Irs Child Tax Credit 2023 Calculator Unlike a tax deduction which reduces the amount of your income that is subjected to income tax child tax credit cut down your tax liability directly For example if you owe 5 500 of income tax to the government getting awarded 2 000 of the child tax credit will reduce your tax bill to 3 500

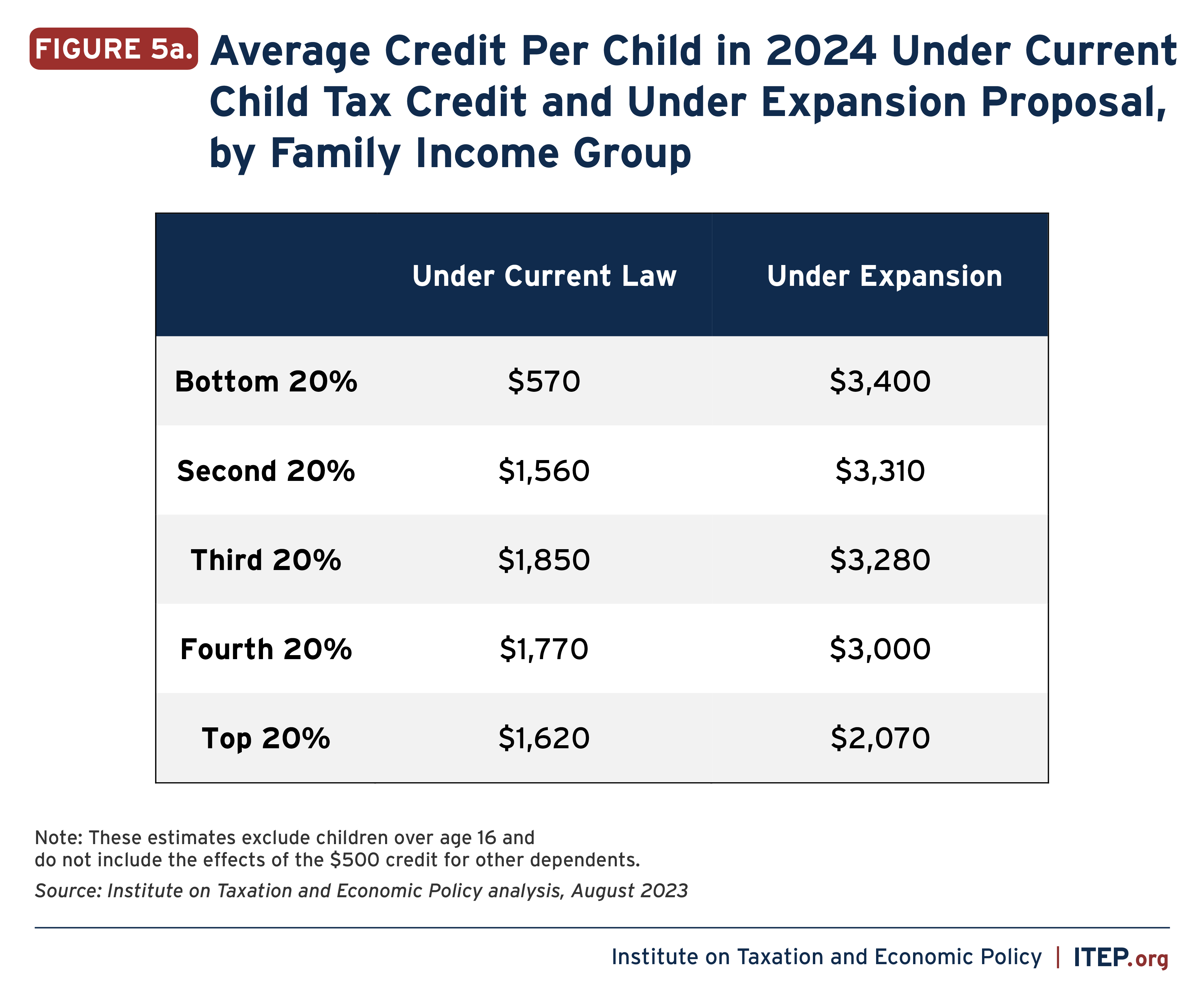

This CHILDucator will let you know if you qualify for the Child Tax Credit and or the Other Dependent Tax Credit on your 2023 Tax Return the amounts are also included The Additional Child Tax Credit or ACTC requires information that is Calculate How is the expanded child tax credit different in 2023 The expansion would primarily benefit lower income families for tax year 2023 especially those with multiple children The

Irs Child Tax Credit 2023 Calculator

Irs Child Tax Credit 2023 Calculator

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

https://cdn.cheapism.com/images/2023-eitc.width-1000.png

New Child Tax Credit 2024 Irs Calculator Mead Stesha

https://imageio.forbes.com/specials-images/imageserve/65134a90a042c751a3253aec/MFJ--2024-/960x0.png?height=480&width=711&fit=bounds

