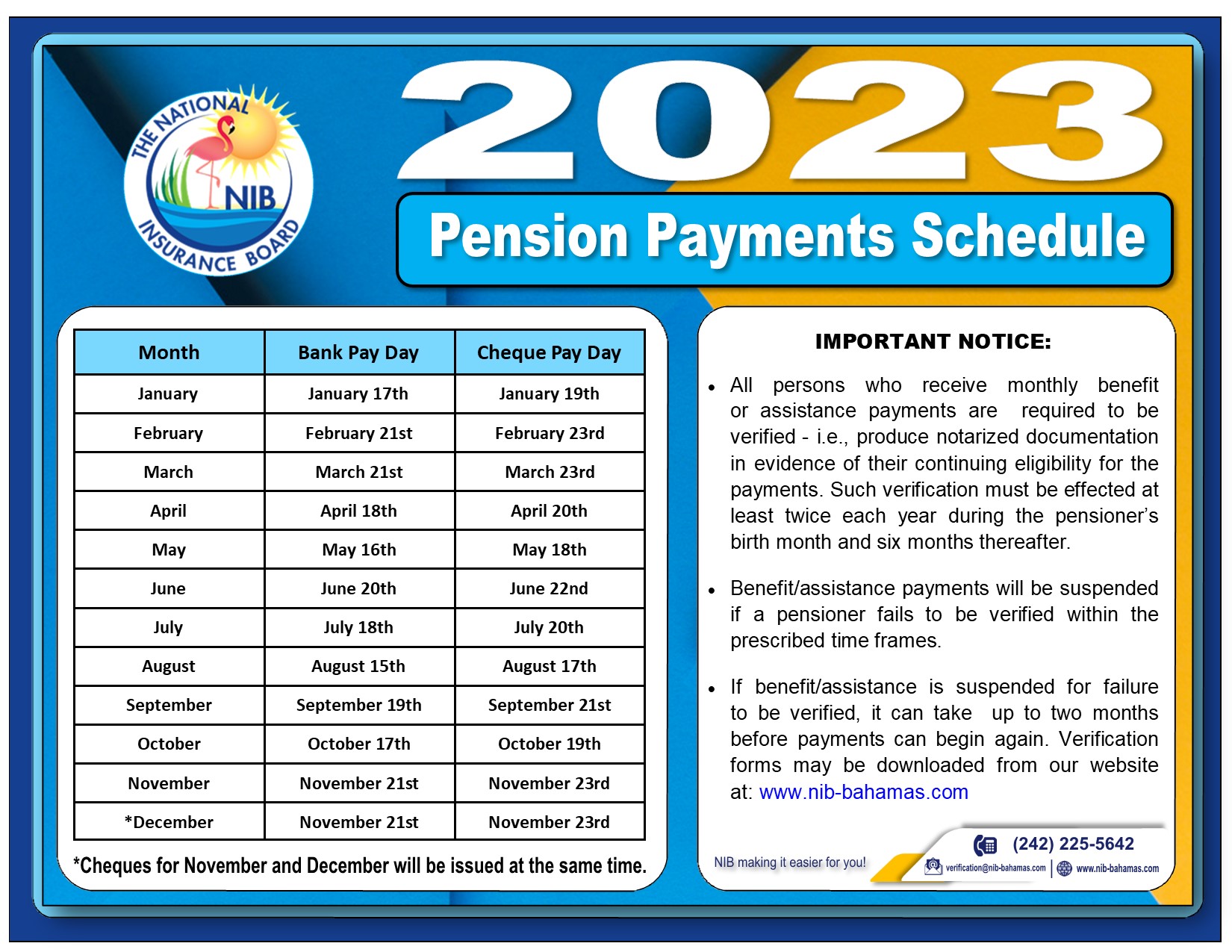

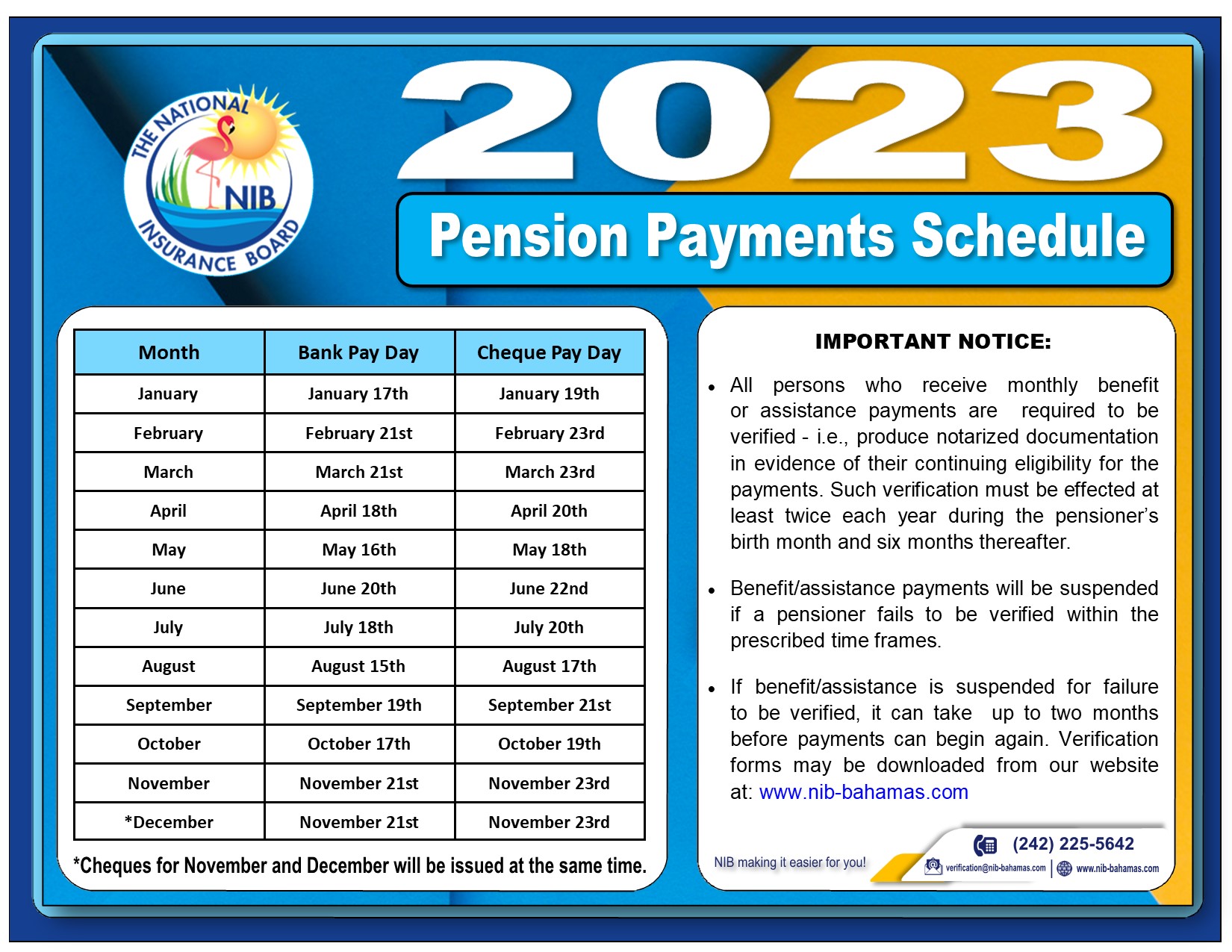

https://www.nib-bahamas.com/UserFiles/HTMLEditor/Pension Payment Schedule 2023.jpg

List Of Tax Refund Calendar 2022 Ideas Blank November 2022 Calendar

https://i2.wp.com/epicsidegigs.com/wp-content/uploads/2019/11/2020-IRS-Refund-Schedule-768x459.jpg

