Tax Rebate In India Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5 lakh

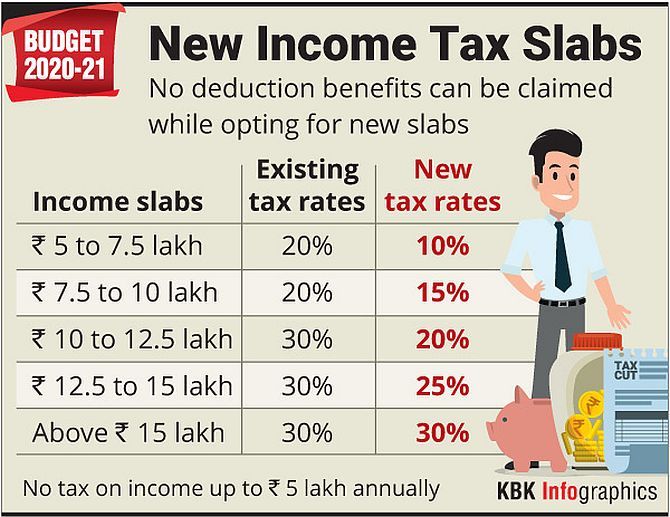

Web 1 f 233 vr 2023 nbsp 0183 32 Newtaxregime will be made as the default tax regime New tax slabs Rs 0 3 lakh Nil Rs 3 6 lakh 5 Rs 6 9 lakh 10 Rs 9 12 Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5

Tax Rebate In India

Tax Rebate In India

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Income Tax Slab Ay 2019 2020 In Pdf Carfare me 2019 2020

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Web 11 avr 2023 nbsp 0183 32 To claim income tax rebate in India follow these steps Determine eligibility Check if you meet the eligibility criteria for claiming an income tax rebate Rebates are Web Here are the eligibility criteria to claim income tax rebate under Section 87A of the Income Tax Act Must be a resident of India Your overall income after taking deductions into

Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following Web Tax rebate and TDS Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of

Download Tax Rebate In India

More picture related to Tax Rebate In India

Major Exemptions Deductions Availed By Taxpayers In India

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

Daily current affairs

http://www.benevolentacademy.com/wp-content/uploads/2023/03/budget-2023-income-tax-india-tv-4-1675237269.jpg

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

Web 16 ao 251 t 2023 nbsp 0183 32 Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be nil of such individual in both New Web Income tax rebate in India is made available for Hindu Undivided Families HUF and individuals who reside in India Taxpayer can claim tax rebates for Rs 40 000 or actual

Web 1 f 233 vr 2023 nbsp 0183 32 What is the tax rebate available under Section 87A under the new tax regime A tax rebate of Rs 25 000 is available under the new tax regime from FY 2023 24 This tax rebate is applicable for all individuals Web Any startup incorporated till March 31 2024 can get a 100 percent tax rebate on its profits for a total period of three years within a block of ten years However if the company s

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

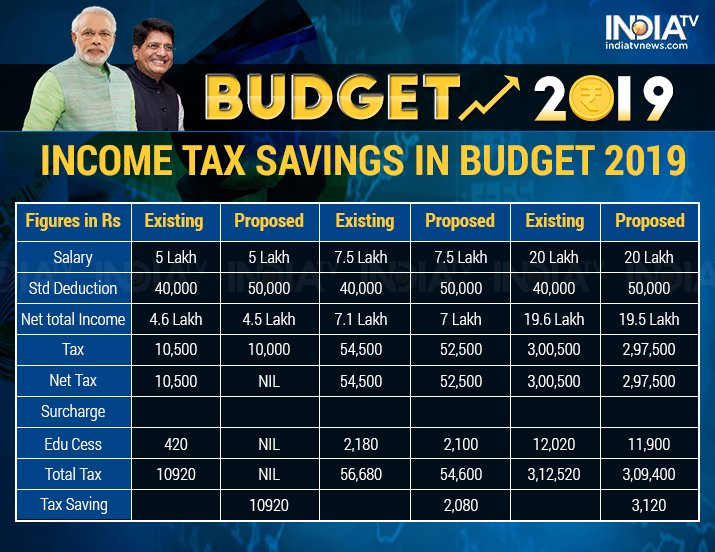

Interim Budget 2019 Full Tax Rebate For Individuals With Upto Rs 5

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2019/02/dyur8scu0aeyns2-1549040592.jpg

https://indianexpress.com/article/explained/ex…

Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5 lakh

https://www.businesstoday.in/union-budget/pe…

Web 1 f 233 vr 2023 nbsp 0183 32 Newtaxregime will be made as the default tax regime New tax slabs Rs 0 3 lakh Nil Rs 3 6 lakh 5 Rs 6 9 lakh 10 Rs 9 12

Income Tax Rates Cut Only If You Give Up Exemptions Rediff Business

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Budget 2023 No Income Tax Up To 7 Lakh Revised Tax Slabs For New

2007 Tax Rebate Tax Deduction Rebates

Standard Deduction For 2021 22 Standard Deduction 2021

Income Tax Slabs Gambaran

Income Tax Slabs Gambaran

Income Tax Rebate On Home Loan Fy 2019 20 A design system

How Can Taxpayers Obtain Income Tax Rebate In India

What Is Rebate U s 87A For AY 2023 24

Tax Rebate In India - Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following