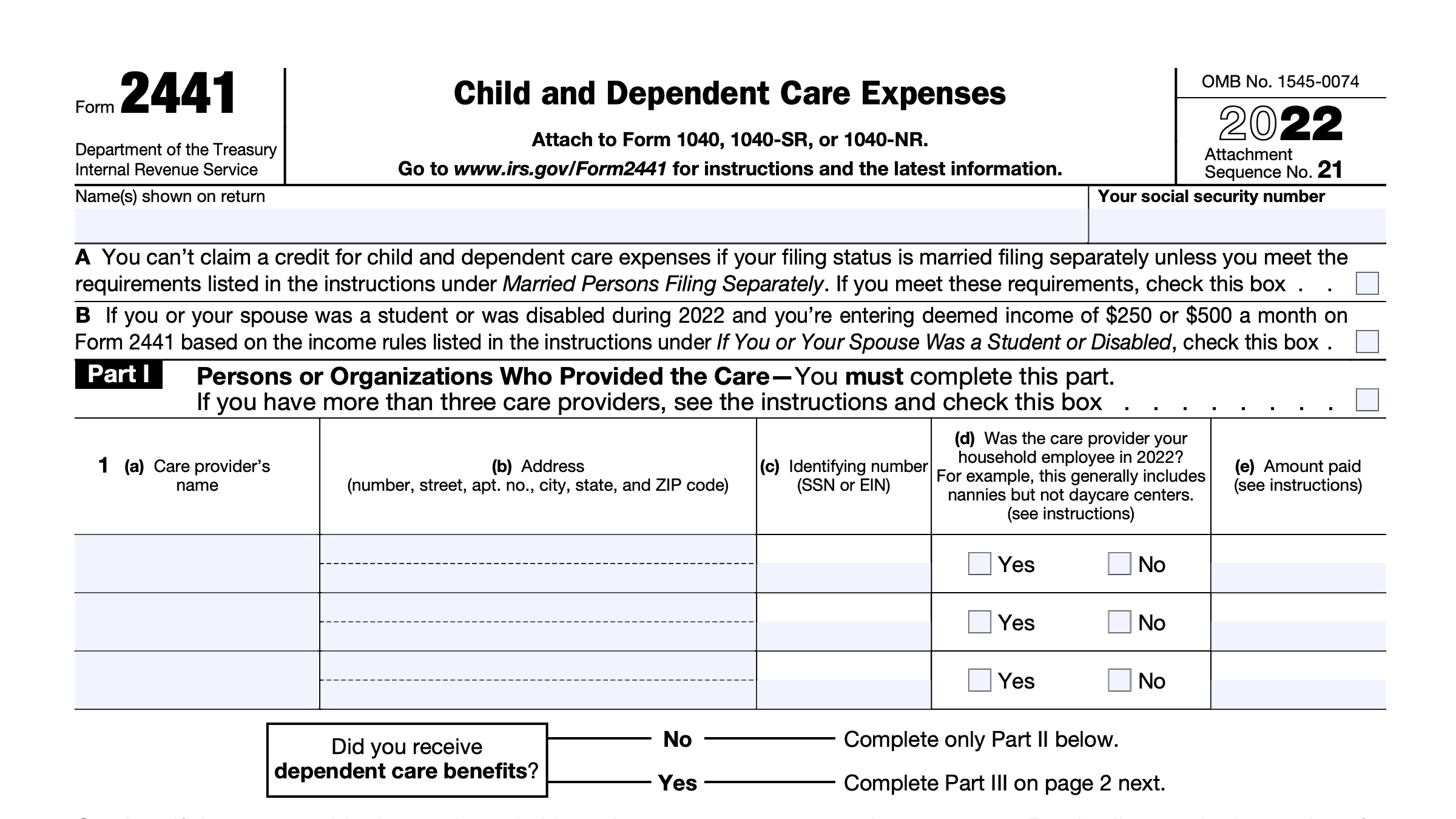

The IRS urges families to use a special online tool available only on IRS gov to help them determine whether they qualify for the child tax credit and the special monthly advance payments beginning July 15 The Child Tax Credit Eligibility Assistant is The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC

Step 1 See if you qualify using the Child Tax Credit Eligibility Assistant Step 2 If you don t normally file a return register with the IRS using the Non filer Sign up Tool Alternatively file a return with the IRS Step 3 Check the status of your monthly payments and update your information using the Child Tax Credit Update Portal Use our monthly child tax credit calculator to estimate how much you might receive Since July millions of families have received monthly child tax credit payments of up to 300 per

Download Irs Child Tax Credit 2023 Calculator

More picture related to Irs Child Tax Credit 2023 Calculator

2022 Child Tax Credit Refundable Amount Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Child Tax Credit 2022 Income Limit Phase Out TAX

https://indianapublicmedia.org/images/news-images/child-tax-credit.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/4d55bc1/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2F21%2F13%2F3b31d5704e9fa71733f5f49524bd%2Fb22189fd0c8f4b6c8d791ab8728170de