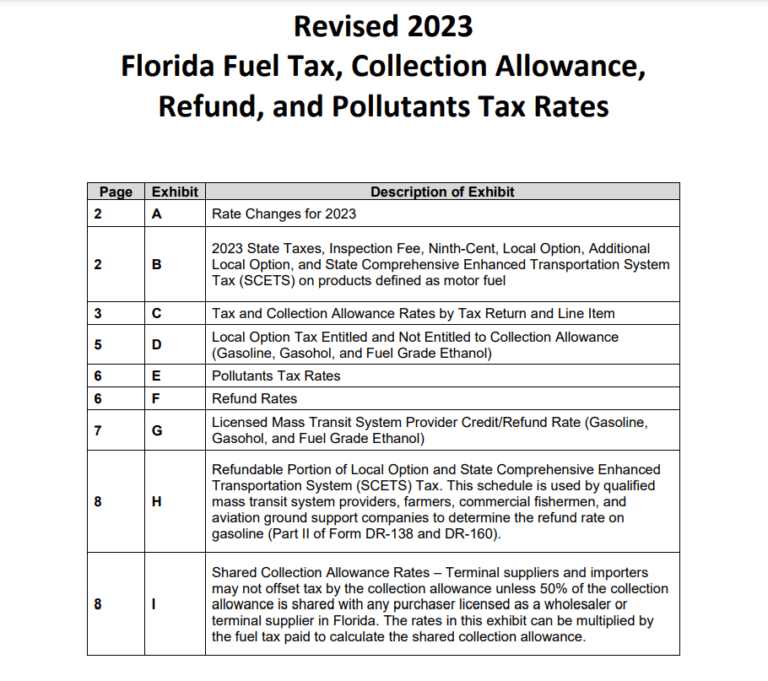

Florida Tax Rebate 2023 Get Tax Relief And Boost Economic Growth

https://printablerebateform.net/wp-content/uploads/2023/03/Florida-Tax-Rebate-2023-768x681.png

Web 6 juil 2023 nbsp 0183 32 For the 2023 tax year taxes filed in 2024 the maximum child tax credit will remain 2 000 per qualifying dependent but the partially refundable payment will increase up to 1 600 per the IRS Web 23 mai 2023 nbsp 0183 32 Credit amount The maximum Child Tax Credit is 3 600 per child under the age of six and 3 000 per child between the ages of six and 17 Monthly payments From July 15 to December 15 2021 the credit

Web 16 avr 2023 nbsp 0183 32 Taxpayers with eligible children in 2022 can claim a credit worth up to 2 000 per child This year the credit is partially refundable and there is an earnings threshold to start claiming the up Web 6 avr 2023 nbsp 0183 32 In the 2021 tax year which was filed in 2022 the Child Tax Credit was 3 600 for children 5 years old and under and 3 000 for children between 6 17 years

Download Child Tax Rebate Payment Schedule 2023

More picture related to Child Tax Rebate Payment Schedule 2023

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger.jpg?w=840&ssl=1

Child Tax Credit Payments Schedule Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/01/child-tax-credit-payments-schedule-1.jpg

Receive IRS Tax Rebates Payments 2023

https://images.unsplash.com/photo-1550565118-3a14e8d0386f?ixid=MnwyNTE2NnwwfDF8c2VhcmNofDE5fHxtb25leXxlbnwwfHx8fDE2NzY1NTYxNDQ&ixlib=rb-4.0.3&q=85&w=2160

Web 29 juin 2023 nbsp 0183 32 Child Tax Rebate Payment Schedule 2023 August 15 2023 June 29 2023 by tamble With many rebate options available in 2023 it s crucial that you know the Web 23 lignes nbsp 0183 32 Glasgow and Aberdeen local holiday on 25 September Edinburgh local holiday on 18 September Dundee local holiday on 2 October Contact your bank for

Web 17 ao 251 t 2023 nbsp 0183 32 The child tax credit is a tax benefit for people with qualifying children For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may Web In 2023 the maximum child tax credit will be 2 000 per child However it will only be available in the form of a tax refund However if you want to see the money sooner you

CT Child Tax Rebate 2023 Eligibility Claim Process Important Dates

https://www.tax-rebate.net/wp-content/uploads/2023/04/Ct-Child-Tax-Rebate-2023.jpg

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

https://www.cnet.com/personal-finance/taxes/…

Web 14 avr 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of

https://www.usatoday.com/story/news/politics/2023/08/01/revive...