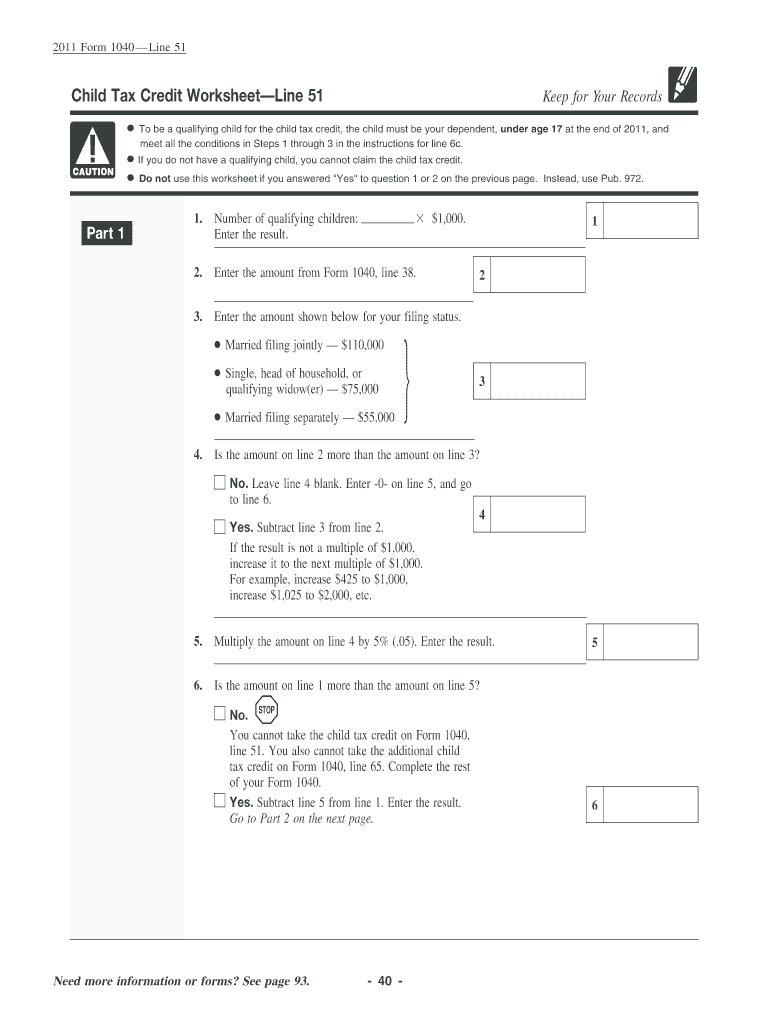

This IRS worksheet helps you correctly calculate your child tax credits Still you ll need info from the 1040 form to complete the schedule arrive at a specific dollar amount and The IRS offers child tax credits to help parents and guardians offset some of the costs of raising a family If you have a dependent who isn t your direct child you may also be eligible to claim a credit And because some child tax credits are refundable you might even make some money in the end

For 2023 taxes for returns filed in 2024 the Child Tax Credit is worth 2 000 for each qualifying child You can claim this full amount if your income is at or below the modified adjusted gross income threshold see the Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Tax Filing 2022 Eitc Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T10-0248.GIF

https://www.omnicalculator.com/finance/child-tax-credit

Unlike a tax deduction which reduces the amount of your income that is subjected to income tax child tax credit cut down your tax liability directly For example if you owe 5 500 of income tax to the government getting awarded 2 000 of the child tax credit will reduce your tax bill to 3 500

https://www.efile.com/2023-child-tax-credit-ctc-calculator

This CHILDucator will let you know if you qualify for the Child Tax Credit and or the Other Dependent Tax Credit on your 2023 Tax Return the amounts are also included The Additional Child Tax Credit or ACTC requires information that is

Expanding The Child Tax Credit Would Advance Racial Equity In The Tax

2022 Education Tax Credits Are You Eligible

Care Credit Printable Application Printable Word Searches

IRS Update To Child Tax Credit Letter Fort Myers Naples MNMW

Child Tax 2011 2024 Form Fill Out And Sign Printable PDF Template

How Do I Fill Out The 2019 W 4 Form Gusto

How Do I Fill Out The 2019 W 4 Form Gusto

IRS Form 2441 Instructions Child And Dependent Care Expenses

Child Tax Credit 2022 Income Limit TAX

Advance Child Tax Credit Changes For 2021 Cerebral Tax Advisors

Irs Child Tax Credit 2023 Calculator - Step 1 See if you qualify using the Child Tax Credit Eligibility Assistant Step 2 If you don t normally file a return register with the IRS using the Non filer Sign up Tool Alternatively file a return with the IRS Step 3 Check the status of your monthly payments and update your information using the Child Tax Credit Update Portal