Web 1 ao 251 t 2023 nbsp 0183 32 Democrats seek a complete return of the expanded child tax credit from President Joe Biden s COVID 19 stimulus bill while Republicans are spearheading their

Fred Meyer Rebate Schedule 2023 Printable Rebate Form

CT Child Tax Rebate 2023 Eligibility Claim Process Important Dates

Georgia Income Tax Rebate 2023 Printable Rebate Form

Financial Relief For Families How To Get Your Share Of Direct

Maine Tax Relief 2023 Printable Rebate Form

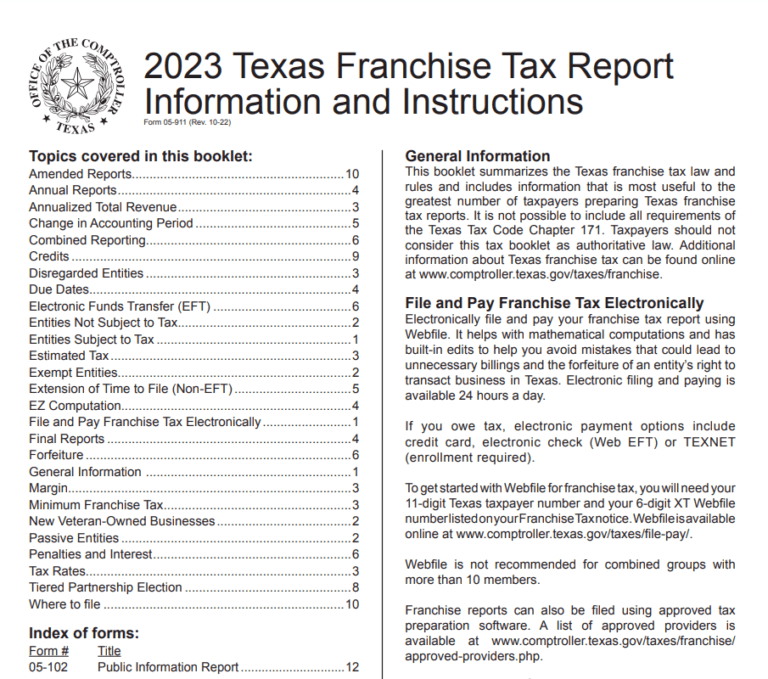

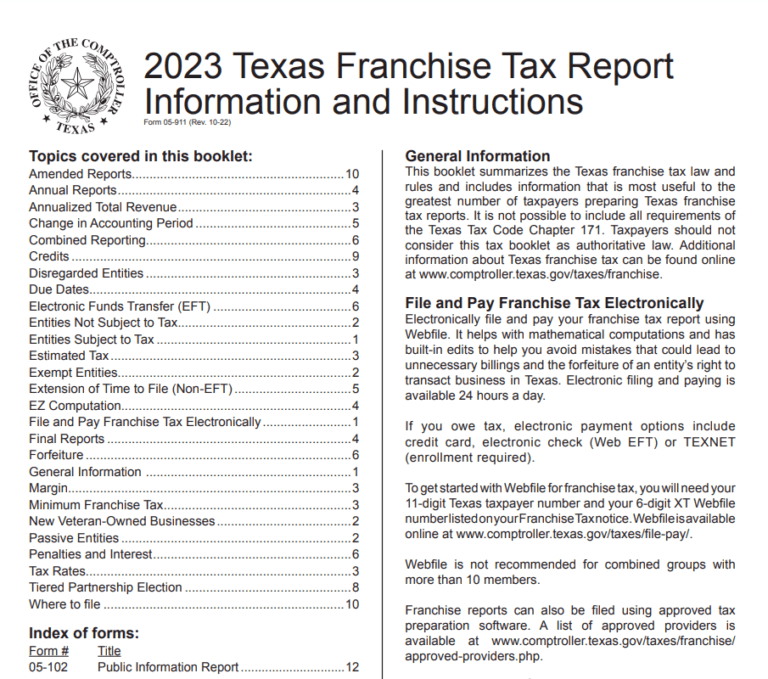

Texas Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

Texas Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

What You Need To Know Federal Carbon Tax Takes Effect In Ont

30 Child Care Tax Rebate 2022 Carrebate

Missouri State Tax Rebate 2023 Printable Rebate Form

Child Tax Rebate Payment Schedule 2023 - Web 5 f 233 vr 2023 nbsp 0183 32 As a parent or guardian you may be eligible for various tax credits and deductions based on your income For 2023 the maximum Child Tax Credit per